Word on the street > CEOs and CFOs by the Numbers; Short-Term vs. Long-Term Thinking—What’s the Right Balance?

Word on the Street: Issue 155

Weekly real-time market and industry intelligence from Morrissey Goodale firm leaders.

CEOs and CFOs by the Numbers

Last October, we took a look at who is leading the AE industry by doing a deep dive on the CEO demographics of the 2022 ENR Top 500 firms in “Here’s Who’s Running the AE Industry—By the Numbers.” What did we find? The average CEO was a 57-year-old man who had been with his firm for 24 years, with half of that time spent as CEO. There was a 50/50 chance he had a master’s degree in addition to his undergraduate professional degree. In all likelihood he did not have a business degree.

Mark Goodale’s article this week is “Short-Term vs. Long-Term Thinking—What’s the Right Balance?” One of the topics that perennially occupies both of those spaces in the CEO brain is succession planning—for themselves and their teams. It’s consistently one of the front-and-center items we experience in our strategy work for clients. And it’s the classic “a journey of a thousand miles begins with a single step” item. You’re planning for an outcome 10 years ahead, but you have to make progress daily in small, meaningful acts and interactions. A good way to mark progress is an annual review.

So, with the release this April of the 2023 ENR Top 500 list, we thought it would be good to check back and see how the leadership demographics in the industry had changed—if at all—over the past year. How have we done as an industry in terms of passing the baton? Is there less gray hair in the C-suite? Maybe more diversified? And while we were at, we decided to take a look at what the typical CFO looks like in the industry. Here’s what we found, by the numbers:

58: That’s the average age of an ENR Top 500 CEO. That’s UP from 57 last year. Not exactly an encouraging sign that a lot of leadership transitions took place over the last year. The youngest CEOs (average age 57.5) are to be found in the ENR Top 100 cohort. The oldest CEOs (average age 59.5) are in the 301-400 tranche. Interestingly, CEOs at private equity-backed firms are on average (barely) younger (56) than their peers at employee-owned/ESOP firms (average age 58) or publicly traded firms (average age 60.5). The oldest industry CEO is in his 80s, the youngest in the mid-30s.

52: That’s the average age of an ENR Top 500 CFO. CFOs pride themselves on consistency and reliability. And that’s reflected in how they are represented in the industry. Regardless of firm size or capital structure, there is practically no variation in CFO ages—they all fall between a tight band of 51 and 54 years old. We’re a mature industry with mature leadership at the helm and writing the checks (with a high probability of having Yacht Rock Radio programmed on their SiriusXM).

25.6: That’s the number of years the average CEO has been with their firm. Not surprisingly given the previous point about an increase in average age, this indicator is also UP from last year’s average of 24. Industry leaders got a little longer in the tooth over the past year. The group of “newest” CEOs are in the 1-100 cohort (average of only 22 years with their current firm) while the 301-400 tranche once again yielded the CEOs who have been with their firms the longest (average of 28 years—almost the same as a standard mortgage). CEOs of publicly traded firms have been with their firms for an average of 17 years, almost a decade less than their peers at employee-owned/ESOP firms (average of 26 years) and marginally less than their counterparts at private equity-backed firms (average of 20 years). The most loyal CEO has been with their firm for over 50 years!

12.5: That’s the number of years the average CFO has been with their firm. It’s half the amount of time their boss has been there. So, they are still relative newbies. Interestingly, CFOs of private equity-backed firms have been with their firms just over seven years, shorter than their peers at publicly traded firms (average of nine years) and employee-owned ESOP firms (thirteen years).

12: That’s how many years the average industry CEO has been at the helm of their firm—up from 10 last year. This continues the theme of little, if any, C-suite leadership transition over the past year. On average, CEOs in the ENR Top 100 have been in the job the least amount of time (7.5 years), while those in the 301-400 cohort have the longest tenure on average at 16 years. CEOs at publicly traded firms have relatively short average tenures in the driver’s seat (7.5 years), compared with their counterparts at private equity-backed firms (9.7 years) or employee-owned/ESOP firms (12.5) years.

