Word on the street > These Are Days; AE Industry Tapping the Brakes on Raises and Bonuses

Word on the Street: Issue 167

Weekly real-time market and industry intelligence from Morrissey Goodale firm leaders.

These Are Days

I was never a big fan of 10,000 Maniacs. (They didn’t even register a song on our Ultimate #AE and #Environmental Industry Playlist.) But their 1992 hit, and the title of this week’s article, almost perfectly sums up where our industry is. There’s never been a better time to own and run a design or environmental firm. “These are days you’ll remember.” But just how good are they? And what lies ahead?

Those are just two of the topics we’ll be exploring at next month’s Texas and Southern States M&A, Strategy, and Innovation Symposium at the gorgeous Post Oak Hotel at Uptown Houston. Our symposia always provide us with a timely way to take the pulse of the industry. And by hosting three symposia a year (Miami in March, Las Vegas in June, and Houston in October), we’re able to glean a close to real-time quarterly view on industry performance, condition, and outlook. Here’s an advance look at the sentiments of the almost 200 already registered attendees—and how they differ from earlier in the year.

Compensation pressures ease: For all the details on this—one of the hottest topics in the industry these days—check out Mark Goodale’s article below this week. He’s got the goods. But the headline is that the super-heated labor market of 2022 has seen some cooling this year, and leadership teams are budgeting accordingly (per our latest survey of Word on the Street readers). Firms have dialed back their raise and bonus budgets from earlier in the year. I’m not sure this is a good move. Granted, we’re still a step-function above pre-pandemic raise and bonus budgets. But the conditions we faced before and during the pandemic that resulted in record raises and bonuses in 2022 still exist. We still don’t have enough professionals and tech folks to meet the current demand for services. And this situation will be exacerbated when IIJA money flows into the system (hopefully sometime this millennium). But for now, firms are dialing back their raise and bonus budgets, while also putting in place more stringent return-to-office (RTO) policies. I expect the combination of both will result in a spike in voluntary turnover rates—especially in large metros.

2024? Bring it on: Seventy-eight percent of the attendees for our upcoming symposium believe that 2024 will be better for their firms than 2023. This is in line with the sentiments expressed back in March in Miami—when 76% anticipated a better year ahead. And it’s a rebound from the 69% who expressed this level of optimism in Las Vegas just last June. (If you remember there was a LOT of chatter about an economic recession late spring/early summer that I believe contributed to this mindset.) Firms that are expressing concerns about 2024 tend to be in the Northeast and tend to have an overexposure to buildings in the corporate and commercial sectors. That’s where we certainly continue to see some softness and layoffs.

It’s all about the people: Question: What’s the biggest challenge facing the industry? Answer: Finding and keeping talent. That’s according to 61% of the Houston symposium attendees. This is down from 69% in June (Las Vegas) and 66% in March (Miami). So, while talent management is still the #1 challenge for leadership teams around the country, its relative importance and urgency has declined over the year. Why? I think for two reasons. First, the industry as a whole has gone from storming to norming in terms of leveraging existing technologies to maximize efficiency. Meaning we’re generating more revenue and profit with fewer people. This provides a pressure release valve in terms of talent management. Meaning we’re relying less on people to do the work. (Megan Miller of Deltek and our own Nick Belitz will be covering this during their State of the Industry presentation in Houston.) Second, there’s relative weakness in the commercial and corporate buildings sectors and some headwinds in the higher education sector that are muting demand for talent. Combined, these factors have contributed to a different hiring environment in the second half of 2023.

This is the age of the expanding man: Or should I say, “expanding industry.” Sixty-two percent of Houston attendees see growth—either in terms of share of specific end-markets or geographies as the greatest untapped opportunity for their firm. We see this ALL the time in our strategy work. Almost every leadership team is focused on growth and positioning themselves to take full advantage of all the opportunities they see now and anticipate in the future. This growth mindset has only gotten stronger in recent months, up from 57% of attendees in Las Vegas.

Acquisitions as a way of life: With growth-driven strategic plans mandating top- and bottom-line expansion, and talent hard to find quickly enough to meet demand, it’s no surprise that many of this year’s Houston attendees are planning to make an acquisition in 2024. Sixty-nine percent of attendees see at least one transaction in the next calendar year. (Many of them are hoping to meet potential partners at the Houston symposium.) This “lean in” to acquisitive growth is an increase from the just 50% of attendees in Las Vegas who anticipated closing a transaction in 2023. The 450 domestic transactions we expect in calendar 2023 represent a decline of some 5% over the record pace of 2022, and the acquisitive sentiments expressed in Las Vegas directly correlate with that dip. The increased interest in acquisitive growth that we are seeing with Houston attendees suggests that 2024 will see a rebound in industry consolidation.

