Word on the street > And This Year’s Most Prolific and Proficient Acquirer Award Goes To…; If You Can’t Do It All, at Least Do Some

Word on the Street: Issue 180

Weekly real-time market and industry intelligence from Morrissey Goodale firm leaders.

And This Year’s Most Prolific and Proficient Acquirer Award Goes To…

We’re delighted to announce that Bowman Consulting Group (Reston, VA) (ENR #87) (NASDAQ: BWMN) is the recipient of this year’s Most Prolific and Proficient Acquirer Award. This is the first of the three awards that will be announced in 2024 as part of our Excellence in Acquisitive Growth Awards series.

Bowman is a multi-disciplinary consulting firm with over 2,000 employees offering a broad range of infrastructure, energy, real estate, and environmental management solutions to both public and private clients across the country. Last year the firm was ranked third on the Forbes list of “America’s Most Successful Small-Cap Companies.” Also, in April 2023, Bowman was recognized as a top industrial IPO of 2021 by CNBC’s Mad Money. With a stock price that was up 109%, Bowman was reported to be 1 of only 5 industrial companies out of the 24 that went public in 2021 to yield positive stock price gains. The firm has received multiple national and state industry awards and recognition. Last year Bowman jumped 31 places on the ENR Top 500 Design Firms ranking. The firm is one of our Nine Movers and Shakers to Watch in 2024.

With a nearly 14% compounded average annual growth over a decade, Bowman went public in 2021 and has recently been on an even more impressive growth trajectory—growing at an average rate of over 40% since its IPO with acquisitions playing an important role in its success. Last year, the firm announced an industry-leading 12 acquisitions, adding over 400 employees in 11 states—AZ, NM, CA, NV, SC, OK, TX, NY, FL, MD, and GA.

The Most Prolific and Proficient Acquirer Award will be presented to the Bowman team at the Southeast M&A and Business Symposium in March. In recognition of Bowman’s excellence in acquisitive growth, Morrissey Goodale will be making a donation of $1,000 to Bridges to Prosperity on the firm’s behalf.

I recently caught up with Gary Bowman—the firm’s founder, chairman, president, and CEO—and Tim Vaughn, executive vice president of mergers and acquisitions, to discuss the firm’s approach to acquisitions and their importance to Bowman’s success.

Congratulations on your continued success. How important have acquisitions been to that success? Do you target a certain balance between acquisitive and organic growth? Do you view one type of growth as “better” than the other?

We place equal importance on both and are committed to maintaining robust organic growth alongside our acquisitive growth strategy. In our view, organic growth is the engine that provides personal and professional development opportunities for our staff. One of the primary preconditions for our acquisition targets is clear visibility to top-line synergies, and we have realized tremendous success. Our acquisitions actually turbocharge our organic growth.

Closing 12 acquisitions in a year is a remarkable achievement. In your experience what’s the lifecycle of an acquisition—from the time you initially connect with a firm’s leadership to the closing of a transaction? How many firms at any given time are in your “pipeline”?

As a highly experienced acquirer, we are able to move quickly. Decision-making here is efficient without burdensome layers of approval. We have had many deals close within 90 to 120 days of initial contact. That time frame is only achievable for a firm that is committed to a transaction, is well prepared and organized, and is able to quickly produce the information needed to advance the process. On the other end of the spectrum, the process can sometimes take as long as a year. Occasionally, complex issues arise in deals that have to be worked through, which can take time. In other cases, owners are not sure that they want to sell and need more time to consider alternatives or may want a more deliberate process. We can act with a sense of urgency or, on the other hand, be patient as the situation warrants. We are happy to work with either scenario. It is critical that owners and leadership teams that merge with Bowman are comfortable with us and our process. In terms of deal pipeline, we are typically actively engaged with anywhere between 5 and 10 firms at any one time. Some move forward, and others don’t. So, having a team that is able to focus on multiple opportunities at any one time is important when focused on acquisitive growth.

Let’s talk integration. I know every CEO who is reading this and considering selling their firm is asking themselves, “What is life like after the deal for myself, my employees, and my clients?” Can you share some insights as to what integration looks like for the firms that you acquire? Is it a one-size-fits-all approach? How do you define success in this regard?

Integration is definitely not a one-size-fits-all process. We have a dedicated full-time integration team, led by one of our long-tenured engineering leaders who reports directly to our chief people officer. Successful cultural integration is of paramount importance to us. We gauge successful cultural integration by staff retention—we aim for a long-term retention rate of 90% or greater, and we generally meet that mark. Our integration team consists of seasoned professionals with years of experience with Bowman in the areas of accounting, HR, IT, and marketing, and integration is all that they do. Integration is never a fun process, but given our extensive experience, we are proud of our ability to see around corners and create a process that is as smooth and efficient as practical.

