Word on the street > A First Look at Industry Performance in 2024; Strategic Growth Planning Ideas for Regional Expansion

Word on the Street: Issue 182

Weekly real-time market and industry intelligence from Morrissey Goodale firm leaders.

A First Look at Industry Performance in 2024

This March, the Southeast M&A and Business Symposium will provide a first real opportunity for CEOs and investors to take the pulse of this year’s AE and environmental industry. We’ll be kicking things off in Miami with our “State of the Industry” presentation, which includes up-to-the-minute hard data on industry financial performance (profits, utilization, revenues per employee, etc.), financial condition (current ratios, debt-to-equity levels), anticipated raises and bonuses, backlogs, and hot and cold markets (courtesy of the Deltek Clarity study and our proprietary databases).

However, we can get an even earlier read on how the industry is faring and where it’s headed from the CEOs and investors who will be in attendance this March in Miami. And based on what they’re telling us, all in all, 2024 is shaping up to be yet another blow-out year of growth and innovation for (most) of the industry.

1. First, a word on who’s coming to Miami: Three-quarters of the attendees are CEOs and C-suite, 16% are M&A executives (mostly from larger firms), and the balance are industry investors. Four in ten are from firms with over $100 million in revenue (generally with a national or global footprint). The balance is less than $100 million, generally from the Southeast. These are the folks giving us a first read on how things are shaping up.

2. “Ain’t No Stoppin’ Us Now”: Seventy-eight percent of symposium attendees expect 2024 to be an even better year for their firms than 2023 was. The balance of attendees expect this year to be the same as last year. For the first time ever, not one attendee is forecasting the year ahead to be weaker. This in and of itself is a remarkable statement about the strength of our industry.

3. It’s all about the people: The success of our industry, and of each individual firm, is driven by employees. But finding and keeping them is—once again—a huge challenge this year. Three-quarters of attendees cite finding and keeping the talent necessary to meet demand as their number-one challenge headed into 2024. Making acquisitions in this super-frothy consolidating industry is a distant second at 6%. The perennial talent challenge is not going away any time soon. And even in those industry sectors that are experiencing some regional softness (e.g., corporate interiors), employees are quickly being snapped up into adjacent sectors. It’s a great time to be a designer, planner, or scientist—maybe the greatest time.

4. Driven to expand and innovate: Forty-one percent of attendees see growth—either geographically, or into new market sectors, or through additional services—as the greatest unmet or untapped opportunity for their firms this year. Another 26% view unlocking the potential of new technologies as being their number-one untapped opportunity. Demand continues to outstrip supply, and firms are eager to make hay while the sun is shining.

5. Continuing consolidation: Eight in ten attendees have M&A of some kind on their minds and are either planning an acquisition in 2024 or they are considering a sale or recapitalization. This is not necessarily a surprise given the theme of the symposium. However, it’s also reflective of the current M&A environment where every CEO is receiving inquiries to sell or recapitalize almost daily.

6. A quickly maturing digital business model: Over 70% of the attendees either will or will possibly generate revenues through digital services and/or products in 2024. This is a significant jump from last year when just 52% indicated the same. Firms have rapidly incorporated digitization initiatives to meet client demands, improve service offerings, and increase profits.

7. A similar timeline for AI? Almost half of the attendees are using artificial intelligence in their businesses. Pretty remarkable seeing as ChatGPT was only launched at the end of 2022. Over 40% of those firms are using it for marketing, with another 20% deploying it to gain efficiency in operations.

8. Another big year for raises/bonuses: Eight in ten attendees are forecasting raises in the 1% to 5% range, with the balance in the 6% to 9% range. One-third of attendees are anticipating higher bonuses than last year. (It’s all about the people…)

So, the earliest look that we have is that 2024 is going to be yet another year of expansion and consolidation with a lot more digitization and artificial intelligence thrown in. (And still not enough people to do all the work.)

