Word on the street > How to Be a Pro in a World Full of Rookies; 5 Business Lessons from a Pagani Factory Tour

Word on the Street: Issue 149

Weekly real-time market and industry intelligence from Morrissey Goodale firm leaders.

How to Be a Pro in a World Full of Rookies

Our research team, led by 10-year Morrissey Goodale veteran Peter Frank, is constantly doing new research on the AE and environmental industry. Half of the time it’s intelligence-mining work commissioned by clients. The other half is to allow us to better understand how the industry is performing and where it’s headed.

One of those recent latter-category studies revealed that since 2018 (when there was a step-function increase in U.S. industry consolidation from 200+ acquisitions per year to 300+) three-quarters of all acquisitions have been made by first-time—and as of today—one-and-done buyers. In other words…rookies. Rookie buyers are driving most of the industry M&A. First-time buyers—just like rookie quarterbacks and never-been-to-the-playoff coaches—tend to make more mistakes—some of them egregious—than experienced ones. (This could be the reason why three-quarters of buyers since 2018 are “one-and-done.” That will be the focus of a future study.)

If you’re about to join the ranks of the first-time buyers, here are six tips from the playbooks of those acquirers that have “been-there-done-that” successfully in the past. If you’d like to learn more from the industry’s most successful acquirers, you can meet them at our Western States M&A, Strategy, and Innovation Symposium in Las Vegas next month.

Rule #1: Don’t overpay. This is where most rookies fail. First-timers have a greater tendency to trust inflated (intentionally or not) forecasts from a seller. They tend to have a rosier-than-could-ever-be-justified view of the “synergies” that an acquisition could yield. They generally have little, if any, appreciation of the costs to integrate. And they usually underestimate the post-transaction investment needed. Combined, these factors end up leading to agenda items on board meetings that go something like: “You told us originally this would pay for itself in three years, now you’re telling us seven?” Don’t let this happen to you. Question every forecast. Challenge every assumption. Be the curmudgeon in the room. Your shareholders will resent you now but thank you down the line.

Optionality: Options. Keep them open as long as you can. Don’t just engage with one target. Instead, develop multiple targets for you to choose from. Sure, they won’t all be the same. Some will be more attractive from an investment perspective than others. But your best deal will result from you having negotiating leverage. That comes from two primary sources. The first is having multiple options in front of you every step of the way to negotiate with. Don’t like what you are seeing from Option A? Then move on to Option B. Option B’s performance tanking? Then move to Option C. The second source of your negotiating power is the option to walk away from a deal that’s going sideways. Options are a rookie buyer’s best friend.

Unicorns and yetis: They don’t exist. Just like the perfect acquisition doesn’t. Your board probably authorized an acquisition in keeping with your firm’s strategic plan. They likely envisioned the integration of a firm with the ideal services mix; a top-notch client list; and a youthful, vigorous management team eager to help you achieve your strategic goals. All at a below-market price. It ain’t gonna happen. Most acquisitions don’t bring on board an ideal service mix or client type. Elements typically need to be repaired or jettisoned post-transaction. Oftentimes you’ll pick up more than one disgruntled or passive-aggressive principal or shareholder who “never wanted to do the deal” and who will make it their life’s mission to bad-mouth you and your firm. And then there’s always the premium that you pay for something that you believe isn’t perfect. First-time buyers always scratch their heads about why they have to pay a premium for a “damaged article.”

Real love comes later: You hate to see it. Buyer meets seller. Buyer falls in love with seller. Buyer breaks rule #1. Buyer ignores all other options. A buyer in love and his money are easily parted. In over 30 years of advising I’ve seen this happen at least once a year. And the aftermath most of the time is a failed combination. Keep your emotion for your home life. Cast a cold eye on the strategy, culture, and economics of any transaction. Then, and only then, make your investment. When you’ve achieved your goals from the acquisition—then it’s safe to fall in love.

