Word on the street > Venture Capital for the AE Industry—The Why, When, How, and How Much; The Path from Idea to Value

Word on the Street: Issue 157

Weekly real-time market and industry intelligence from Morrissey Goodale firm leaders.

Venture Capital for the AE Industry—The Why, When, How, and How Much

A major theme in our strategy work—especially with those clients who meaningfully engage their next-generation leaders—is one of “innovation.” For the most part, this involves development of proprietary technology—or customization of “off-the-shelf” tech—to deliver better, faster service to clients. For a hot second a couple of years ago, it seemed like every firm was digitizing and digital-twinning to beat the band. These days it’s a little bit of artificial intelligence here with some machine learning over there while everyone is ChatGPT-ing their way to transforming the way the industry works. Maybe. The innovation narrative that plays out in most AE and environmental firms is that most of these seemingly brilliant start-up, tech-driven business ideas that bubble up from within gain some early traction, secure more than nominal (all things are subjective) internal “funding” or management support, and then…just kinda fizzle out.

To find out why this pattern repeats in our industry, and what alternative approaches CEOs and leadership teams can take to actually productize their firm’s IP, I checked in with KP Reddy. He’s founder and managing partner of Shadow Ventures (Atlanta, GA), a seed-stage technology investment firm focused on the real estate and construction sectors with a mission to “revolutionize the way we design, build, and maintain our physical surroundings.” He knows a thing or two about start-ups in the AE and environmental industry—he and his team hear pitches from 30 new start-ups each week. In his experience, there are three related problems that combine to kill 90% of innovations before they can be monetized.

Think and act like a start-up: The first problem KP sees is that AE and environmental leadership teams “don’t have the right mindset.” They make a fatal flaw early by keeping the innovation team, systems, and product infrastructure inside their core, traditional fee-for-service business when they should instead spin it out and run it as a separate entity. The primary reason for this mistake is that leadership teams are “too emotionally attached” to the outcomes of their company-fostered innovation. So instead of “going to zero in three years they slowly go to zero in ten years. It becomes death by a thousand cuts.” This approach, per KP, is an anathema to a successful start-up. It leads to multiple unnatural and unhelpful behaviors built on a poor incentive backbone. When you staff your start-up with current employees from your core or legacy business who know they have a job to go back to and will get paid on the 1st and the 15th of the month, regardless of whether they fail or not, that’s a fundamental problem. It’s an innovation killer. “That’s not how a successful start-up works,” he says.

A winning team: According to KP, the second reason that innovations never get monetized is because the product company leadership team gets built from within the four walls of your service business. You might have a great idea, but after that “it’s all about execution.” Nobody from an AE or environmental firm leadership or management team “is equipped to do a start-up” successfully. The skillset and incentives are often diametrically opposed. “The first two key leadership positions to fill are those of the CEO and CTO,” he says. Hire them externally. Without them, the start-up will fail—slowly and miserably.

Risk and reward: The third reason innovative ideas fail to reach their full potential, according to KP, is that AE and environmental leadership teams are unable to deliver the appropriate funding model. “They know how to capitalize their core professional services business, but they don’t understand how you capitalize a product business – which is what these innovative ideas are.” Capitalization of a product business is nearly impossible to do internally. Beyond the earliest phases of product development, it requires external capital sources (sometimes venture capital [VC], sometimes private equity, or sometimes even debt) to set it on a successful growth trajectory.

Size and severity: Addressing these three issues upfront is critical if you want to take your firm’s innovations and monetize them. But even before that, you have to figure out if the innovations that you’re considering investing in even have a shot at being meaningful or not. According to Reddy, “This comes down to separating signal from noise. One of the biggest things that we in the VC community throw around is customer discovery. Talk with 100 clients and prospects—to figure out the sizing and severity of the problem.” In his experience, too many leadership teams live in an echo chamber where they delude themselves into believing that the problem that they are aiming to fix is massively widespread and requires an innovative approach when in fact it’s very limited, niche, and can be addressed by other more traditional means (such as insurance or litigation). Per KP, “The size and severity of the problem that your innovation is intended to address need to be of such a scale and so important as to warrant a venture investment.”