Which acquirers are making the most positive impact on the industry? We’ll be announcing the recipients of the Best Post-Transaction Performance Award in Houston next month—recognizing those acquirers that improve the fortunes of the firms that they invest in. There’s still time to submit an application for the award. So, if you’ve made an acquisition that you’re proud of, and you believe it merits consideration for this award, then we invite you to begin the application process here. Once you’ve gathered all of the information required, the application should take no more than 30 minutes to complete. The window for applications is open until October 6. If you have any questions about the award, please contact [email protected].

We’re excited to once again co-host the Texas and Southern States Symposium with our friends at ACEC Texas. I look forward to seeing you there next month.

To complain to Mick Morrissey about his taste in music or to connect with him about anything else, email him at [email protected] or call/text on 508.380.1868.

AE Industry Tapping the Brakes on Raises and Bonuses

Mark Goodale

Back in January, Word on the Street readers shared their 2023 projections for raises and bonuses. Between record-high profits and the sizzling demand for talent, employees were reaping the rewards. But as Mick Morrissey’s article above points out, the compensation race has cooled down a bit. Two weeks ago, we once again canvassed our readers to find out what their intentions are for raises and bonuses—and the side-by-side comparison below shows how the landscape is changing:

Annual raise expectations in January: Over half (55%) of respondents were planning on increasing salaries between 6% and 9% in 2023. Just over 40% of firms were budgeting raises of between 1% and 5%. And 3% of firms were planning on raises of 10% or greater. Firms in this last category had backlogs that far exceeded their current and projected production capacities. Their strategy was to (a) make an employee’s decision to leave for another firm as difficult as possible and (b) outspend their competitors to get the talent needed to meet their obligations and generate significant profit.

In general, more architecture and AE firms were planning for lighter raises in the 1% to 5% range than their engineering and EA peers, who were budgeting 6% to 9%. Similarly, a greater percentage of firms with 1,000 employees or more were budgeting in the 1% to 5% range, compared with their smaller peers. In large part this is because, all things being equal, larger firms were already paying higher salaries than their smaller counterparts, not to mention they typically have heftier non-salary benefits and perks. The pressure on surveying/mapping firms appeared to be intense with all of these respondents anticipating a 6% to 9% raise in labor costs at the time.

Annual raise expectations in September: Now, about 70% of respondents anticipate 1% to 5% raises, while less than a third (28%) are budgeting for 6% to 9% boosts. Demand for talent is still extreme, but softness in pockets of private-sector markets and the intermittent flashing of engine lights on the economy’s dashboard have got some owners tightening their fists.

In January, the majority of firms in both the 101-999 employees and 100 or fewer employees categories were budgeting for 6% to 9% raises while the majority of 1,000 and above employee firms were budgeting for 1% to 5% raises. But now, the majority of firms in all of the firm size categories surveyed are budgeting for 1% to 5% raises.

Annual bonus expectations in January: Nearly half (48%) of respondents anticipated that bonuses would be about the same as last year, while 10% expected them to be lower. That said, 42% anticipated paying out more in bonuses this year than they did in 2022.

Across all size categories, environmental firms most frequently (56%) anticipated paying greater bonuses in 2023. Just over a quarter (27%) of architecture firms anticipated paying less in bonuses this year. Between this and their lower anticipated raises, architecture firms—particularly those with heavy exposure to the tech sector—were likely anticipating a more challenging business environment this year. That said, 55% of architecture firms were anticipating a similar level of bonus payouts in 2023. Just over half (53%) of engineering firms were anticipating that bonuses would match those of 2022, with 42% reporting they expected to pay out more.

Annual bonus expectations in September: Bonuses, like raises, are expected to decline. The percentage of firms that expect bonuses to be about the same as they were last year rose 6% while the percentage of firms that expect bonuses to be more than last year dropped 11%. In all size categories surveyed, the majority of respondents expect bonuses to be about the same as last year.

For more details on AE industry salary and bonus trends, join Morrissey Goodale’s Nick Belitz and Deltek’s Megan Miller for their State of the Industry presentation at Morrissey Goodale’s Texas and Southern States M&A, Strategy, and Innovation Symposium.

Market Snapshot: Public Safety (Part 1)

Weekly market intelligence data and insights for AE firm leaders.

Overview

- The public safety category of engineering and construction primarily includes correctional and fire/rescue facilities, such as police and fire stations and dispatch and emergency centers. It also includes armories and military structures (not categorized under a specific type of construction).

- Based on 2022 data from the U.S. Census Bureau, the public safety category represents 3.1% of public construction work.