Champion/Scapegoat: Have a strategic plan that provides context for an acquisition? Great. Did a deal fall serendipitously into your lap? Terrific. Regardless of how you came to the deal—or it came to you—you better have two champions in place. Champion 1A gets the deal done. Champion 1B rolls up their sleeves to get the acquisition integrated. They may or may not be the same person. Most first-time buyers don’t have qualified individuals for either of these roles. At the same time, any and all studies of acquisitions indicate that about two-thirds of deals are a failure when measured against their original goals. The probability of failure is likely higher for first-time buyers in this industry. As such, there’s a high risk that those on the team who volunteer for the Champion 1A or 1B spots end up instead becoming Scapegoat 1A or Scapegoat 1B. Don’t let this happen to your team. Do not sacrifice your team’s integrity at the altar of a failed acquisition. Make sure your entire team is socialized to the potential risks ahead of time to avoid the blame game internally.

Mind your manners: Rookie buyers may have a wonderful reputation for service with their clients. They may be known as a great place to work by their employees and peers. But they are an unknown quantity in the world of acquisitions. And whether they know it or not, their brand is at risk once they start to explore the world of acquisitions. Potential sellers remember when you waste their time. Or when you show up late for a meeting. Or don’t listen to them or their concerns. Or when you appear arrogant. Not only do they remember, but they’re also happy to talk about it with their peers. And when they do that, you’re experiencing self-inflicted wounds to your brand. The best buyers show up on time and leave a great impression after meetings. They are courteous and respectful. And the best of the best know how to say “Thanks but no thanks” with class. They know that because for every single acquisition that they close, they engage with about 20 other firms—each of which they need to say “goodbye” to. Pro tip—sending a handwritten thank you card after every meeting goes a long way.

Rookie and “one-and-done” buyers are driving most of the M&A activity in the industry. This means that a lot of industry consolidation is being performed in beta mode—which is likely not ideal for buyers or sellers.

Questions, comments? Contact Mick Morrissey at [email protected] or 508.380.1868.

5 Business Lessons from a Pagani Factory Tour

Last week I returned from a family trip to Italy. While visiting Rome, Florence, and Venice is a simply splendid way to spend a week, it does come with a significant downside—pizza is now pretty much ruined for me. I can’t return to the local variety. I can’t. I won’t. Thanks for nothing, Italy.

Anyway, my personal struggles aside, there was one aspect of the trip, in particular, that made me think, “This is something our Word on the Street readers might find interesting.” Yes, even when I’m on vacation I’m thinking of you!

My son and I are fairly enthusiastic about cars, so as we planned our Italy trip (and when I say “we,” I mean my wife), we knew we had to get in some serious exotic car-gawking. But which factory to visit—Ferrari, Lamborghini, Maserati? No. We wanted to see the hyperest of the hypercars, so our pilgrimage would be made to the Pagani factory and museum in Modena. My 17-year-old daughter couldn’t wait (yes, that’s sarcasm).

First, some background.

Born in Argentina in 1955, Horacio Pagani showed a passion for cars at a tender age. Since his father was a baker and his mother an artist, Horacio would not inherit a generational automotive company as most traditional carmakers do. Instead, Horacio started his automotive empire by drawing visions in the dirt with a stick and crafting miniature models with whatever he could find. He was a voracious reader of anything involving the supercar world, especially articles featuring Ferrari and Lamborghini. But it was his chance encounter with a Reader’s Digest issue featuring Leonardo Da Vinci that resulted in his greatest moment of inspiration. Da Vinci’s statement that “art and science are two disciplines that must walk together hand-in-hand” set Pagani’s wheels in motion.

By the time he was 20, Pagani had opened his own shop. He built his first F3 racer, and at the age 23 made a Formula 2 single-seater racer so impressively designed that it caught the attention of Renault and five-time Formula One Champion Juan Manuel Fangio. Renault hired Pagani to improve their race car, and the results were superb. He built on this success by setting off for Italy where he would pursue his childhood dream of creating a supercar of his own.

