Word on the street > Debunking M&A Myths by the Numbers; The AE Industry and the NFL—Separated at Birth?

Word on the Street: Issue 183

Weekly real-time market and industry intelligence from Morrissey Goodale firm leaders.

Debunking M&A Myths by the Numbers

“Mergers and acquisitions are at record levels!” “The ‘big boys’ are buying up everyone!” “Venture capital is buying up the industry!” “M&A is only for the giant firms.” “Acquisitions are killing good firms!” No. Definitely not. Wrong. What, now? And “you don’t know what you’re talking about.” There’s a ton of myths around AE industry M&A. What’s actually happening in reality can be found in the numbers.

1. 427: That’s the number of U.S. AE and environmental firm transactions announced in calendar 2023. Deal activity last year was actually down 11.2% from the record 481 transactions in 2022. So no, M&A is not “at record levels.” But it’s fair to say that the industry is experiencing consecutive years of consolidation at unprecedented levels. For each of the past three years, over 400 firms have been acquired. This is a rate never seen before and double that of just a decade earlier. Given the pace of year-to-date activity (the trailing 12-month deal volume average is still down but trending up), we fully expect 2024 to be yet another 400-plus year.

2. 300: No, not the awesome 2006 Leonidas vs. Xerxes smackdown at Thermopylae movie. This 300 is the number of acquirers and investors—from 10 countries—that combined to make the 427 acquisitions and recapitalizations in the U.S. last year. Combined, the last three years have seen not only 1,350 transactions across most (not all) of the 50 states, but also an influx of capital from Canada, the EU, the UK, and the Middle East into the design and environmental consulting professions.

3. $95 million: That was the size of the median acquirer last year—meaning that the median buyer falls in or around the ENR Top 250 range. So no, industry M&A is far from just the “big boys” buying everyone. Indeed, the most active acquirer last year (and recipient of this year’s Most Prolific and Proficient Acquirer Award as part of our Excellence in Acquisitive Growth Awards series) was Bowman Consulting (Reston, VA) (ENR #87). The firm made 11 acquisitions last year and has already announced an acquisition in 2024. (To read our recent interview with Bowman’s CEO and executive VP of M&A, click here.)

4. 53%: That’s the percentage of transactions made by employee-owned or ESOP/partial-ESOP firms last year. These types of firms still account for more than half of all acquisitions in the industry. So no, venture capital is not “buying up” the industry. (More on this later.) That said, the percentage of transactions completed annually by employee-owned or ESOP/partial ESOP firms has been steadily declining over the past decade (from 78% in 2013) even while the number of acquisitions has been steadily increasing. The bottom line is that employee-owned and ESOP-owned firms are steadily becoming less of a factor in industry consolidation.

5. 39%: Almost four in ten transactions last year were completed by either a private equity sponsored acquirer or through the recapitalization of a design or environmental firm by a private equity sponsor. Venture capital was involved in zero, none, zilch. (In our work, we find that many clients still mistakenly conflate venture capital with private equity when embarking on explorations of their recapitalization strategic planning.) The involvement of private equity in the recapitalization of the design and environmental consulting industry has increased steadily over the past decade, growing from just 7% of transactions in 2013. Based on everything we’re seeing in our M&A advisory and capitalization strategy work, 2024 will yield another 100-plus industry firms acquired or recapitalized by private equity.

Bonus numbers section

6. 16: That’s the number of ENR Top 500 firms that sold or recapitalized in 2023. That’s around 3% of that grouping of the largest design firms in the country. Since 2021, 12% of the ENR Top 500 have sold or recapitalized, and 90% of those transactions have involved private equity (see above).

7. $3 million: That’s the median-sized seller in the industry. On the one hand that shouldn’t be surprising given there are so many firms of this size in the industry. On the other hand, it’s a number that always surprises, given the conventional wisdom that M&A exclusively involves the largest firms. It does not. And possibly the most encouraging message from this statistic is that small firm owners can sell or merge and use M&A as a way to liquidate their equity or solve their ownership transition conundrum or accelerate their growth—or all three.

8. Double: (OK, this is not a number—even I know that, but…) In our research for our Excellence in Acquisitive Growth Awards series, we found that on average, acquirers have been doubling the profits of their acquisitions a year after completing the transactions. More stats from our research in bullets 9 through 11 below.

9. 44%: On average, acquirers have seen the backlogs attributable to their acquisitions grow 44% within a year of the transaction.

10. 33%: On average, acquirers have been realizing a 33% increase in revenues attributable to their acquisitions one year after completing transactions. When you combine the average increase in backlog at acquisitions (44%) with the increase in revenues, you can see why some firms are spending relatively less on sales and marketing staff and systems and investing relatively more in their corporate development groups. Simply put, acquisitions are a great way to drive top-line growth.

11. 20%: On average, acquirers have been seeing voluntary turnover rates decline by almost one-fifth a year into their transactions. One reason for this is that most acquisitions are creating more opportunities for employees of acquired firms post-transaction. Another is that acquirers are bringing improved benefits to employees at a lower cost to them. So no, acquisitions are not “destroying good firms.”

