Word on the street > The All-Pervasive Nature of Private Equity; Fumbled Leadership Handoffs

Word on the Street: Issue 195

Weekly real-time market and industry intelligence from Morrissey Goodale firm leaders.

The All-Pervasive Nature of Private Equity

If you’ve been feeling like there’s a lot more private equity in our industry, you’d be correct. The numbers confirm it. Design and environmental firms have been trading in their employee capitalization models for private equity at a record clip. But it’s more pervasive than just stats. “Private equity”—the concept—is the elephant in the room when it comes to decision-making about corporate matters, strategy, and culture all across the industry.

- First the stats: There are now 114 private equity-backed “platforms” in the AE industry. That’s up from 50 just 5 years ago. Of the 163 M&A transactions this year, a record 44% have included a private equity-backed acquirer or recapitalization by a financial sponsor. Of the 69 ENR Top 500 firms that have been acquired or recapitalized since 2020, 85% have involved private equity. In 2016, just 4 of the top 100 firms in the industry were capitalized by private equity. Today, it’s 21. The “smart money” (private equity, family offices) is head over heels in love with our industry and is piling in faster than ever.

- Corporate conundrums: The rapid influx of private equity has caught the attention of leadership teams of employee-owned and publicly traded firms. And they have incorporated it into an important part of their corporate and governance discussions. In boardrooms across the country, the topic of private equity is now either a semi-regular or standing agenda item. As they watch their peers recapitalize with equity out of Miami, New York, Chicago, Los Angeles, and Toronto, leadership teams want to know if this model could work for them. Stoked by rumors of valuations at nose-bleed altitudes, internal board members of a certain age with sizable ownership stakes are advocating for a fulsome examination of the financial-sponsor option—often for personal, rather than corporate, reasons. This is particularly challenging from a cultural perspective for employee-owned boards that assumed their commitment to employee ownership was universal and iron-clad. Concerned that internal leadership and ownership transition is a bridge too far—and finding a sale to a brand-name strategic as unappealing—more and more boards are selecting the apparent blank canvas, open checkbook, and ability to retain their brand name of a private equity recapitalization. So, while a representative from private equity may not be sitting in the boardroom, the topic itself is now front and center.

- Strategy upended: More than a few “sleepy,” historically slow-growth ENR 500 brands have been recapitalized by private equity over the past four years. Newly pumped up with outside capital and professional M&A management, they are now growing rapidly through acquisitions. And this dynamic is working its way into the strategic planning of employee-owned firms. Ever more frequently, they are finding themselves getting outspent for acquisitions and talent by these newly rejuvenated brands. They are experiencing fiercer competition for market share. And in many cases, they are finding their traditional “home” markets—which they had considered “safe”—now under assault. More and more, strategy and strategic planning is taking into account these new market dynamics and compelling teams to find new ways to reveal and deploy relative competitive advantages. (Word to the wise—a VRIO analysis is a great way for leadership to objectively assess their internal capabilities and innate competitive advantages. And before you ask, it stands for Value, Rarity, Imitability, and Organization.)

- Living rent-free in the competition’s headspace: Whenever we undertake strategy engagements, we like to conduct some good old-fashioned, one-on-one confidential interviews with firm leaders, managers, and employees. (Sure, we could do this with AI—and we have experimented with that—but nothing beats a real conversation for getting candid responses that can result in meaningful change for the client.) We like to ask a variety of questions during these interviews. Some are about the present, others about the future. Many focus on positives and suggested improvements. We also ask questions like “What’s your greatest concern?” or “What’s your greatest fear?” or “Fast forward 10 years and your firm has failed, what does failure look like and why did it fail?” (I know it seems like that escalated fast from the first two questions to the third, but that’s the way we roll.) What is remarkable is that when we ask those three questions of our employee-owned clients, one of the top responses is ALWAYS some variation of “selling to private equity.” We NEVER hear this response when we ask these questions in our work with our publicly traded or private equity-backed clients. Private equity somehow has gotten into the psyche of employee-owned firms as the bete noire de jour.

So yes, private equity is pervading seemingly all aspects of the industry. Not only is it having a meaningful impact on the capital composition of the design and environmental industry, but it’s also influencing industry-wide corporate, strategy, and cultural aspects.

M&A Best Practices Award application window open until May 17: Applications continue to roll in for this year’s M&A Best Practices Award, which will be presented at the Western States M&A and Business Symposium at the luxe Wynn Hotel in Las Vegas, June 12-14. If you’d like your firm to be considered for the award and the industry recognition that comes with it, we invite you to complete the simple application form here. The application should take no more than 20 to 30 minutes to complete. The award recipient will be notified in early June.

