Word on the street > Think the Future Is Unknowable? Think Again.

Word on the Street: Issue 128

Weekly real-time market and industry intelligence from Morrissey Goodale firm leaders.

Think the Future Is Unknowable? Think Again.

Predicting the future is hard. Duh. No one knows which markets are going to be hot in the future. Or when the economy is going to be in recession. Or if there’s going to be another pandemic. Or when a killer app is going to revolutionize our industry. Those are all external factors that you and your leadership team—along with the leadership teams at Disney and Meta and General Electric, etc.—are all trying to guess at how they are going to play out. (The difference is that Disney et al spend a lot more money than you on scenario planning to predict what’s going to happen. Doesn’t make them any smarter, though. They still miss the target as often as they hit it.)

However, when it comes to predicting what lies ahead for your AE or environmental consulting firm, well, there are some surprisingly accurate models available about what you can expect in the future. These are available for you and your leadership team to anticipate “what’s around the corner” as you grow your firm. They are best used to take advantage of “the good times” and to prepare for future inevitable organizational and cultural changes and crises.

One of these models that I like to use in our strategy work is Larry Greiner’s Growth Model. It’s a really good organizational development model for a professional services firm in a mature, relatively slow-growth industry. “Hey, this Greiner thing was published in 1972, what relevance could it have to today’s tech-enabled AE and environmental business models?” you ask. To which I reply, “What have you got against 1972? Don McLean released both “American Pie” and “Vincent” in 1972, and they’re both as relevant today as they were then.” You then tell me that’s a lousy reply, and I agree. But seriously, Greiner’s model is as robust today for you to reference in your planning for the future as it was 50 years ago. Let’s take a look…

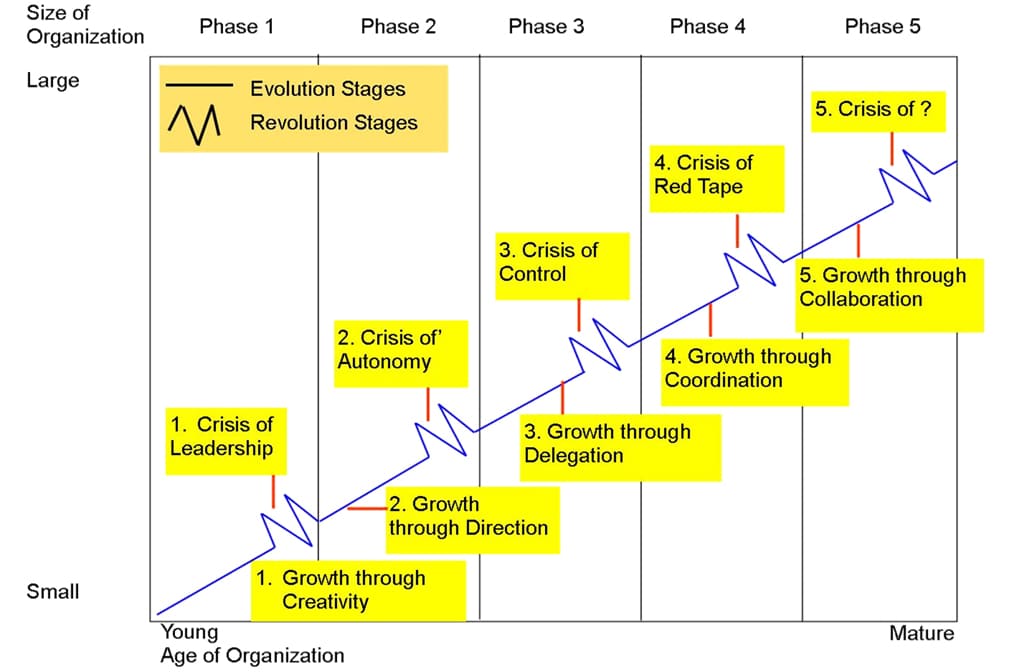

Figure 1: Greiner’s Growth Model

On the vertical axis is the size of the firm—from small to large. Along the horizontal axis is the age of the organization—from young to mature (we’re not allowed to say “old” apparently). As the firm grows and matures, the model predicts five phases of growth—each capped with a “crisis” that must be navigated to continue growing.

