Word on the street > Best Post-Transaction Performance Award Update and FAQs; Raises or Bonuses—Which Do AE Employees Prefer?

Word on the Street: Issue 165

Weekly real-time market and industry intelligence from Morrissey Goodale firm leaders.

Best Post-Transaction Performance Award Update and FAQs

Since opening the window for applications for this award at the end of August, we’ve received multiple submissions from firms across the U.S. and Canada. We’ve also received a number of questions about the award and the application process. Here are some of those questions in case they are also on your mind:

What about an internal ownership transition? Internal transactions are not eligible for this award. (No matter how successful!) It’s limited to acquisitions (or recapitalizations) of one firm by another.

What about performance in excess of the one-year timeline? If you wish to use a longer timeline for post-transaction performance results, that is OK, so long as you compare it to the acquired firm’s performance for the same period prior to the transaction. So, for example, if you wanted to use performance over a two-year timeline post-transaction, you will need to compare that to the acquisition’s performance for the two years prior to the transaction.

Why include the voluntary turnover rate in the assessment of performance? While improved financial performance is an important part of a successful acquisition, it’s not everything—by a long shot. This award seeks to recognize those firms that are improving conditions for the employees of the firms that they have acquired. Voluntary turnover rate is a key performance indicator in this regard. Acquirers that drive down voluntary turnover rates by better business management deliver better outcomes for both shareholders and clients.

What about confidentiality? Your application does not require you to share any proprietary financial information. Instead, you calculate the difference in performance before and after your chosen transaction in four areas (revenues, profits, backlog, and voluntary turnover rate). You self-report those differences (not the actual inputs) without revealing any proprietary information. For example, let’s say you acquired a firm whose profit in the year after the transaction was $3.2 million compared with $1.7 million in the year before you acquired them. Your input for profit performance would simply be ((3.2/1.7)-1) = 0.882. We don’t see the actual inputs, so your information remains completely confidential.

Isn’t this award a lock for one of the industry’s large firms or prolific acquirers? No, not at all. The median-sized acquisition in the industry is approximately $3.5 million in revenue. Most of these acquisitions are NOT completed by the larger firms. Also, as we are seeing in the submissions, many of these smaller acquisitions demonstrate extraordinary post-transaction performance. This award is not a competition per se. Rather, it’s a way to (a) establish for the first time a benchmark for acquisition performance in the industry that buyers can use as a reference point and (b) establish a way for potential sellers to recognize those buyers that have a track record in improving the fortunes of the business they acquire.

So, if you’ve made an acquisition that you’re proud of and has been a high-performer since the transaction, and you believe it merits consideration for this award, then we invite you to begin the application process here. The window for applications is open until October 6.

The award will be presented at our Texas and Southern States M&A, Strategy, and Innovation Symposium in Houston on October 25-27.

If you have any questions about whether your firm is eligible for the application process or the application process itself, please contact our awards department at [email protected].

Raises or Bonuses—Which Do AE Employees Prefer?

Mark Goodale

So, Word on the Street readers, what are you budgeting for raises and bonuses this year? Please take this quick, confidential, and anonymous survey. We’ll slice and dice the data to organize anticipated raises and bonuses by firm size and type. We’ll share the results at the end of September to provide you with a valuable reference point to help you navigate the rest of 2023 and beyond.

2023 Raises and Bonuses Survey

Whether AE firm employees prefer salary increases over bonuses or bonuses over salary increases varies depending on individual preferences and circumstances. There is no one-size-fits-all answer to this question because different employees may have different priorities. However, there are a number of considerations that can shed light on why some employees prefer one over the other.

Let’s start with those who favor raises—and why:

- Financial stability: In my 30 years of serving the AE industry, a sizeable majority of the thousands of AE professionals I’ve met can be found on the more fiscally conservative end of the spectrum. In their minds, higher salaries provide a more stable and predictable income in contrast to the potential variability of bonuses. This stance is reinforced when the economy gets bumpy and bonuses become less predictable.

