Word on the street > Reflections on a Year of Excellence in Acquisitive Growth; IT’s So Frustrating! Why Can’t You Get Any Traction?

Word on the Street: Issue 173

Weekly real-time market and industry intelligence from Morrissey Goodale firm leaders.

Reflections on a Year of Excellence in Acquisitive Growth

Industry consolidation continues at a transformational pace of more than 450 transactions a year. Over the past decade, better than 3,500 design and environmental firms have sold or merged here in the United States. This wave of consolidation has created thousands of millionaires and multi-millionaires out of those selling shareholders who have seen their equity unlocked in the transaction. Concurrently, those acquisitions have resulted in step-function increases in profits, revenues, and backlogs for the acquiring firms as they achieve their strategic goals through acquisition (see below).

Industry consolidation will continue to increase over the next decade, fueled by the two trends of industry recapitalization by private equity and Boomer and Gen X owners unable to transition ownership internally. The next decade will see the creation of even more millionaires as sellers exit and the realization of even more strategic objectives by acquirers through another 5,000 or so acquisitions.

Recognizing that this wave of consolidation will impact all domestic design and environmental firms, we believe that it’s in the best interests of all industry stakeholders—project owners, firm shareholders, managers, and employees—that consolidation takes place in a manner that creates greater value, more stability, enhanced client service, and improved resource allocation.

And that is why this year we created our Excellence in Acquisitive Growth Awards series. In doing so we wanted to recognize those acquirers that are in the vanguard, improving how consolidation happens in our industry. And we wanted to create a forum to share M&A best practices so that collectively the industry achieves better outcomes in terms of client satisfaction, employee engagement, and value for investors.

We owe a debt of gratitude to the CEOs, corporate development officers, and investors who collaborated with us in January and February to help us take this concept and make it a reality.

Reflections on the Most Prolific and Proficient Acquirer Award: In March of this year at our Southeast Symposium, we presented the 2023 Most Prolific and Proficient Acquirer Award to IMEG (Rock Island, IL) (ENR #57—up from #71 the prior year). IMEG received the award in recognition of the nine acquisitions that this leading design firm made in the U.S. during the prior year. Accepting the award on behalf of IMEG was Dan Huntington, executive vice president, M&A synergy team, and others from the IMEG team (who just happened to be in Miami to take in the wonderful March weather!). IMEG is not a client of Morrissey Goodale. However, we know them well, having helped four of our clients complete transactions with them since January 2020. What we have learned about them through those transactions is that they are a quality, thoughtful acquirer. They choose their potential partner firms with extraordinary care in the context of a well-founded strategic plan. They have a skilled M&A team that collaborates every step of the way—with each other internally and with the seller’s management team. They follow a methodical, well thought-out courtship process designed to allow them to get to know everything they need to about a potential partner firm before putting a Letter of Intent together. They make their acquisition decisions based on strategy and culture, not on emotion. Meaning that when a seller receives an LOI from them, they should have a high degree of confidence that IMEG will be able to complete the deal as proposed. Importantly, they have a long-term view of their acquisitions, and that is why they are one of the best integrators of acquisitions of design firms that we have had experience with. Beyond that, the IMEG team is one of a handful of prolific acquirers that proactively share best M&A practices not only with each other, but with rookie acquirers. They are one of those special organizations that is not only a great design firm, but also a quality acquirer and a force for improving our industry.

Progress, not perfection: Of the 300 firms that have made two or more acquisitions of AE or environmental consulting firms since January 1, 2018, we wanted to see which ones were improving the way they made their acquisitions. That’s why we created the Most Innovative Acquirer Award. We wanted to recognize the acquirers who took the lessons learned from their prior acquisitions and applied them going forward. Fifty firms provided submissions for this award. Collectively, these firms have completed over 400 acquisitions (and counting). The median size acquisition was $5 million—or 35 employees. (Note: This size tracks almost exactly with the median-sized industry acquisition that we have reported over the years.) The largest acquisition recorded was over 550 employees. The recipient of the 2023 Most Innovative Acquirer Award was 6,000-person, employee-owned Terracon (Olathe, KS) (ENR #20). (Full disclosure: Terracon is a consulting client of Morrissey Goodale.) Their submission not only laid out multiple innovations in the integration execution category, but it also described how each of those innovations was directly connected to one of the firm’s core values of caring, courage, curiosity, excellence, integrity, and prosperity and documented measurable results from each. Knowing Terracon like we do, this is not surprising. I like to refer to them as “a billion-dollar firm with a heart.” In their strategic plan, they place a remarkable emphasis on their culture and people. Being “best at people” is at the core of their business, and they walk the talk. This is apparent in their selection of, negotiations with, and integrations of the acquisitions that they make. They take the time to make sure everyone is on the same page and understands and practices the firm’s values. Along with IMEG, they are also part of the select group of acquirers who give back to the industry by sharing best M&A practices with peers. Accepting the award for Terracon in Las Vegas at our Western States Symposium was Kristi Tahmasiyan, the firm’s director of M&A, and Joe Aldern, senior vice president.

