Word on the street > Of PE Platforms and Playlists; What Kind of Thinker Are You? (Part 2)

Word on the Street: Issue 161

Weekly real-time market and industry intelligence from Morrissey Goodale firm leaders.

Of PE Platforms and Playlists

There’s a lot of talk about how “Private Equity” (“PE”) is “transforming” or “sweeping” (pick your hyperbolic description) the design and environmental industry. This week we document the actual scope, scale, and impact that PE “platforms” are having on the industry. The numbers may surprise you.

PE platforms defined: The tried-and-true method for a PE firm to enter the AE and environmental Industry is through a single “platform investment.” This typically involves investing in one industry brand that meets a minimum EBITDA threshold (more often than not, that’s $5 million). Most—but far from all—design and environmental firms that meet this earnings criterion are of a scale that they are featured on one or more of the multiple ENR Top Firm lists (more on this below). Additionally, a popular variation on the single-investment platform approach is when a PE firm makes concurrent or close-to-concurrent investments in multiple firms and then “combines” them under an existing or new brand name. The platform investment provides the investor with both the entry point to the industry and the operating entity (“operating firm”) to which it will add future acquisitions.

Parallel platforms: It’s not unusual for a PE firm to have multiple platforms in the industry. (No surprise there, we’re a great industry to invest in!) The “multiple platform model” typically (but not always) has its portfolio of operating firms in distinct sectors to eliminate competition (cannibalization) or conflicts of interest. In this model, an investor may have an architecture platform, an environmental platform, an infrastructure platform, or a construction services platform. More on this below.

More than you imagined: So, just how many PE platforms are there in the AE and environmental industry? Ten? Twenty? Fifty? Would you believe over 100? In fact, there are 102 active PE-backed platforms in the industry today.

A capital idea! Together these platforms represent the interests of 78 different PE firms. Combined, they account for investments in the industry of between some $50 and $60 billion.

What a difference a pandemic makes: Almost two-thirds of these platform investments were newly capitalized or recapitalized in just the last three years—since August 2020. That represents a LOT of investment in anticipation of (a) IIJA funds, (b) improvement of the electrical grid, (c) climate-driven infrastructure hardening, and (d) decarbonization. It also speaks to the speed that PE has been appearing in the industry.

Juggling multiple balls: Seventeen of these seventy-eight PE firms have more than one platform operating in the industry. Two of them each have four different concurrent platforms, while another five PE firms each have three distinct platform companies.

Industry brands: Forty-nine of these platforms may be found on the ENR Top 500 Design, ENR Top Environmental, ENR Top CM-at-Risk, or ENR Top Program Managers lists. The largest (and possibly best-known) PE-backed platforms include the iconic TRC Companies (ENR #16), Gannett Fleming (ENR #26) (which recently announced its acquisition of power delivery solutions provider—and Morrissey Goodale client—DiGioia Gray, its first since being recapitalized by Oceansound Partners), and Michael Baker (ENR #31). Eight of these ENR-listed firms underwent recapitalizations in 2023 alone.

Re-upping: Thirty of these PE-backed platform firms have been recapitalized at least once since they received their initial investment. Each of these recapitalizations involved another PE firm. This suggests that the hold time of PE firms is decreasing.

Impact 2023: Through 68 acquisitions in the first half of 2023, these platforms grew by a combined $687 million in revenue.

No slowdown in sight: These stats emphasize the scale and speed of PE’s involvement in the design and environmental industry. Based on everything we are seeing in the market, and inquiries from PE firms of all shapes and sizes, industry executives can expect to continue to receive non-stop emails and calls from PE investors and their representatives looking to get that first meeting that could lead to their first (or second) platform investment. (So maybe we should also create a PE-themed playlist?)

You can contact Mick Morrissey at [email protected] or 508.380.1868.

What Kind of Thinker Are You? (Part 2)

Last week I wrote about reductionist and deterministic thinking:

For those of you unfamiliar with the terms, “reductionist thinkers” break down complex systems into their individual components and assume that understanding the behavior of the parts separately will lead to an understanding of the entire system—but that kind of thinking can be short-sighted. “Deterministic thinkers” believe that particular causes make particular outcomes inevitable. It implies that every action or event has a single, definite cause and that given the same set of circumstances, the outcome will always be the same—but that kind of thinking can be close-minded. Any of this striking a chord?

I also listed a number of things that can go wrong when reductionist and deterministic thinking is solely relied upon to manage and grow an AE firm.

But now let’s look at a couple of alternatives—systems thinking and holistic thinking.

Systems thinking is an all-inclusive and analytical approach to understanding complex systems and problems. It involves viewing a system as an interconnected and interdependent network of elements that work together to achieve a common purpose. This way of thinking considers the relationships and interactions between the parts of a system rather than analyzing them in isolation (e.g., looking to the system vs. an individual when something goes wrong).

