Word on the street > The Heirs Apparent Have Some Things They’d Like You to Know; Top 10 Terrible Financial Management Sins (Part Two)

Word on the Street: Issue 187

Weekly real-time market and industry intelligence from Morrissey Goodale firm leaders.

The Heirs Apparent Have Some Things They’d Like You to Know

In our strategy work, we often have the opportunity to hear from and interact with the next generation of AE and environmental consulting industry leaders. (For the purposes of this discussion, these emerging leader groups are comprised of about 10% Gen Z, 80% millennials, and 10% early Gen X. Later Gen Xers and boomers can be found in “Departing Leaders” groups, but that’s another article.)

In fact, we make a point in our strategy engagements to intentionally incorporate meaningful input from the folks “waiting in the wings” to take over their firms in the future. We’re big believers that you cannot start developing next-generation leaders too early. And where possible and practical, we encourage our clients to engage talent beyond the C-suite in visioning, ideation, and business planning.

Lately, we’ve been hearing emerging leaders express some common themes in visioning and strategy discussions. Regardless of whether it’s a small or large firm, located in the South or the Midwest, a designer or environmental scientist, a multi-discipline generalist or a deep-dive technical expert, emerging leaders across the board are bringing these topics to the strategy discussion, and they want the boomer C-suite to take note. Here are some of those themes with their potential strategic and cultural implications for your firm:

1. Time Is on My Side: Emerging leaders will work long hours—in the office or remotely—when they need to. But with caveats. First, they need to see justification. Whereas 20 years ago if a manager indicated that it was all hands on deck for late nights and weekends to “get a project out the door,” pretty much everybody did so without comment. Not so today. Collaboration, consensus, and culture have conspired to create a dynamic where managerial directions—especially around demands on the time of emerging leaders or their “fellow” employees—are frequently viewed instead as the start of a conversation about what they are willing to do and under what conditions, rather than an order to be followed. This can be a big frustration for boomer or Gen X firm managers who are conditioned to respond to direction immediately. Managing while frustrated is a recipe for wasted time and squandered opportunity. It also needlessly and slowly inserts tension into a firm’s culture. If this dynamic is at play in your firm, you need to prioritize ongoing meaningful dollar investments in coaching for your older managers. Of course, the dollar investment isn’t the challenge (your firm is flush with cash these days). The real battle is getting these managers to actually spend the time to understand what has changed in employee attitudes since their glory days 20 years ago so that they can learn how to get the most out of a next generation that has a very different perspective on work.

2. If I Could Turn Back Time: “You need me to work 50 hours next week? Sure. 60 hours? Great, I can do that for you. But let’s make sure we’re all on the same page that the following week, I’ll be working just 20 hours, right?” Again, always with the caveats. Call it what you like (we’ve heard “time averaging,” “hours smoothing,” and “week surfing”), the concept of the 2,080-hour work year (I’ll save you doing the math, that’s 40 hours a week) is strong with these emerging leaders. We saw shades of this pre-pandemic. Back then, consultants (not us) were trying to push “work-life blending” (in other words, the 24-hour workday facilitated through technology) as a way to get more “employee engagement” out of the growing “work-life balance” movement. Pandemic hits in 2020. Industry utilization rates surge to record highs (this was the era of the ultimate work-life blending), and the awful effects of employee burnout showed up industry-wide with a vengeance in 2021. Since then, next-generation leaders have reframed their relationships with their work, their firms, and their personal lives. And now firms stand at an inflection point. The industry’s business model prior to 2020 assumed a workforce that would—on-demand and for however long it would take—work 50-plus hours a week between “face time” in the office and logging on during vacations and after hours to “get the job done.” The next generation of industry leaders doesn’t necessarily see it that way. They have a very different vision for the business model when they take over. It’s one that assumes an employee will deliver “quality” time for the firm, not necessarily more time. We’ve had the opportunity to facilitate some pretty heated discussions around this topic in the first few weeks of 2024.

