Word on the street > The British (and Canadians) Are Coming!; Top 10 Terrible Financial Management Sins (part 1)

Word on the Street: Issue 186

Weekly real-time market and industry intelligence from Morrissey Goodale firm leaders.

The British (and Canadians) Are Coming!

So, turns out Paul Revere didn’t actually cry, “The British are coming! The British are coming!” during his midnight ride. Instead, according to “historians” using “facts” to ruin a perfectly good article title, he most likely shouted, “The regulars are coming out!” on his midnight ride. (For an explanation of why, I recommend giving a listen to the excellent The Rest Is History podcast series on the American Revolution.) But I digress.

What I was trying to get to with today’s title was that when it comes to the U.S. AE and environmental consulting industry, it’s British and Canadian firms (and some others, as we will see) that are coming to claim their share of the massive and growing U.S. market through M&A. Interestingly, as we’ll see later, both of those nations are popular markets for U.S. firms to grow in through acquisitions. Let’s take a look at the numbers.

1. We are the world? While there’s lots of buzz about globalization of the AE and environmental consulting industry, transnational M&A activity doesn’t necessarily support that—at least when it comes to foreign firms acquiring into the U.S. From 2013 through 2023, overseas firms made 201 acquisitions in the U.S., accounting for just under 6% of all domestic consolidation. Acquisitions of U.S. firms by overseas acquirers peaked in 2014 in terms of deals done (28) and as a percentage of domestic transactions (12%). Since then, sales to foreign firms have been on a steady decline, reaching their nadir in 2019 (7), representing just 2% of all domestic M&A activity. Last year, overseas firms made just 14 acquisitions in the U.S.—barely 3% of all domestic deals.

2. Où sont tous les prétendants internationaux? Overseas buyers continue to express a keen interest in either entering the U.S. market or growing their existing presence here through acquisition. Demand to enter the U.S. market is as high as ever. Indeed, as many foreign CEOs state, for their firms to be recognized as truly global they must have a scale of business in the U.S. commensurate with the size of the domestic market. So, if the demand is there, why has there been such a decline in activity? We see two reasons. First, overseas buyers have been finding it increasingly difficult to “win” deals in the hyper-competitive U.S. M&A market. They are typically not the highest “bidder” nor do they put enough cash up front in transactions to close the deal. Sellers—especially ENR Top 500 firms—have been voting with their feet and selling to or recapitalizing with U.S.-based private equity backed strategics or recapitalizations. (Nine out of ten ENR 500 firms that have changed hands since 2021 have done so with private equity.) Second, overseas buyers tend to move slower than their U.S. counterparts. Their decision-making is often labored and ponderous, frustrating and ultimately turning off U.S.-based sellers.

3. Ice hockey, soccer, and rugby: So, where have the most successful foreign acquirers come from? Since 2018, Canadian firms have been the most active acquirers of U.S. firms, completing 40 transactions. Not surprisingly, WSP (Montreal, Canada) and Stantec (Edmonton, Canada) have been the two top acquirers from the North. Firms from across the pond have been the second-most active group of overseas consolidators in the U.S. market over the same time period, completing 17 transactions. The most prolific U.K. buyers in the U.S. recently have been ERM (London, UK) and Mott MacDonald (Croydon, UK). Firms from France (16), Denmark (6), Australia (5), and Italy (3) have also completed multiple domestic transactions to advance their businesses in the U.S. Of note is the relative lack of investment in the domestic market on the part of Asian, Middle Eastern, or South American firms.

4. Shopping abroad: While acquisitions by overseas buyers have steadily declined over the last decade, the exact opposite trend can be seen with U.S. firms acquiring overseas. Top U.S. design and environmental firms made 216 overseas transactions from 2013 to 2023. Almost half of those have taken place since 2020. Since the pandemic, U.S. firms have demonstrated a remarkable appetite to invest in overseas growth through M&A.

5. In the vanguard: The three most popular destinations for U.S. design and environmental firms to make acquisitions since 2018 have been Canada (50), the U.K. (45), and Australia (18). U.S. firms have cast a pretty wide net over the past six years, making acquisitions in an additional 26 countries in every continent (except South America), including South Africa, New Zealand, South Korea, India, Saudi Arabia, Finland, and perennial favorite Ireland. The three most prolific U.S acquirers overseas include J.S. Held (Jericho, NY), Jensen Hughes (Baltimore, MD), and Trinity Consultants (Dallas, TX).

The evolving domestic and global M&A scene is just one of the topics that will be covered at the Southeast M&A and Business Symposium in Miami later this month. Register today to reserve your spot.