The Southeast M&A and Business Symposium—now in its 10th year—is the destination for AE industry executives and investors to get a first read on industry performance, get the latest on trends and best practices, and network with decision-makers from the Southeast and around the nation. Register today to reserve your place.

To connect with Mick Morrissey, email him at [email protected] or text him at 508.380.1868.

Strategic Growth Planning Ideas for Regional Expansion

After 30 years of consulting to the AE industry, every single strategic planning client I’ve worked with has included some level of geographic expansion in their strategic plan. Why? Because achieving this kind of growth can lead to significant competitive advantages. First, expansion into new regions allows firms to tap into emerging markets, diversify their client base, and access new opportunities for growth and revenue generation. Second, geographic expansion enables firms to better serve existing clients with operations in different locations, enhancing client satisfaction and loyalty. Third, expanding into new regions can provide access to specialized talent pools, allowing firms to strengthen their capabilities and expertise in specific sectors or disciplines. Moreover, geographic expansion enhances a firm’s resilience against market fluctuations and economic downturns by spreading risk across multiple regions.

But it’s not easy—to say the least. Failure is only a stone’s throw away, whether it’s caused by a) inadequate market research and understanding of the new region’s dynamics, including regulatory requirements, cultural differences, and competitive landscape; b) insufficient adaptation of business strategies to suit local market needs, such as pricing structures, service offerings, and client expectations; c) poor execution of expansion plans, including ineffective leadership, lack of local talent acquisition, and underestimation of logistical challenges; and/or d) unsuccessful integration of technology and communication systems across geographically dispersed offices, which hinders collaboration and project delivery, and ultimately dooms the firm’s expansion efforts.

If your firm is contemplating expansion into a new region, thorough consideration is essential. With that in mind, presented below are examples of strategic growth plan elements tailored to three distinct scenarios:

Scenario 1: “Newest Kid on the Block”—No existing presence in the new region

In this scenario, an AE firm is looking to establish a foothold in a region or regions where they currently have no presence. Here are some thoughts on how to frame the approach:

- Market Research and Analysis: Begin by conducting comprehensive market research to understand the dynamics, needs, and competition in the new region. Identify key sectors, potential clients, regulatory requirements, and market trends.

- Hire a Local Leader/Talent Acquisition: Hire a local leader with knowledge of the regional market, industry connections, and cultural insights. This individual will spearhead business development efforts, forge strategic partnerships, and lead the recruitment of local talent.

- Strategic Acquisitions: Explore opportunities for strategic acquisitions of local firms in the region to accelerate growth and provide access to existing client bases and projects.

- Strategic Partnerships and Networking: With the guidance of your firm’s new local leadership, establish strategic partnerships with local firms, industry associations, and government agencies to gain insights and build relationships. Attend networking events, conferences, and trade shows to expand your professional network.

- Tailored Marketing and Branding: Develop a localized marketing strategy that highlights your firm’s unique value proposition and expertise. Invest in targeted direct and digital marketing as well as public relations efforts to increase brand visibility and awareness.

- Project Acquisition and Execution: Focus initially on securing small to mid-sized projects to establish credibility and reputation in the new market. Deliver high-quality services, exceed client expectations, and leverage satisfied clients for referrals and testimonials.

- Continuous Evaluation and Adaptation: Regularly review and evaluate the progress of your growth plan. Analyze key performance indicators, client feedback, and market trends to adapt strategies and tactics accordingly.

Scenario 2: “The Little Engine That Would if It Could”—Small production outpost in the new region

In this scenario, a firm already has a small contingency of production folks and a competent project manager in the region. The team serves as a reliable production outpost but does not generate any revenue on its own. In this case, consider the following planning components:

- Recruitment/Talent Acquisition: Recruit, hire, and onboard a leader/rainmaker with a proven track record in business development and client acquisition. This individual will be instrumental in converting the outpost into a self-sufficient, revenue-generating office/region.

- Capacity Building and Resource Allocation: Assess the current capabilities and capacity of the production outpost. Invest in infrastructure, technology, and training to enhance efficiency and productivity.