Phase 1: Growth through Creativity: This speaks to the inception and early years of the AE or environmental firm. Those heady days when it’s founded by (typically in our industry) two professionals whose skillsets complement each other. One of them is really good at business development, and one excels at managing projects. One brings home the bacon, and one fries it up and serves it. The perfect yin to the yang. And the firm thrives with that dynamic. It’s nimble; it feels like a “family.” There’s magic in creating something out of nothing. Most firms in our industry are in this phase. They generate somewhere between $5 million and $10 million a year. The founders are making more money than they ever dreamed they could have and are feeling good about where they’re sitting on Maslow’s pyramid. The firm still runs on spreadsheets, QuickBooks, and owner sentiment and personal whim. But it’s working just fine.

Crisis 1: Crisis of Leadership: This crisis occurs when the firm’s growth and associated regulatory (“Wait, I was supposed to fund the 401(k) with actual money?”) and business risks (“I’m not sure our team of 20 full-time employees is really all that qualified to design this $2 billion international airport terminal project that we just won.”) outstrip the management competencies of the founders. The only way to navigate this crisis successfully is by bringing on professional managers in some or all of the functional areas of finance, operations, HR, marketing, and IT. Failure to get through this crisis results in a slow decline with clients and employees abandoning the firm.

Phase 2: Growth through Direction: In this phase, the professional managers establish enterprise-wide systems and processes (read “rules”) to drive efficiencies and manage risk. Classic Business 101. The founders are likely still around, but they have ceded some management responsibilities. The rules and regulations put in place by professional managers represent a “growing up” of the business model. They establish best business practices that are foundational for future profitable growth and expansion to new locations. With this model, the firm can double in size.

Crisis 2: Crisis of Autonomy: I like to call this the “Rebel Yell” crisis. This happens when the project, design, and technical managers push back on the “professionally installed” business systems. (We don’t much like rules, do we?) They consider them in conflict with how best to serve clients and manage projects. This is particularly true for managers who are located in outlying offices. (“Our biggest client in Arizona wants our proposals to look a certain way, but “Marketing” up there in New York City (rolls eyes) keeps using that crummy corporate template. It’s crazy!”) The only way to address this crisis is to grant more decision-making authority to the project, design, technical, and office managers.

Phase 3: Growth through Delegation: Growth is driven by delegating responsibility to client, project, and operations managers. The philosophy is that these specialized managers know what’s best for the company as it pertains to serving a particular client or set of clients, delivering projects, and allocating resources. This in turn allows leaders and professional managers to focus on enterprise strategy and developing systems that support—rather than direct—the specialized managers. This model tends to coincide with the implementation of a multi-faceted profit center or incentive-compensation system (which almost always has a lousy set of unintended consequences—see the next crisis) designed to improve and reward the performance of individual elements of the business. You see this model at play in many multi-office, multi-discipline firms throughout the AE and environmental industry.

Crisis 3: Crisis of Control: This is the “Inmates Are Running the Prison” crisis. “Growth through Delegation” has descended into “Growth through Abdication.” The characteristics of this crisis are plain to see around our industry. Deliverables coming out of the Oakland office don’t look anything like those developed in the San Diego office. Quality controls in the higher education studio are practically non-existent compared with the consistent application of Demings-style systems in the sports studio. Project kickoffs are happening religiously in the structural group while nobody in the civil department can tell you where to find the project management manual. (Don’t even try asking them who is on their project team.) The firm’s insurance providers are now getting spooked as its risk profile is rising dangerously. The only way to navigate this crisis is to “get real” about the core competencies of the business and coordinate activity across the enterprise for the good of the entire firm. No easy or small task. And many AE and environmental firms never make it through this crisis. In many ways, this crisis is fueled by managers looking to “game” their incentive-compensation plans. (Note: This latter point is a huge third-rail issue in the industry. I’ve seen firms implode because of managers trying to maximize their year-end bonuses. It’s a slow-moving train wreck as alpha managers with sizeable equity positions drain the firm for personal gain.)