Five, ten, fifty: If some of your next-generation leaders have an idea to solve a problem that is of a size and severity that is meaningful (think energy transition, decarbonization, electrification, climate change, etc.), then you (almost) have a tiger by the tail. If this is the case, then you likely require capital of between $5 million and $50 million, and there’s a good chance you won’t see profitability for five or ten years. In our industry, this sum is pretty much impossible to self-fund. This is the “why” for VC in the AE and environmental industry. The way KP describes the situation is this: “VC as an asset class is different. It’s looking for 10x to 20x on its investment as a minimum. It’s seeking businesses that are doubling their revenues every two months. It’s a winner-takes-all proposition. The market needs to be big enough and growing fast enough to be interesting. VC adheres to the power law.” (The “power law” is a phenomenon that describes the distribution of returns in VC investing. Put simply, the “power law” states that a small number of investments in a VC portfolio will generate the vast majority of returns.) One in ten is a winner—maybe fewer. As Reddy sees it, “You only need one Google investment—who cares about the rest?”

Simple, but not easy: Reddy’s simple-to-understand, but far from easy-to-implement, four-step process to increase your chances of winning in the innovation or start-up world is as follows:

- First, separate the signal from the noise. Do your own research. Talk with customers and prospects to test the size and severity of the problem your innovation is addressing.

- Second, break up the band. Spin out the innovation into a separate, start-up business and capitalize it for 12 to 24 months (gulp!) with your firm as the 100% or majority investor with board control.

- Third, recruit a savvy CEO and CTO to lead the new company. One or both of them should have experience in successfully scaling up and exiting start-ups and ideally have connections with the VC community.

- Fourth, run it like a start-up for one to two years to accelerate the proof of concept while concurrently pitching/courting VC partners. This is the incubation period. And it’s this last step that is a big impediment for many AE and environmental leadership teams. It represents, in all likelihood, the biggest and riskiest investment that they will ever have made. This indeed is where the rubber meets the road for many teams, and they balk at the commitment.

Liftoff: If all goes to plan and your concept is proved out, you will secure a first round of VC funding. This is not the end of the journey; it’s just the beginning of the next stage. At this point, your firm’s investment in the venture will be diluted. You may or may not have control of the board of directors. And it’s possible—given the competitive environment—that your representation on the board has to be “masked” through a third party. And with every future round of funding, the original AE and environmental firm that originally spun out the innovation becomes a more and more diluted and passive investor. But the good news is it’s now a self-sustaining entity with sought-after technology margins, still with massive upside.

Success stories: There are multiple examples of how VC has supported AE entrepreneurs in successfully bringing their innovations to market including Procore, SketchUp, PlanGrid, ICON (a Shadow Ventures company), Spacemaker, EquipmentShare, and OnScale (another Shadow Ventures company), just to name a few. Per KP: “Each of these represents the power law dynamic in action with massive, asymmetric growth (and still room to run). Our strategy post-investment is to be extremely hands-on, get involved with product strategy, fix technical bugs, make sure the right team is in place to scale, and immediately drive customer adoption from our existing LP relationships. Most of our investors are looking to buy great products—they just need help sifting through the noise. We play a role of trusted matchmaker and, in the process, greatly increase the odds of success across our portfolio.”

Coda: In his travels around the industry, KP continues to be struck by how “tech-unsavvy” CEOs and their leadership teams are. He views this as an opportunity lost because if the C-suite is not aware of tech-enabled opportunities and tools, then they generally will not get the care and attention they need to create breakout opportunities for their firms. The mission for engineering and design firms has always been to leverage the most efficient tools to build the highest quality product at scale. He advises that leadership teams get smart about emerging tech by investing in a VC fund themselves, or in one or more start-ups, to learn and get some skin in the game. There is no better way to learn than to get active.

You can contact Mick Morrissey at [email protected] or 508.380.1868.

The Path from Idea to Value

Last week, I tracked down Rob Ioanna, chief technical officer of Syska Hennessy, an ENR Top 500 mechanical/electrical engineering firm, to walk me through the life cycle of how his firm converts ideas into services and products. Rob also happens to be the point person for Syska Innovations, a subsidiary organization that invests in seed-stage companies, pilots their software and products, and promotes ideation and technology development within Syska Hennessy. While Rob’s mantra is “work smarter,” he works hard, too, so I knew I had a chance of catching up with him during the Fourth of July week. Anyway, here’s how our conversation went:

The kind of work Syska Hennessy does demands innovation. How do you communicate that you are in the market for ideas, and from whom do you seek them?

