Word on the street > AE Industry Intelligence: Issue 71

AE Industry Intelligence: Issue 71

The future’s so bright: Industry leaders see a strong ending to a remarkable 2021

Pinch yourself. Do it again. Yes, this is real. Your business is performing better than you ever thought possible. And yes, your backlog is stronger than ever. Never mind that you’re still trying to figure out your “back-to-the-office strategy.” (Everyone else is, too.) It doesn’t matter that you’re still bemoaning how difficult it is to “find talent.” (As an industry we’ve been struggling with that for over 20 years, and we always seem to get by.) The fact is the A/E industry is humming—like never before.

An industry in full gear: The engines of infrastructure, environmental and site/civil firms continue to run red hot. M/E/P & structural firms are busier than ever, designing data centers, distribution facilities, and K-12 schools. The demand for laboratories, research, and sports facilities is buoying architecture and interiors firms that are concurrently seeing their recently dormant hospitality and entertainment sectors roar back to life. The remarkable residential market is like the best ever bass and drums combo—providing a non-stop, full-on backbeat, keeping everything moving. Water engineering firms are almost as valuable as water itself now. And wait, what’s that you say? The Feds are going to spend big on infrastructure? There’s a LOT of positivity going around—but not a lot of capacity. It’s no wonder that so much of our strategic planning work this year is helping leadership teams figure out how to exit low performing markets and say “no” to bad clients.

A view from the front of the pack: How strong is the industry in 2021? A great way to quickly assess the state of the market is through the eyes of the industry’s publicly traded firms. Their quarterly reports provide a timely opportunity for their investors to view their performance. They also provide a close-to-real-time proxy of industry activity and outlook. Taken together, the most recent crop of quarterly reports reflects an A/E industry that is booming with no slowdown in sight. The common message from these industry leaders is, “We’ve had a great year thus far, and we feel even better about the future!” Let’s take a look at what some of these industry leaders are reporting.

- Setting records in the Sunshine State: On August 10, Hollywood, FL-based NV5 Global Inc. (NASDAQ: NVEE) reported “record performance in the second quarter” and “the highest gross revenues, net income, adjusted EBITDA, and adjusted EPS that NV5 has delivered in a quarter since [the firm’s] inception.” How optimistic is management about the balance of 2021? By the sound of things, pretty, pretty, upbeat. “We expect to build upon our strong second quarter momentum and are raising our guidance on gross revenues…to a range of $705 million to $727 million (previously $695 million to $720 million).”

- Water + Technology + Innovation = Success: At the end of July, Tetra Tech Inc. (NASDAQ: TTEK)—ranked #1 in Water by ENR for 18 years in a row—reported “record quarterly [net] revenue” of “$638 million, up 14% year-over-year.” And there is no slow down in sight for the firm’s momentum as “backlog grew to an all-time high of $3.25 billion with increased orders for water and environmental services.”

- Good news from the Great White North: On August 10, WSP Global Inc. (TSX: WSP) reported “robust results for the second quarter of 2021 driven by strong performance from recent acquisitions and better than anticipated organic growth, resulting in improved adjusted EBITDA margins.” (Adjusted EBITDA margin for the second quarter was 16.9% compared with 15.8% for the same quarter last year.) The company’s management expects that “on the basis of our strong performance, we feel confident in revising our 2021 outlook upwards.” Importantly, “Backlog as at June 26, 2021 stood at $9.6 billion, representing 11.2 months of revenues, up 14.4% in the six-month period, mainly due to acquisition growth.”

- Global is good: On August 4, Stantec Inc. (TSX, NYSE: STN) reported that it, too, was revising its guidance for the year upwards. From the firm’s press release, “Based on the strength of its performance to date and confidence in the continued execution of its strategic plan, Stantec is raising earnings guidance for the year, with full year adjusted diluted earnings per share in comparison to 2020 now expected to achieve 4% to 7% growth compared to the previous guidance of low to mid-single digit (1% to 5%) growth.” What’s behind the optimism? Well, according to Gord Johnston, President and CEO, “We see clear evidence of building momentum in all our key markets, particularly in the US where we have achieved 6.4% organic backlog growth through the first half of this year. Beyond wins recorded in backlog, we have received award notifications for approximately $1.2 billion in gross revenue, more than half of which is in the US.”

- Momentum from NKOTB: On August 16, Atlas Technical Consultants Inc. (Nasdaq: ATCX)—a firm that only went public in February 2020—reported, “Gross revenue grew 17% to $131.6 million, compared to $112.7 million in the prior-year quarter,” and, “Adjusted EBITDA increased 17.9% to $18.2 million, compared to $15.4 million in the prior-year quarter.” Importantly, according to a company statement, “Backlog at quarter-end was $751 million, up sequentially to a record high, driven by key infrastructure and environmental related contract wins.” In many ways, L. Joe Boyer, Atlas’ Chief Executive Officer sums up not only the outlook for his firm but also for the industry when he states, “As we look ahead, the markets we serve are promising even before any increased federal infrastructure spending.”

