Word on the street > Making Sense of M&A—Southeast Style; Beat the Procrastination Bug

Word on the Street: Issue 185

Weekly real-time market and industry intelligence from Morrissey Goodale firm leaders.

Making Sense of M&A—Southeast Style

Since the beginning of 2020, the AE and environmental industry in the Southeast has experienced a remarkable wave of consolidation. We’ve recorded some 375 regional transactions during those 3-plus years. That number represents one in every five deals in the U.S. over the same period and equates to ten sales, mergers, or recapitalizations every month. Sizzle.

Conventional wisdom would suggest that M&A activity in the region is primarily driven by national firms looking to establish a presence or grow their existing business there. (A quick look at the strategic plans of many ENR Top 500 firms would show the Southeast as either the #1 or #2 priority for geographic expansion.) And the big picture bears this out. However, a closer review of actual transaction activity reveals some more nuanced patterns of consolidation, shifting competitive environments, and capital flows.

1. Floridays: It’s perhaps not surprising that Florida has seen the most M&A activity of any Southeast state over the past three years (fourth-largest state economy in the U.S., one of the fastest-growing states, continued diversification of the state economy). And sure enough, since the beginning of 2020 we’ve recorded 172 transactions in the Sunshine State, accounting for 46% of all transactions in the region. What’s maybe more surprising, though, is the fact that it’s Florida-headquartered firms that are the primary driving force of consolidation throughout the Southeast. Since 2020, Florida-headquartered firms have made 69 acquisitions in the Southeast—over twice as many as firms from any other state (or country for that matter). Florida-based acquirers have been particularly active close to home—making 47 “in-state” acquisitions of other Florida firms, accounting for 27% of all transactions in the state. Beyond their home states, when it comes to the Southeast, Florida firms have been most acquisitive in Georgia (7 acquisitions), Tennessee (6), North Carolina (4), and Alabama (4).

2. All My Ex’s Live in Texas: Firms headquartered in the Lone Star State have shown a keen interest in expanding into the Southeast through acquisition since 2020. Over the past 3 years, they’ve made 34 acquisitions. Eighteen of those have been (not surprisingly) in Florida. Eleven have been in Georgia. It may seem surprising that the most active out-of-region state to yield acquirers is the booming state of Texas. (Surely these firms have their hands full with all of the work they have in their home state!?) But the story behind many of these acquisitions is Texas firms that continue to have record financial performance (and backlogs) and are looking to either hedge against slowdowns in the state in the future (as happened in 2020/2021 with transportation funding) or follow developer clients to other fast-growing regional markets (aligned with their business models).

3. Georgia Rain: Firms based in Georgia are the next most influential group of acquirers in the Southeast. Since 2020, they’ve made 20 acquisitions in the region. Eight of those transactions have been “in-state.” Beyond their home state, Georgia-based firms have made acquisitions in Tennessee (4), Florida (3), North Carolina (3), and South Carolina (2).

4. New York State of Mind: The Empire State yields the next most active group of acquirers in the Southeast. New York-headquartered firms have made 19 acquisitions in the Southeast since the beginning of the decade. Eleven of those were in Florida with the balance being in North Carolina (3), Alabama and Kentucky (2 each), and Georgia. It’s not surprising to see firms from New York diversifying into the Southeast—given population and business migration patterns. What’s maybe more surprising is the fact that the activity level is not greater than it is given just how many New York firms are actively pursuing growth in the region.

5. Pretty Girl from Raleigh: Rounding out the primary drivers of consolidation in the Southeast since 2020 are North Carolina-headquartered firms. In all, they’ve made 19 acquisitions over the past 3 years, with 10 of those being “in-state.” Tar Heel State-based firms expanded through acquisition out of state in Florida (6), South Carolina (1), Georgia (1), and Kentucky (1).

6. Pattern #1: Intra-region consolidation plays a significant role in reshaping the industry in the Southeast. Since 2020, 40% of all transactions in the region were made by firms headquartered in the Southeast. This intra-region consolidation has been led by firms from Florida, Georgia, and North Carolina. Acquirers headquartered in each of these three states have prioritized the use of acquisitions to expand within and consolidate their positions in their home states. Only secondarily have they deployed capital to grow across state lines, and even then, the preponderance of those acquisitions has been in immediately adjacent states.