Every partner firm merging into Bowman has different practices, perspectives, and resources, and we tailor the integration process individually to each firm. We need certain aspects of operations to be fully integrated, in particular accounting and IT (especially since this permits work and resource-sharing between offices). However, every office—whether a legacy Bowman office or a newly acquired firm—maintains some individual aspects of culture and operates with a tremendous degree of autonomy. We merge with firms that are run by smart and talented people who have created tremendous value. So, we don’t want to lose that “secret sauce” that each has developed by trying to overly standardize them.

Our primary focus is to fully leverage revenue, marketing, and human capital resources. A successful integration is marked by staff retention and healthy culture; cross-office sharing of leads, work, and resources; new and enhanced growth opportunities for the staff of acquired firms; and substantial revenue synergies.

In our research for the Excellence in Acquisitive Growth Awards series, we found that skilled acquirers in the industry can create some impressive business results through their acquisitions. How do you look to improve the performance of the firms that you acquire? What sort of results do you look for? What KPIs, if any, do you track to measure success?

In just about every case, prior to us acquiring them, the acquired firm’s leaders have become bogged down in day-to-day administrivia that gets in the way of them doing what they do best (and enjoy most)—selling work and delivering for clients. We immediately get these leaders back to their highest and best use. At Bowman, we manage by a simple and straightforward set of KPIs, and we generally introduce our systems and processes after the heavy lifting of integration is accomplished. When we acquire a highly profitable firm, we do our best to stay out of the way so that they keep doing what made them successful in the past. On the other hand, when we see potential for efficiencies and increased profitability, we work more closely on systems and processes with the objective of achieving meaningful bottom-line improvement. We measure the success of our acquisition program by maintaining and growing the bottom line, top-line revenue growth, and long-term staff retention. We also measure synergistic revenues; however, since we integrate rapidly, this soon becomes difficult to gauge with precision.

Tim, you have the title of executive vice president of M&A. But I can’t imagine that you do all of this by yourself. Can you talk about the team at Bowman that works to make it all happen? What are the key functions within the team and how do they work together? How do they work with the firm’s management and technical functions?

This is very much a team effort—I don’t make anything happen on my own. I look at my role as similar to that of a point guard in basketball. I’m the facilitator for the team, and I need to recognize when to get other members of the team involved at appropriate times. While I may source opportunities or be the initial point of contact if a firm is internally sourced by our people or externally sourced via an intermediary, Gary and our COO, Mike Bruen, are very involved in the initial assessment and screening of opportunities. As we work through the LOI process and start due diligence, I take the lead. But, by fairly early in the due diligence process, our integration team becomes involved as well, assisting in due diligence and transitioning the process from due diligence into integration. Our chief legal officer, Bob Hickey, plays a key role in deal structuring and documentation and leading the due diligence process. Our CFO, Bruce Labovitz, leads financial due diligence and regulatory compliance, and he also handles complex tax matters. Most importantly, Bruce is responsible for raising the capital necessary to keep our machine running. It would not be possible to be such an active acquirer without a leadership team that is fully aligned on strategy and highly experienced in all matters dealing with M&A.

2023 was a remarkably busy year for Bowman Consulting in terms of acquisitive growth. How is 2024 shaping up? Do you have any specific types of firms or geographies that you will be prioritizing?

We have gone into the year with a robust pipeline, and we intend to continue on in 2024 at the same pace as last year. We are open to considering any opportunity that offers compelling synergies, in terms of technical capabilities, clients, and markets serviced. We are particularly interested in growing our water resources, environmental, transportation, utilities, renewable energy, and facilities engineering practices. Our geographic focus is the continental U.S., and like most, we are especially keen on rapidly growing Sun Belt markets. That said, we place much greater importance on the quality and dedication of the leadership team than on geography. In our view, talent and ambition trumps geography any time.

Thanks, Gary and Tim. It’s abundantly clear that M&A is a core business competency for Bowman. Potential sellers can feel confident that should they engage with your firm, they can do so with the confidence that they are dealing with experienced and skilled practitioners who are serious and intentional. Congratulations again on being the recipient of this year’s Most Prolific and Proficient Acquirer Award, and see you in Miami!