To connect with Mick Morrissey, email him at [email protected] or text him at 508.380.1868.

Fumbled Leadership Handoffs

Leadership transitions in AE firms are delicate and complex, and they require careful management for a clean handoff. Here’s a look at a few disguised scenarios based on real industry firms I’ve come across in the last two years that depict how specific CEO transitions were fumbled, along with insights on how each case could have been better managed for a more positive outcome.

Scenario 1: Cultural Disconnect at “Rhodes & Saucy Architects”

Rhodes & Saucy Architects was founded by Micah Rhodes in 1998. Micah was known not only for his innovative designs, but for the design of his firm’s close-knit, family culture. After 25 years of leading the firm, Micah decided to retire, appointing David Foster as his successor. David, however, was cut from a different cloth. He paid much closer attention to the business of the business and had a more structured approach to leadership, focusing on efficiency and profit margins. As the transition from Micah to David rapidly approached, Rhodes & Saucy Architects staff became uneasy with what they anticipated would be a wholesale dismantling of their treasured company culture.

And they weren’t entirely wrong. In the blink of an eye, Micah was out, and David was in, and a significant shift in the culture soon followed. The sudden focus on revenue reporting and profit projections was jolting. Architects who had never been asked to do more than the work in front of them felt that David’s business-first mindset ignored the creative process that made Rhodes & Saucy Architects successful. Tensions rose as employees felt disconnected from the new leadership, leading to a decline in morale, a few key defections, and eventually an erosion of innovation and quality.

For a cleaner handoff…

- A phased transition could have allowed David to maintain important aspects of the firm’s culture while changing others that really did need to be changed, giving him the time he needed to build relationships and gain trust.

- Had Micah taken a more active role in mentoring and guiding David, he could have helped David adapt to the role and prepare for the challenges he would face as Micah’s replacement.

- Engaging key stakeholders in the transition process would have helped create buy-in and support for David and the firm’s new direction.

Scenario 2: Power Struggles at “Mighty Good Engineering”

Mighty Good Engineering had a strong team of senior engineers, each with considerable influence inside the firm. When the CEO, Samantha Gray, announced her retirement, she chose her deputy, Eric Taylor, as her successor. However, Eric’s appointment sparked a power struggle among senior leaders, some of whom believed they deserved the top position.

These internal conflicts caused office politics to take center stage. As the power struggle intensified, communication broke down, frustrations intensified, and decisions became more challenging to make. The resulting toxic work environment led to decreased productivity and high employee turnover. The firm’s clients—the ones who actually paid the bills—had all but disappeared from the radar screen.

For a cleaner handoff…

- Samantha could have developed a comprehensive succession plan that outlined the selection process, the criteria used for selecting the new CEO, and how the transition would take place. She could have involved key stakeholders in this process to foster a sense of inclusion and reduce the risk of power struggles.

- Once the selection was made, Samantha could have provided clear information on why Eric was chosen and his vision for the company. Another option for Samantha would have been to have Eric and his partners collaboratively work on the vision together after Eric’s appointment.

- The development of clearly defined roles and responsibilities of senior leaders during the transition would have gone a long way in helping to prevent overlaps and reduce confusion, allowing everyone to focus on their commitments.

Scenario 3: Perceived Nepotism at “Watson Burbick Design”

Watson Burbick Design was a family-owned firm with a long-standing tradition of innovative planning and design. When the CEO, Thomas Watson, decided to step down, he named his daughter, Emily Watson, as his successor. Although Emily was quite sharp and had experience in the field, her appointment raised concerns among employees about nepotism.

The perception of nepotism led to unrest among the staff, with many questioning whether Emily’s appointment was based on merit. After all, there were plenty of loyal, long-term, hard-working folks who were wondering if and when it would ever be their turn. This dynamic caused a lack of confidence in Emily’s leadership and resistance to her directives, ultimately impacting the firm’s productivity and morale.

For a cleaner handoff…

- Watson Burbick Design would have benefited greatly from a formal process for CEO selection involving external advisors and/or board members to ensure that the appointment was based on merit and not merely familial ties. This step would have added credibility to the selection and reduced the perception of favoritism.

- Had employees been solicited for their feedback on the desired qualities in a new CEO, a sense of inclusion would have been created, and more focus would have been put on the transition itself than on who would be selected.

- Emily’s legitimate qualifications and experience should have been highlighted to demonstrate her capabilities and suitability for the role. This “marketing” could have been achieved through internal communications, town hall meetings, and other forums where she would have interacted with managers and staff and built relationships.

