Word on the street > Viva La Vida (A Cautionary Tale of Hubris and Accountability); Navigating Year-End Bonuses: Conversations Inside 6 Fictional AE Firms

Word on the Street: Issue 177

Weekly real-time market and industry intelligence from Morrissey Goodale firm leaders.

Viva La Vida (A Cautionary Tale of Hubris and Accountability)

A CEO finds himself out on the street. Fired by his board of directors—despite stellar financial performance. He “reflects” on what happened (WHILE A NARRATOR—THINK “ARRESTED DEVELOPMENT”—PROVIDES AN ALTERNATE PERSPECTIVE ON EVENTS). This week’s article is surprisingly (because I’m not a fan) inspired by Chris Martin, et al.

I used to rule the world: Seas would rise when I gave the word. I had led my firm for a decade. And I was brilliant at my job. In 2013, I led the charge to throw out the founders who had overstayed their welcomes (and usefulness) by several long and painful years. It was a wicked and wild wind. Blew down the doors to let me in. I created a fresh start. I delivered 10 consecutive years of record-breaking financial performance. At the end of 2023, I was running an ENR Top 200 Design Firm (well, I called it a “SmartDesign” firm to anyone who would listen as I made my rounds on the CEO circuit so as to catch all of the AI buzz going around at the time) that was throwing off pre-tax, pre-bonus profits of 25% and had a backlog of over two years (highest in the firm’s history). I was killing it. I had all the answers. (HE WASN’T, AND HE DIDN’T. HE WAS RIDING THE REMARKABLE WAVE OF INDUSTRY EXPANSION THAT HAS TAKEN PLACE OVER THE PAST DECADE AND STILL HAS LEGS. DOUBLE-DIGIT PROFITS ARE THE NORM, NOT THE EXCEPTION. EVEN UNDER-PERFORMING, MIS-MANAGED BRANDS ARE HITTING 10%+ PRE-TAX, PRE-BONUS. RECORD BACKLOGS ARE A FACTOR OF NATIONWIDE DEMAND OUTSTRIPPING SUPPLY OF AE FIRMS—FOR NOW. NO, HE WAS JUST ONE OF THE MANY INDUSTRY CEOS WHO MISTOOK HIS FIRM’S PERFORMANCE AS INDICATIVE OF HIS LEADERSHIP PROWESS. BUT HOW COULD HE HAVE EVER KNOWN THAT? HOW COULD HE HAVE BEEN ALERTED TO THIS BLIND SPOT SO HE COULD TAKE CORRECTIVE MEASURES AND BE A BETTER CEO?)

I used to roll the dice: I saw opportunities that others didn’t. They couldn’t. They were not visionary like me. I was frustrated with the age-old business model of selling time for money. My (high-priced) consultants (nothing but the best for me)—some of them almost 25 years old —advised me there was a better way to make money. So, I convinced my board (not hard to do really—they all worked for me, all internal folks I had promoted) to invest in digital initiatives, AI schemes, machine learning ventures, VR and AR startups. If something was “different” or “groundbreaking,” or sounded “techy,” or was being “pitched” to me with a good slide deck and included the word “decarbonization,” I was all in. I lived to break the old mode of doing things. Tear it down to the studs and rebuild better—that was my philosophy. Re-make, re-model was my mantra and that of Bryan Ferry. I wanted us in on the ground floor of big hits for our shareholders (coincidentally, I was the largest one), and I didn’t need naysayers holding me up. We had to have first-mover advantage. (LIKE MANY OF HIS PEERS, HE WAS TRYING TO FIGURE OUT HOW THE INDUSTRY WAS GOING TO TRANSFORM THROUGH—OR BE TRANSFORMED BY—TECHNOLOGY. HE FELT THE NEED TO PROACTIVELY PURSUE CHANGE, RATHER THAN WAIT FOR IT TO HAPPEN. EVERYTHING HE WAS READING, EVERY PODCAST THAT HE LISTENED TO WAS TELLING HIM MASSIVE CHANGE WAS RIGHT HERE, RIGHT NOW—ALTHOUGH CURIOUSLY HE COULDN’T FIND ANY SPECIFIC EXAMPLES WHEN TALKING WITH PEERS, JUST LOTS OF “HERE’S WHAT COULD HAPPEN.” LIKE MOST INDUSTRY CEOS TODAY, HIS BALANCE SHEET WAS IN ITS BEST SHAPE EVER. THE URGE TO EXPERIMENT WITH, DEVELOP, OR ACQUIRE NEW TECHNOLOGIES WAS POWERFUL. AND IT WAS MATCHED BY A BOATLOAD OF CASH GETTING HIM JUST 5% IN THE BANK. HE NEEDED TO PUT IT TO BETTER USE. WHO COULD TELL HIM HE WAS WRONG TO INVEST SO MUCH, SO FAST? OR THAT WHAT HE WAS DOING WAS NOT SO MUCH INVESTING IN THE FIRM’S FUTURE BUT MORE LIKE GAMBLING IT AWAY? WHO?)

