Word on the street > Artificial Intelligence—First- and Second-Order Effects for the AE Industry

Word on the Street: Issue 135

Weekly real-time market and industry intelligence from Morrissey Goodale firm leaders.

Artificial Intelligence—First- and Second-Order Effects for the AE Industry

This week, I wanted to take some time to discuss the impact artificial intelligence (AI) is having—and will continue to have—on the AE industry.

First-Order Effects: AI technology is beginning to revolutionize the way we approach many facets of our field—from the conception of design all the way through construction.

It’s clear that AI can drastically improve project efficiency by helping to make better decisions, anticipate outcomes, and prevent errors. For example, AI-powered digital twins are being used as models of a building before its construction has even begun in order to quickly evaluate how certain changes may affect cost, environmental performance, or any other aspect.

The use of AI for predictive maintenance also promises major advancements for our industry. With the ability to detect anomalies and determine maintenance schedules, it is projected that this kind of preventive work could lead to an estimated 40% decrease in costs.

There’s no denying that these technological advancements offer immense potential in terms of time savings and cost savings, but they must be integrated into the workflow carefully. Understanding the tools available, proper implementation, and adaptation within current processes is key when taking full advantage of these new opportunities.

I really hope you disliked the previous four paragraphs: Because, dear reader, they were not written by me (and your betrayal cuts me deep). They were “written” by Anyword—a copywriting AI service. I entered what I wanted to write about. Anyword produced the copy in about three seconds. Saved me a TON of time (and puts me on notice—as if I need more—that my obsolescence continues to hurtle toward me like a runaway train, which no doubt AI could have predicted).

First-Order Effects (not written by creepy AI): AI copywriting is a parlor game (although copywriters don’t see it that way) compared to the planning, design, and operational power that the technology will bring to our industry. From the C-suite (you seriously don’t think that AI can deliver better—as in more accurate, more understandable, and less biased—forecasting and reporting than your current COO?) to how your designers deliver value is up for grabs. The future combination of AI, machine learning, and deliverable digitization will create the next big winners/losers fracture in our industry.

Second-Order Effects: The growth of AI for internet will be rapid. OpenAI—the owner of the pretty remarkable ChatGPT—is forecasting $200 million in revenue this year and $1 billion in revenue in 2024. “Exponential” springs to mind. OpenAI is potentially a very powerful Google search competitor with ChatGPT answering queries for more than one million users thus far. It’s likely to become a commodity very, very quickly. But, it’s relatively expensive—at about two cents per query of processing power, which is seven times what a Google search takes. So to keep up with demand and to bring the cost down, there’s going to be massive investment in processing power and the supporting infrastructure over the next decade. That’s music to the ears of those AE firms designing mission-critical facilities and data centers.

Questions or comments, email or call Mick Morrissey at [email protected] or 508.380.1868.

Trinnex—A Year-One Retrospective

Mark Goodale

It’s been a year since CDM Smith launched Trinnex, a customized digital solutions firm that serves utilities and infrastructure owners. Trinnex specializes in digital-first resiliency strategy, ranging from asset performance and capital planning to digital twin design. Last week, I talked with the president of Trinnex, Amy Corriveau, to get her take on the firm’s first year in business. Here’s what she had to say:

![]()

Thanks for contributing to this week’s Word on the Street!

Thank you for the opportunity!

![]()

After a year in business, what did you learn? Any big surprises and/or epiphanies?

It’s not all about the tech. For a technology company, admittedly, that’s an unconventional stance. And Trinnex is certainly passionate about technology, but as an enabler—it’s not a silver bullet. The exciting part for us has been working with clients that are equally passionate about transforming their organization, embracing a digital mindset. We’ve seen such a mindset shift and a new openness to experiment with technology to enable decision-making, enable operational efficiencies, and enable a more flexible and mobile environment for staff.

Granted, technology has always touted similar benefits, but there’s a growing awareness that successfully achieving these benefits requires transforming the organization—its people, processes, data, and systems. We liken it to climbing a mountain. Despite seeing the peak and knowing where it is, the journey is hard. Even the most experienced mountain climbers turn to a guide to help prepare, help traverse obstacles, and help navigate along the way. Our clients are embarking on their digital climb, and we are proud to serve as their guides.

![]()

What turned out the way you thought it would?