If you’d like to know more about Bowman Consulting and meet with their executive team, you can do so at the Southeast M&A and Business Symposium in Miami this March. Gary Bowman—the firm’s founder, chairman, president, and CEO—will feature on a panel of ENR 500 CEOs about the future of the AE and environmental industry.

To connect with Mick Morrissey, email him at [email protected] or text him at 508.380.1868.

If You Can’t Do It All, at Least Do Some

While it may seem unnecessary for AE firms that have an abundance of projects (i.e., seemingly the vast majority of you), abandoning marketing altogether results in real problems, such as:

Inconsistent workflows

The nature of the AE industry often involves project cycles, and workloads can fluctuate, to say the least. No matter how much backlog your firm has, relying solely on current projects without a continuous influx of new work will eventually lead to inconsistent workflows. When ongoing projects are completed, there might be a gap before new projects start, and you’ll have to balance cash flow considerations with staffing decisions.

Dependence on existing clients

While your competition is busy building business relationships and diversifying revenue streams, if you’re focused solely on serving existing clients, you’re taking on a bigger risk than you might think. Client needs and budgets may change, and if a major client decides to scale back or shift priorities, the firm could experience a sudden drop in workload.

Missed opportunities

By not actively marketing, you could miss out on the opportunity to lead larger, more impactful projects that could help create long-lasting competitive advantages. Firms in the AE industry compete primarily on fees and experience, and the more experience you have, the higher fees you command.

Fading visibility

A lack of marketing can result in decreased visibility in the industry. Over time, your firm may lose its standing as a thought leader or trendsetter, making it more challenging to attract top talent and secure top-tier projects.

Slow reaction to market changes

Industries used to evolve. Now they rapidly transform. Client preferences, technological advancements, and market trends can change in the blink of an eye. Firms that are not actively engaged in marketing will find it challenging to adapt to these changes and may lose relevance in the industry.

Impact on brand perception

Consistent marketing helps build and maintain a positive brand image. When a firm stops marketing, it is often perceived as stagnant or less innovative by both clients and competitors.

To head off these problems, commit to maintaining a baseline level of marketing efforts, including:

Sustaining an online presence

Regularly update the website and social media profiles with project highlights, industry insights, and team achievements. Nothing says “closed for business” like two-year-old media posts.

Networking

Participate in industry events, webinars, and conferences to stay connected with peers and potential clients. Don’t close doors when you are busy. Open them.

Thought leadership

Continue to share expertise through blogs, articles, and white papers to establish the firm as a thought leader in the field. Delegate if you must, but make time for these activities.

Client relationship management and maintenance

Nurture relationships with existing clients and seek referrals, which can lead to future projects. Find ways to provide value beyond the projects.

Wondering what kind of distraction this could be from the “real work”? Here’s what a simple marketing action plan might look like to keep the embers burning for the too-busy-to-market AE firm—along with estimated time commitments:

1. Client testimonials and case studies

Time estimate: 4-6 hours for gathering feedback, drafting content, and creating visuals

2. Optimize online presence

Time estimate: 5-8 hours to review and update website content and optimize for search engines

3. Leverage social media efficiently

Time estimate: 1-2 hours per week for planning, creating, and scheduling posts using automation tools

4. Email marketing with minimal effort

Time estimate: 3-4 hours to set up an initial template and 1-2 hours per month for content creation and scheduling

5. Networking in industry events

Time estimate: 1-2 days per year per participant for attendance and preparation

6. Strategic alliances

Time estimate: 3-5 hours for research, outreach, and initial discussions

7. Maximize client relationships

Time estimate: 1-2 hours per month for client check-ins and relationship-building efforts

8. Streamlined content creation

Time estimate: 2-3 hours per month for repurposing existing content and creating new snippets.

9. Analytics and iteration

Time estimate: 1-2 hours per month for reviewing analytics and adjusting the marketing action plan

Committing to a handful of marketing activities like these, especially when you are swamped with work, will rust-proof your firm—and its brand.

For more information on how Morrissey Goodale can help your firm’s marketing efforts in 2024, call Mark Goodale at 508.254.3914 or email him at [email protected].

Market Snapshot: Industry Backlog Indicators

Weekly market intelligence for AE and environmental industry leaders.

According to the 2023 Q4 Engineering Business Sentiment Study published by the American Council of Engineering Companies (ACEC), the median project backlog for engineering firms is 11 months. Additionally, out of 485 responses regarding future backlog in the study, 52% stated they believe backlog levels will be higher going into Q4 of 2024.

