Word on the street > Who Is the Industry’s Most Innovative Acquirer?; Getting the Best Deal as a Seller

Word on the Street: Issue 153

Weekly real-time market and industry intelligence from Morrissey Goodale firm leaders.

Who Is the Industry’s Most Innovative Acquirer?

The 2023 Most Innovative Acquirer Award will be presented this week at the Western States M&A, Strategy, and Innovation Symposium in Las Vegas. This is the second of three annual awards in our Excellence in Acquisitive Growth Awards Series designed to recognize the most accomplished acquirers in the AE and environmental industry.

Eligibility was limited to those 300 firms that have made two or more acquisitions of AE or environmental consulting firms since January 1, 2018. Applicants described a specific innovation or—in some cases—a series of innovations that they have made in their deal-making or deal-integration processes that resulted in measurable improvements. All applicants will receive a detailed, anonymized summary of the innovations and resulting improvements shared by the other eligible acquirers. Morrissey Goodale will be making a $1,000 donation to an AE industry-related 501(c)(3) organization to be chosen by the award recipient.

By the numbers: Fifty firms provided submissions for the 2023 Most Innovative Acquirer Award as part of our Excellence in Acquisitive Growth Awards Series. Collectively, these firms have completed over 400 acquisitions (and counting). The median size acquisition was $5 million or 35 employees. (Note: This size tracks almost exactly with the median-sized industry acquisition that we have reported over the years.) The largest acquisition recorded was over 550 employees. The five most popular states for acquisitive growth were California, Florida, Texas, Arizona, and Virginia. Interestingly, states where these firms have never made an acquisition include Alaska, Connecticut, Delaware, Hawaii, Maine, New Mexico, South Dakota, Vermont, West Virginia, and Wyoming.

A focus on integration: Innovations were presented in the acquisition process categories of Acquisition Planning, Acquisition Sourcing, Deal Structuring, Acquisition Candidate Courtship/Management, Integration Execution, and Post-Closing Communications. The most popular category where firms chose to emphasize their innovations was that of Integration Execution.

And the winner is…: We would like to congratulate the recipient of the 2023 Most Innovative Acquirer Award—6,000-person, employee-owned Terracon (Olathe, KS) (ENR #20). Their submission not only laid out multiple innovations in the Integration Execution category, but it also described how each of those innovations was directly connected to one of the firm’s core values of caring, courage, curiosity, excellence, integrity, and prosperity and documented measurable results from each. Accepting the award this week in Las Vegas for Terracon will be Kristi Tahmasiyan, the firm’s Director of M&A.

Simply the Best: (No way I could write this without a nod to Tina Turner.) Our leadership team carefully reviewed all 50 submissions. The scope and depth of the innovations were so comprehensive, and such was the thoughtfulness and care with which they were presented, that we agreed that it would be best to share not only the award recipient, but also recognize a select group of those acquirers whose acquisition process innovations really impressed us. And those firms are:

Ulteig (Fargo, ND) (ENR #123): For innovation in Integration Execution.

Dawood (Harrisburg, PA): For innovation in Post-Closing Communications

Kleinfelder (San Diego, CA) (ENR #42): For innovation in Integration Execution.

Tighe & Bond (Westfield, MA) (ENR #228): For innovation in Acquisition Planning.

West Yost (Davis, CA): For innovation in Integration Execution.

The HFW Companies (St. Louis, MO) (ENR #281) For innovation in Integration Execution.

Bowman Consulting Group (Reston, VA) (ENR #87): For innovation in Integration Execution.

Ardurra Group (Tampa, FL) (ENR #89): For innovation in Integration Execution.

Merrick (Greenwood Village, CO) (ENR #92): For innovation in Integration Execution.

Consolidation in our industry continues at a transformational pace of over 400 transactions a year. It’s in the interests of all industry stakeholders—project owners, firm shareholders, managers, and employees—that consolidation is done well, creating value and stability and enhancing client service and improved resource allocation. On behalf of us all here at Morrissey Goodale, we would like to recognize these acquirers in leading the way to improve how consolidation happens in our industry.