Phase 4: Growth through Coordination: This phase recognizes that intentional coordination is required across the firm to continue to grow and minimize risk. It’s a repudiation of “every man for himself” and a commitment to “we’re all in this together.” This phase often coincides with a strategic planning effort that is put in place to address the Crisis of Control mess. There is general acknowledgement by managers (although some of it is lip service) that coordination is essential for the good of the entire firm. Meaning that certain managers need to “give up” or “relinquish” some power—or autonomy or compensation (this is where the lip service gets dangerous)—for the greater good. This phase is where you often see the emergence of a Chief Operations Officer in a firm. This person is a direct report to the CEO (if that relationship does not exist, then this phase becomes a disaster) who has legitimacy and standing with both corporate managers and the design, project, and regional managers. She is alternatively called the “Velvet Hammer” or “Ultimate Traffic Cop.” She is trusted by all to look out for the best interests of the firm. She oversees that coordination of business and operations activities designed to optimize results for the entire firm. It’s during this phase that leadership leans heavily on phrases such as “culture,” “shared values,” and “vision.”

Crisis 4: Crisis of Red Tape: In this phase, the good intentions of mission-driven Growth through Coordination and the efforts of the COO are often found on the rocks of bureaucracy. The creation, layering-on, and far too often poor execution of new reports, processes, and functions in the name of leadership-sponsored coordination results in additional “busy” work for employees, which “damages” the firm’s culture. This results in slower decision-making, reduced agility, and diminished ability to respond to market changes while also ushering in a wider loss of efficiency/reduced margins. The severity of this crisis grows the more services, departments, and offices a firm has.

Phase 5: Growth through Collaboration: This is the “Holy Grail” or “Mature” phase. In this phase, everyone in the firm lives and breathes the mantra of owning their own experience, the client’s experience, and the firm’s experience. This is the ideal evolution of Growth through Coordination, one where all parts of the company work together in a trusted, effective manner. Systems are simplified for efficiency; learning and development is championed; and all aspects of the business contribute towards ways to continue success. There is a positive culture around problem-solving. There’s little “red tape,” and processes are simple. Reward is shared on the basis of team performance. Employees feel they can contribute ideas for growth. Everyone knows how they impact the company with the work they do. A common element of firms that are at this phase is that they are leveraging their ERP systems not as a tool “to be used,” but as a core competency critical to continuous improvement.

Crisis 5: Crisis of ? For those industry-leading firms that have mastered Growth through Collaboration, the next crisis is how to continue to grow. Is it through new services? New risk models? Partnerships? Product development? The crisis does not come from within—instead it’s a “better” crisis of picking the right path(s) forward.

Where to next for your firm? Do you recognize your firm in a specific growth phase or at a particular crisis point in the model? If so, look to the right to see what’s next and what’s needed to continue your growth.

Questions or comments? Email or call Mick Morrissey at [email protected] or 508.380.1868.

Resist the Victim Complex

vic-tim [vik-tim]

noun

1. a person who suffers from a destructive or injurious action or agency

2. a person who is deceived or cheated, as by the dishonesty of others or by some impersonal agency

As you read in Mick Morrissey’s article, various phases of growth bring with them a number of challenges. And when those challenges go unmet, “victims” and their excuses (the archenemy of sustainable, profitable growth) often start pouring out of the woodwork.

Do you have victims in your company? Do they unfairly blame circumstances or other people for their own struggles and failures? Perhaps you might recognize a few of these folks if you tune your ear to the conversations that surround you each day. Dare I question that, from time to time, you might even be a victim? There’s no shame in it, really— unless, of course, you find yourself on this list and ignore what you need to hear:

The Frazzled Division Leader: You are one of the busiest people in the company with 17 direct reports, and none of them can carry your water two measly yards. Every day is a fire fight. You’re loyal, doggedly determined, and highly trustworthy, but your inexperienced, inadequate staff is always dragging you down. You can’t help but be a bottleneck. And that’s why your group isn’t growing with the rest of the firm.

What you need to hear: You are probably a fantastic doer, but accomplishing through others is where you struggle. First, reorganize your group so you have no more than four or five direct reports. Second, challenge your top “lieutenants” to take on some of your responsibilities. Push it on them, and don’t be afraid to ask. Chances are they are starving for the opportunity. And if they truly are not cut out for the job, what are you going to do about it? It’s your responsibility to build your team and make it work.