Are you facing a challenging leadership transition? Call or text Mark Goodale at 508.254.3914 or send an email to [email protected].

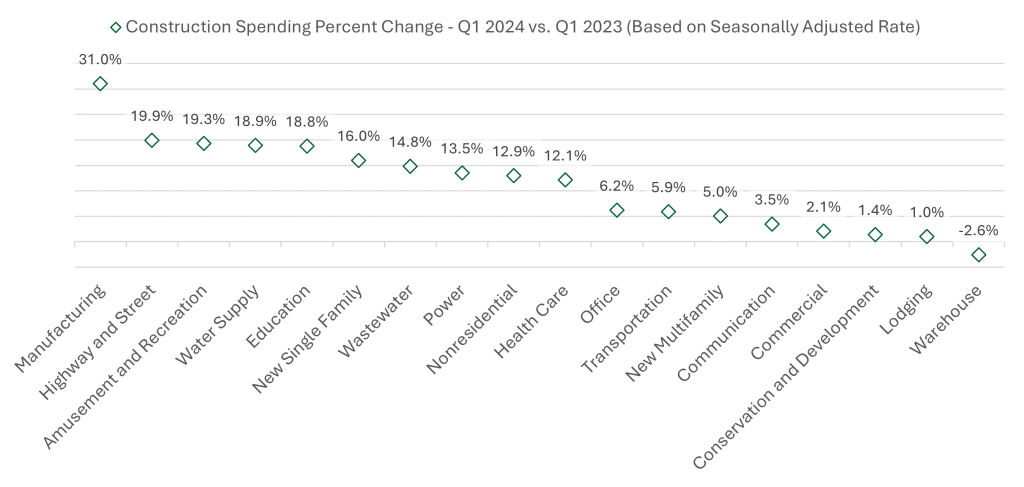

Market Snapshot: First-Quarter Construction Spending

March construction spending data (not adjusted for inflation) has been released by the U.S. Census Bureau, reflecting a slight decrease from February (-0.2%). In the first quarter of 2024, the annual rate went up by 10% against the same period last year for overall construction. See percentage changes by sector below:

For the latest insights on U.S. regions and AE markets, check out our 2024 AE Market Intelligence Webinar. Click here to access recording and materials.

To learn more about market intelligence data and research services offered by Morrissey Goodale, schedule an intro call with Rafael Barbosa.

Weekly M&A Round Up

Congratulations to CRIADO & Associates (Dallas, TX): The public infrastructure firm joined “Texas powerhouse” Dunaway (Fort Worth, TX) (ENR #112), a civil engineering, structural, landscape architecture, surveying, and construction inspection services firm. Dunaway’s Dallas office will join forces with CRIADO’s nearly 60 employees and will broaden its capabilities through CRIADO’s experience serving municipal clients, creating a fully integrated team. We’re thankful that the CRIADO team trusted us to advise them on this transaction.

Another congrats to Clark Dietz (Champaign, IL): The multi-disciplined engineering firm acquired RS Engineering (Lansing, MI), a civil, structural, traffic, and construction engineering firm. The acquisition enables Clark Dietz to serve additional Midwestern markets, while the growth of the combined firm provides expanded opportunities for employees. We feel privileged that the Clark Dietz team trusted us to initiate and advise them on this transaction.

Three deals in the West: Last week we reported on three new deals in the fast-consolidating Western U.S., this time in Washington and California. To learn more about M&A activity in this fast-growing region, join over 200 industry executives and investors from all across the West and beyond at the 10th annual Western States M&A and Business Symposium on June 12-14. You can check all the week’s M&A news here.

June 12-14, 2024 Las Vegas, NV

Western States M&A and Business Symposium

Join us for the 10th annual Western States Symposium, bringing together over 200 AE and environmental industry executives and investors in one of the world’s most vibrant and iconic cities.

Learn More

AI & Innovation

Tap Into the Power of AI for your Firm

We’re partnering with the AI experts at Thrivence to bring AI Education and Business Solutions to the AE and environmental consulting Industry. Introducing a powerful 90-minute, on-demand AI Masterclass designed and delivered by CEOs for CEOs.

Searching for an external Board member?

Our Board of Directors candidate database has over one hundred current and former CEOs, executives, business strategists, and experts from both inside and outside the AE and Environmental Consulting industry who are interested in serving on Boards. Contact Tim Pettepit via email or call him directly at (617) 982-3829 for pricing and access to the database.

Are you interested in serving on an AE firm Board of Directors?

We have numerous clients that are seeking qualified industry executives to serve on their boards. If you’re interested, please upload your resume here.

Subscribe to our Newsletters

Stay up-to-date in real-time.