Before the ideas come, you need the needs first, and we go to our clients for those. We certainly have our regular client touchpoints, and during those meetings—like any other good service provider would do—we ask them about their biggest struggles and needs. But more recently, we expanded that line of questioning to include what their pain points are in their overall jobs. It turns out a lot of those pain points are not answerable with the typical approach, like trying some new PM software. Instead, we have to innovate and develop new methodologies and tools. In some cases, we’ve already been working on the answer without really knowing it. For example, one of our larger clients does co-working office spaces. They explained their problems with modifications and so forth. It turned out we were looking at a product on the electrical side that we beta tested that could actually suit their needs. Now, obviously this was not a product that had been on the market with 500 client experiences behind it, but our client wanted to walk down that path, nonetheless. Now five years ago, that same client probably didn’t want to walk down the path, but there’s been a collective mindset change as clients get hungrier and hungrier for innovation.

Engineering firms are filled with great problem solvers, but they often run low on problem finders. What have you done in Syska Hennessy to address that tendency?

We source ideas internally by applying our client methodology to ourselves. What are our own pain points? Then we try to address them. We just completed our second “Idea-athon.” The theme this year was robotic process automation. Essentially, we asked ourselves, “What could automation do to help our clients and help us internally?” We got close to 60 responses, which is pretty good for a firm our size. We announce winners and include top 10 solutions. It gets people engaged.

How do you generate ideas beyond seeking input from clients and staff?

We might have a pain point that we are trying to solve with a client and a partner like Shadow Ventures (see Mick Morrissey’s article above), who might have a start-up under their umbrella that addresses the problem, and we co-mingle. We wind up partnering with that start-up and perhaps even help that business mature, in which case an investment opportunity might result through Shadow Ventures or directly with the start-up, depending on the situation.

What kinds of ideas are you looking for?

We have been publishing blog posts on our website soliciting start-up companies that have ideas in one or more of our seven “focus buckets” that we are interested in. We’ve received a good number of responses ranging from three guys in a garage to twenty people in their third year in business. You get connected to the ideas and what stages they’re in and where you can help them get unstuck. A lot of these start-ups are looking for folks to test their innovations. But we have something more valuable, and that’s data. We have thousands of projects and millions of RFIs and submittals, and with AI, you can comb through the information and observe the patterns that emerge. That’s really valuable to someone who is developing a product in the AE space.

How do you know when to take an idea to the next level? What tips you off?

I look for the opportunity of an unfair advantage. All the good ones seem to have one. Take supply chain issues, which have created a lot of headaches for the AE industry, as an example. We invested in a company called HVAC Manufacturers LLC, which developed a variable air-balancing device with a turndown ratio of 100 to 1. The smart air valve, or SAV, in one 15×20 size can fit the bill for all our VAV box needs for a commercial office product. As a baseball fan, it reminds me of when New Era invented the snapback one-size-fits-all baseball hat. So now, once a client dreams of a project—let’s say a commercial one for 70,000 SF—we can take immediate action. Our designs typically average one box per 700 SF, so we order 100 boxes at project inception, and the VAV boxes are suddenly no longer a supply-chain issue. That’s an unfair advantage. The next step for us is to take this approach to hospitals and laboratory projects, where standardization and pre-ordering can significantly enhance performance. Anyway, there are a million really good ideas. But transforming an idea into something that creates value is much harder than coming up with the good idea—so, the more the idea has an unfair advantage, the better chance it has of being successful somewhere down the line.

How do you say “no” to one idea without discouraging others?

You never say “no.” It’s, “Yes, and/but here are the issues and here’s what we need to overcome—go talk to this person or that person, etc.” The value proposition is the big dose of reality that gets people to go back to the drawing board. The ROI simply has to be there. You can’t sink $200K into an idea that’s only going to save you a couple of hours a week, so is there some way to get something done cheaper? Maybe use AI for the coding, for example? Anyway, we never give an outright “no” to any idea. If you want to innovate, you have to be open-minded.

Market Snapshot: Water (Part 1)

Weekly market intelligence data and insights for AE firm leaders.

