Word on the street > AE Industry Intelligence: Issue 89

AE Industry Intelligence: Issue 89

Employee-owned Firms, The Big Squeeze, And The Nifty Fifty

As if the Great Resignation, Great Reassessment, and Big Quit weren’t enough, employee-owned AE leadership teams are also caught in the middle of the Big Squeeze. And it’s not one of those warm and fuzzy happy squeezes. (Speaking of “Greats,” Hulu’s The Great deserves a big huzzah.)

Oh no, the Big Squeeze is a whole trifecta of bad. It’s one of those hugs that’s way too tight, far too long, and with a stranger. It’s a direct result of four trends that are converging over the next five years to remake the AE industry. (See January 10’s Word on the Street.) And when the bear hug is over, employee-owned brands will occupy a very different position in the industry. And it starts with firm valuations…

- You think real estate in Aspen is expensive? Try buying an AE or environmental consulting firm these days. M&A valuations (a fancy way to say “prices”) for design and environmental firms are at all-time highs. One CEO that I spoke with this week described experiencing something akin to vertigo when he realized what he would have to pay for a preferred acquisition target. Other terms we’ve heard to describe today’s prices from similarly spooked executives are the fun “champagne multiples” and somewhat more concerning “nosebleed levels.”

- Five frothy years ahead: The combination of buy-side demand factors (mature industry, private capital influx, infrastructure bill, talent constraints) and sell-side drivers (boomer and Gen-X owners cashing out at record rates, inability to transfer leadership and ownership internally, changed competitive environment) are teeing up five years of unprecedented industry hyper-consolidation. We expect volume to escalate at a rate of 10% annually with some 3,250 AE and environmental firms being sold between now and the end of 2026. Concurrently, deal prices—already at record levels—will increase further. Firms in high demand will see multiples approaching those typically reserved for tech firms, not professional services ones. Truth be told, we’ve been in the early stages of this market dynamic since 2018 when there was a step function in industry deal activity (that was the first year that annual deal volume exceeded 300 transactions) and associated spike in multiples.

- Core competencies count: Such a M&A environment favors skilled buyers with ample capital whose core competency is creating and delivering superior, sustainable returns for shareholders through buying and selling businesses. In the AE industry those types of buyers are the cohort of publicly traded firms and the relatively new breed of private equity backed players. This M&A environment does not favor the majority of industry employee-owned firms for three reasons. First, their core competencies lie in designing solutions for clients—not in acquiring firms. Second, they are, for the most part, conservative in accessing and deploying capital rather than maximizing returns. Third, and most important, many are in the midst of the dreaded Nifty Fifty syndrome.

- The Nifty Fifty Syndrome: AE and environmental firms experience this when more than 50% of their equity is owned by managers over the age of 55. Tell-tale symptoms of the syndrome include: less appetite for risk, slower decision-making, a reluctance to make long-term investments, and itchiness. All these factors taken together place employee-owned firms at a clear disadvantage in the competition to acquire high-performing firms over the next five years.

- Consolidation, not acquisition: As we’ve moved into this high-multiple M&A environment, more and more employee-owned firms—which in the past were active and enthusiastic buyers—have been choosing to sit out the acquisition market. They do the math, figure the hit to their internal stock price, and pass because they figure it’s too darn risky. (Narrator: Can you say, “Nifty Fifty?”) Instead, they’ve been looking to consolidate and build on historic acquisitions that they have made in the past. As a result, the percentage of industry acquisitions completed by employee-owned firms has steadily declined from 71% in 2018 to 68% in 2019 to 66% in 2020 to an historic low of 56% in 2021. Indeed, when you look at the most prolific industry acquirers (See Word on the Street, October 11, 2021) there are zero non-ESOP employee-owned firms in the mix. We can expect the influence of employee-owned acquirers to continue to be diminished as prices increase through 2027. They will be squeezed out by private equity and publicly traded buyers.

- The upshot: The Big Squeeze will put most employee-owned firms at a disadvantage in the upcoming period of industry hyper-consolidation. More often than not, they will find that the acquisitions that they need to make to achieve the goals in their strategic plans have been snapped up by their competitors with different capital models. The industry landscape at the end of 2026 will look decidedly less employee-owned. The employee-owned firms that will make it through the Big Squeeze are those high performers that can grow at 10% plus per year with profits north of 20% per year. The others will be watching from the sidelines as the industry gets remade.

We’re turning up the heat in Miami this March! Our Southeast States M&A Symposium is taking place at the stunning Mandarin Oriental Miami on March 23 and 24. Soak up the sun with over 120 AE industry executives, buyers, sellers, and investors in the nation’s most exciting city. The M&A market in the Southeast is so hot that we’ve had to increase the meeting space not once but twice and added outdoor networking and dining options. Register today to reserve your cabana in the sun. All this plus continuing education credits!