9.5: That’s how many years the average industry CFO has been in their position overseeing their firm’s finances. There’s quite a range in this tenure depending on a firm’s capital structure. CFOs at publicly traded firms have an average tenure of just under four years while those at employee-owned/ESOP firms have been relentlessly saying “no” to extravagant company parties and requests for new computers for an average of 10 years.

9%: The percentage of female industry CEOs. This is stuck at last year’s level. If there was a big effort for gender diversity at the top of our industry, its results have yet to manifest themselves.

30%: This is the percentage of female industry CFOs—more than triple the percentage of female CEOs. In the 401-500 cohort this percentage reaches a high of 37%.

Older (and wiser?): Leadership at the industry’s top firms aged over the past year. Industry CEOs are now on average older than their counterparts in the Fortune 500 (57 years old) with an average tenure in the position that’s longer than their peers in the S&P 500 (10.2 years). The industry’s leadership now has less gender diversity than the Fortune 500 (10.4%). Twenty-five percent of the female CEOs in the Fortune 500 became their companies’ leaders in just the past year. Last year just 9% of the Fortune 500 CEOs were women. Interesting that that group is more diverse one year on, but our industry is not. Small steps, long journey.

You can reach Mick Morrissey @ 508.380.1868 or [email protected].

Short-Term vs. Long-Term Thinking—What’s the Right Balance?

Last week, I caught up with David Thornhill, CFO/COO of New York-based AKF, a 400-person mechanical/electrical engineering firm with 11 offices in the U.S. and two in Mexico. David regularly couples financial expertise with strategic thinking, so I thought it would be interesting to get his perspective on balancing near-term issues with longer-term matters. Here’s how it went:

![]()

David, thanks for contributing to Word on the Street!

![]()

Thanks for the opportunity.

![]()

Why is it important for AE firm leaders to distinguish between short- and long-term focus?

![]()

It’s important because over time, you expect your focus to go where it needs to go, whether it’s to something immediate or down the road. But if you aren’t conscious of balancing the two, you ultimately won’t get to where you want to go in the long term. You need to carve out that time in your calendar to figure out where you’re headed, how you’ll get there, how you’ll know you’re getting there, and how you’ll adjust when you need to make a course correction.

![]()

What makes a short-term item short term, and what makes a long-term item long term?

![]()

Unfortunately, I’m not sure you can always tell in the moment, but I consider short-term items to have specific deadlines, like Section 174. To me, it’s a short-term issue because there are dates— tax filing dates, congressional dates, and so on. Some might say that’s an intermediate concern, but ideally you are not talking about it five years from now. On the other hand, you will be talking about succession five years from now.

![]()

What long-term issues have your attention?

![]()

Succession, broadly defined, including employee training and development, as well as ownership transition—making sure we serve our clients today and are prepared to help them tomorrow. The second long-term item is maintaining and strengthening the relationship with our Mexico offices—the differences in culture and time zones can make that challenging. And a third is our strategic plan—simplifying it enough so employees know how to prioritize their time in ways that align with the direction of the firm.

![]()

What’s the right balance?

![]()

Where you stand depends on where you sit. If you are the COO, it’s more short to intermediate actions with the understanding of where you’re trying to go. If you’re the CEO, it’s about achieving the firm’s vision and communicating that vision relentlessly. I once worked with an executive who summed up his priorities this way—put food on the table for other people, put the right people in the right job, let them do it and hold them accountable, and set the direction and tone. All of his time was dedicated to those specific things. I personally focus about 60-70% of my time on short-term issues and the rest on how I can help the company focus where we need to focus, whether that’s our organizational or capital structure, geographic concentration, our various sectors, or even sales. But as you have often reminded me, I am an unusual CFO. I started from the engineering/project side, so I’m not the debit and credit guy—but when I see the balance sheet, I know the story it tells and the strengths and weaknesses it reveals.