Feel the fear in my enemy’s eyes: Listen as the crowd would sing. Now the old king is dead, long live the king. I was feted at every industry conference for my powerful vision of marrying technology with professional services. Audiences hung on my every folksy, but insightful word. They scribbled notes when I spoke. Laughed at my jokes. Asked me questions about the future of the industry and then listened earnestly to my answers. I could feel the FOMO of my peers when they heard my story. They envied our performance and our new, tech-savvy brand. They wanted to be like us. They wanted to know our secrets. I was more than happy to share them. (HE HAD NO SECRETS TO SHARE. HIS FIRM’S PERFORMANCE WAS MORE ABOUT LUCK, TIMING, AND A RISING TIDE LIFTING ALL BOATS THAN IT WAS ANY SECRET LEADERSHIP OR MANAGEMENT SAUCE HE HAD COOKED UP. HIS INVESTMENTS IN ALL THINGS TECH MADE FOR GREAT HEADLINES AND GOOD PRESS [WHAT’S NOT TO LIKE BEING FEATURED ON THE COVER OF SO MANY INDUSTRY TRADE MAGS?] AND CERTAINLY ATTRACTED EAGER YOUNG TALENT. BUT JUST LIKE 90% OF HIS PEERS, HIS TECH INVESTMENTS HAD YET TO BE PROFITABLE, WERE LOSING THEIR WAY REGULARLY, AND CHANGING THEIR MISSIONS MONTHLY, SUCKING EVEN MORE CASH OUT OF THE FIRM AND DIVERTING PRECIOUS MANAGEMENT TIME AND EFFORT. BREAK-EVEN FOR THESE NEW VENTURES KEPT GETTING PUSHED TO THE RIGHT. WHO COULD REIN THESE IN OR MAKE THE HARD DECISION TO TURN OFF THE CASH SPIGOT AND SHUT THEM DOWN?)