No slowdown in industry M&A: This week saw 17 acquisitions of AE and environmental firms announced in the U.S. with the pace of industry consolidation up 36% over the past 12 months.

It’s Texas Two-Step week!

Congratulations to our client HR Green (Cedar Rapids, IA) (ENR #188): This week they announced their acquisition of LDC (Austin, TX), a land development, telecom, and surveying firm. The acquisition allows HR Green to continue its growth in Texas, adding Austin to its footprint. We’re thankful the HR Green team trusted us to assist them with this strategic growth initiative.

Congratulations also to our client AG&E (Addison, TX): This week the leadership of this nationally recognized structural engineering firm announced their acquisition of Blue Ridge Design (Winchester, VA), a consulting engineering firm with expertise in the precast/prestressed concrete industry. We’re privileged that the team at AG&E chose us as their advisor for this acquisition.

Questions? Insights? How do you see the Big Squeeze playing out over the next five years? Email Mick Morrissey at [email protected] or call him at 508.380.1868 or connect with him on LinkedIn.

Want To Get Things Done? Watch Your Language (Part 1)

Over the next few years, production capacity will continue to be a fundamental constraint for the vast majority of AE industry firms. And if you just read the previous article on the “Big Squeeze,” you know the cavalry might not show up with an acquisition to provide reinforcements. Many of you are simply going to have to do more with less.

With that scenario as the backdrop, think for a moment about how things work in your firm today. When you ask someone (anyone) in your firm to do something for you, how often are you satisfied with the outcome? How often are you surprised by that outcome—in a good way? On the other hand, how often do you find yourself muttering something along the lines of, “I should have just done it myself?” If it’s more of the latter, you’re in the same boat with the thousands of smart, hard-working, well-intentioned AE professionals I’ve had the privilege of interacting with during my career.

Yet I can say this with certainty—you are blind.

You are blind to what somebody hears as opposed to what you actually request. You are blind to the conversations that are going on all around you every day. And you are blind to the ineffectiveness of the language you choose to use. But this is your lucky day, because I’m going to help you see the light.

Low reliability generally results in chaos, lots of pressure, and unmet expectations (i.e., dissatisfaction). Lack of good intentions or “drive” is typically not the problem. More often, it’s a fundamental communication issue. The good news? You can improve it!

Focusing on making and securing “reliable commitments” taps into how AE professionals are wired:

- They like to be effective

- They can be more effective if the folks “upstream” give them what they need when they are expecting it

- They like to think of themselves as being highly reliable

- They often find that their own levels of reliability offer great opportunities for improvement (why wouldn’t anyone want to get better at being reliable?)

To get your head around the notion of reliability, think about it in the context of the project environment. After all, AE firms are project-driven organizations, and since projects are a network of commitments and promises (nothing more, nothing less), it stands to reason that the better the people in your firm get at making and securing reliable commitments, the more successful your firm will be.

Dozens, if not hundreds, of project commitments are made daily. The quality of these “transactions” largely dictates how smooth the project runs. Missed commitments tend to flow downstream in cascading fashion. The earlier the lack of reliability is located and controlled, the less damage it causes.

The good news is that improved reliability will cascade through the network in the same way.

Improving reliability throughout your organization requires the following:

- A focus on improving the interfaces and hand-offs on projects

- Promoting a culture where the staff can better manage countless informal commitments

- Training yourself and others to go “on alert” to recognize when a commitment is necessary and assure that the basic communication steps have been taken