7. Pattern #2: Sixty percent of all acquisitions in the Southeast since 2020 have been made by firms headquartered outside of the region. While only Texas- and New York-based acquirers feature among the top five groups of most buyers in the region, they are followed closely by acquirers from Ohio (18), Illinois (15), Virginia (14), California (13), Maryland (12), and Pennsylvania (11). Also, overseas firms made 16 acquisitions in the Southeast since 2020. The primary Southeast destination for all of these acquirers has been Florida.

The Southeast M&A and Business Symposium is the destination for Southeast industry buyers, sellers, and investors. Register today to reserve your spot.

To connect with Mick Morrissey, email him at [email protected] or text him at 508.380.1868.

Beat the Procrastination Bug

As a captain of industry, you navigate the turbulent waters of business with steely resolve and visionary insight. You’re no stranger to the dance of decision-making and strategic planning. Yet, even the most seasoned among us can find ourselves catching procrastination fever from time to time. Let’s take a look at some of the forms procrastination takes and how to address them in the spirit of getting stuff done sooner rather than later.

1. Strategic Planning Stalemate

Trust me. I feel your pain on this one. Strategic planning can be a big, thankless undertaking. And there’s no shortage of what could add to your stress, whether it’s the complexity of the decision-making process, the uncertainty of future market conditions, or the potentially significant consequences of your choices. Or you might fret about your firm’s leadership bandwidth and the resource investment you envision is required for a successful strategic planning effort. Either case could easily lead you to delay the process or postpone it altogether. Meanwhile, strategic decision-making stalls as does your firm’s progress toward building long-lasting competitive advantages.

To help you get unstuck, consider implementing a structured decision-making process that involves gathering input from key stakeholders, conducting thorough analyses of available data, and setting clear criteria for evaluating options. By breaking down strategic decisions into manageable steps and relying on data-driven insights, you can mitigate the fear of failure and make more confident decisions. Additionally, to address concerns about committing resources to the effort, simply breaking down the strategic planning process into manageable steps and allocating resources incrementally will go a long way in alleviating your anxiety.

2. Talent Acquisition Apprehension

As a steward of talent, you understand the paramount importance of recruiting top-tier professionals to drive your firm’s success. However, the procrastination bug may bite when it comes to making critical hiring decisions. To counter the fear of commitment, establish clear hiring criteria and a structured interview process that aligns with your firm’s values and objectives. By defining what success looks like for each role and objectively assessing candidates against these criteria, you can minimize the fear of making the wrong choice and expedite the decision-making process. Additionally, to combat the desire for perfection, prioritize identifying candidates who possess the core skills and competencies needed to excel in the role, while recognizing that no candidate will be a perfect fit. Emphasize the importance of cultural fit and potential for growth, rather than seeking an elusive ideal candidate, to avoid prolonged deliberation and ensure timely hiring decisions. These days, you need to be in constant recruiting mode, always looking for the best athlete on the board, regardless of whether you have “a need.” It’s a rare AE firm, indeed that couldn’t immediately put talent to work in this business environment.

3. Technology Trepidation

This particular strain of procrastination seems to be spreading in our industry. One of the main symptoms is a fear of investing in solutions that are perceived as being ahead of your clients’ levels of technological sophistication. This hesitation often stems from the belief that clients aren’t ready for or won’t value technological advancements, leading to a delay in formulating a strategy. If you caught this particular procrastination bug, adopt a proactive approach by engaging with clients to assess their technological needs and readiness. You might uncover untapped opportunities for value-added services. Additionally, leveraging pilot programs or case studies to showcase the benefits of technological solutions to hesitant clients can help demystify perceived barriers, whatever they may be, and facilitate buy-in.