Launching a new company is arduous and takes perseverance; it’s not for everyone. We knew early on that a key to our success would be assembling the right team of sales and marketing staff, software engineers, product specialists, and digital consultants. We set out to build a diverse team of skilled, passionate, and committed team members. While diversity is an important cultural asset for us, I’m proud to say we all share one common trait—grit. That grit has helped the team achieve the most herculean tasks. In a short amount of time, we’ve achieved a synergy and a culture that works together, driving towards a common goal. The team is invested in the success of Trinnex and motivated to put in extra effort to ensure that we are a success. As a startup, we face a lot of uncertainties, but the perseverance of my team is not one of them!

![]()

What turned out better than you thought it would?

At Trinnex, our mission is centered around delivering powerful and insightful solutions today, to build a better tomorrow. We’ve had some great wins during our first year and have expanded our client base across our entire portfolio of products, signifying strong market validation of our products. While the market traction is great, the real thrill for us is that our offerings are delivering value and helping our clients build a better tomorrow. This early traction is strong market validation that Trinnex and our products can be the high-value disruptors we theorized. It’s exciting to see this validation happen so early in our business lifespan.

![]()

What, if anything, fell short of expectations?

The great thing about the startup world is that a failing-fast mindset is a prerequisite. We have tested and pivoted several concepts, but the most notable was when we pivoted our product strategy earlier this year. In the beginning, we had high expectations about quickly releasing a larger number of products to meet the broad needs of the public infrastructure space. The reality is that creating, maintaining, and refining high-quality products that deliver value for our clients takes time. We owe it to our clients to resist the temptation to rush to new releases—haste makes waste. We are committed to helping our clients solve their pressing issues of today and have plans to expand appropriately into the energy, environmental, and transportation markets, but that is on our future roadmap.

![]()

What did Trinnex accomplish for its clients in its first year of business? What were some of the success stories?

As I mentioned earlier, our products are helping our clients build a better tomorrow. They are being used to monitor public health statewide, administer the removal of lead from our drinking water, manage flooding and overflows, and rapidly comply with evolving regulations. In 2022 alone, we welcomed 15 new clients across our product portfolio, including the statewide implementation for the State of Louisiana’s Department of Health to monitor and respond to future outbreaks of SARS-CoV-2 and other viral threats, using our wastewater surveillance tool called epiCAST. We’re proud that leadCAST, our software for Lead & Copper Rule Revisions compliance, is being used by numerous water utilities across the nation. And despite being a new entrant in this marketspace, leadCAST was highlighted by the Environmental Policy Innovation Center as one of the only tools to meet all five technology categories for lead pipe replacement programs. We’re also proud that pipeCAST, our digital twin platform for collection systems, has helped our clients manage overflows and even enabled our Massachusetts client to swiftly comply with new public notification regulations.

![]()

Given your desire to grow Trinnex, what are some of the key challenges that lie ahead and how do you intend to tackle them?

We have large growth goals for 2023—we want to grow our headcount by an additional 40%, we want to grow our client base by an additional 150%, and we want to expand our digital offerings and features. While our focus is growth, there are plenty of challenges on the horizon.

Resourcing is a big component in our operational strategy. Despite the massive rounds of layoffs in the tech industry, we still encounter sourcing challenges. We have explored a variety of hiring options beyond permanent hires, including short-term contractors and staff augmentation to help with our sourcing difficulties. We will continue to explore novel resourcing options, and one that also aligns with our DEI values is partnering with organizations to source underrepresented groups.

The accelerating pace of technology is another area of concern for us. Yes, the pace of technology can be a double-edge sword, even for a tech firm. We’re rapidly refining our products to leverage AI/ML and achieving great success. Yet, as we can all attest after experimenting with ChatGPT and DALL·E 2, the AI sector has potentially disrupted tech powerhouses (potential “Google killer”) and whole industries (education and creatives) practically overnight. We are working tirelessly to stay ahead of the advancements, so we can balance our ability to deliver leading-edge, rather than bleeding-edge, solutions.

Along those same lines, technology advancements have led to a great dependency upon data and its accessibility. As this dependency grows, so do cyber attacks. We’re diligent about our cybersecurity program, and working in concert with our cloud hosting partners, our cyber team is using a variety of tools and processes to safeguard our systems and data.

2022 was our building year. We built everything from a new brand and identity to job positions, to new teams, processes, systems—you name it. This construction phase was critical but necessitated an internal focus. We’re excited to transition to our growth phase, allowing us to focus more externally, driving our strategy and ensuring we have tight market alignment. As we move into 2023, we’ll be ascending along our own digital climb, keeping the summit of success in our sights, while calling upon the experience and grit of the team to navigate the obstacles.

Meet Amy Corriveau, one of the featured speakers at our Southeast M&A, Strategy, and Innovation Symposium, March 23-24 in Miami.

Market Snapshot: Wastewater (Part 1)

Weekly market intelligence data and insights for AE firm leaders.