Using systems thinking in the leadership and management of an AE firm can lead to a number of benefits, including:

Understanding complexity: AE firms are intricate organizations, often with multiple disciplines, offices, teams, and processes. Systems thinking helps leaders see the bigger picture and comprehend the complex interactions between different parts of the organization. This understanding allows them to identify the root causes of problems and make more informed decisions. Consider change management and organizational restructuring, for example—systems thinking can provide insights into how different parts of the organization interact and adapt during periods of change. These observations can go a long way in devising effective change management strategies and implanting successful restructuring efforts.

Identifying feedback loops: Systems thinking helps in recognizing feedback loops within the organization. Positive feedback loops reinforce good practices, while negative feedback loops can lead to issues and inefficiencies. By understanding these loops, leaders and managers can reinforce positive elements and address negative ones to improve overall performance. Creating feedback loops takes commitment and practice, but the payoff is enormous.

Addressing interdependencies: In professional services firms, various departments and teams are interdependent on each other to deliver high-quality services. Systems thinking enables leaders to identify these interdependencies and ensure effective coordination between different parts of the organization, which reduces silos and enhances collaboration. Many AE firms strive to be “One ABC” or “One XYZ” largely because reductionist and deterministic thinking have rendered them otherwise.

Anticipating unintended consequences: Actions taken in one area of an AE firm can have unintended consequences in other areas. Systems thinking helps leaders consider the potential ripple effects of their decisions and take proactive measures to mitigate any adverse impacts. When salary and bonus decisions for a particular office are made in a vacuum, for example, a firm’s entire compensation structure can be thrown off kilter, sending morale into a tailspin.

Adaptability and resilience: Embracing systems thinking allows leaders to build a more adaptable and resilient organization. They can anticipate changes in their target markets, such as technological advancements, and make necessary adjustments to establish competitive advantages.

Continuous improvement: Systems thinking promotes a culture of continuous improvement within the organization. By examining the entire system and its processes, an AE firm’s problem solvers become problem finders who identify areas that need enhancement and implement changes to optimize performance.

Long-term perspective: Focusing on the entire system instead of isolated components enables leaders to take a long-term view of the organization’s success. They can set strategic goals that align with the firm’s overall vision and ensure that short-term decisions do not undermine long-term objectives (e.g., cost-cutting measures that fail to take into account employee morale, service quality, and client experience).

Effective resource allocation: Chief among AE firm fundamental constraints are talent and time. Systems thinking helps leaders allocate these scarce resources more effectively by prioritizing critical areas and getting the right people in the right seats for the right reasons.

Like systems thinking, holistic thinking is an approach that considers the entire organization and its various components as interconnected and interdependent parts of a unified whole. It involves looking at the bigger picture, considering all the relevant factors, and recognizing the relationships and interactions between different elements within a firm.

In the context of an AE firm, holistic thinking involves several key aspects:

Comprehensive approach: Holistic thinking means considering all the aspects and functions of the firm, including strategy, operations, finance, marketing, human resources, client maintenance and development, and so on. Instead of focusing solely on project performance metrics, for example, the firm’s leaders and employees consider how each value-producing element of the firm works in concert with each other to generate value for the firm and its clients.

Client-centric perspective: An AE firm primarily exists to serve its clients. Holistic thinking requires understanding the clients’ needs and expectations. By considering the clients’ broader objectives and how the firm’s services fit into their overall goals, a firm can provide more valuable and integrated solutions and wind down services that are no longer considered valuable.

Collaboration and communication: Holistic thinking encourages collaboration and open communication among different teams, disciplines, and offices within an AE firm. Silos break down, and employees share insights, expertise, and best practices.

Integration of technology: Holistic thinking involves leveraging technology to streamline processes, improve efficiency, and enhance the value delivered to clients. It opens the door to adopting integrated software platforms, data analytics, and digital tools to facilitate collaboration and data-driven decision-making.

So, what kind of thinker are you? And maybe more importantly, what kind of thinker is your next you?

To learn more about systems thinking and holistic thinking, call Mark Goodale at 508.254.3914 or send an email to [email protected].