Best post-transaction performance: The third award in our Excellence in Acquisitive Growth Series is the Best Post-Transaction Performance Award. We will be opening applications for this award in the summer. The award will be presented at our Texas and Southern States M&A, Strategy, and Innovation Symposium at the five-star Post Oak Hotel at Uptown Houston in October. We will know then who will be joining IMEG, winner of the Most Prolific and Proficient Acquirer Award, and Terracon as this year’s award winners.

Questions? Comments? Suggestions? You can reach Mick Morrissey @ 508.380.1868 or [email protected].

Getting the Best Deal as a Seller

Mark Goodale

Last week, I had a chance to sit down with Brendon Cussio, Morrissey Goodale’s head of sell-side M&A, to talk about what it takes for sellers to get the best all-around deals for their firms. Believe me, finding the time to talk was no mean feat given how busy Brendon is getting deals done for our clients—in fact, he was in the process of closing two deals during our discussion. Anyway, here’s how it went:

MG: Aside from “price,” what separates great deals from the not so great?

BC: Tax and legal structures are important considerations, but they are secondary to how the deal itself is structured. The headline purchase price is one thing, but what’s guaranteed? In a vacuum, a $175 million all-cash deal is actually better than a $200 million deal that is $150 million in cash and $50 million in, say, a three-year earnout. In addition to the present value of cash, a deal that features that kind of an earnout introduces a lot of uncertainty.

MG: What kind of uncertainty?

BC: What if integration takes six months longer than was initially discussed? That kind of delay could have a serious impact on revenue and profitability. Or what if a corporate overhead allocation is placed on your business? If you have an earnout based on EBITDA performance, this corporate allocation could significantly reduce your ability to hit your earnout target. Are you able to realize revenue synergies and cross-pollinate as well as originally advertised? Will you be able to get that work from the buyers’ clients that they sub out? It sounded good in theory before the deal happened, but so do a lot of things. Plus, there are macro factors in play. Will there be another debt-ceiling issue? Are interest rates that are at a two-decade high going to cause key clients to put projects on hold? Is another major financial crisis going to blindside us? Anything can and does happen.

MG: So, the further you extend the payments, the less certain things get, right?

BC: Absolutely. You hope things will materialize the way they were discussed during the courtship, but who really knows? The future is famously hard to predict, and you might talk yourself into how easy it will be because you want to get the deal done. For example, you might anticipate very few, if any, defections after the deal, but if a few key managers get spooked for reasons real or imagined and decide to jump ship (which can and does happen to even the best of firms), your ability to attract new people, keep key clients, and ultimately reach those earnouts is going to be impacted. Or maybe that promise of the bolt-on acquisition that was going to help you double your revenue turned out to be vapor, and you find yourself scrambling to fill the gap. In any case, time has a way of turning a walk-in-the-park earnout into an uphill battle.

MG: What else separates the good, the bad, and the ugly?

BC: The amount of gravy. You might not like gravy poured over your meal, but you want as much as you can get on your deal. Gravy is the consideration beyond the purchase price, like profits interest units (PIUs) or Class B units, transaction costs that are picked up by the buyer (such as prior acts coverage or rep and warranty insurance), cash to accrual conversion costs, or deferred tax liability (all of which could easily represent value in the seven-figure range). The longer the list, the better.

MG: What about balance sheet items?

BC: Those are very important. Who takes what on the balance sheet? If it’s a cash-free, debt-free deal, what is considered working capital as opposed to an indebtedness item? If it is a debt-free deal, how much cash will you need to leave on the balance sheet (which is essentially providing an interest-free loan to the buyer)? If you recently purchased new equipment and took advantage of the accelerated depreciation but still have a loan outstanding, who pays off the remaining balance knowing the asset will continue to generate additional revenue in the future? How is accrued PTO handled?

MG: OK, now let’s get down to it. How do you get those big multiples as a seller?