- Base for future earnings: Many AE professionals equate a higher base salary with a solid foundation for future earnings growth. It’s not uncommon for annual salary increases, promotions, and bonuses to be calculated based on an employee’s base salary. The logic follows that a higher base salary can lead to higher future earnings. Bonuses, on the other hand, may not contribute to long-term income growth in the same way.

- Long-term financial planning: Some of your employees may prioritize long-term financial planning and saving for retirement. A higher salary can contribute more to retirement accounts and other long-term savings goals.

- Benefits and retirement contributions: In AE firms, employee benefits—such as health insurance, retirement contributions, and other perks—are often tied to an employee’s base salary. A higher base salary can result in greater contributions from the employer, which can have long-term financial benefits for the employee.

- Job security: AE professionals typically consider salary raises to be a more stable form of compensation and, as such, may perceive them as a sign of job security. Employees sometimes feel more secure in their positions when they receive salary raises because in their minds, it suggests an investment in their long-term employment.

- Career progression: Salary raises are often linked to career progression and advancement within AE firms. Employees may view salary increases as recognition of their contributions and an indication that they are on a positive career trajectory within the organization.

- Financial planning: Salary raises allow for easier financial planning because they provide consistent income streams that employees can budget around. This clarity can reduce financial stress and help employees better manage their finances.

On the other hand, plenty of AE employees prefer bonuses over raises—and here’s why:

- Performance-based rewards: Bonuses are typically tied to individual or team performance, which can be motivating for employees who thrive on challenges and want to be directly compensated for their efforts. This performance-based structure can provide a direct link between an employee’s contributions and their compensation.

- Opportunity for high earnings: A healthy bonus has the potential to significantly boost an employee’s total compensation in one fell swoop, especially if they consistently perform well or achieve specific targets. This potential for high earnings can be appealing to those in your staff who are confident in their abilities to meet or exceed performance expectations.

- Short-term financial goals: Some employees have short-term financial goals and other needs that can be better addressed through bonuses. For example, if an employee has immediate financial obligations, such as paying off debt or making a major purchase, a bonus can provide a lump sum of money to cover it.

- Flexibility: Bonuses can offer flexibility in how employees use the additional income. They can choose to save it, invest it, or spend it. This flexibility can be particularly attractive to employees who value financial autonomy.

- Entrepreneurial mindset: Employees who have an entrepreneurial mindset and are more inclined to work on the business and not just in it are more accepting and often more accustomed to variable income structures and thus prefer bonuses. They may be more comfortable with the potential ups and downs of variable compensation and see it as an opportunity to take control of their earnings.

It’s important to recognize that individual preferences for compensation vary widely depending on a variety of factors, and as a result, employees value different blends of competitive base salaries and performance-based bonuses. The challenge, and the goal, is to tailor your firm’s compensation packages to accommodate different employee preferences while aligning with the company’s values and philosophies.