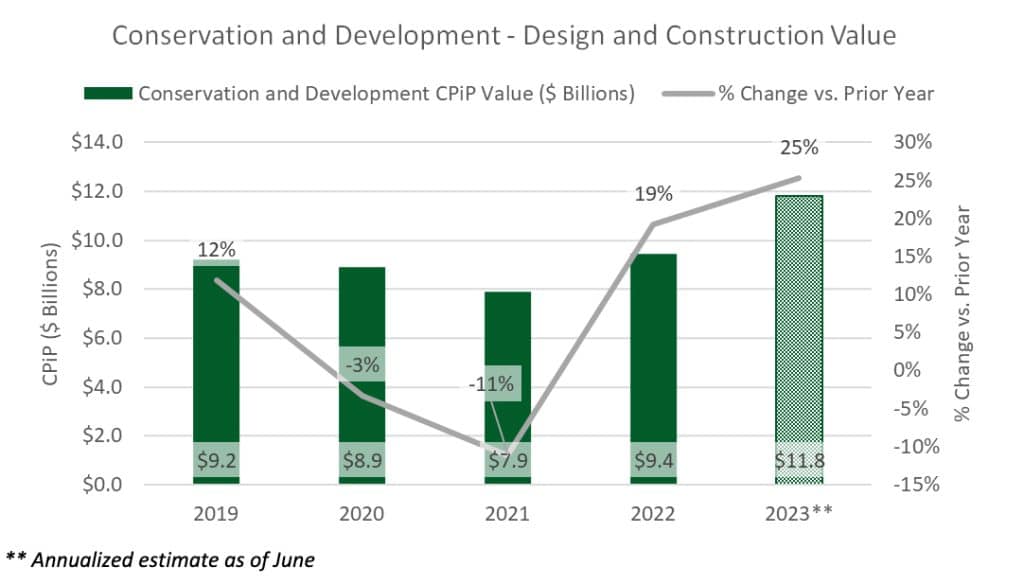

Market Snapshot: Conservation and Development (Part 1)

Weekly market intelligence data and insights for AE firm leaders.

Overview

- The conservation and development category of construction includes dams (non-power), dikes, levees, locks and lock gates, breakwaters, bulkheads, tide gates, jetties, erosion control, retaining walls, sea walls, and dredging (non-irrigation). It also includes facilities constructed for irrigation (e.g., draining, dredging, water collection systems, non-potable reservoirs), mine reclamation, fish hatcheries, and wetlands.

- Based on 2022 data from the U.S. Census Bureau, the conservation and development category represents about 1% of total nonresidential construction. The majority of the work (~57% based on 2022) is driven by federal agencies.

Market Size

- $9.4 billion

*Based on 2022 Value of Construction Put in Place (CPiP) (U.S. Census Bureau)

Outlook

- The conservation and development construction category is trending higher in 2023 and expected to increase further in 2024. During the first half of this year, spending has been 30% higher than it was in the same period last year, mostly driven by federal projects.

- With the passing of the Infrastructure Investment and Jobs Act (IIJA) and the more recent Disaster Supplemental Appropriations Act, several agencies will have additional support for dam safety, levees, breakwaters, jetties, and other projects related to mitigation of and recovery from natural disasters, such as tornadoes, hurricanes, flooding, and wildfires.

- Significant focus is being placed on coastal resilience projects, primarily through the National Oceanic and Atmospheric Administration (NOAA). The agency reports that 2022 tied 2017 and 2011 for the third-highest number of billion-dollar disasters (behind 2017 and 2005), and there is an increasing trend of these types of events due to a combination of exposure, vulnerability, and climate factors.

In next week’s issue, we’ll look at trends and hot spots for this sector. To learn more about market intelligence and research services from Morrissey Goodale, schedule an intro call with Rafael Barbosa. Connect with him on LinkedIn.

Weekly M&A Round Up

Congratulations to DiGioia Gray (Monroeville, PA): The 120-person power delivery solutions provider joined industry leader Gannett Fleming (Camp Hill, PA) (ENR #26). The acquisition will deepen Gannett Fleming’s existing transmission and substation engineering offerings and allow Gannett Fleming to serve power and utility clients on a larger scale. We’re thankful that the DiGioia Gray team trusted us to initiate and advise them on this transaction.

Four additional domestic deals announced: Last week we reported domestic deals in CA, FL, and TN. Overseas we reported four new transactions in the UK and Malaysia. You can check all of last week’s M&A news here.

Searching for an external Board member?

Our Board of Directors candidate database has over one hundred current and former CEOs, executives, business strategists, and experts from both inside and outside the AE and Environmental Consulting industry who are interested in serving on Boards. Contact Tim Pettepit via email or call him directly at (617) 982-3829 for pricing and access to the database.

Are you interested in serving on an AE firm Board of Directors?

We have numerous clients that are seeking qualified industry executives to serve on their boards. If you’re interested, please upload your resume here.

June 12-14, 2024 Las Vegas, NV

Western States M&A and Business Symposium

Join us for the 10th annual Western States Symposium, bringing together over 200 AE and environmental industry executives and investors in one of the world’s most vibrant and iconic cities.

Learn More

Subscribe to our Newsletters

Stay up-to-date in real-time.