![]()

How do you balance the short term and the long term when everything is changing at such a rapid pace?

![]()

You need to be flexible enough to know when situations are changing so you can either change yourself to fit the plan or shift the plan to fit reality. For example, COVID impacted the commercial market. Some architects in that space are beginning to lay people off. So, what does that mean to us? Our people have to be cross-trained to do work in health care and science and tech. In any case, we can’t just sit still when the rules of the game change. We have to adapt.

![]()

I’ve seen how easy it is for well-intentioned leadership teams to get distracted when they blend short-term and long-term issues. What do you do at AKF to avoid going in any and all directions?

![]()

First, we separate out operational matters from our strategic meetings so things don’t go off the rails. Second, we invite our outside members to some meetings but not others, which helps to maintain their interest and objectivity. Third, we look to accomplish specific things, like deciding who we’ll train and develop and who will be offered ownership and when. We also assign read-aheads and create clear agendas so we’re not going into meetings asking what we’re doing or why we’re there.

![]()

How do you know if you’re focusing too much time on short-term issues? What do you observe when that happens?

![]()

Too many conflicts with where the firm should go and what it should do, and subtle signals that indicate a lack of alignment with the firm’s vision. If you’re getting a lot of questions about the firm’s direction that you can’t answer, you don’t have enough time going in the long-term bucket.

![]()

What about when too much time is dedicated to the long term?

![]()

That will show up in liquidity. Take Long-Term Capital Management (LTCM), for example. It was a large hedge fund led by some of the most accomplished people in the world, including Nobel Prize-winning economists and renowned Wall Street traders. They had a brilliant strategy but some fatal short-term issues that eventually caused them to crater. It was like going to the blackjack table not knowing that if you lose all your money, you don’t get to bet anymore. You may have a good strategy, but if you ignore the short term, you’re out of the game before you know it.

![]()

What are some other considerations when trying to balance the short term and long term?

![]()

It’s not just about you. It’s about your people’s development. To me, that always takes precedence. Even when you are looking at the long term, if someone needs you in the short term, you have to give them that time. I’m talking more in terms of mentoring, training, and investing in people.

![]()

Should you invest your time or spend your time? What’s the difference?

![]()

Invest time, don’t spend it. For example, you can spend time in a meeting only to find three hours later that nothing got done. On the other hand, you could invest your time to help someone decide what to do and how to best do it to achieve mutually advantageous objectives. There’s only so much time to go around, so be selective in how you invest it because when everything is important, nothing is.

For help with balancing your short-term and long-term priorities, call Mark Goodale at 508.254.3914 or send an email to [email protected].

Market Snapshot: Manufacturing (Part 1)

Weekly market intelligence data and insights for AE firm leaders.

Overview

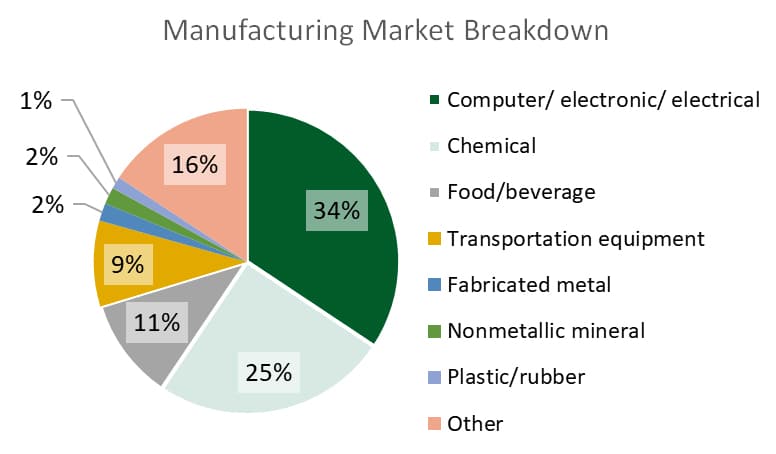

- The manufacturing category of construction comprises buildings and structures at durable and nondurable goods manufacturing sites.