2022 more of the same? Backlogs in the industry are back to—and in many cases exceed—pre-pandemic levels. Our clients report continuing robust demand across all service lines and sectors. And this is the state of the industry BEFORE any federal stimulus spending. Assuming that an infrastructure bill passes, it’s likely that 2022 (and 2023) will continue to be remarkable years for all in our industry—from the largest publicly traded firms to the smallest startups.

Network and learn in the Lone Star State: Our Texas M&A Symposium is on track to smash attendance records. We will likely have to close registration early. Join over 100 industry CEOs, M&A decision makers, and investors from Texas and around the nation this October 21 and 22 in Houston. Don’t miss out—register today. We’re thrilled to co-produce this event once again with our friends at ACEC Texas.

What we’re tweeting this week: The new #AE firm workplace will be sandwiched between what clients need and what employees want. Managers won’t get to choose the model; they will only get to react to these two competing demands.

In observance of the Labor Day Holiday, there will be no Word on the Street next Monday. We will see you again on Monday, Sept 13.

Questions? Insights? How does the outlook for your firm compare with these industry leaders? Email Mick Morrissey @ [email protected] or call him @ 508.380.1868.

Four Factors to Watch

1. Infrastructure Bill

Now that the House has passed the $3.5 trillion budget framework for the Democrat-led social and environmental package, it appears a vote will finally happen for the $1 trillion infrastructure bill in late September. Centrist Democrats established a deadline of September 27 for the vote on the infrastructure bill and claim that a stand-alone vote is now established for the bipartisan infrastructure bill separate from the larger stimulus package.

The $1 trillion infrastructure bill increases new funding by $550 billion, which will be dedicated to roads and bridges, water infrastructure, expanding broadband access, and other infrastructure-related projects. It also reauthorizes existing federal infrastructure programs.

2. COVID-19 Case Numbers

In the last week, the seven-day average of daily COVID cases in the U.S. grew from just over 140,800 to nearly 156,300. August 26 saw over 187,400 cases.

Seven-day averages of COVID cases increased in California and Texas but dropped in Florida:

- California: from 12,991 to 14,881

- Texas: from 15,376 to 16,612

- Florida: from 24,517 to 22,556

3. Delta Impact on Economy

The pandemic isn’t over, not while the Delta variant keeps a full recovery at bay. It’s not entirely clear yet how much of an impact Delta has had, but there are some concerning trends, including consumer sentiment data for August which was at its lowest point since 2011. Retail sales fell harder than expected in July, and growth in the private sector slowed down due to supply chain disruptions and the recent Delta-induced COVID spike. Other indicators, like the Composite Purchasing Managers’ Index, dropped to its lowest level in eight months.

On the other hand, this spike likely won’t lead to the kind of lockdowns we saw earlier in the pandemic, given the impact of available vaccines. To boot, some state economies are actually stronger now than before the pandemic hit, and even inflation started to cool in July.

The Back-to-Normal Index, created by CNN Business and Moody’s Analytics, has been holding steady at 92% in recent weeks, but some states’ economies are better now than they were before the pandemic. And inflation is finally starting to show up in the rearview mirror. Higher prices have been a hallmark of the recovery, but in July, consumer price inflation began to moderate. Nevertheless, the same industries that were decimated by the initial impact of the pandemic (like travel and hospitality) are feeling Delta’s bite, while those that endured and even grew (like some of the big-box retailers) are actually seeing a significant amount of foot traffic returning to their stores.

Third-quarter GDP numbers won’t be out for another two months, but in the meantime, the economy appears to at least be on its feet as the pandemic continues to throw haymakers.

4. Employment

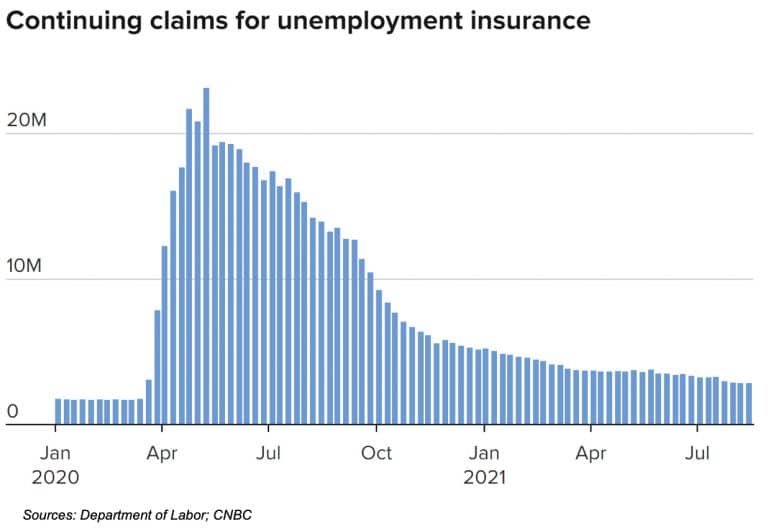

Initial claims for unemployment insurance remained relatively steady, up slightly to 353,000 from the previous week’s total of 349,000. The Dow Jones estimate was basically on target at 350,000.

Continuing claims dropped 3,000 from the previous week to 2.86 million. The four-week moving average showed a significant drop of 108,500 to a little over 2.9 million.

Subscribe to our Newsletters

Stay up-to-date in real-time.

Subscribe Now

Subscribe Now