Pagani’s road to success would not be paved in gold. It was 1982, and the economy was suffering. Pagani and his wife started out their Italian dream by living in a tent. While Pagani was able to land a job as a mechanic with Lamborghini in the body work department, he started out sweeping floors. But his drive and skills were overpowering, and he rapidly rose in the organization, eventually becoming chief engineer. His tenure with Lamborghini culminated with the concept for the Lamborghini Countach.

But Pagani had bigger mountains to climb. As the ’80s drew to a close, he established Modena Design, the company that would eventually become Pagani Automobili. Modena Design manufactured state-of-the art composite materials for established car brands, including Renault and Ferrari Formula One among others. But in the background, Pagani was feverishly creating a masterpiece—a new hypercar that would thrust him onto the world stage. It took seven years to complete the Zonda C12, but it was worth the wait—the new hypercar was a smash hit at the 1999 Geneva Auto Show.

Pagani’s first hypercar spawned multiple new models, each featuring unique refinements and improvements.

Now for the 5 lessons:

Lesson #1: If you want to retain your best and brightest, sometimes you have to bet on them.

When Pagani was at Lamborghini, he tried to persuade his bosses to buy an autoclave (a specialized oven used to bake composite materials) so they could extend the production of the carbon parts for the Evoluzione. But Lamborghini was facing financial challenges at the time and told Pagani that since Ferrari did not have an autoclave, Lamborghini didn’t need one, either. Pagani was frustrated by this because without an autoclave, he couldn’t advance his research. Undaunted, Pagani borrowed the capital to buy his own autoclave, left Lamborghini, and founded Pagani Composite Research in 1988 (followed by Modena Design in 1991). The autoclave is still in use today at the Pagani factory.

What do you need to do to retain your visionary, highly driven Horacio Pagani-types?

Lesson #2: Don’t be bashful about branding.

Everything about Pagani is branded. And I mean everything. The oval shape of the logo can be found like Easter eggs throughout every car. Every bolt on the Pagani Huayra (the Zonda’s successor and named for an Andean wind god) is crafted from grade-7 titanium (I held one—they are lighter than air) and features a tiny etching of the Pagani logo—an incredible attention to detail. Incidentally, the bolts on the Huayra alone cost as much as a Porsche 911. Oh yeah—Pagani signs every car, too.

How well does your firm take care of its brand details? Do they do your company justice?

Lesson #3: If you are everything to everyone, you’re no one to anyone.

I get it. Pagani is over the top in just about every way. But the focus on producing something that’s the best in the world has resulted in a fiercely loyal niche client base of some of the wealthiest people in the world. Pagani’s identity is a fanatical attention to detail. The cars are mostly hand-built, using the very best materials. Every curve, notch, and line is art and science rolled into one. Horacio Pagani would not stand for less. Each car takes about six months to build, and the backlog is significant. Since the company only produces 40-50 cars a year, you could be waiting a year or more for your new Pagani. But don’t feel bad—Mark Zuckerberg had to wait for his, too. This imbalance between supply and demand fits Pagani just fine. A “starter Pagani” will set you back over $3 million, and it goes up from there—rapidly.

How do clients perceive the value your firm delivers?

Lesson #4: WIP is a big waste.

When Pagani produces carbon fiber components for its cars, they work on one car at a time. They carry little to no inventory (they barely had any spare parts to show us on the factory tour). They don’t produce anything that hasn’t been ordered. On the other hand, the vast majority of AE firms manage for resource efficiency. And that means keeping everyone busy no matter what. But what is actually getting done? Is staff working on things that add value? Are they getting the work done in a short amount of time? Most AE firms have so much design work in process it’s almost impossible to figure out what’s finished and what’s not. Multi-tasking and task-switching kill efficiency. Managing for flow efficiency, on the other hand, is about finishing what is started and minimizing WIP. If your firm could get this right—really right—it would dwarf most any other improvement you could make in your firm.

How much more efficient would your firm be if your employees finished what they started, with no interruption, or close to it?

Lesson #5: Great employers attract great people.