Once you’d gone, there was never, never an honest word: And that was when I ruled the world. I made a bold decision early in my tenure as CEO to remove all legacy external board members. They were old, crusty relics of a bygone era of how business got done. They didn’t understand the new world. They lacked dynamism. They didn’t “get it.” So, I created a board designed for speedy decision-making. (All the management books I’d read—well, skimmed really, I was too busy “transforming” things to actually read—said this was important.) The board was composed of five guys who had grown up with me in the firm. We hunted and fished together regularly. I promised them we would grow the firm and then sell it for a big payday for us all down the road. We were 100% in alignment. If by “alignment” you mean they did what I told them to do. I said “jump”; they figured out how high. (SKILLED, ENGAGED NON-EXECUTIVE BOARD MEMBERS ARE CRITICAL FOR THE SUCCESS OF SECOND-GENERATION DESIGN AND ENVIRONMENTAL FIRMS. TOO OFTEN THE MOST POWERFUL PRESENCE ON THE BOARD IN SECOND-GENERATION FIRMS IS THE HUBRIS OF THE CEO. ESPECIALLY IN THIS INDUSTRY ENVIRONMENT—WHERE EVERYTHING IS COMING UP ROSES. IT’S NEVER BEEN EASIER FOR A FIRM TO BE A TOP-QUARTILE PERFORMER. THIS CEO CREATED FOR HIMSELF A TENUOUS SITUATION THAT EXISTS ACROSS THE INDUSTRY. HE WAS SURROUNDED BY “YES” MEN ON HIS BOARD WHO HAD NEITHER THE KNOWLEDGE NOR FORTITUDE TO QUESTION OR CHALLENGE HIS IDEAS OR ACTIONS. NOR DID THEY HAVE THE INCENTIVE TO DO SO—THEY WERE EACH MAKING MORE MONEY THAN THEY HAD EVER IMAGINED. WHY WOULD THEY WANT TO PULL THE BRAKE ON THAT GRAVY TRAIN? HE HAD BECOME THAT MOST DANGEROUS OF CEOS—THE ONE WHO BELIEVED HIS OWN PRESS RELEASES IN AN ECHO CHAMBER OF HIS OWN CREATION. WHO COULD HAVE HELPED HIM? WELL, SOME GOOD NON-EXECUTIVE BOARD MEMBERS FOR A START. OR A SKILLED EXECUTIVE COACH WHO WAS UNAFRAID TO GET FIRED FOR TELLING THE TRUTH.)

People couldn’t believe what I’d become: Revolutionaries wait. For my head on a silver plate. Just a puppet on a lonely string. Oh, who would ever want to be king? Despite everything I had done for my firm, my shareholders, and my board, apparently it wasn’t good enough. Sure, some of the “alternative” investments didn’t play out exactly as we had planned, but you’ve got to roll the dice, right? Maybe I spent a little too much time claiming the credit for our performance. Possibly, I could have listened more to my board—maybe even have asked them for their input once or twice. Maybe I shouldn’t have made it all about myself. But to say I was surprised when I arrived at my Q1 2024 board meeting to find the first item on the agenda was “severance package for CEO” is an understatement. I was blindsided. To this day, I’m still unsure why I was terminated. And the NDA I signed for the $5 million severance precludes me from discussing the matter any further. (SOME YEARS AGO, WHILE HELPING THE CHAIRMAN OF AN ENR TOP 100 FIRM THROUGH HIS—RATHER MESSY, BUT AREN’T THEY ALL?—LEADERSHIP SUCCESSION, HE MADE THE COMMENT TO ME THAT “POWER DOESN’T NECESSARILY CORRUPT. BUT IT SURE DOES REVEAL.” AND BY THAT HE MEANT IT REVEALS THE TRUE CHARACTER OF A PERSON. I’M AWARE OF MORE THAN 20 CEOS WHO’VE BEEN FIRED—BY THEIR BOARDS OR SHAREHOLDERS OR MANAGEMENT TEAMS DEPENDING ON THE PARTICULARS OF THE SITUATION—AND WHO HAVE BEEN COMPLETELY BLINDSIDED BY THE ACTION TAKEN. THE MOST COMMON REASONS FOR CEO TERMINATIONS [OUTSIDE OF “FOR CAUSE” ISSUES—A WHOLE SEPARATE ARTICLE] ARE HUBRIS AND A LACK OF SELF-AWARENESS. WHEN I SEE THESE BOTH AT PLAY IN A NEW CEO, I CAN ALMOST ALWAYS WRITE THE SCRIPT OF WHERE THINGS ARE GOING TO END UP. IN THE WORDS OF GOB BLUTH, “I’VE MADE A HUGE MISTAKE.”)

To connect with Mick Morrissey, email him at [email protected] or text/call at 508.380.1868.