- Insisting on reliable commitments throughout the firm

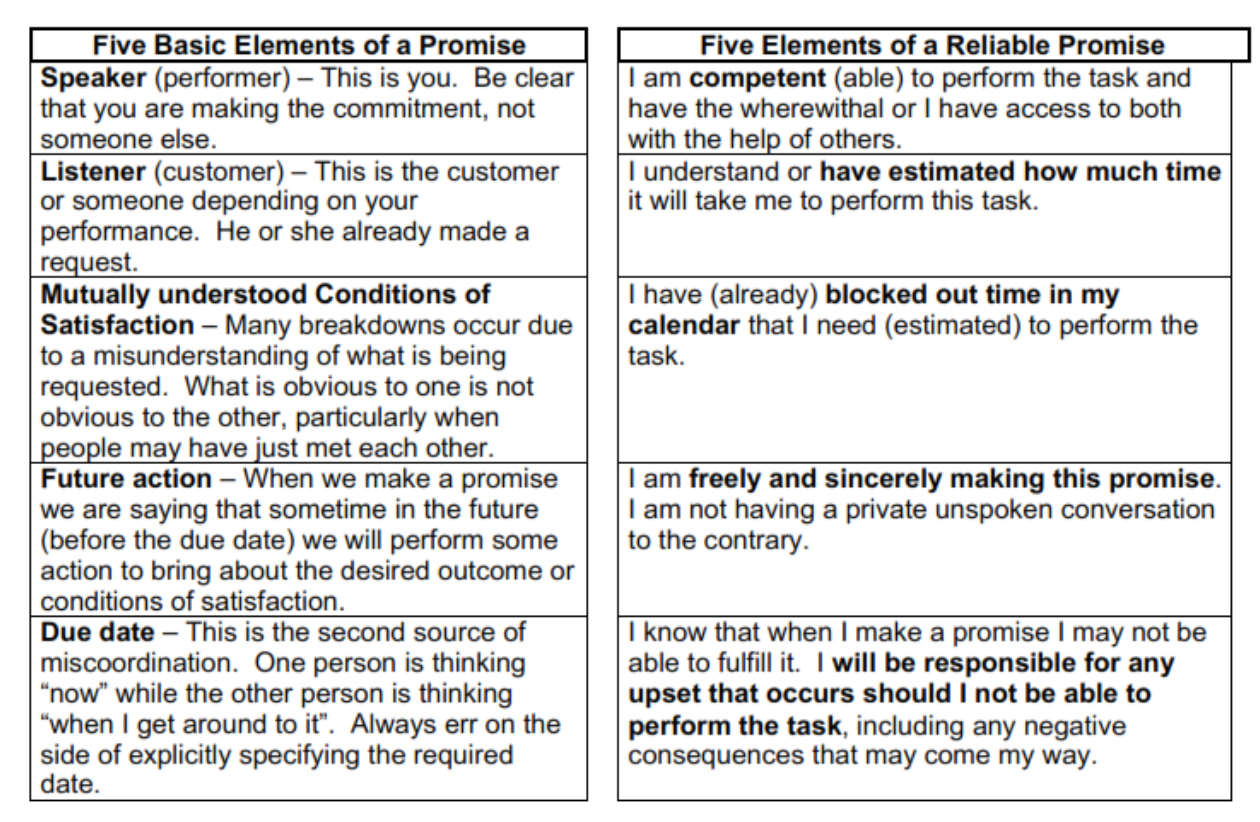

It also requires an understanding of what a reliable commitment (promise) is. There are five elements to a promise and five more to a reliable promise. The table below was created by my friend and colleague, Hal Macomber, who is the industry authority on adapting “Lean” strategies for the AE industry. This simple framework speaks to the importance of the language we use (and don’t use) when we make requests. Several of my clients have printed this table and keep it on their desk for quick reference.

If you are missing just one of these elements, you have a hope or a good intention, but you don’t have a commitment. And in this context, hope is the raw material of dissatisfaction.

Next week, Part 2 of this mini-series will provide examples of reliable requests, how to detect when people are “waffling” on their commitments, reliable ways to respond to a request, how to begin developing reliable commitment skills, and more. In the meantime, if you’d like to learn more about how to improve reliability in your firm, call Mark Goodale at 508.254.3914 or send an email to [email protected].

Four Factors to Watch

1. U.S. Economy

The Conference Board Leading Economic Index (LEI) increased by 0.8% in December, suggesting the economy is likely to continue expanding during the first half of 2022, although tempered by Omicron, labor shortages, inflation, and Fed rate hikes. The economic research team at The Conference Board is forecasting GDP growth of 2.2% for Q1 2022 and 3.5% for all of 2022.

2. Housing Market

According to the National Association of Realtors (NAR), in 2021, 8.2% more homes were sold than in 2020 and they sold faster and for more money than ever. Going into 2022, demand can be affected by affordability as mortgage rates move up and inventory is at a record-low due in large part to labor shortages and rising costs of building materials. The Census published the latest numbers for housing building permits, which went up by 17% last year compared to 2020. With increases in housing starts and the current backlog subsiding, we might see a more normalized market in the later months of 2022.

3. Supply Chain

The container ship backlog in the port of Los Angeles, something that was uncommon before the pandemic, can be a representative measure of the ongoing supply chain bottlenecks that have had a significant impact on the U.S. economy. The number of container ships anchored offshore of the port of Los Angeles has come down from 17 on January 2nd to 9 on January 21st.

4. U.S. COVID-19 Case Numbers and Vaccination

The 7-day moving average of new cases reported on January 20 was 726,870, an 18% increase from the 7-day moving average on January 6, which was 616,972. According to the CDC, 75% of the U.S. population have received at least one vaccine dose and 53% of those fully vaccinated have received a booster dose.

In related news, this past Friday, a federal judge in Texas blocked the Biden administration’s vaccine requirement for federal employees. In recent weeks, other mandates targeting federal contractors as well as large private employers have been blocked or put on hold by the courts.

Subscribe to our Newsletters

Stay up-to-date in real-time.