BC: First, understand your strongest selling points and continually redirect negotiations back to them. If the business is enormously profitable but the backlog isn’t busting at the seams and the multiples on revenue aren’t exactly through the roof, we carry the profitability flag because we know the buyer has an accretive rollup strategy, so the profitability is what they are buying. Sure, they get the revenue, too, but that’s not the headline. Second, don’t exaggerate your strength. When you do, the price has only one way to go when the truth eventually comes out—and it will come out.

MG: What else is important?

BC: The goose has to continue to lay the golden eggs throughout the process. The firm has to hold serve or better during due diligence and negotiation. This is why you don’t want to exaggerate. You lose leverage, and leverage is what wins the things you want, not just the things that the buyer lets you win.

MG: How do you prevent getting pushed around at the bargaining table when it comes to price?

BC: Have more than one option. If you are only negotiating with one buyer, you can’t be sure you’re getting the best deal possible, and the buyer might very well know you have no other alternatives. It’s a bad recipe for a good deal and even worse if you have to sell. But if you do find yourself in that situation and you can’t move the purchase price up, close the gap by finding other ways to win, like getting value for your key folks. The buyer will want to limit defections, so find opportunities to incentivize people to stay on board. The more you bring the focus to others, the more confidence the buyer will have and the less likely you’ll be arm wrestling over a price reduction or contingent money.

MG: What mistakes do sellers make that cost them real dollars in terms of price?

BC: They fall in love too quickly. They think their new prospective partner is the best thing since sliced bread, and they have not and will not consider other opportunities. You are naïve if you’re not entertaining other overtures or seeking them out. When you are only interested in one partner or one type of partner, it’s more likely than not that you’ll give ground on price and probably a lot of other things, too.

MG: What about who’s got your ear—and if they’re whispering the wrong things to you?

BC: Oh, yes. Taking bad advice is another misstep that will cost you big at the bargaining table. You may have a great corporate attorney, but if they’re not deal makers, they can really mess up the process, and that can definitely impact the valuation. We’ve seen attorneys come to the table with little to no understanding of the AE industry and the market, and advocate for a higher price or off-market terms with literally no basis for their requests. They harm the process to such a degree that the buyer, who could have been a great partner, becomes disinterested and chooses to go in a different direction. And if your tax advisor does your taxes but isn’t terribly savvy in the world of dealmaking—like not knowing about F-reorgs and how to leverage them—you’re apt to lose a lot of ground there, too. Building a knowledgeable, skilled, and reliable M&A team is the best way to get the best deal.

If you’re thinking about selling your AE or environmental consulting firm, send an email to [email protected] or call 720.309.0704.

Market Snapshot: Higher Education (Part 1)

Weekly market intelligence data and insights for AE firm leaders.

Overview

- The higher education category of construction is made up primarily of instructional and administration buildings, dormitories, sports/recreation facilities, libraries, and infrastructure facilities within colleges and universities.

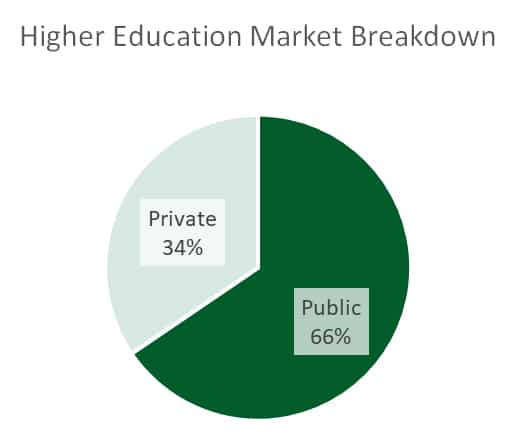

- Public institutions account for approximately two-thirds of the higher education market.