Navigating Year-End Bonuses: Conversations Inside 6 Fictional AE Firms

As the year draws to a close, leaders of AE firms find themselves engaged in crucial conversations about year-end bonuses for their dedicated staffs. These discussions are not only about recognizing hard work and dedication but also about navigating the complex landscape of business performance, market conditions, and employee expectations.

Note: For context, when we polled our “Word on the Street” readership in October, a slight majority of respondents (53%) expect bonuses to be about the same in 2023 as they were in 2022.

Now then, let’s delve into the hypothetical corridors of six fictitious AE firms, each facing unique challenges in determining the best course of action regarding year-end bonuses.

1. Ver-Tech Innovations—Balancing Profits and Morale

At Ver-Tech Innovations, a cutting-edge engineering firm known for pushing technological boundaries, the leadership team is huddled in a conference room to discuss year-end bonuses. CEO Emily Foster, a forward-thinking engineer with a passion for innovation, is leading the discussion.

Emily: “Team, our profits have been solid this year, and it’s a testament to the incredible work everyone has put in. However, I’m concerned about retaining our top talent. Other firms are offering attractive packages, and we need to stay competitive. What are your thoughts on allocating a significant portion of our profits to bonuses this year?”

CFO Harry Daniels: “Emily, while I agree that retaining talent is crucial, we also need to consider future investments in R&D. How about a tiered bonus system? We reward exceptional performers more but still allocate a decent bonus for everyone.”

Emily: “That sounds reasonable, Harry. Let’s figure out how to frame a bonus structure that reflects our commitment to both our people and our technological advancements.”

2. HorizonWest Architects—Navigating a Challenging Market

Over at HorizonWest Architects, a renowned firm specializing in sustainable design, the leadership team is facing a different set of challenges. The firm’s president, David Park, gathers the team to discuss the firm’s financial outlook and its impact on year-end bonuses.

David: “As we all know, the market has been tough this year. Our projects are on hold, and our revenue projections have taken a hit. We want to reward our team, but we also need to be realistic. Thoughts?”

Head of Operations Sarah Rodriguez: “David, what if we tie the bonuses to specific selling and cost-saving initiatives? We encourage our team to find innovative ways to sell more work and cut costs, and a percentage of revenue from wins along with any cost savings they create could go into their bonuses.”

Daniel: “I like that, Sarah. It involves everyone in overcoming our financial challenges collaboratively. Now, let’s talk about that cost-cutting part—we need to be cautious about unintended consequences.”

3. Stellar Designs—Fostering a Culture of Recognition

At Stellar Designs, an architecture firm known for its aesthetically pleasing and functional designs, the leadership team is gathering in its stylish office to discuss how best to acknowledge their staff’s hard work and creativity.

Managing Partner Olivia Mitchell: “Our designs have garnered attention and acclaim this year, all thanks to the incredible talent we have. How can we make sure our team feels valued, especially in a year where external recognition has been significant?”

Creative Director Alex Farren: “What if we focus on personalized bonuses tied to specific projects? It not only acknowledges individual contributions but also emphasizes the unique qualities each team member brings to the table.”

Olivia: “That’s a great idea, Alex. Let’s celebrate the uniqueness of our team while ensuring everyone feels seen and appreciated. But let’s also make sure that we aren’t encouraging a mindset of ‘my work’ and ‘your work’ when it’s really ‘our work.’”

4. Quantum3 Engineering—Emphasizing Employee Growth

Quantum Engineering, a firm known for its commitment to employee development and growth, is grappling with the challenge of maintaining this ethos while considering year-end bonuses. The CEO, James Adelson, gathers his team to discuss their approach.

James: “Our commitment to employee growth has always set us apart. How can we align our year-end bonuses with our emphasis on professional development?”

HR Director Rachel Carter: “James, what if we allocate a portion of the bonus for training and development? Employees can use it for courses, certifications, or workshops to enhance their skills.”

James: “I like that, Rachel. It not only recognizes their hard work but also invests in their future. Let’s make sure we get the messaging right. We don’t want people thinking we are using their bonuses to pay for something the company should cover.”