3. Time in a Bottle: You’ve identified these folks as emerging leaders because they are smart, hard-working, and naturally look for ways to improve themselves and the firm. So, when they ask the question (and I’m paraphrasing here) “So why exactly do you want me to drive an hour into the office and an hour home—essentially wasting two hours—polluting the atmosphere to do work that I could be doing remotely?” beware if your response includes florid references to “collaboration,” “culture,” or “innovation.” Not only do next-generation leaders place a high value on their time (and how they spend it—preferably not commuting for no good reason), but they also excel at getting the most out of a hybrid working environment. Again, this can be a frustration for current leaders and managers who demand that folks be in the office full time but are unable to convey why, nor are able to back their position up with data.

4. My Friend the Robot: Finally, even though C-suites are still trying to find their feet with enterprise-wide policies for and deployments of AI, next-generation leaders have fully embraced it. They and their teams are not only using it to deliver faster and better services to clients, but also to free up time in their own days through the creation of internal efficiencies. Their vision for their firms is one where AI is their co-pilot (AI pun intended) in creating a business model where the 40-hour week is a reality.

On the one hand, a boomer manager might think the unbridled optimism and self-confidence of these emerging leaders is what happens when you haven’t had a good old recession in 15 years and there’s a labor shortage. On the other hand, maybe this blend of optimism and self-confidence is exactly what’s needed to transform this industry for the better.

To connect with Mick Morrissey, email him at [email protected] or text him at 508.380.1868.

Top 10 Terrible Financial Management Sins

(Part Two: #6 through #10)

Last week, we explored the first five of the Top 10 Terrible Financial Management Sins. Here’s a quick recap:

Sin #1: Neglecting Cash Flow Management: Failure to accurately forecast cash inflows and outflows leads to cash shortages during critical periods. Poor cash flow management can hinder a firm’s ability to meet financial obligations, pay employees and suppliers, and invest in growth opportunities.

Sin #2: Underestimating Project Costs: Whether caused by insufficient planning, scope creep, or rose-colored glasses, underestimating project costs not only erodes profit margins, but often damages client relationships and tarnishes reputations.

Sin #3: Overreliance on Billable Hours: Depending primarily, if not solely, on billable hours can lead to revenue volatility, staff burnout from excessive workloads, and missed opportunities for alternative revenue streams that can generate greater fees while expending less labor.

Sin #4: Inadequate Cost Control: Firms that fail to implement effective cost control measures suffer operational inefficiencies, wasteful spending, reduced profitability, and the systematic undermining of long-term financial sustainability.

Sin #5: Ignoring Technology Investments: Neglecting investments in technology infrastructure, software tools, and digital capabilities hinders productivity, stunts innovation, reduces competitiveness, and all but guarantees eventual obsolescence in an increasingly digital landscape.

Now, on with the rest…

Sin #6: Inefficient Resource Allocation

Poor project planning, unhealthy internal competition, relying on individual heroics instead of systems to get work out the door, and refusing to delegate are just a handful of reasons why resource allocation gets out of whack far too often in AE firms. Committing this sin results in higher project costs, decreased profitability, and employee burnout and resentment.

How to fix it: Adopting Lean principles and implementing the Kanban methodology can significantly enhance resource allocation. By embracing Lean, AE firms can streamline processes, reduce waste, and improve overall efficiency. Kanban, with its visual representation of work in progress and clear workflow management, enables better tracking of tasks and resources. This approach allows for real-time adjustments in resource allocation based on project needs, ensuring optimal utilization of talent and minimizing bottlenecks.

Sin #7: Neglecting Strategic Planning

These days, successful AE firms are in rapid growth mode, and their leaders can no longer rely on feel alone. Without strategic planning, firms risk stagnation, missed opportunities to create significant competitive advantages, and vulnerability to any number of industry disruptors. Firms that neglect strategic planning often fail to set clear financial goals, define growth strategies, or adapt to changing market dynamics. This lack of foresight can impede long-term financial success and resilience and limit succession alternatives.

What to do: Develop a comprehensive strategic plan aligned with the firm’s vision and objectives, regularly review and update the plan based on market trends and internal capabilities, engage stakeholders in the planning process, and allocate resources to support strategic growth initiatives.