4. Innovation Indecision

Innovation is the lifeblood of any truly successful AE firm, yet the journey from concept to implementation can be fraught with procrastination-induced roadblocks. To combat the fear of failure, foster a culture of experimentation and learning within your firm, where team members are encouraged to embrace a mindset of continuous improvement and resilience in the face of setbacks. Create a safe space for sharing ideas and exploring new concepts, where failure is viewed as an opportunity for growth and iteration, rather than a mark of incompetence. By celebrating experimentation and embracing a culture of innovation, you can create an environment where team members feel empowered to take calculated risks and pursue bold ideas with confidence. Additionally, to overcome the desire for perfection, establish clear milestones and success criteria for innovation projects, emphasizing the importance of iteration and feedback in the creative process. Encourage a mindset of progress over perfection, where incremental improvements and rapid prototyping are valued as essential components of the innovation journey, rather than aiming for an unattainable standard of flawlessness.

5. Client Relationship Reluctance

Aspiring owners who have largely benefited from your firm’s brand might not yet understand the importance of maintaining regular communication and fostering long-term partnerships, nor fully appreciate the effort it requires. Valuable leads routinely get funneled to them, so why should they feel compelled to leave the nest on their own? You’ll always be around to feed them, after all. But their reliance will certainly result in a reluctance to cultivate their own client connections because they may feel ill-equipped or uncertain about initiating and nurturing these relationships. This delay may lie more at your feet than theirs. Maybe you fear the potential risk of losing control over client interactions or maybe you worry about the time and resources required to mentor and support these leaders in building their own networks—or maybe you wonder, “What if they do it better than me?” But know this: Cultivating a self-sufficient and empowered team is one of the most valuable investments you can make in your firm, so deliberately put your risers first in your mind and let your fears, concerns, and ego take a backseat. Share your knowledge, your network, and your compassion, and it will come back to you tenfold.

Navigating the procrastination pitfalls inherent in leading an AE firm requires a blend of strategic foresight, proactive leadership, and a willingness to embrace change. Overcoming procrastination is not just about checking off tasks on a to-do list; it’s about fostering a culture of proactive decision-making, continuous learning, and adaptability.

The clock’s ticking. Your move.

Need help getting off the dime? Call or text Mark Goodale at 508.254.3914 or email [email protected].

Market Snapshot: Population Data and Insights (Part 1)

Weekly market intelligence for AE and environmental industry leaders.

According to data recently released by the U.S. Census Bureau, U.S. population trends have returned to pre-pandemic norms. Only eight states had a year-over-year decline in population in 2023 compared to nineteen in 2022.

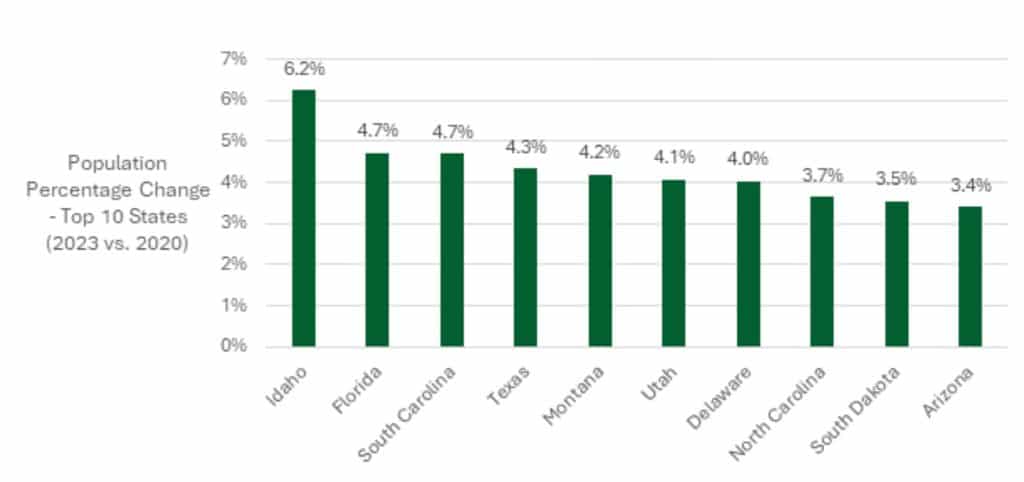

Percentage change: The list of fastest-growing states between mid-2022 and mid-2023 is topped by South Carolina, Florida, Texas, Idaho, and North Carolina. If comparing the latest data to 2020 estimates, the top five states with the highest percentage change would then be Idaho, Florida, South Carolina, Texas, and Montana.