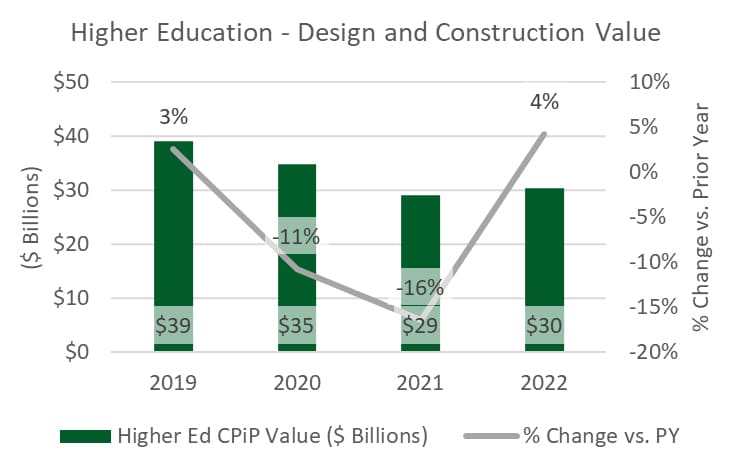

Market Size

$30.3 billion*

*Based on Value of Private Construction Put in Place (CPiP) – 2022 (U.S. Census Bureau)

Outlook

- Based on the first four months of activity in 2023, design and construction spending in higher education is trending up for both private and public colleges and universities.

- The latest enrollment statistics indicate challenges, especially within the public domain. Enrollment is down as more high school graduates are opting for blue-collar jobs.

- Upward transfers (moving from a two-year community college to a four-year institution) have declined almost 15% since 2020.

- Government funding support for higher education will get a boost in certain areas. Pell Grant award increases will go into effect in the next academic year. The latest adopted budget increased funding for federal higher education programs, such as those directed toward under-resourced institutions.

- The FY 2023 spending bill for the Departments of Labor, Health and Human Services, and Education includes more than $1 billion for higher education. The money will support over 540 projects throughout the country.

- Research funding associated with the National Science Foundation (NSF) and the National Institute of Health (NIH) is likely to help higher education institutions pay for improvements in existing facilities or enable investment in new ones (the CHIPS Act increased the NSF’s budget by $36 billion over the next five years).

In next week’s issue, we’ll look at trends and hot spots for this sector. To learn what’s ahead for higher education and other AE markets, consider attending the Western States M&A, Strategy, and Innovation Symposium on June 7-9 in Las Vegas—The #1 business networking and education event for AE industry executives and investors interested in growing in the West.

To learn more about market intelligence and research services from Morrissey Goodale, schedule an intro call with Rafael Barbosa. Connect with him on LinkedIn.

Weekly M&A Round Up

Congratulations to Doucet & Associates (Austin, TX): The Texas civil engineering, environmental planning, surveying, and CM services firm joined industry leader Kleinfelder (San Diego, CA) (ENR #42). The transaction fortifies Kleinfelder’s commitment to strategic growth and strengthens an already robust client and service portfolio in the growing Texas market. We’re thankful that the Doucet & Associates team trusted us to initiate and advise them on this transaction.

Additional domestic deals in CO, IL, and FL: Last week we reported a total of four domestic deals and four international deals. Join industry executives, dealmakers, and investors in Texas on October 25-27 to learn more about the latest happenings in the industry at our Texas and Southern States M&A, Strategy, and Innovation Symposium. You can check all the week’s M&A news here.

Searching for an external Board member?

Our Board of Directors candidate database has over one hundred current and former CEOs, executives, business strategists, and experts from both inside and outside the AE and Environmental Consulting industry who are interested in serving on Boards. Contact Tim Pettepit via email or call him directly at (617) 982-3829 for pricing and access to the database.

Are you interested in serving on an AE firm Board of Directors?

We have numerous clients that are seeking qualified industry executives to serve on their boards. If you’re interested, please upload your resume here.

June 12-14, 2024 Las Vegas, NV

Western States M&A and Business Symposium

Join us for the 10th annual Western States Symposium, bringing together over 200 AE and environmental industry executives and investors in one of the world’s most vibrant and iconic cities.

Learn More

Subscribe to our Newsletters

Stay up-to-date in real-time.