Sin #8: Poor Debt Management

While certainly not unheard of, it’s not the norm that AE firms mismanage debt by taking on excessive financial obligations. If anything, it’s more likely that they’ll neglect opportunities to leverage debt for strategic investments. In any case, the former strains cash flow and increases financial risk, which causes liquidity problems, while the latter hinders sustainable, profitable growth.

A better way: Adopt a prudent approach to debt management by carefully evaluating borrowing needs, negotiating favorable loan terms, diversifying sources of financing, maintaining a healthy debt-to-equity ratio, and using debt strategically to fund growth initiatives with clear ROI.

Sin #9: Lack of Financial Transparency

AE firms typically hold financial information close to the vest. Too close. Withholding a reasonable amount of financial performance information from managers can impair their decision-making, while refusing to deliver at least periodic financial overviews to the staff can erode trust. Lack of financial transparency breeds suspicion, undermines credibility, and shrinks (if not outright eliminates) the internal market for a firm’s stock.

How to loosen the grip: Establish transparent financial reporting practices, communicate financial performance regularly to managers, educate employees on key financial metrics and goals, address concerns or questions openly, and foster a culture of accountability and integrity in financial matters.

Sin #10: Short-Term Thinking

Whether it’s because of risk aversion, immediate financial burdens, market pressures, or retiring owners who want to maximize their distributions, some AE firms sacrifice investments in innovation, talent development, and strategic initiatives for immediate profit maximization. But it comes at a steep cost. Short-term thinking hampers innovation, limits competitiveness, and jeopardizes the firm’s ability to adapt to evolving market trends and technological advancements.

How to think about it: Embrace a balanced approach that considers both short-term profitability and long-term value creation; invest in research and development, talent acquisition, and training; cultivate a culture of innovation and continuous improvement; and align financial decisions with the firm’s long-term strategic objectives.

Avoiding “The Terrible 10” is essential for achieving sustainable growth, maintaining profitability, and thriving in an increasingly competitive and dynamic business environment. By addressing these common pitfalls and adopting best practices in financial management, firms can enhance their financial health, mitigate risks, and position themselves for long-term success.

Questions? Comments? Call or text Mark Goodale at 508.254.3914 or email [email protected].

Market Snapshot: AE Industry Employment

The labor force participation rate in the United States has been rising since 2020, but as population growth rates decrease and baby boomers age into the 65-and-older age group, it is expected to fall from 62.5% (as of last February) to 60.4% in 2032. Due to these constraints, many industries are experiencing labor shortages. Below are projections for certain AE occupations based on data from the Bureau of Labor Statistics.

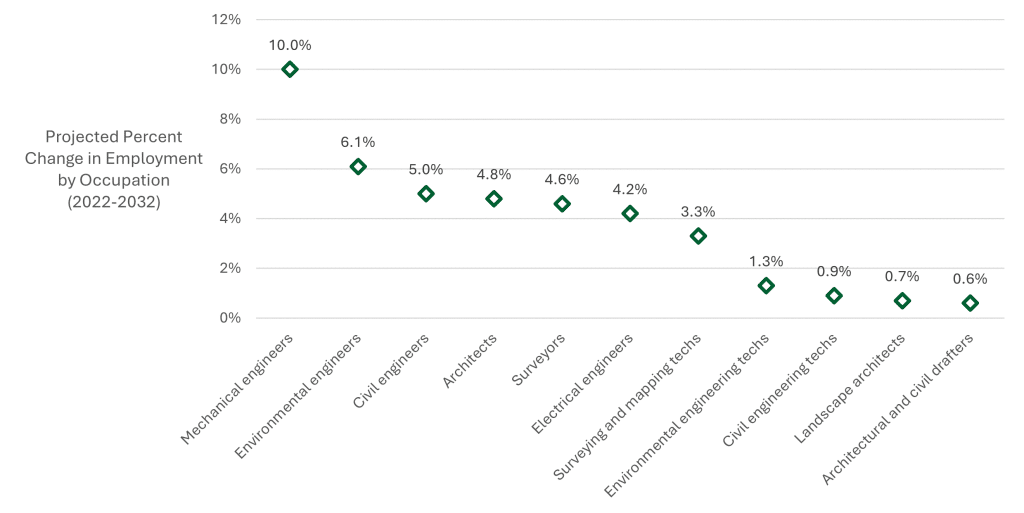

- Architecture and engineering employment is projected to grow by 5.2% between 2022 and 2032. As it relates to specific AE industry occupations, mechanical, environmental, and civil engineers will have the highest percentage jobs increases.