The 2023 Most Innovative Acquirer Award is presented to Terracon in Las Vegas

From left to right: Nick Belitz, Mick Morrissey, Joe Aldern (Terracon), Kristi Tahmasiyan (Terracon), Mark Goodale, Jon Escobar, Brendon Cussio

Performance counts: With the Best Post-Transaction Performance Award, we wanted to break new ground for the industry and try to answer the question “How successful are acquisitions?” Once again, thank you to the industry CEOs, corporate development officers, and investors who helped us create a simple, objective measurement of post-transaction performance—the Acquisition Performance Indicator (API). The API combines the performance in four key business areas (profits, revenues, backlog, and voluntary turnover rates) a year after a transaction is completed.

The data from the over 50 applications we received for this award yielded four surprising and reaffirming insights as follows:

1. Acquirers excel at creating profits: Industry acquirers are having the greatest success in increasing profits post-transaction. On average, acquirers have been doubling the profits of their acquisitions a year after completing the transaction. What’s not to like there?

2. Boosting sales through acquisitions: One of the big lessons learned is just how good acquirers are at increasing backlogs through their acquisitions. On average, acquirers have seen the backlogs attributable to their acquisitions grow 44% within a year of the transaction.

3. Top-line growth: On average, acquirers have been realizing a 33% increase in revenues attributable to their acquisitions one year after completing transactions. When you combine the average increase in backlog at acquisitions (44%) with the increase in revenues, you can see why some firms are spending relatively less on sales and marketing staff and systems and investing relatively more in their corporate development groups. Simply put, acquisitions are a great way to drive top-line growth.

4. Reductions in voluntary turnover: After almost every industry acquisition, you hear grumblings and warnings from the begrudgers and naysayers about how employees will leave because of the resulting changes. The data set from these acquirers refutes that misconception. On average, acquirers have been seeing voluntary turnover rates decline by almost one-fifth a year into their transactions. One reason for this is that most acquisitions are creating more opportunities for employees post-transaction. Another is that acquirers are bringing improved benefits to employees at a lower cost to them.

The recipients of the 2023 Best Post-Transaction Performance Awards are TRC (in the greater than $50 million size category), Salas O’Brien (in the $10 million to $50 million category), and Englobe (in the less than $10 million category). None of these three award recipients are clients of Morrissey Goodale. However, we know the teams at TRC and Salas O’Brien well, having represented clients that have sold to both firms. Not only are they quality acquirers, they are superior business performers and have a demonstrated track record of improving the performance of the firms that they acquire. Accepting the awards for their respective firms in Houston at our Texas and Southern States Symposium were Daniel Powers, senior vice president, TRC; Nathan Rust, manager of corporate development and FP&A, Salas O’Brien; and Marc Trudell, vice president, corporate development, Englobe.

The Best Post-Transaction Performance Awards are presented in Houston

From left to right: Daniel Powers, TRC; Nathan Rust, Salas O’Brien; Marc Trudell, Englobe

Giving back: With each award in the Excellence in Acquisitive Growth Awards series, Morrissey Goodale makes a $1,000 donation to an industry-related 501(c)(3) on behalf of the award recipient. In 2023, we donated $3,000 to the ACE Mentor Program, $1,000 to the Society of American Military Engineers, and $1,000 to the Canadian Women in STEM Scholarship—FIRST Robotics Canada.

Join us in Miami in March 2024 for an entirely new Southeast M&A and Business Symposium to see who will be presented with the 2024 Most Prolific and Proficient Acquirer Award. To connect with Mick Morrissey, email him at [email protected] or text/call at 508.380.1868.

It’s So Frustrating! Why Can’t You Get Any Traction?

There are few things more demoralizing in business than putting your heart and soul into a strategic plan that ultimately goes nowhere. You know your AE firm’s future is at stake, yet despite your best efforts, once the sugar-high of the planning process wears off, your partners immediately abandon working on the business and return to their comfort zone—working in it.

The sparkling mission statement, the shiny new vision, the monster goals, the detailed implementation plan, the soulful introspection, the emotional declarations, the iron-clad commitments—all of it, and I mean all of it—turns to vapor right before your eyes.

Say it isn’t so! But, as Cosmo Kramer once famously said when asked if he had, in fact, eliminated the practice of wearing a rather fundamental undergarment, “Oh, it be so.”