To connect with Mick Morrissey, email him at [email protected] or text him at 508.380.1868.

Top 10 Terrible Financial Management Sins

(Part One: #1 through #5)

I’ve witnessed from front-row seats the detrimental impact financial management “sins” have on otherwise terrific AE firms. In our rapidly evolving business climate where the rising tide no longer appears to be floating every single boat, the consequences of these sins can be greatly magnified, posing significant threats to the financial health and long-term viability of unsuspecting organizations. From neglecting cash flow management to underestimating project costs to relying too much on outdated business models, these missteps can impede growth, erode profitability, and undermine competitiveness. In this article, we delve into the first five of these ten financial management sins, highlighting their adverse effects and providing actionable guidance on how you can avoid them.

Sin #1: Neglecting Cash Flow Management

When I served as an adjunct professor at Suffolk University—a small, private university in downtown Boston—I would ask the students on the first day of class, “What is the most important thing in business?” Invariably, they would give the same answers many of our clients do today—people, brand, client relationships, etc. While all of those are valuable assets, cash is king of the business jungle. It’s the air businesses breathe. We may not want to admit it, but sometimes in the pursuit of profitability, we can lose focus on cash flow management. Remember, you can be profitable and bankrupt at the same time. Failure to accurately forecast cash inflows and outflows leads to cash shortages during critical periods. Poor cash flow management can hinder a firm’s ability to meet financial obligations, pay employees and suppliers, and invest in growth opportunities…and you can take it from there.

How to avoid the trap: Implement robust cash flow forecasting mechanisms, regularly monitor cash flow statements, negotiate favorable payment terms with clients and suppliers, and maintain adequate cash reserves. It’s really a discipline thing more than anything else.

Sin #2: Underestimating Project Costs

Firms that consistently underestimate project costs also happen to consistently blow budgets and crater profitability. Whether caused by insufficient planning, scope creep, or rose-colored glasses, underestimating project costs not only erodes profit margins, but often damages client relationships and tarnishes reputations.

How to stay on the straight and narrow: Get religious about conducting comprehensive project cost estimations, ditch the rose-colored glasses and account for contingencies and unforeseen expenses in place of using “The Force,” closely monitor project progress and costs, and give clients bad news early about any changes that may impact the budget.

Sin #3: Overreliance on Billable Hours

Many AE firms we’ve worked with over the years rely heavily on billable hours as their main revenue stream. While billable hours are important, overreliance on this model can limit revenue scalability and profitability. Depending primarily, if not solely, on billable hours can lead to revenue volatility, staff burnout from excessive workloads, and missed opportunities for alternative revenue streams that can generate greater fees while expending less labor.

What to do instead: Diversify revenue streams by offering value-based pricing, exploring more fixed-fee arrangements, pursuing retainer agreements, and developing complementary services as added value. If your clients “will never go for it,” maybe it’s time to consider expanding your firm’s horizons.

Sin #4: Inadequate Cost Control

Times have been good for AE firms—as in historically good. Cash is flowing and plentiful, backlog is strong, and for many of you, it seems like there’s no end in sight. Yet, therein lies the problem. Because we currently find ourselves in the land of plenty, we may not be as discerning about expenses as we otherwise would. Why not fly in everyone from near and far for yet another boondoggle at some fancy resort even though we just met two months ago? Why not turn a blind eye to suspiciously high expense reports? Why not ignore write-offs? For firms that fail to implement effective cost control measures, door prizes include operational inefficiencies, wasteful spending, reduced profitability, and the systematic undermining of long-term financial sustainability.

How to stay on the straight and narrow: Establish clear budgeting processes, track expenses rigorously, implement cost-saving initiatives, regularly review overhead costs, and foster a culture of cost-consciousness within the organization.

Sin #5: Ignoring Technology Investments

“We can get by with what we have. Besides, our clients don’t value technology anyway. Relationships are what really matters.” If you think along these lines, be prepared to eat rival dust, if you aren’t already. Neglecting investments in technology infrastructure, software tools, and digital capabilities hinders productivity, stunts innovation, and reduces competitiveness, and all but guarantees eventual obsolescence in an increasingly digital landscape.

How to get with it: Assess company and client technology needs; invest in appropriate software tools for project management, design, and collaboration; provide staff training on new technologies; and continuously evaluate and adopt emerging technologies to enhance firm capabilities.

I’ll unveil sins six through ten next week. In the meantime, see what you can do about turning the first five into company virtues.

Questions? Comments? Call or text Mark Goodale at 508.254.3914 or email [email protected].