- Client Relationship Management: Strengthen relationships with existing clients in the new region and identify opportunities for upselling and cross-selling services. Develop a client-centric approach focused on understanding their evolving needs and delivering tailored solutions.

- Team Development and Empowerment: Provide ongoing training and professional development opportunities to empower the team. The leader/rainmaker will play a key role in mentoring and guiding the team to achieve their full potential.

- Diversification of Services: Expand the range of services offered by the outpost to meet the diverse needs of clients in the new region, whether by cross-selling existing services or establishing new ones. The leader/rainmaker can identify new market opportunities and develop strategies to capitalize on them.

- Market Expansion and Brand Building: Increase brand awareness and visibility through targeted marketing campaigns and participation in industry events. The leader/rainmaker will drive business development efforts and establish the outpost as a reputable player in the local market.

- Performance Measurement and Optimization: Implement performance metrics to track the new region’s efficiency, project delivery timelines, and client satisfaction. The leader/rainmaker will continuously optimize operations and strategies to maximize profitability and revenue generation.

Scenario 3: “You and What Army?”—Key leader without significant production support

In this third case, you’ve got a legit local leader on the ground but not much else—so, here’s what to think about:

- Strategic Leadership and Relationship Building: Leverage the expertise and network of the key leader to establish strong relationships with key stakeholders, including clients, regulators, and industry partners. Position the leader as a thought leader in the region through speaking engagements, publications, and participation in industry forums.

- Client Acquisition and Retention: Leverage the reputation and connections of the key leader to identify and secure high-value projects in the new region. Focus on delivering exceptional client experiences to build long-term relationships and foster repeat business.

- Resource Mobilization and Collaboration: Collaborate with other offices or external partners to access resources, expertise, and support for project execution. Develop strategic alliances or joint ventures with local firms to complement your firm’s capabilities until you build up your own staff (see the next bullet).

- Talent Acquisition: In stages, hire the necessary talent locally (and/or nationally, depending on your remote work philosophies) to produce work and deliver projects, reducing reliance on branch office assistance over time.

- Market Positioning and Differentiation: Position your firm as a trusted advisor and preferred partner for clients in the new region. Highlight the unique value proposition and competitive advantages offered by the firm, leveraging the expertise and reputation of the key leader.

- Knowledge Transfer and Capacity Building: Facilitate knowledge transfer from the key leader to local staff through mentorships, training programs, and cross-office collaborations. Invest in developing local talent to ensure continuity and sustainability of operations.

- Continuous Improvement and Adaptation: Foster a culture of continuous improvement and innovation within the team. Encourage feedback, creativity, and experimentation to adapt to evolving client needs and market dynamics.

Expanding your business into new regions requires a comprehensive and strategic approach tailored to the specific circumstances of your firm’s particular scenario. By focusing on market research, relationship building, talent acquisition and development, and continuous improvement, your firm can successfully bring what it does best to many new places.

For help creating a strategic growth plan for your firm, call Mark Goodale at 508.254.3914 or send an email to [email protected].