But why, after all of this hard work and seemingly good intentions, do these best-laid plans go to waste?

Well, there are a bunch of reasons. Here are five of them:

- Lack of clarity in the vision: “Do we really need to say how big we are going to be? I think that will scare people off.” What a cop out. I hear this all the time—in my sleep, in fact. Nine times out of ten, the people who say such things aren’t nearly as concerned about the tender feelings of the staff as they are about having to put their weight behind real growth. But don’t give in. If the firm’s direction is to double its size in five years, sing it from the rooftops. If you leave it vague (for which many will advocate as others righteously nod their heads in approval), you are simply kicking the can down the road. All of your firm’s strategic decisions hinge on its vision and direction. If those things are unclear, good luck getting any agreement on key investments and generating any real momentum on meaningful initiatives. You can’t agree to disagree about the vision. Your company isn’t, and shouldn’t be, for everyone. Those who can’t or won’t get on board would march to their own tunes with or without a clear vision, so you might as well draw the line. Of course, everyone should be heard and listened to, but there can be only one direction for a company. Perhaps those who can’t or won’t get on board would be better off hanging out their own shingles. And so would your firm.

- Unimaginative, uninspired communication of the plan: So, how do you plan on unveiling your strategic plan? Will it be a thrilling sermon? Will it be a graphics-packed PowerPoint on a Teams call? Will it be communicated by the CEO, and the CEO alone? Yuck, yuck, and yuck. Hackneyed techniques for communicating the strategic plan to the organization can lead to a lack of understanding and a lack of buy-in. Employees need to understand the plan’s importance, their roles in it, and how it aligns with the firm’s overall goals. So, design ways to get engagement beyond asking, “Does anyone have any questions?” to a broad audience of people who, understandably, don’t want to speak up in front of the entire firm. Think of the rollout as an orientation rather than a presentation. Set up an open-space meeting where the various components of the plan are represented in facilitated break-out areas in a large room, and let people go where their feet take them so they can ask questions and offer ideas in smaller, self-forming “communities of interest.” And once implementation begins, faithfully update the firm on the plan’s progress at least every quarter.

- Resistance to change: Let’s face it. Folks in the AE industry tend to like their comfort zones and will do what they must to maintain the status quo—whether it’s openly defying the new direction, arriving late and leaving early, spreading gossip, or exhibiting passive aggressive behavior. This stance could stem from fear of the unknown, perceived job insecurity, or simply a lack of motivation to change. Managing change starts with talking and listening. Define the change; specify what is changing, and why; and perhaps equally important, communicate what is not changing. Seek to understand concerns and let employees know you are on their side and you’re there to help them be successful. Consider implementing change in phases and conducting pilot programs to avoid overwhelming staff. But ultimately, you’ll need to change the people—or change the people.

- No implementation plan: I get that strategic planning requires big thinking and looking way out there. But if you don’t eventually get down to the nitty-gritty, I can guarantee you nothing is going to happen. Now, you don’t have to map out every single action item that’s going to happen over the next five years. You can’t predict what will work and what won’t. But you do need to get off the dime. So, create specific action items that will get key initiatives off the ground. Who will do what and by when? The “who” should be one person, not a committee. People in committees tend to point fingers at each other. Now, these “champions” don’t have to do all or even some of the work, but they are responsible for execution. As for the “what,” action items need to be clear as crystal, leaving no room for interpretation or ambiguity—and they need to be agreed-upon. Finally, a deadline is not “as soon as you can” or “sometime next year.” It’s a date. Period. Hard deadlines instill accountability—and without that accountability, tasks don’t get done and there’s no learning or progress made toward the vision.

- Lack of monitoring and evaluation: Without regular monitoring and evaluation, it’s challenging to track progress, identify areas needing adjustment, or celebrate successes. Failure to assess and recalibrate as necessary is yet another reason plans fail to grip. I suggest meeting every 60 days for the first six months after the establishment of the plan to a) verify that scheduled actions were carried out, b) explore the results of those actions, and c) determine whether those results were the desired results, and if not, why not. After six months, decide whether the 60-day interval is too long, too short, or just right. Without this level of rigor, don’t expect your strategic plan to stay on anyone’s radar for long.

True story: I was once hired by an ENR Top 500 firm to lead their strategic planning process. Before we got started, I met with the firm’s board of directors. One of the first questions I asked was, “What was the focus of your previous strategic plan?” After an uncomfortably long period of silence, one of the board members opened his laptop and, after several frantic minutes of keystrokes and mouse clicks, shouted, “I found it! I found it!” I kid you not, the rest of the board erupted in applause. Forget about making any progress on their plan—they were just thrilled someone was actually able to locate it.