The Neglected Marketing Director: Bright, passionate, and creative, you simply can’t get anyone to listen to you so you spend most of your time going to where the love is, cranking out proposals, and otherwise generally staying out of the way. You are well aware of your company’s growth goals, but what the heck can you do when you’re seen as a second-class citizen? The fact is AE firms just don’t respect marketing, and that’s that.

What you need to hear: You’d better get out of the order-taking mode or you’ll never help your company the way you could and should. Do what it takes to be at the strategic planning table and contribute to business unit plans. They need your input and leadership, so you can’t afford to be timid. Take it upon yourself to start regularly reporting to the senior management team on marketing and business development activities— after all, if you can’t sell yourself internally, leadership will have a hard time believing you can sell the firm externally.

The Wayward Regional Director: Your region has struggled, mainly because it’s not considered part of the mothership and is essentially “out of the loop.” You don’t get any help from the home office, nobody ever tells you anything about the direction of the firm, and you resent writing big checks every month for corporate “support.”

What you need to hear: If you want to be in the loop, get in the loop. Pick up the phone twice a week and give the CEO a call. Schedule it if you have to. And challenge marketing, human resources, financial, and operations leadership to be your partner in building your area of the business. Tell them exactly what you need and extract it. Corporate functions will always be imperfect. But it’s up to you to leverage what does exist the best way you can.

The Besieged CEO: You are the heart and soul of the company. Everyone in the firm wonders what’s going to happen when you finally retire. You want to leave in five years, but you have significant doubts that any of your partners have what it takes to keep it all together, never mind leading it to new heights.

What you need to hear: Time to get it in gear. For starters, if you don’t have a chief operating officer, now is a good time to put one in place. The COO oversees the operations of all business units and is ultimately responsible for how the work of a firm gets done. It will also afford you the opportunity to get out of the weeds once and for all. Also, invest in executive coaching for your second-tier leaders. Leadership seminars are fine, but two-day programs by themselves seldom churn out future CEOs. Your next-in-line need to practice leadership skills in real time, not just listen to someone present an endless list of leadership traits and characteristics. If you don’t have enough runway left to adequately prepare your heir apparent, you likely need to seek an external buyer. It may not be your first choice, but it might be the only responsible way you can get your equity out of the firm and provide your people with better opportunities and a brighter future.

If you are a victim, just know that a lot more will be in your control once you give yourself permission to act. And if you know any victims in your firm, forward them this article!

Morrissey Goodale can help your AE firm successfully transition through the five phases of growth. Call Mark Goodale today at 508.254.3914 or send an email to [email protected].

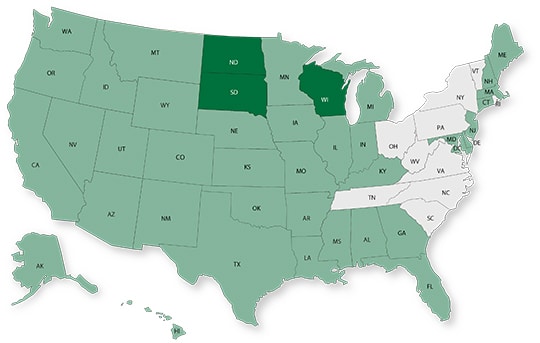

50 in 50: North Dakota, South Dakota, and Wisconsin

50 states in 50 weeks: U.S. states economic and infrastructure highlights.

Our team is putting together new content and a different format to kick off 2023 Word on the Street. For that reason, we will be publishing the remaining states of the 50 in 50 Series in a combined fashion. This week we are featuring the last three states in the Midwest: North Dakota, South Dakota, and Wisconsin

Key Economic Indicators

| Measure | North Dakota | South Dakota | Wisconsin |

| GDP (billions) | $55.7 | $49.0 | $302.8 |

| GDP 5-year CAGR | 0.8% | 1.6% | 0.9% |

| GDP per capita (U.S.: $58,154) | $71,657 | $54,702 | $52,025 |

| Population (millions) | .775 | .895 | 5.9 |

| Population 5-year CAGR (U.S.: 0.5%) | 0.6% | 0.6% | 0.4% |

| Unemployment (U.S.: 3.7%) | 2.3% | 2.4% | 3.3% |

| Economic outlook ranking | #9 | #12 | #14 |

| Fiscal health ranking | #2 | #5 | #17 |

| Overall tax climate ranking | #19 | #2 | #27 |

* Compounded annual growth rate (2017-2021)