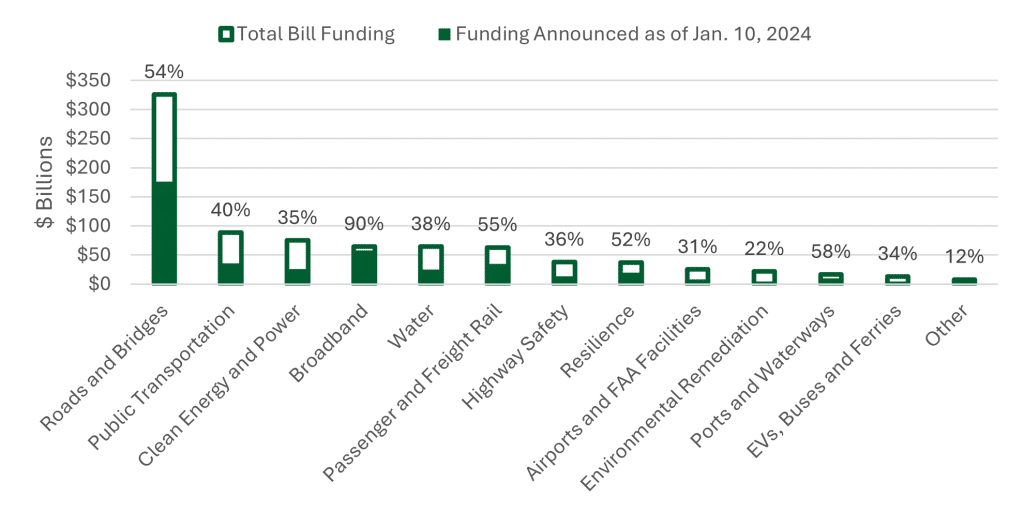

Market Snapshot: Infrastructure Bill

Weekly market intelligence for AE and environmental industry leaders.

Since the signing of the Infrastructure Investment and Jobs Act (IIJA) in 2021, the U.S. government has announced over $415 billion in funds (as of January 10, 2024). Throughout 2023, the percentage of firm leaders concerned about the rollout of funds from the bill steadily declined from 35% in Q1 to 29% in Q4, according to the American Council of Engineering Companies (ACEC) Engineering Business Sentiment Study. However, data from the Q1 2024 survey released last week by the ACEC Research Institute show that 40% of firm leaders are concerned about IIJA funding deployment.

Overall, roughly half of the original funding (appropriated) in the infrastructure bill has been announced (such funding is considered preliminary and non-binding).

A portion of announced funds has been awarded, meaning that there are legally binding agreements in place, which are followed by outlays. Based on a (rather involved) subset of program funding data from the White House, six out of fourteen categories have had funds awarded after announcements (this subset of projects represents about 39% of the total funding announced as of January 10 and includes projects within select programs for which approximate geolocation is available and the funding amount is at least $100,000). The majority of roads and bridges and highway safety projects announced thus far have been awarded. Other program categories that have had funds deployed include resilience, airports/FAA, water, and environmental remediation.

While this sample may not be the best (or most straightforward) measure of infrastructure funding rollout, it helps to understand increasing concerns from engineering firms affected by IIJA procurement processes. The issue can be further complicated by new Buy America provisions as well as the lack of necessary resources and staff within the public sector to properly manage and allocate funds.

For the latest insights on U.S. regions and AE markets, check out our 2024 AE Market Intelligence Webinar. Click here to access recording and materials.

To learn more about market intelligence data and research services offered by Morrissey Goodale, schedule an intro call with Rafael Barbosa.

Weekly M&A Round Up

Two more deals in the Southeast; Deals reported in NY, VA, WA, PA, TX, and IN: Last week was a busy one for M&A, with 11 transactions announced. The Southeast continues to consolidate rapidly with two new deals in Florida. You can check out all the week’s M&A news here.

Searching for an external Board member?

Our Board of Directors candidate database has over one hundred current and former CEOs, executives, business strategists, and experts from both inside and outside the AE and Environmental Consulting industry who are interested in serving on Boards. Contact Tim Pettepit via email or call him directly at (617) 982-3829 for pricing and access to the database.

Are you interested in serving on an AE firm Board of Directors?

We have numerous clients that are seeking qualified industry executives to serve on their boards. If you’re interested, please upload your resume here.

June 12-14, 2024 Las Vegas, NV

Western States M&A and Business Symposium

Join us for the 10th annual Western States Symposium, bringing together over 200 AE and environmental industry executives and investors in one of the world’s most vibrant and iconic cities.

Learn More

Subscribe to our Newsletters

Stay up-to-date in real-time.