Don’t let this happen to you.

For more information on how Morrissey Goodale can help your firm successfully design and implement its strategic plan, call Mark Goodale at 508.254.3914 or email [email protected].

Market Snapshot: Hazardous Waste (Part 1)

Weekly market intelligence data and insights for AE firm leaders.

Overview

- Hazardous waste (in the form of liquids, solids, gases, or sludges) is generated from industrial manufacturing processes, household products, agriculture, healthcare facilities, construction, and many other sources.

- The Resource Conservation and Recovery Act (RCRA), passed in 1976, was established to set up a framework for the proper management of hazardous waste.

- Companies in this market perform remediation services in many different types of impacted sites. Brownfields are underutilized sites where previous industrial or commercial activity may have led to contamination. Superfund sites have more severe contamination and may require extensive federal oversight and funding. As of September, there were 1,336 Superfund sites on the EPA’s National Priorities List (NPL).

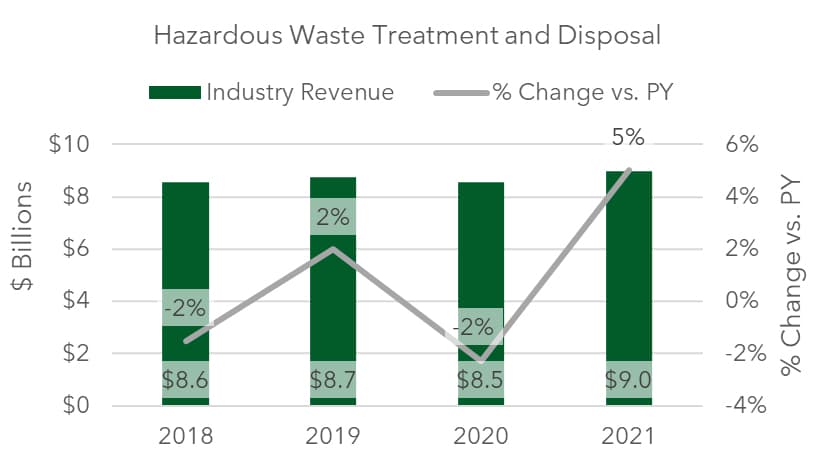

Market Size

- The hazardous waste treatment and disposal industry revenue was nearly $9 billion in 2021.

- According to IBISWorld, the broader market for remediation and environmental cleanup services in the U.S. is valued at approximately $24 billion.

Outlook

- There has been an increase in public sector-driven funding and projects related to hazardous waste remediation. The third wave of funding supported by the Infrastructure Investment and Jobs Act (IIJA) made $235 million available in grants for brownfield sites in FY 2024.

- Earlier this year, the EPA announced the second wave of funding allocated for Superfund sites, which amounts to $1 billion toward cleanup projects.

- With the surge in manufacturing and industrial activity, demand for hazardous waste programs is expected to increase.

- Severe weather events involving storms, flooding, wildfires, or extreme temperatures have increased in frequency and costs, which may lead to companies revamping emergency programs and assets for cleanup and recovery efforts.

In next week’s issue, we’ll look at drivers, trends, and hot spots for this sector. To learn more about market intelligence and research services from Morrissey Goodale, schedule an intro call with Rafael Barbosa. Connect with him on LinkedIn.

Weekly M&A Round Up

Nine ENR Top 500 Design Firms announce new deals: Last week nine ENR Top 500 Design Firms announced new transactions, led by deals made by IMEG Corp. (Rock Island, IL) (ENR #57), Parsons Corporation (Chantilly, VA) (ENR #15), and Psomas (Los Angeles, CA) (ENR #144). A total of 11 domestic deals were reported in TX, CA, NY, MI, DE, CO, OH, and GA. Overseas, we reported five transactions in the UK, Australia, and Canada. You can check all the week’s M&A news here.

Searching for an external Board member?

Our Board of Directors candidate database has over one hundred current and former CEOs, executives, business strategists, and experts from both inside and outside the AE and Environmental Consulting industry who are interested in serving on Boards. Contact Tim Pettepit via email or call him directly at (617) 982-3829 for pricing and access to the database.

Are you interested in serving on an AE firm Board of Directors?

We have numerous clients that are seeking qualified industry executives to serve on their boards. If you’re interested, please upload your resume here.

June 12-14, 2024 Las Vegas, NV

Western States M&A and Business Symposium

Join us for the 10th annual Western States Symposium, bringing together over 200 AE and environmental industry executives and investors in one of the world’s most vibrant and iconic cities.

Learn More

Subscribe to our Newsletters

Stay up-to-date in real-time.