5. InnoSphere Engineering—Addressing Diversity and Inclusion

InnoSphere Engineering, led by CEO Ross Brooks, is a firm dedicated to diversity and inclusion. As the team gathers to discuss year-end bonuses, the conversation takes a turn towards fostering inclusivity within the organization.

Ross: “Team, our commitment to diversity and inclusion has been a cornerstone of our success. How can we ensure our year-end bonuses reflect our dedication to creating a workplace that values everyone?”

Diversity and Inclusion Officer Maya Pathon: “James, we can consider implementing a bonus structure that accounts for contributions to our diversity and inclusion initiatives. Acknowledge those who have actively participated in mentorship programs and outreach events or have championed inclusivity within their teams.”

Ross: “That’s an excellent suggestion, Maya. Bonuses would not only recognize individual achievements but also emphasize the importance of fostering a diverse and inclusive workplace. What percentage of the bonus pool should we allot?”

6. EcoStructures—Balancing Remote Work Realities

EcoStructures, an architectural firm specializing in eco-friendly designs, is grappling with the challenges posed by the rise of remote work. The leadership team, led by CEO Julie Thurmond, convenes to discuss how this shift impacts year-end bonuses.

Julie: “This year has seen a significant shift towards remote work, and it’s likely to continue. How can we ensure our year-end bonuses acknowledge the challenges and successes of our remote teams?”

Head of Technology Chris Delappa: “Julie, what if we allocate a portion of the bonuses for employees to set up or enhance their home offices? It recognizes the new reality of remote work while showing our commitment to their well-being.”

Julie: “I appreciate that, Chris. It not only acknowledges the challenges but also invests in our team’s comfort and productivity. Let’s think through the program details—and the math.”

While the firms and people in this article are fictitious, they showcase the diversity of the challenges and opportunities that real AE firm leaders face in recognizing and rewarding their teams. Whether it’s balancing profits and morale, navigating a challenging market, fostering a culture of recognition, emphasizing employee growth, addressing diversity and inclusion, or adapting to remote work realities, these conversations provide a glimpse into some of the thoughtful dialogue required to ensure bonuses do what they are meant to do—appropriately recognize and reward employees for their hard work, dedication, and contributions to the firm.

Need help developing your strategic plan? Call Mark Goodale at 508.254.3914 or email [email protected].

Market Snapshot: Retail (Part 1)

Weekly market intelligence data and insights for AE firm leaders.

Overview

- In this post, we will focus on the retail category of construction, comprising buildings and structures primarily used by food and beverage and general merchandise retailers as well as shopping centers, malls, and other commercial establishments.