If you’d like to dive deeper into the numbers and explore the state of industry mergers and acquisitions, then take a spin through our hot-off-the-presses 2023 AE Industry M&A Year-in-Review Report.

And if you’d like to get up close and personal and meet the executives, investors, and experts who are at the forefront of industry consolidation, then book your place at the Southeast M&A and Business Symposium. Register today to reserve your spot.

To connect with Mick Morrissey, email him at [email protected] or text him at 508.380.1868.

The AE Industry and the NFL—Separated at Birth?

As the final seconds of Super Bowl LVIII disappeared into the Nevada desert yesterday and fans began to analyze every play and every commercial, it occurred to me how much the NFL has changed since the first Super Bowl. In fact, the first Super Bowl wasn’t even called the “Super Bowl”—it was referred to as the “AFL-NFL World Championship Game” until the “Super Bowl” moniker was adopted in 1969’s Super Bowl III.

Since then, the AE industry has been engaged in its own game of evolution. Much as NFL teams constantly adjust their tactics and philosophies in an attempt to achieve success, AE firms have embarked on a transformative journey of their own. From talent management to internal operations, growth strategies, and technological integration, some of the most successful firms in our industry mirror the adaptive strategies observed in professional football, understanding that embracing change is paramount to building and maintaining a competitive edge over the long run. Here’s what I mean:

Succession and collaborative leadership

Despite Bill Belichick’s unparalleled success as the head coach of the New England Patriots for nearly a quarter-century, there came a point where the organization needed to plan for the future. The team owner, Robert Kraft, recognized the importance of succession planning and a more collaborative and inclusive approach to leadership, and as a result parted ways with Belichick and hired the new head coach from within the organization. Other NFL teams around the league are also ushering in new leadership—one-quarter of them, in fact. And these coaches are not just retreads—five of the eight have no previous head coaching experience at the NFL level. Similarly, more and more AE firms are prioritizing the grooming of future leaders and promoting a culture of collaboration throughout their companies. Whether it’s implementing mentorship programs, providing opportunities for cross-functional learning and development, or actively involving emerging talent in leadership initiatives to ensure a seamless transition and a strong leadership pipeline, a new generation of leadership is emerging, valuing responsible autonomy over command and control.

Diversity

AE firms and the NFL are showing a similar emphasis on diversity, inclusion, and talent development. Much like NFL teams recognizing the value of diverse perspectives on and off the field, AE firms are prioritizing diversity and inclusion initiatives. They’re actively recruiting talent from underrepresented groups, fostering inclusive work cultures, and establishing mentorship programs to support career advancement for all employees.

Agility

Much like NFL teams adapting playbooks and game plans on the fly when opposing teams, AE firms are increasingly embracing agile project management methodologies. Agile project management involves the adoption of flexible and iterative approaches to project execution, akin to the principles of agile methodology in software development. This approach emphasizes collaboration, adaptability, and frequent communication among project teams, clients, and stakeholders throughout the project lifecycle, leading to improved project outcomes such as enhanced efficiency, increased client satisfaction, higher-quality deliverables, and reduced risks of schedule or budget overruns.

Digitization and automation

The NFL incorporates cutting-edge player tracking systems, such as Zebra Technologies’ RFID tags, to gather real-time data on player movements, speed, and positioning during games. This technology provides coaches with valuable insights into player performance and enables them to make data-driven decisions to optimize game strategies. They also use virtual reality (VR) training systems to simulate game scenarios and enhance player preparation. Similarly, AE firms are integrating digitization and automation into their internal processes with technologies such as BIM, VR simulations, and project management software that streamline workflows, enhance communication, and minimize errors throughout the project lifecycle.

AI

The NFL is still in the early stages of adopting AI, and its widespread implementation across all teams and aspects of the game is still evolving. Sound familiar? Similar to how NFL teams use advanced analytics to predict player performance, AE firms are using generative design powered by AI algorithms. Generative design produces numerous design alternatives based on specified parameters and performance criteria, enabling firms to explore a wide range of design possibilities and identify optimal solutions that meet project requirements while maximizing efficiency and performance. And much like NFL teams that use predictive analytics to anticipate opponents’ strategies and adapt their game plans, AE firms are leveraging predictive analytics for project forecasting. By analyzing historical project data, market trends, and client preferences, firms can forecast project timelines, budgets, and resource requirements more accurately. This proactive approach allows firms to mitigate risks, optimize resource allocation, and deliver projects on time and within budget.

Growth and diversification

Similar to NFL teams playing international games to expand the league’s fan base, AE firms continue to pursue geographic expansion by establishing offices in new regions. By setting up offices in strategic locations, firms can tap into new markets, access larger talent pools, and strengthen their national and global presence. This expansion enables firms to diversify their revenue streams and offer localized expertise to clients in more regions.