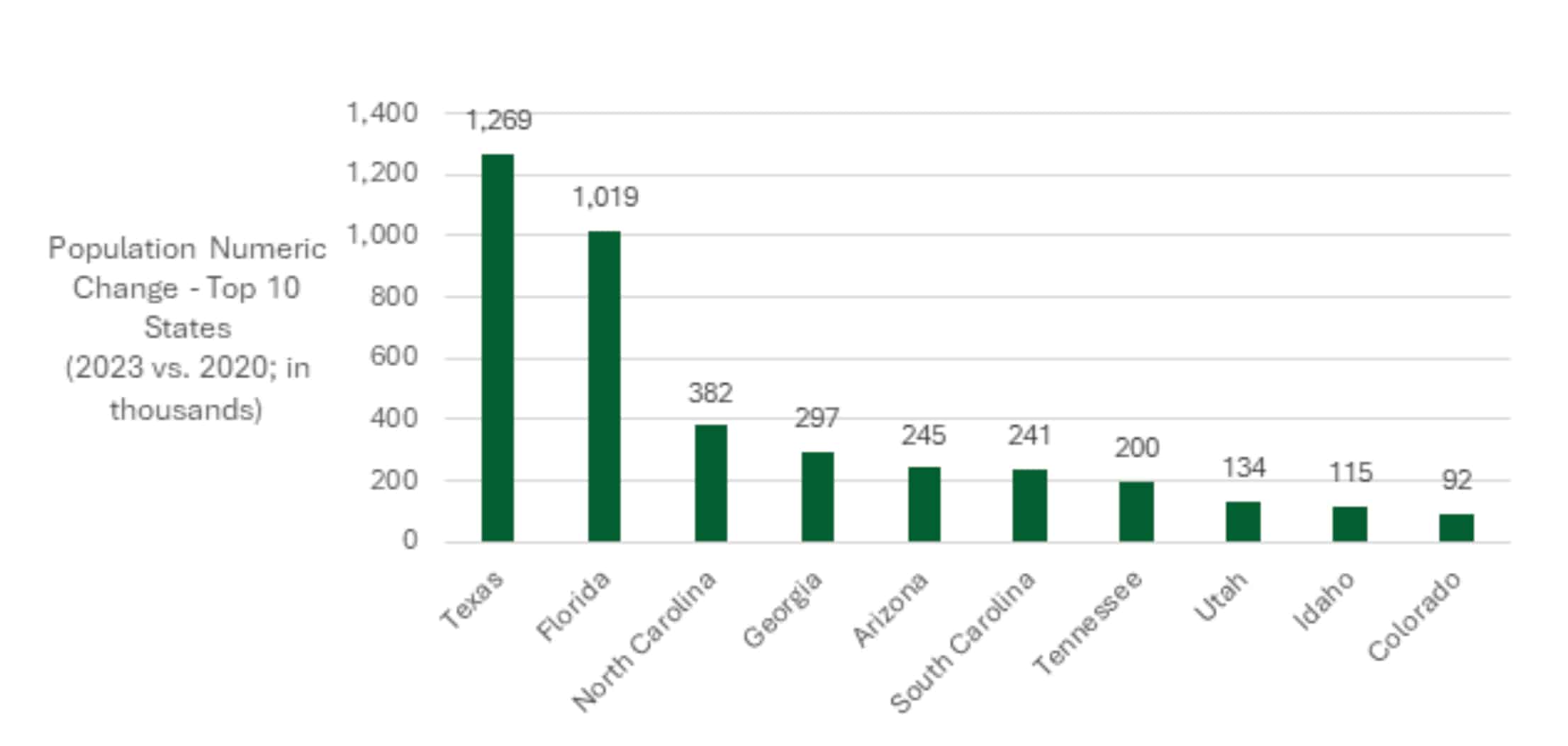

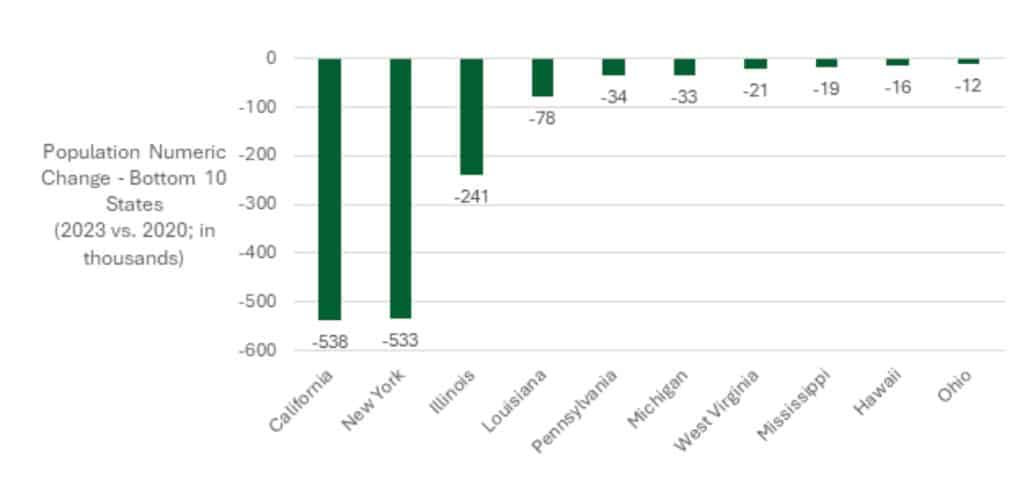

Numeric change (mid-2023 vs. mid-2020): By comparing the 2023 estimates against 2020, Texas and Florida sit way higher than the rest of the pack, each adding over a million residents over the period. North Carolina, Georgia, and Arizona are next on the list. Populations in California, New York, Illinois, Louisiana, and Pennsylvania declined the most in numeric terms.

Latest insights: A study published this month by the Bank of America Institute provided more up-to-date trends based on customer data across the country from a sample size of roughly 45 million customers as recent as Q4 2023. Takeaways for states and regions include:

- Population growth is slowing down in Florida and Texas.

- The share of population in the South continues to climb.

- Western states’ share of population has started to decline.

For the latest data and insights on U.S. regions and AE markets, check out our 2024 AE Market Intelligence Webinar. Click here to access recording and materials.

To learn more about market intelligence data and research services offered by Morrissey Goodale, schedule an intro call with Rafael Barbosa.

Weekly M&A Round Up

Congratulations to AE Engineering (Jacksonville, FL): The high-growth transportation infrastructure engineering firm joined WSB (Minneapolis, MN) (ENR #178), one of the nation’s leading infrastructure engineering consulting firms serving the transportation, environmental, utility, renewable energy, and other critical infrastructure end-markets. The strategic addition of AE will solidify WSB’s presence and service offerings in the southeastern United States. We’re thankful that the AE Engineering team trusted us to initiate and advise them on this transaction.

Another two deals in the Southeast: Last week we reported two more deals in the Southeast, with one each in Georgia and Florida. Both deals involved private equity-backed buyers. Additional domestic deals were reported in Nebraska, California, New Hampshire, Ohio, and Maryland. You can check all of last week’s M&A news here.

Searching for an external Board member?

Our Board of Directors candidate database has over one hundred current and former CEOs, executives, business strategists, and experts from both inside and outside the AE and Environmental Consulting industry who are interested in serving on Boards. Contact Tim Pettepit via email or call him directly at (617) 982-3829 for pricing and access to the database.

Are you interested in serving on an AE firm Board of Directors?

We have numerous clients that are seeking qualified industry executives to serve on their boards. If you’re interested, please upload your resume here.

June 12-14, 2024 Las Vegas, NV

Western States M&A and Business Symposium

Join us for the 10th annual Western States Symposium, bringing together over 200 AE and environmental industry executives and investors in one of the world’s most vibrant and iconic cities.

Learn More

Subscribe to our Newsletters

Stay up-to-date in real-time.