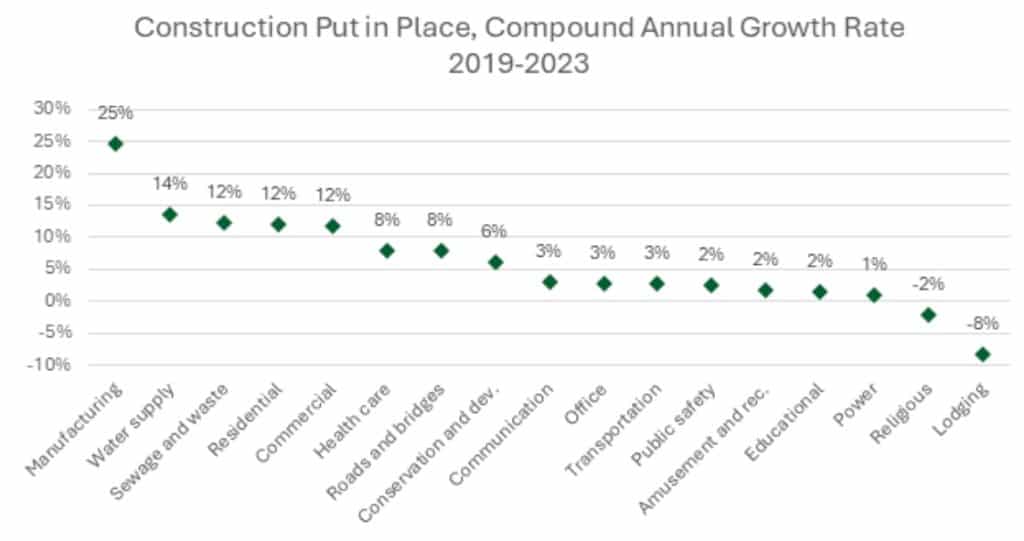

Market Snapshot: Construction Spending

Weekly market intelligence for AE and environmental industry leaders.

The U.S. Census Bureau just released preliminary estimates for construction spending in December 2023. In the last month of the year, the value of construction put in place was nearly 14% higher than it was in December 2022. The value of construction put in place in 2023 was $1.98 trillion (seasonally adjusted annual rate), 7% above spending in the year prior. Here are the highlights by construction type:

- The manufacturing category had the highest overall percentage increase compared to 2022, rising 71%. Sewage and waste disposal and conservation and development were next, with 27% and 24% increases, respectively.

- Residential had a 5.5% year-over-year decline in 2023, driven by a double-digit decrease in single-family construction. Multi-family spending was up 20%.

- Private nonresidential was up 22% year-over-year, with manufacturing, lodging, education, health care, and transportation having double-digit increases in construction spending in 2023.

- Among state and local construction, which was up about 16%, the highest spending percentage increases were for power (57%), sewage and waste disposal (24%), and roads and bridges (18%).

- Federal construction wrapped 2023 with $34.2 billion in spending, increasing by 19% from 2022. Conservation and development, which is the largest federal category, had the highest year-over-year percentage increase at 33%.

- Over the last five years, manufacturing, water supply, and sewage and waste disposal experienced the fastest growth rates, while lodging and religious levels declined.

Source: U.S. Census Bureau

For the latest insights on U.S. regions and AE markets, check out our 2024 AE Market Intelligence Webinar. Click here to access recording and materials.

To learn more about market intelligence data and research services offered by Morrissey Goodale, schedule an intro call with Rafael Barbosa.

Weekly M&A Round Up

Congratulations to Gradient (Boston, MA): The premier environmental and health risk sciences consulting firm joined environmental and engineering firm Geosyntec Consultants (Boca Raton, FL) (ENR #40). This new partnership will expand Geosyntec’s services in risk sciences and enhance its environmental, health, and safety capabilities. We’re thankful that the Gradient team trusted us to advise them on this transaction.

Strong start for domestic activity: U.S. M&A continued its strong start to the new year with seven more deals announced. Last week we reported another private equity recapitalization of an ENR Top 500 firm, an employee-owned deal, and more. You can check all the week’s M&A news here.

Searching for an external Board member?

Our Board of Directors candidate database has over one hundred current and former CEOs, executives, business strategists, and experts from both inside and outside the AE and Environmental Consulting industry who are interested in serving on Boards. Contact Tim Pettepit via email or call him directly at (617) 982-3829 for pricing and access to the database.

Are you interested in serving on an AE firm Board of Directors?

We have numerous clients that are seeking qualified industry executives to serve on their boards. If you’re interested, please upload your resume here.

June 12-14, 2024 Las Vegas, NV

Western States M&A and Business Symposium

Join us for the 10th annual Western States Symposium, bringing together over 200 AE and environmental industry executives and investors in one of the world’s most vibrant and iconic cities.

Learn More

Subscribe to our Newsletters

Stay up-to-date in real-time.