Strategic alliances

Just as NFL teams now engage in joint training camps to enhance performance, AE firms form strategic alliances with other firms or organizations. And while forming strategic alliances is nothing new, the practice has evolved over the last decade toward more strategic and collaborative partnerships aimed at achieving mutual growth and innovation. Today’s alliances tend to focus on strategic alignment of goals, integrated services across disciplines, and global reach, and include a strong emphasis on innovation and technology.

So, what about it? Is your firm Super Bowl material? If so, how will you keep up with the trends and get back to the big game next year? If not, what do you need to do to become a perennial contender?

Morrissey Goodale helps AE firms of all shapes and sizes achieve sustainable, profitable growth. For more information, call Mark Goodale at 508.254.3914 or email [email protected]

Market Snapshot: Construction Starts

Weekly market intelligence for AE and environmental industry leaders.

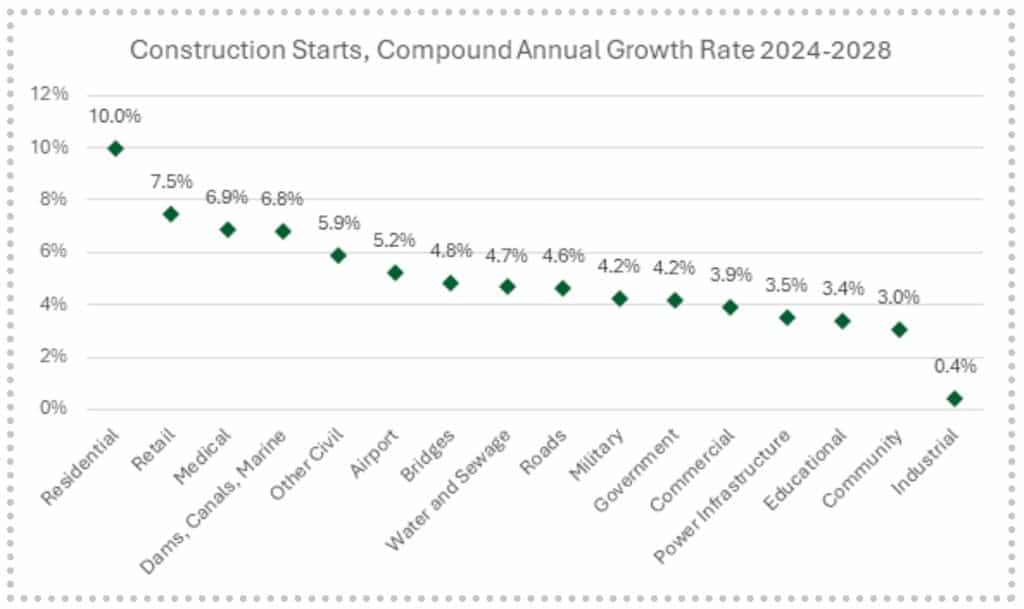

Last week we posted a summary of the December 2023 construction spending (put in place value) release from the U.S. Census Bureau. This week, we comment on the latest forecasts for construction starts, which represents the estimated value of projects in a given period when the work starts.

Dodge Construction Network (DCN) projects a 7% increase in total starts in 2024. DCN forecasts highways and bridges and hotels to have the highest percentage increases this year. The category including power plants, gas, and communication is projected to drop the most in relative terms, followed by warehouses.

According to ConstructConnect, the overall value of construction starts will grow by 4.5% in 2024. The company projects the biggest winners (by percentage change year-over-year) in 2024 to be the medical and retail categories, while governmental and industrial will drop the most in percentage terms from 2023. Over the next five years, the economic model forecasts the highest compound annual growth rates for the residential and retail categories.

Source: U.S. Oxford Economics/ConstructConnect

For the latest insights on U.S. regions and AE markets, check out our 2024 AE Market Intelligence Webinar. Click here to access recording and materials.

To learn more about market intelligence data and research services offered by Morrissey Goodale, schedule an intro call with Rafael Barbosa.

Weekly M&A Round Up

Active week for both domestic and global deals: Last week we reported strong M&A activity with a total of 16 new domestic and global transactions. The Southeast continues to consolidate rapidly with four new deals in NC, AL, LA, and GA. You can check all the week’s M&A news here.

Searching for an external Board member?

Our Board of Directors candidate database has over one hundred current and former CEOs, executives, business strategists, and experts from both inside and outside the AE and Environmental Consulting industry who are interested in serving on Boards. Contact Tim Pettepit via email or call him directly at (617) 982-3829 for pricing and access to the database.

Are you interested in serving on an AE firm Board of Directors?

We have numerous clients that are seeking qualified industry executives to serve on their boards. If you’re interested, please upload your resume here.

June 12-14, 2024 Las Vegas, NV

Western States M&A and Business Symposium

Join us for the 10th annual Western States Symposium, bringing together over 200 AE and environmental industry executives and investors in one of the world’s most vibrant and iconic cities.

Learn More

Subscribe to our Newsletters

Stay up-to-date in real-time.