Overview

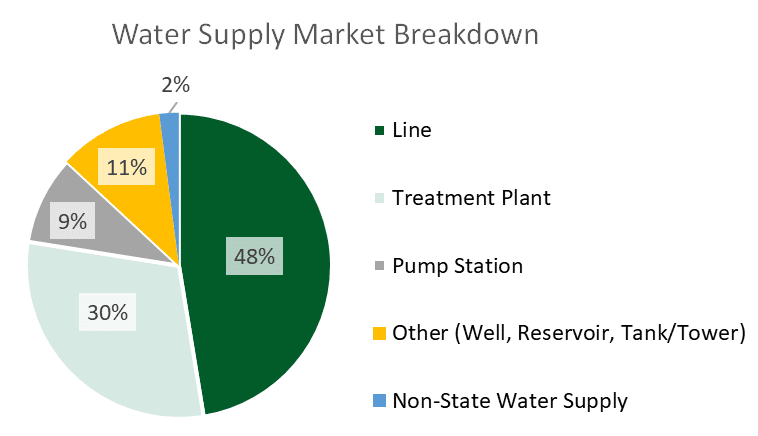

- The water supply category of construction includes plants (filtration, treatment, water supply, and water softening), transmission pipeline systems, pump stations, wells, supply reservoirs, and storage tanks and towers.

- Based on 2022 data from the U.S. Census Bureau, state and local entities are responsible for 95% of the spending on water supply design and construction. Federal and private owners represent 2% and 3% of total spending, respectively.

Market Size

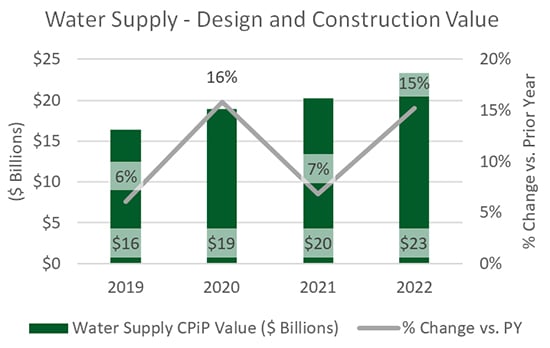

$23.3 billion*

*Based on 2022 Value of Construction Put in Place (CPiP) (U.S. Census Bureau)

Outlook

- Over the last five years, water supply design and construction spending has grown at a compound annual rate of 10.9%. If 2023 activity levels remain where they have been up until May, the category will reach even higher growth rates during the five-year period at the end of 2023.

- Federal funding programs were enhanced with the signing of the Infrastructure Investment and Jobs Act (IIJA), which included $15 billion for lead service line replacements and almost $12 billion for other improvements as part of the Drinking Water State Revolving Fund (DWSRF). Another $9 billion is being deployed towards addressing emerging contaminants (PFAS).

- According to ConstructConnect, construction starts for the water and sewage treatment category will remain flat in 2023 after a 28% year-over-year increase in 2022 and is expected to increase by roughly 6% each year until 2027.

In next week’s issue, we’ll look at trends and hot spots for this sector. To learn more about market intelligence and research services from Morrissey Goodale, schedule an intro call with Rafael Barbosa. Connect with him on LinkedIn.

Weekly M&A Round Up

Six domestic deals reported: Last week we reported deals in TX, ID, CA, WA, FL, and CO, highlighted by the Westwood Professional Services (Minnetonka, MN) (ENR #79) acquisition of Peloton Land Solutions (Fort Worth, TX). This marked the 19th deal in Texas this year. Additional global deals were reported in Canada, India, Belgium, the UK, and Malaysia. You can check all the week’s M&A news here.

Searching for an external Board member?

Our Board of Directors candidate database has over one hundred current and former CEOs, executives, business strategists, and experts from both inside and outside the AE and Environmental Consulting industry who are interested in serving on Boards. Contact Tim Pettepit via email or call him directly at (617) 982-3829 for pricing and access to the database.

Are you interested in serving on an AE firm Board of Directors?

We have numerous clients that are seeking qualified industry executives to serve on their boards. If you’re interested, please upload your resume here.

June 12-14, 2024 Las Vegas, NV

Western States M&A and Business Symposium

Join us for the 10th annual Western States Symposium, bringing together over 200 AE and environmental industry executives and investors in one of the world’s most vibrant and iconic cities.

Learn More

Subscribe to our Newsletters

Stay up-to-date in real-time.