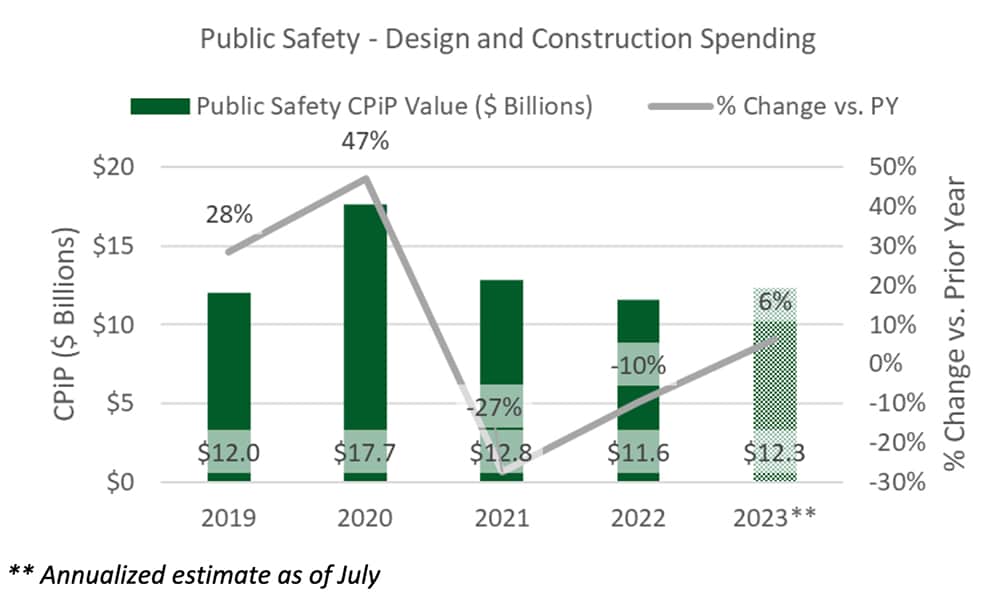

Market Size

- $11.6 billion*

*Based on 2022 Value of Construction Put in Place (CPiP) (U.S. Census Bureau)

Outlook

- Public safety project activity is expected to be 6.6% higher in 2023 compared to last year, based on the annualized July construction spending estimate. The fire/rescue category has been experiencing strong growth and is expected to go up by more than 17% this year.

- Based on the latest AIA Consensus Construction Forecast, public safety is the only area expected to have a higher year-over-year growth in 2024 (5.3%) than what is forecasted for 2023 (3.9%).

- Public safety will continue to be a critical concern for citizens not only with regards to security and law enforcement but also for emergency management support in communities throughout the U.S. The Department of Homeland Security and the Department of Defense have several grant programs available that can be accessed by state and local public safety agencies.

In next week’s issue, we’ll look at trends and hot spots for this sector. To learn more about market intelligence and research services from Morrissey Goodale, schedule an intro call with Rafael Barbosa. Connect with him on LinkedIn.

Weekly M&A Round Up

Congratulations to GHK Capital Partners (Greenwich, CT): The middle-market private equity firm created a new critical infrastructure engineering consulting platform with the acquisition of WSB & Associates (Minneapolis, MN) (ENR #178), one of the nation’s leading infrastructure engineering consulting firms serving the transportation, environmental, utility, renewable energy, and other critical infrastructure end-markets across the Midwest and Central states. Concurrent with the acquisition of WSB, GHK also completed the acquisition of EST (Oklahoma City, OK), a leading transportation infrastructure engineering consulting firm. EST will be part of the new leading platform operating under the WSB banner providing full-service engineering solutions across the United States. We’re thankful that the GHK team trusted us to initiate and advise them on this transaction.

Eight other deals this week: Last week we reported additional domestic deals in CO, FL, IN, CA, MI, UT, and OR. You can check all of last week’s M&A news here.

Searching for an external Board member?

Our Board of Directors candidate database has over one hundred current and former CEOs, executives, business strategists, and experts from both inside and outside the AE and Environmental Consulting industry who are interested in serving on Boards. Contact Tim Pettepit via email or call him directly at (617) 982-3829 for pricing and access to the database.

Are you interested in serving on an AE firm Board of Directors?

We have numerous clients that are seeking qualified industry executives to serve on their boards. If you’re interested, please upload your resume here.

June 12-14, 2024 Las Vegas, NV

Western States M&A and Business Symposium

Join us for the 10th annual Western States Symposium, bringing together over 200 AE and environmental industry executives and investors in one of the world’s most vibrant and iconic cities.

Learn More

Subscribe to our Newsletters

Stay up-to-date in real-time.