Word on the street > What It Takes To Create a High-Performing Acquisition; Legislative Update—R&D

Word on the Street: Issue 171

Weekly real-time market and industry intelligence from Morrissey Goodale firm leaders.

What It Takes To Create a High-Performing Acquisition

“How successful are acquisitions in this industry?” “How do you measure the success of an acquisition?” We get those questions all the time at our symposiums. In the past, any discussion around acquisition performance or success was largely subjective or anecdotal. Fuzzy at best, with a whole lot of subtle exaggeration. Not a lot of transparency. Quite a bit of FOMO.

This year we changed that. In a first for the industry, our Best Post-Transaction Performance Award established the Acquisition Performance Indicator (API)—an objective, multi-factored benchmark to assess post-transaction performance. Developed through discussions with industry acquirers and investors and by leveraging our experience in advising on over 200 AE and environmental firm transactions, the API provides buyers, potential sellers, and strategists with an objective benchmark to assess post-transaction performance.

The API takes a holistic view of the acquisition. It does not just focus on financial indicators. Rather it assesses performance in the areas of revenue, profit, backlog, and voluntary turnover in the 12 months following the date of a transaction. The revenue and profit elements indicate top- and bottom-line improvements—and speak to returns on investment. The backlog element is an indicator of sales and marketing improvements. The voluntary turnover element reflects improvements in employee engagement and connectivity.

Key findings from the over 50 firms that submitted applications for the Best Post-Transaction Performance Award show that acquirers have been, on average, doubling profits, increasing backlogs by 44%, boosting revenues by 33%, and reducing voluntary turnover rates by 20% one year after they close on transactions. How do these acquirers go about driving improved performance post-transaction? Here’s how three of them create high performance and business improvements:

Cross-selling, collaboration, and a common language: These are the factors that drive superior post-transaction performance. That’s according to Dean Petrovic, senior vice president, M&A and strategic initiatives at Englobe (Montreal, Canada). Englobe is the recipient of the 2023 Best Post-Transaction Performance Award in the $10 million or less size category for their October 2021 acquisition of Protostatix (API 4.58). The firm has made a total of eight acquisitions. I asked Petrovic what he and his team focus on to improve performance post-transaction. He spoke to the importance of kick-starting cross-selling and joint project pursuits as quickly as possible by facilitating introductions across departments, geographies, and disciplines. “When engineers start collaborating with other engineers across the company, some incredibly exciting opportunities and growth stories emerge very organically. In addition, developing the tools to understand the financial performance and KPIs of an acquired company early on is paramount to helping us ‘speak the same language’ and make quick course-corrections together as partners.”

Find the right “like-minded” partner (it’s intentional, not by accident): It turns out that what’s important in a great relationship is also the catalyst for a high-performing acquisition. That’s according to Nathan Rust, senior vice president, manager of corporate development and FP&A, at Salas O’Brien (Irvine, CA) (ENR #54)—the recipient of this year’s Best Post-Transaction Performance Award in the $10 to $50 million size range with a reported API of 5.94 for their June 2021 acquisition of BVH Integrated Services.

According to Rust, “Our post-transaction success is due in large part to the culture and the merger philosophy we have nurtured. We approach every transaction as a partnership, finding organizations with proven track records of success, like-minded and active leaders, passionate talent, alignment of values and goals, and a shared vision for future success. This starts well before and lasts well beyond closing, from screening and due diligence to select the ideal partners; to intentional communication with leaders, team members, and clients; through integration where teams continue to operate with the same local, empowered decision-making.”

Try the Triple T: A focus on three specific “T”s is the recipe for creating superior post-transaction performance according to Tom Secker, senior vice president, corporate development, at Trilon Group (Denver, CO). And he should know. Fast-growing Trilon Group has made 12 acquisitions in the U.S. The firm received an honorable mention for the Best Post-Transaction Performance Award in the $50 million-plus size category for its acquisition of CPH (reported API of 1.49). According to Secker, he and the Trilon team aim to accelerate the growth of its partner firms through targeted investments in what they call the “Three Ts”: Talent, Technology and Targeted M&A. “Specifically, within Talent, Trilon focuses its efforts on increasing hiring through its own talent acquisition program, creating long-term talent development programs for staff, and investments in corporate teams to build a foundation for future growth. Trilon’s partners benefit from the family of firms approach by being able to cross-sell their services into new customers who already have strong, long-term relationships with other Trilon partners.”