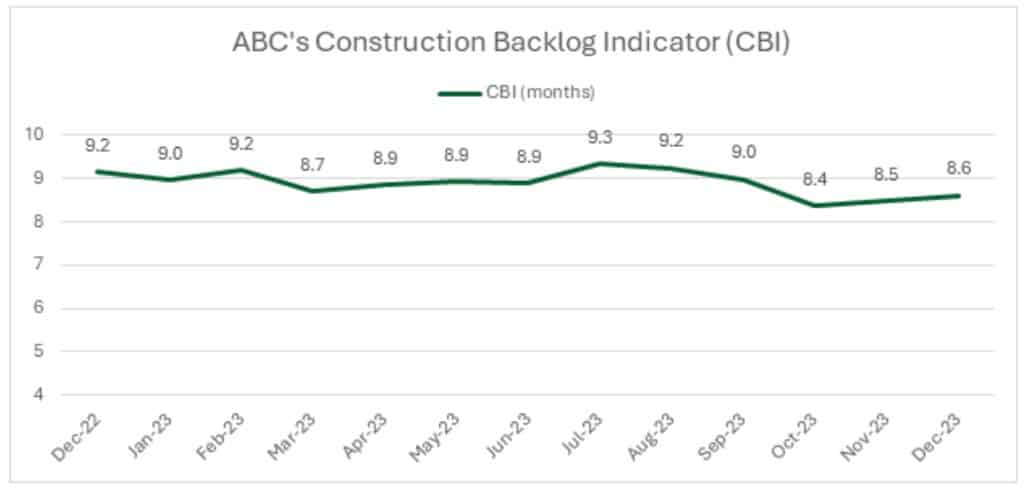

Another measure of backlog to note is the Construction Backlog Indicator (CBI) published by the Associated Builders and Contractors (ABC). The CBI in December was 8.6 months, slightly higher than in November (8.5 months), driven mostly by commercial and institutional projects. Despite the strong outlook for infrastructure markets, the category’s backlog dropped by 2.1 months compared to the same period in 2022, closing the year at 7.9 months. Many Infrastructure Investment and Jobs Act (IIJA) transportation projects have been announced, but in some cases, planners may be waiting for better timing on material costs (as inflation goes down) before moving forward with allocations.

Source: Associated Builders and Contractors (ABC)

Don’t miss the upcoming Morrissey Goodale AE Market Intelligence Webinar on January 23, 2024. Click here to register.

To learn more about market intelligence data and research services offered by Morrissey Goodale, schedule an intro call with Rafael Barbosa. Connect with him on LinkedIn.

Weekly M&A Round Up

Congratulations to Verdantas (Dublin, OH) (ENR #149): The private equity-backed specialist in environmental consulting, sustainable engineering, modeling, and digital technology acquired Flatwoods Consulting Group (Tampa, FL). This strategic acquisition broadens Verdantas’ portfolio of services, particularly in natural resources, environmental permitting, and compliance across the Southeast region. We’re thankful that the Verdantas team trusted us to initiate and advise them on this transaction.

Another congrats to Structural Engineering Associates (SEA) (San Antonio, TX): The structural engineering firm serving private clients and governmental agencies joined industry leader and employee-owned Johnson, Mirmiran & Thompson (JMT) (Hunt Valley, MD) (ENR #59). The strategic acquisition marks a significant expansion of JMT’s presence in the Texas market and enhances its comprehensive suite of engineering services. We feel privileged that the SEA team trusted us to initiate and advise them on this transaction.

Consolidation is picking up: Last week we reported 10 new transactions, including 3 in the Southeast states of Florida and Georgia. Other deals included an ENR Top 500 seller, a private equity recapitalization, additional private equity-backed deals, and more. You can check all the week’s M&A news here.

Searching for an external Board member?

Our Board of Directors candidate database has over one hundred current and former CEOs, executives, business strategists, and experts from both inside and outside the AE and Environmental Consulting industry who are interested in serving on Boards. Contact Tim Pettepit via email or call him directly at (617) 982-3829 for pricing and access to the database.

Are you interested in serving on an AE firm Board of Directors?

We have numerous clients that are seeking qualified industry executives to serve on their boards. If you’re interested, please upload your resume here.

June 12-14, 2024 Las Vegas, NV

Western States M&A and Business Symposium

Join us for the 10th annual Western States Symposium, bringing together over 200 AE and environmental industry executives and investors in one of the world’s most vibrant and iconic cities.

Learn More

Subscribe to our Newsletters

Stay up-to-date in real-time.