I’ve worked with enough companies to know when a firm has it going on, and Pagani has it going on. I saw people doing what they do best in an environment that brings it out in them. Starting with the physical surroundings, it was hard to distinguish the museum from the factory. Everything was immaculate, and like the cars Pagani produces, the factory is a mix of art and science. Some of the most innovative tools in the world are housed in a building that seems more like a showroom than a production facility. Every person I saw working that day seemed genuinely happy to be there and even happier to be with each other. The Pagani brand, and the people’s pride in it, can be felt.

Whether your employees work remotely or in the office, what kind of pride do they feel working in your organization?

If you’d like to meet with me in person to talk business (or cars), register for our Western States M&A, Strategy, and Innovation Symposium June 7-9 in Las Vegas. I hope to see you there!

Market Snapshot: Commercial (Part 1)

Weekly market intelligence data and insights for AE firm leaders.

Overview

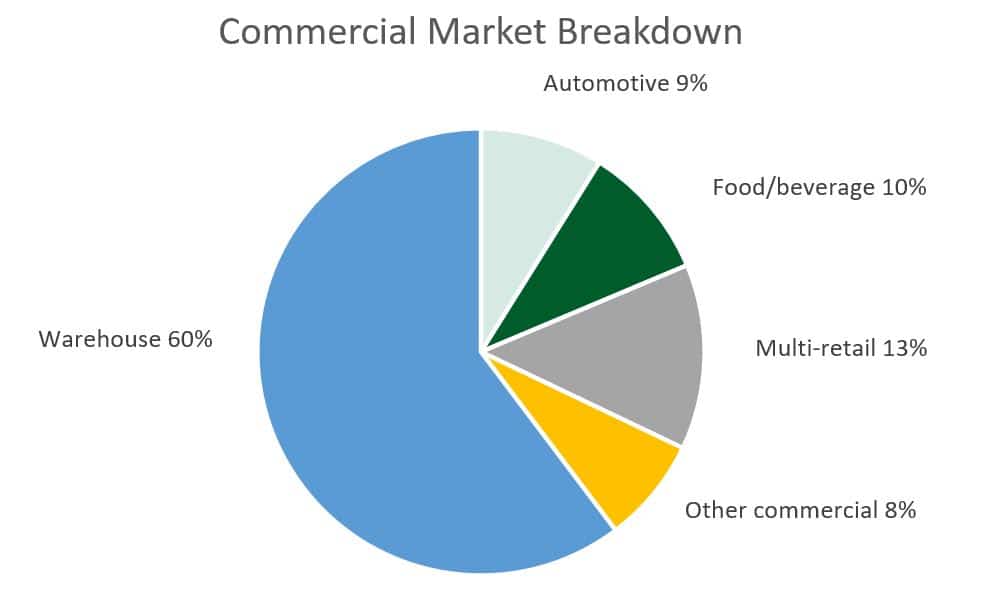

- The commercial category of construction is made up primarily of buildings and structures used by retail, wholesale, and service establishments.

- Key industries that make up the commercial design and construction market include:

- Automotive

- Food and beverage

- Multi-retail (department stores, warehouse retailers, shopping centers, malls)

- Other commercial (drug stores, building supply, furniture, beauty salons, etc.)

- Warehouse (storage and distribution buildings and self-storage)