M&A connections and best practices: If you’re a first-time buyer or a buyer that needs to improve your acquisition outcomes and you want to learn from the best, or if you’re considering selling your firm and would like to network with quality, successful acquirers, then the Texas and Southern States M&A, Strategy, and Innovation Symposium in Houston this week is the place for you. Executives from all the 2023 Excellence in Acquisitive Growth Award recipients and honorable mentions—including IMEG, Terracon, TRC, Trilon Group, Salas O’Brien, Atwell, and Englobe—will be in the house and available for you to connect with.

To contact Mick Morrissey, you can email him at [email protected] or call/text on 508.380.1868. If you’re going to be in Houston this week, drop him a line to set up a time to connect in person.

Legislative Update—R&D

Last spring, we were buried with inquiries from concerned AE firm leaders about Section 174, the rules of which require businesses to capitalize and amortize specified R&D expenditures over a period of five years. Now, as 2024 draws near, we find ourselves facing a year-end congressional strategy to fully repeal or at least delay the measure. Where does that leave the AE industry? I spoke with tax expert Jordan Wilson of Corporate Tax Advisors, Inc., a Huntsville, Alabama-based tax advisory firm that specializes in research and development (R&D) tax credits. Here’s how it went:

![]()

Jordan, thanks for contributing to “Word on the Street!”

![]()

I’m always happy to share our thoughts on this important topic.

![]()

So, do you have any good news to share?

![]()

Well, unfortunately, like many things in D.C., it often takes feeling the full force of negative impacts before Congress can achieve enough political momentum to address a problem. In an attempt to move things along, businesses of all sizes have continued a massive lobbying campaign to achieve a fix in a year-end package—as in this year. They have been able to point to the tangible and damaging impacts of the amortization requirements on all businesses from Fortune 500 companies to small businesses, without much buffeting.

![]()

But…?

![]()

But while there continues to be no real “opposition” within Congress to returning to immediate deductibility of R&D expenses, the implementation will still require political concessions and compromise.

![]()

Where are the snags?

![]()

The challenges Congress faces are multi-faceted and must be addressed to achieve success this year. First, Congress is facing even more difficulty than normal finding compromise within their own parties, let alone across the aisle. If the House can unite behind a new speaker who is empowered to pass their remaining appropriations bills, the Senate will be pressured to follow suit, and work can begin in earnest to achieve a compromise year-end package of bills. This opens the door for a bipartisan tax package to be included. With the approaching election year, there is added pressure to try to clear the deck of difficult policy and funding decisions by the end of the year or very early in the new year. Both parties will also benefit by being able to campaign on their role in supporting U.S. innovation and businesses. If the House does not choose a speaker who is empowered to compromise, gridlock between the House and Senate will continue and will damage chances for year-end agreements on funding bills or a bipartisan tax package.

![]()

If this gets walked back, won’t some dominos start falling? What are the implications?

![]()

They are not insignificant. Reversing the Tax Cuts and Jobs Act (TCJA) R&D amortization rule will result in a high cost to government tax revenue. Congress will have to find a way to offset the cost or deliver a convincing argument that justifies the cost as an investment in future tax revenue that will result if U.S. businesses are encouraged to grow and innovate in the U.S. An option to try to alleviate the tax revenue impact could be to approve only a “temporary” reprieve—in other words, reinstating immediate deductibility of R&D, but only for five years, at which time Congress would have to address it again. While congressional advocates still believe any change (to repeal or to delay) would be retroactive to January 1, 2022, there could be a proposal to reinstate immediate deductibility, but only going forward in an effort to decrease the tax revenue impact.

![]()

How does this all play out politically?

![]()

Democrats view this as being the Republicans’ fault (because the 2017 TCJA was a partisan law with little Democratic input) and therefore believe the Republicans should support another Democratic tax priority in return for helping to fix the R&D problem. Discussions currently, and for the last several years, have centered around agreeing to the R&D amortization fix IF they can also agree to an enhanced Child Tax Credit (CTC). Like the R&D amortization fix, the CTC also largely has bipartisan support, but it, too, is expensive, and Republicans favor a slightly different approach to the CTC than Democrats. These differences will have to be resolved, but agreement on an enhanced CTC is still viewed as the best opportunity to getting the R&D fix over the finish line.

![]()

How likely is a government shutdown as this all comes down to the wire, yet again?

![]()

Currently, the government is operating under a continuing resolution (CR) until November 17, 2023. It is widely anticipated that another CR will be required that could last until the end of the year or into early 2024 to give Congress more time to find a compromise on the annual funding bills and other legislation to include the tax extender package. Again, since we are headed into an election year, there will be added pressure to get these bills done by year end, to avoid being caught up in the 2024 presidential election.