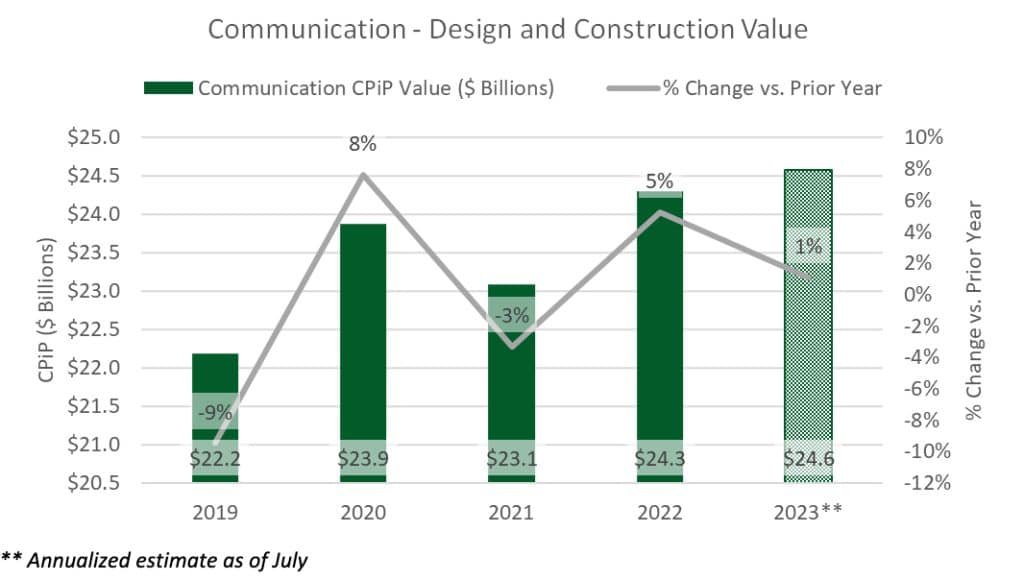

Market Snapshot: Communication (Part 1)

Weekly market intelligence data and insights for AE firm leaders.

Overview

- According to the U.S. Census Bureau, the communication category of construction includes telephone, television, and radio distribution and maintenance buildings and structures. The vast majority of these structures are privately owned.

- Based on 2022 data from the U.S. Census Bureau, the communication category represents about 2.6% of total nonresidential construction.

Market Size

$24.3 billion*

*Based on 2022 Value of Construction Put in Place (CPiP) (U.S. Census Bureau)

Outlook

- By annualizing the latest numbers for communication construction put-in-place spending, which captures the month of July, the category is slated to reach a five-year compound annual growth rate of 2.6% at the end of 2023.

- Markets revolving around the information and communications technology (ICT) industry, fiber networks, and Intelligent Transportation Systems (ITS) initiatives are expected to have consistent growth throughout this decade.

- Fiber networks are needed to support 5G deployment and broadband access in urban and rural areas. The Infrastructure Investment and Jobs Act (IIJA) made $65 billion available for broadband infrastructure. The largest program within this funding category is the Broadband Equity Access and Deployment (BEAD) program, which allocates $42 billion to states for planning, data collection, mapping, and construction projects. The National Telecommunications and Information Administration (NTIA) is responsible for managing the BEAD program, which will prioritize projects in unserved areas.

- Telecom providers have been the traditional customers of fiber products and systems. However, tech companies are increasing their share in order to support hyperscale datacenters, which run cloud-based applications.

In next week’s issue, we’ll look at trends and hot spots for this sector. To learn more about market intelligence and research services from Morrissey Goodale, schedule an intro call with Rafael Barbosa. Connect with him on LinkedIn.

Weekly M&A Round Up

Congratulations to Atwell (Southfield, MI) (ENR #74): The industry leader and national consulting, engineering, and construction services firm acquired the operations of land surveying firm Mead Gilman & Associates (Woodinville, WA). The acquisition of Mead Gilman & Associates continues to strengthen Atwell’s resources and capabilities in the Pacific Northwest. The deal is Atwell’s fourth of 2023. We’re thankful that the Atwell team trusted us to advise them on this transaction.

Eight other deals this week: Last week we reported domestic deals in TX, VA, FL, WA, TN, and KY. You can check all of last week’s M&A news here.

Searching for an external Board member?

Our Board of Directors candidate database has over one hundred current and former CEOs, executives, business strategists, and experts from both inside and outside the AE and Environmental Consulting industry who are interested in serving on Boards. Contact Tim Pettepit via email or call him directly at (617) 982-3829 for pricing and access to the database.

Are you interested in serving on an AE firm Board of Directors?

We have numerous clients that are seeking qualified industry executives to serve on their boards. If you’re interested, please upload your resume here.

June 12-14, 2024 Las Vegas, NV

Western States M&A and Business Symposium

Join us for the 10th annual Western States Symposium, bringing together over 200 AE and environmental industry executives and investors in one of the world’s most vibrant and iconic cities.

Learn More

Subscribe to our Newsletters

Stay up-to-date in real-time.