Introducing the Market Snapshot series. This section will include sector-specific market intelligence data and insights to help AE firm leaders stay informed.

Overview

- The wastewater category of construction primarily includes wastewater and sewage plants, pipelines, and pump stations.

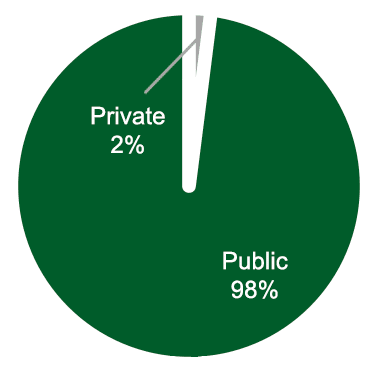

- Approximately 98% of total wastewater construction is public.

- The U.S. has more than 16,000 wastewater treatment plants and over 800,000 miles of public sewers, along with 500,000 miles of private lateral sewers.

Wastewater Market Breakdown

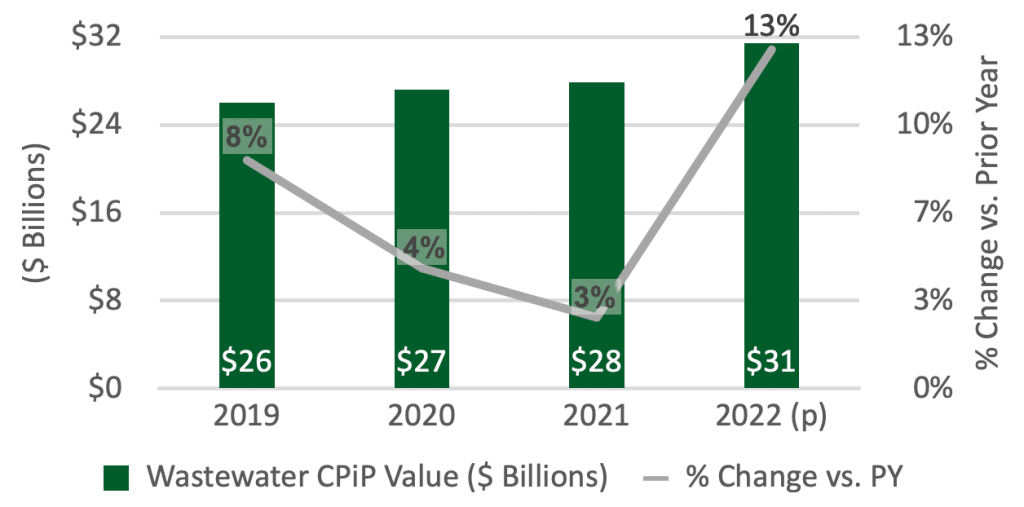

Market Size*: $31.4 billion

*Based on Value of Construction Put in Place (CPiP) – 2022 preliminary estimate (U.S. Census Bureau)

Wastewater – Design and Construction Value

Outlook

- The market for wastewater design and construction is expected to go up significantly over the next few years due to substantial government funding to upgrade systems that are reaching the end of their useful life (40 to 50 years). Funding for Clean Water State Revolving Fund programs nearly doubled in FY 2022 and appropriations for FY 2023 surpass $4 billion.

- In addition to aging infrastructure, owners and operators will continue to focus on addressing regulatory compliance, emerging contaminants, and energy efficiency.

- Extreme drought and rainfall events are driving water reuse/recycling and resiliency projects.

In next week’s issue, we’ll look at trends and hot spots for this sector. To learn what’s ahead for other markets, don’t miss our January 24 online event: Morrissey Goodale’s 2023 Market Outlook for the AE Industry. Click here for details and registration.

For customized market intelligence and research, contact Rafael Barbosa at [email protected] or 972.266.4955. Connect with him on LinkedIn.

Weekly M&A Round Up

Industry M&A is up 1% over the past 12 months: Last week we reported another transaction in the rapidly consolidating Southeast as design firm BDG Architects (Tampa, FL) joined forces with architecture firm Parker Walter Group (Sarasota, FL). Additional domestic and global deals were announced in NJ, CA, KS, the Netherlands, and Ireland. You can check all the week’s M&A news here.

June 12-14, 2024 Las Vegas, NV

Western States M&A and Business Symposium

Join us for the 10th annual Western States Symposium, bringing together over 200 AE and environmental industry executives and investors in one of the world’s most vibrant and iconic cities.

Learn More

Subscribe to our Newsletters

Stay up-to-date in real-time.

Subscribe Now

Subscribe Now