Top three industries by GDP Growth (last five years):

| # | North Dakota | South Dakota | Wisconsin |

| #1 | Agriculture, forestry, fishing and hunting |

Mining, quarrying, and oil and gas extraction |

Information |

| #2 | Manufacturing | Agriculture, forestry, fishing and hunting | Military |

| #3 | Federal civilian | Administrative and support and waste management and remediation services |

Management of companies and enterprises |

Areas with the highest population percentage increase in 2021 vs. 2020:

| # | North Dakota | South Dakota | Wisconsin |

| #1 | Fargo, ND-MN Metro Area | Rapid City, SD Metro Area | Eau Claire, WI Metro Area |

| #2 | Bismarck, NA Metro Area | Sioux Falls, SD Metro Area | Janesville-Beloit, WI Metro Area |

| #3 | Jamestown, ND Micro Area | Spearfish, SD Micro Area | Green Bay, WI Metro Area |

Infrastructure Highlights

North Dakota received a ‘C’ grade on its last report card from the ASCE, with the worst categories being bridges and dams. According to the ARTBA, after one year of Bipartisan Infrastructure Law (BIL), the state has started 358 transportation projects. To date, $130 million has been announced for water infrastructure as well as significant funds for flood protection projects.

South Dakota has not started transportation projects at the same pace as its northern neighbor, but work is underway with large projects on I-90, I-29, and US 81. Over $167 million was recently announced by the Department of Agriculture and Natural Resources (DANR). The funds will be deployed as grants and loans for drinking water, wastewater, and solid waste projects in the state.

Wisconsin’s road and transit infrastructure were graded as poor in its 2020 ASCE scorecard. The state was able to start 719 projects to improve bridges and highways since the BIL passed. A significant portion of funds was tagged for improvements on I-43. Wisconsin is the state with the most lead pipes per capita, which is why service line replacements will be a priority for the $150 million announced thus far for water infrastructure.

AE Industry

| AE Industry Metric | North Dakota | South Dakota | Wisconsin |

| ENR 500 firm headquarters | 0 | 0 | 13 |

| M&A buyers since 2018 | 8 | 9 | 24 |

| M&A sellers since 2018 | 7 | 2 | 21 |

For customized market research, contact Rafael Barbosa at [email protected] or 972.266.4955. Connect with him on LinkedIn.

Weekly M&A Round Up

Congratulations to Atwell (Southfield, MI) (ENR #81): The fast-growing consulting, engineering, and construction services firm provided the financing to a private investment group that has acquired land surveying firm Cross Surveying (Bradenton, FL). The acquisition will immediately enhance the depth and breadth of Atwell’s surveying capabilities within the real estate and land development and power and energy teams in the Southeast region. We’re thankful that the Atwell team trusted us to initiate and advise them on this transaction.

Another congrats to Johnson, Mirmiran & Thompson (JMT) (Hunt Valley, MD) (ENR #60): The leading employee-owned firm acquired Civil Consulting Group (McKinney, TX), a consulting firm with expertise in roadway design, water resources, traffic control design, and utilities engineering. The combination of the firms strengthens JMT’s commitment within Texas by augmenting its local and regional transportation design capabilities. Morrissey Goodale initiated the transaction.

Industry M&A is up 10% over the past 12 months: Last week we saw consolidation in Florida continue to gather steam with two new deals announced. Additional domestic transactions occurred in Texas and Virginia as well as a single deal in Germany. You can check all the week’s M&A news here.

June 12-14, 2024 Las Vegas, NV

Western States M&A and Business Symposium

Join us for the 10th annual Western States Symposium, bringing together over 200 AE and environmental industry executives and investors in one of the world’s most vibrant and iconic cities.

Learn More

Subscribe to our Newsletters

Stay up-to-date in real-time.