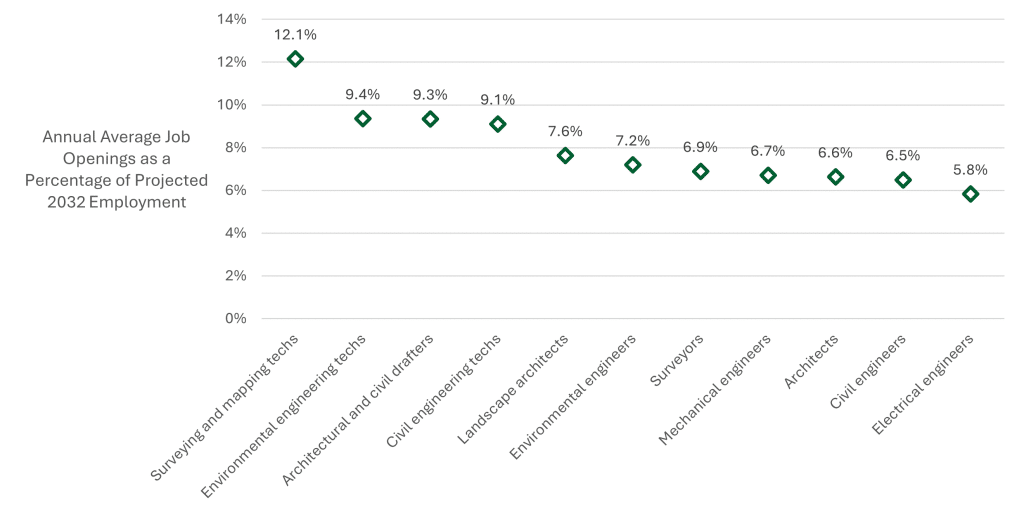

- AE job openings are projected to average around 188,000 per year until 2032. Most openings will be for civil and mechanical engineers, but as a percentage of projected 2032 employment, technical occupations are anticipated to top the list.

For the latest insights on U.S. regions and AE markets, check out our 2024 AE Market Intelligence Webinar. Click here to access recording and materials.

Weekly M&A Round Up

Congratulations to Insight Group (North Charleston, SC): The geotechnical, environmental, and construction materials engineering consulting firm joined industry leader and one of our “Nine Movers and Shakers to Watch in 2024,” RMA Companies (Rancho Cucamonga, CA) (ENR #146). The addition of Insight Group marks a significant milestone as RMA expands in the growing Southeast. We’re thankful that the Insight Group team trusted us to initiate and advise them on this transaction.

Another congrats to O’Dell Engineering (Modesto, CA): The design firm dedicated to supporting public and private improvement projects joined industry-leading firm Westwood Professional Services (Plano, TX) (ENR #79). O’Dell is Westwood’s inaugural investment in California and brings four new offices in Modesto, Pleasanton, Fresno, and Merced. We feel privileged that the O’Dell team trusted us to initiate and advise them on this transaction.

Busy week in M&A: Last week we reported 12 new transactions, including 4 in the Southeast states of South Carolina, Florida, and Tennessee. We also reported nine additional global deals. You can check all the week’s M&A news here.

Searching for an external Board member?

Our Board of Directors candidate database has over one hundred current and former CEOs, executives, business strategists, and experts from both inside and outside the AE and Environmental Consulting industry who are interested in serving on Boards. Contact Tim Pettepit via email or call him directly at (617) 982-3829 for pricing and access to the database.

Are you interested in serving on an AE firm Board of Directors?

We have numerous clients that are seeking qualified industry executives to serve on their boards. If you’re interested, please upload your resume here.

June 12-14, 2024 Las Vegas, NV

Western States M&A and Business Symposium

Join us for the 10th annual Western States Symposium, bringing together over 200 AE and environmental industry executives and investors in one of the world’s most vibrant and iconic cities.

Learn More

Subscribe to our Newsletters

Stay up-to-date in real-time.