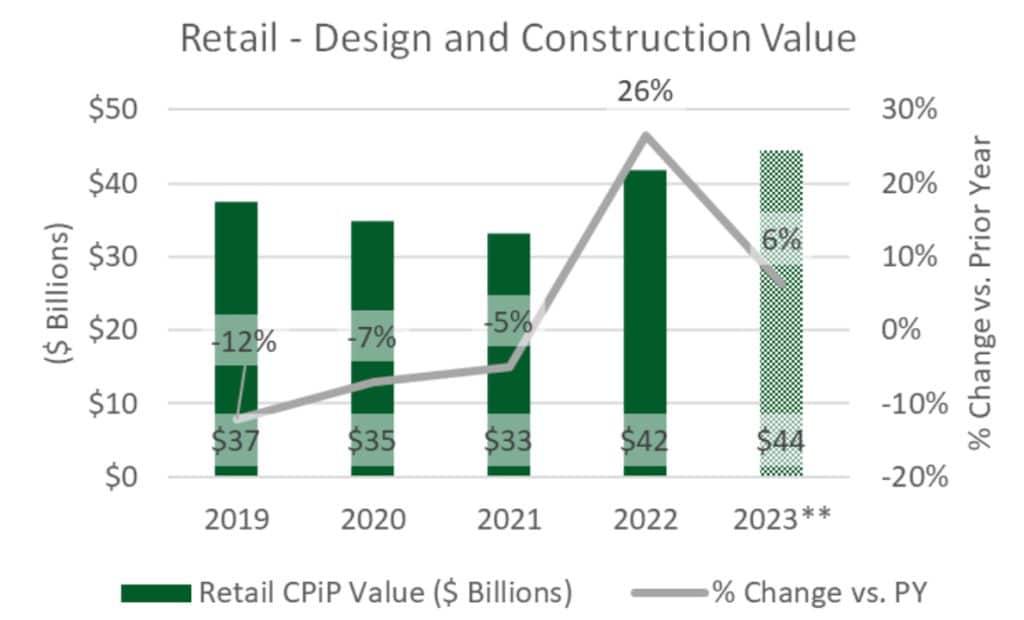

- The market size for retail engineering and construction projects in 2022 reached nearly $42 billion and is trending towards $44 billion at the end of 2023.

** Annualized estimate as of October (Source: U.S. Census Bureau)

Outlook

- Higher interest rates have forced owners and developers to postpone or cancel many commercial and retail projects in 2023.

- The retail sector’s growth slowed in 2023 but is expected to show strength and resilience next year as a majority of U.S. consumers feel optimistic about their finances, according to GlobalData.

- Online sales continue to rise and significantly impact the retail sector. A significant portion of investments within retail will be focused on omnichannel strategies, which increase touchpoints with consumers through in-store and digital channels.

- Online retail sales currently represent 15.6% of total sales and are expected to surpass 20% by 2027.

- According to a research report from Colliers, 47% of retailers plan to further establish their footprint in 2024. Additionally, about 41% intend to invest in automation within stores.

In next week’s issue, we’ll look at trends and hot spots for this sector. To learn what’s ahead for other markets, check out Morrissey Goodale’s AE Market Intelligence Webinar on January 23, 2024. Click here to register.

Weekly M&A Round Up

Congratulations to BSSW Architects (Fort Myers, FL): The architecture firm that provides feasibility studies, site analysis, programming, building design, interior design, and owner representation services joined Grace Hebert Curtis Architects (Baton Rouge, LA), an architecture and engineering firm. BSSW’s offering will enhance GHC’s expertise and allow the firm to capitalize on the growing demand for education and hospitality infrastructure. We’re thankful that the BSSW team trusted us to initiate and advise them on this transaction.

Another congrats to City Point Partners (Boston, MA): The PM services firm focused on project controls, public outreach, construction services, and owner’s project management joined HDR (Omaha, NE) (ENR #6). The strategic partnership complements HDR’s collaborative full life-cycle approach. We feel privileged that the City Point Partners team trusted us to initiate and advise them on this transaction.

More deals in the Southeast: In addition to the featured deal in Florida, last week we reported two more deals in the rapidly consolidating Sunshine State. Additional domestic deals were reported in TX, NJ, AZ, WA, and CA. Global transactions were reported in Australia and Canada. You can check all the week’s M&A news here.

Southeast M&A and Business Symposium Update

March 20-22, 2024 | miami, fl

Southeast

M&A and Business

Symposium

Searching for an external Board member?

Our Board of Directors candidate database has over one hundred current and former CEOs, executives, business strategists, and experts from both inside and outside the AE and Environmental Consulting industry who are interested in serving on Boards. Contact Tim Pettepit via email or call him directly at (617) 982-3829 for pricing and access to the database.

Are you interested in serving on an AE firm Board of Directors?

We have numerous clients that are seeking qualified industry executives to serve on their boards. If you’re interested, please upload your resume here.

June 12-14, 2024 Las Vegas, NV

Western States M&A and Business Symposium

Join us for the 10th annual Western States Symposium, bringing together over 200 AE and environmental industry executives and investors in one of the world’s most vibrant and iconic cities.

Learn More

Subscribe to our Newsletters

Stay up-to-date in real-time.