- Farm-related buildings and structures

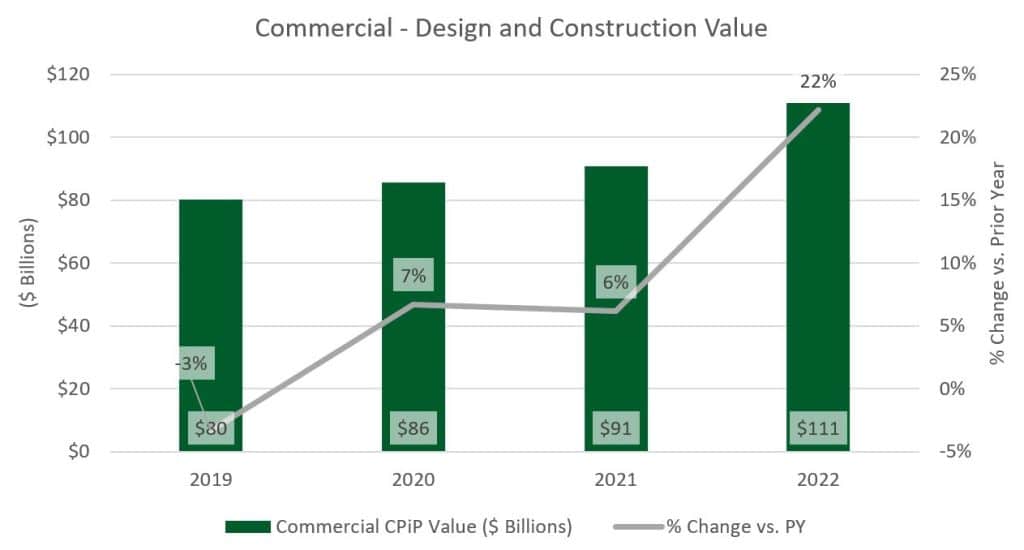

Market Size

$111.0 billion*

*Based on Value of Private Construction Put in Place (CPiP) – 2022 (U.S. Census Bureau)

Outlook

- The commercial sector had a strong performance in 2022. For this year, the AIA Consensus Construction Forecast indicates a modest 3% increase in commercial and retail-related construction spending.

- Consumer confidence has been on a declining trend. Additionally, retailers are having to deal with a tight labor market. With that, more technology is being implemented in stores to not only enhance shopping experiences, but also address workforce challenges.

- After intense construction activity in 2022, the warehouse and distribution market will sustain its strong position in 2023. Although most companies are still holding relatively high inventory levels, about a quarter of businesses are selling excess stock. Warehouse construction starts will be slightly lower in 2023.

- Despite growth in online shopping, large brick-and-mortar retailers are still relevant, and many grocers are expanding and exploring new formats.

- In some markets, retail expansions will slow down due to inflated development and construction costs, which may result in more remodeling projects intended to drive foot traffic and accommodate for digital sales.

- No major disruptions are expected within shopping center development as companies are being cautious in 2023.

In next week’s issue, we’ll look at trends and hot spots for this sector. To learn what’s ahead for other markets, check out Morrissey Goodale’s 2023 Market Outlook for the AE Industry. Click here to access recording and materials.

To learn more about market intelligence and research services from Morrissey Goodale, schedule an intro call with Rafael Barbosa. Connect with him on LinkedIn.

Weekly M&A Round Up

Congratulations to Atwell (Southfield, MI) (ENR #74): The national consulting, engineering, and construction services firm acquired DexBender (Fort Myers, FL), an environmental and marine consulting firm. DexBender works with private and public clients to provide services such as protected species assessment, wetland mitigation, preserve monitoring and compliance, state and federal wetland permitting, and other environmental services. This is Atwell’s fifth acquisition in the last six months. We’re thankful that the Atwell team trusted us to advise them on this transaction.

Five additional domestic deals: Last week saw five other domestic deals announced in MO, TX, MI, NY, and KS. Overseas we reported three new transactions. You can check all of last week’s M&A news here.

.

.

Searching for an external Board member?

Our Board of Directors candidate database has over one hundred current and former CEOs, executives, business strategists, and experts from both inside and outside the AE and Environmental Consulting industry who are interested in serving on Boards. Contact Tim Pettepit via email or call him directly at (617) 982-3829 for pricing and access to the database.

Are you interested in serving on an AE firm Board of Directors?

We have numerous clients that are seeking qualified industry executives to serve on their boards. If you’re interested, please upload your resume here.

June 12-14, 2024 Las Vegas, NV

Western States M&A and Business Symposium

Join us for the 10th annual Western States Symposium, bringing together over 200 AE and environmental industry executives and investors in one of the world’s most vibrant and iconic cities.

Learn More

Subscribe to our Newsletters

Stay up-to-date in real-time.