- Almost 60% of the manufacturing market for design and construction is made up of computer/electronics/electrical and chemical manufacturing facilities.

Market Size

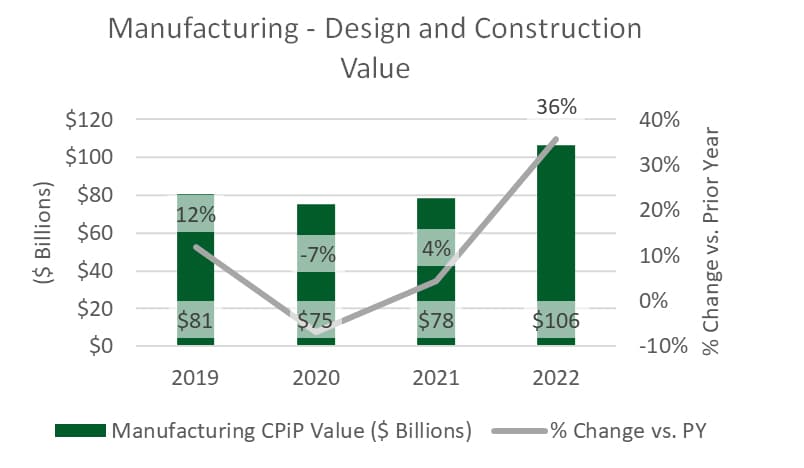

$106.3 billion*

*Based on 2022 Value of Private Construction Put in Place (CPiP) (U.S. Census Bureau)

Outlook

- Based on the first four months of activity in 2023 reported by the U.S. Census Bureau, design and construction spending in manufacturing is trending up for all sectors, with the exception of fabricated metals.

- Forecasts for construction project starts, however, are down compared to 2022, which was a record year for the sector.

- Due to the implementation of the CHIPS Act and the IRA (Inflation Reduction Act), more industries are investing in U.S.-based manufacturing sites. Many companies kicked off projects in 2022, notably those focused on semiconductors and industrial electrification, such as EV batteries. Investments are forecasted to be down in comparison to last year, but still historically high.

- Manufacturing onshoring has been increasing in many U.S. industries in efforts to improve efficiencies related to supply chains.

- Industry 4.0 applications such as 3D printing, data analytics, and machine learning in combination with the tight labor market will continue to drive advancements and demand for design and construction within manufacturing industries in coming years.

In next week’s issue, we’ll look at trends and hot spots for this sector. To learn more about market intelligence and research services from Morrissey Goodale, schedule an intro call with Rafael Barbosa. Connect with him on LinkedIn.

Weekly M&A Round Up

Five new deals around the country: Last week we reported deals in AZ, CA, NY, MA, and NJ, highlighted by the Huitt-Zollars (Dallas, TX) (ENR #188) acquisition of Gavan & Barker (Phoenix, AZ). Additional global deals were reported in Spain, the UK, and Canada. You can check all the week’s M&A news here.

Searching for an external Board member?

Our Board of Directors candidate database has over one hundred current and former CEOs, executives, business strategists, and experts from both inside and outside the AE and Environmental Consulting industry who are interested in serving on Boards. Contact Tim Pettepit via email or call him directly at (617) 982-3829 for pricing and access to the database.

Are you interested in serving on an AE firm Board of Directors?

We have numerous clients that are seeking qualified industry executives to serve on their boards. If you’re interested, please upload your resume here.

June 12-14, 2024 Las Vegas, NV

Western States M&A and Business Symposium

Join us for the 10th annual Western States Symposium, bringing together over 200 AE and environmental industry executives and investors in one of the world’s most vibrant and iconic cities.

Learn More

Subscribe to our Newsletters

Stay up-to-date in real-time.