Meet members of CTA at Morrissey Goodale’s Texas and Southern States M&A, Strategy, and Innovation Symposium October 25-27 in Houston.

Market Snapshot: Data Centers (Part 1)

Weekly market intelligence data and insights for AE firm leaders.

Overview

- Data centers are facilities containing information technology equipment including servers and networking computers for data processing, data storage, and communications. Organizations use data centers to house their critical applications and data.

- The United States accounts for roughly 40% of the global market for data centers, with over 2,700 locations as of 2022.

- Two broad categories of data center ownership are enterprise and colocation.

- Enterprise (or corporate) is a fully company-owned data center used to process internal data and host mission-critical applications.

- Colocation data centers are owned and operated by providers who lease the data space to multiple tenants.

- Architectural planning and design range between 7% and 25% of total data center construction costs. Mechanical and electrical costs can reach up to 85% of initial capital investments.

- Power expenses can range between 40% and 80% of the overall cost of operating a data center.

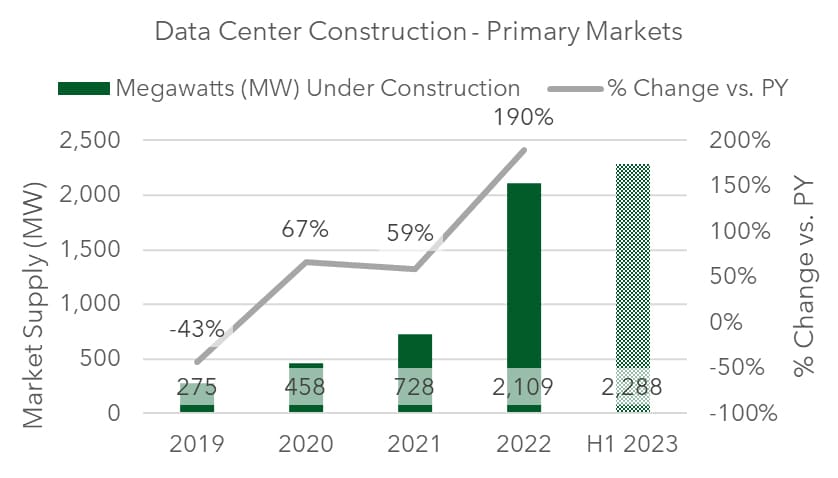

Market Size

- $18.8 billion*

*Based on 2022 supply under construction in primary and secondary U.S. markets (source: CBRE), applying cost of $8 million per megawatt.

Outlook

- According to a McKinsey report, U.S. data center demand is forecasted to grow by about 10% each year until 2030.

- Data center systems rely on multiple energy sources to operate, such as diesel, natural gas, and water. Energy demands and environmental concerns can hinder growth in certain areas as there is pressure to find efficiencies in energy use.

- This past May, the U.S. Department of Energy announced an investment of $40 million towards 15 projects aiming to develop high-performance, energy-efficient cooling solutions for data centers.

- Land availability and power procurement have become key constraints within the industry, making it harder for new capacity to come online.

- Additionally, the current economic environment with high interest rates has driven companies to postpone expansion investments, delaying fulfillment of current enterprise demands.

In next week’s issue, we’ll look at drivers, trends, and hot spots for this sector. To learn more about market intelligence and research services from Morrissey Goodale, schedule an intro call with Rafael Barbosa. Connect with him on LinkedIn.

Weekly M&A Round Up

Active week for architecture firms: Last week was a busy one for consolidation in the architecture sector with deals in MO, NC, KY, and NJ. Additional domestic deals took place in CA, VA, TX, and LA. Global deals occurred in Australia, the UK, and Italy. You can check all the week’s M&A news here.

Searching for an external Board member?

Our Board of Directors candidate database has over one hundred current and former CEOs, executives, business strategists, and experts from both inside and outside the AE and Environmental Consulting industry who are interested in serving on Boards. Contact Tim Pettepit via email or call him directly at (617) 982-3829 for pricing and access to the database.

Are you interested in serving on an AE firm Board of Directors?

We have numerous clients that are seeking qualified industry executives to serve on their boards. If you’re interested, please upload your resume here.

June 12-14, 2024 Las Vegas, NV

Western States M&A and Business Symposium

Join us for the 10th annual Western States Symposium, bringing together over 200 AE and environmental industry executives and investors in one of the world’s most vibrant and iconic cities.

Learn More

Subscribe to our Newsletters

Stay up-to-date in real-time.