Word on the street > AE Industry Intelligence: Issue 35

AE Industry Intelligence: Issue 35

21 predictions for 2021 by the Morrissey Goodale Team

As we get to the end of this craziest of years, here are some bold (some might say whacky) predictions from the Morrissey Goodale team for you to consider as you head into the holiday. And on that note, we wish you all a very happy Thanksgiving. Stay safe please.

- Uncle Sam to the rescue. A Democratic administration will promote stimulus for small businesses and state and local governments which will include an infrastructure bill with a heavy focus on renewables and technology infrastructure (smart roads, charging stations, grid infrastructure, etc.). As this is a positive for our industry, we will still see significant consolidation as larger firms use this as a lever to capture market share. (Brendon Cussio, Principal Consultant)

- The rise of the circular economy. The A/E industry will have the opportunity to lead the circular economy. The circular economy is a systemic approach to economic development designed to benefit industry, society, and the environment— vs. the linear model of “take – make – waste.” A massive portion of energy is associated with constructing infrastructure and buildings and operating them for long lives. Progressive A/E firms will have a wide-open opportunity to innovate and make great change in this area. (Mark Goodale, Principal)

- Demographic shifts to lower-density settings. High-density new urbanism will increasingly lose its luster and social distancing becomes a permanent way of life. The many-year trend of the 21st century of people, especially young professionals, moving to dense urban cores will reverse as technology and investments therein enable people to relocate to more spacious, lower-cost environments away from the urbanized coasts. (Nick Belitz, Principal)

- Reimagined commercial space. Forward-thinking architects and developers will develop and push ways to re-position millions of square feet of commercial office space now left unused, leaving architects who are waiting for a return to the good old pre-pandemic days in the dust. Instead of JC Penny being a mall anchor store, it will be a Tesla showroom (I STILL love my 2016 Model S!) or an Apple store. (Belitz – with Mick Morrissey, Managing Principal on the Tesla endorsement)

- Big boom in retrofitting and conversion. Now that firms have seen the savings of employees working from home and relatively stable productivity, urban offices will be reimagined and repurposed. There will be a real estate shift that will provide a boom to the A/E industry in the form of retrofit/conversion of these spaces. (Cussio)

- At least a third of the industry will still be working from home by the end of 2021. Even with vaccines in play, this train has left the station. Employees love the flexibility. Firms are benefitting from reduced office-related expenses. Clients really don’t care where you work from so long as you get the job done safely and keep their data safe. Technology makes it all work smoothly. There’s no going back. And many employees know someone in high-risk categories. (Goodale/Belitz)

- You’ll tear up your employee manual. A/E firms will revisit their work from home policies and offer more flexibility as they now have the technology, processes, and confidence in place that this can work. Employees will expect to have more flexibility in their work environment, splitting their time between working on laptops or on calls at Starbucks, or as they walk the dog (try it by the ocean— it’s productive AND therapeutic) or— perish the thought— in the office. (Lisa Elster, Consultant)

- Relocate? No big deal! Firms will be more flexible on location requirements. By allowing more people to work remotely, relocation will not be required as much which will make it easier to hire in many cases. The trend toward hiring people virtually will continue. In-person interviews will become a thing of the past. (John Kreiss, Principal Consultant)

- Cut up your Platinum AMEX business card. You won’t be travelling anywhere soon. Firms have realized they can get a bunch of stuff done in Virtual Reality and on Zoom and Teams without wasting a lot of time travelling and spending a ton of money on $15 salads at a Marriott. In-person conferences won’t be back until 2022 (that’s why all of our 2021 events will be in game-changing Virtual Reality) (Kreiss)

- Brain drain. The Great Recession, and now this. Many boomers will not want to stick around for the next act and will call it a career. The pressure will be on industry firms to transition institutional and industry knowledge before it’s lost for good. (Goodale)

- Strategy shifts. With people home more than ever, A/E firms will shift their strategic focus away from major metros and reallocate their growth investments towards the long-term prospects of second-tier markets, also known as 18-hour cities— such as Denver, Austin, Texas, and Nashville, amongst others. These cities provide affordable living, strong job growth potential, and growing economies, and will draw investors, designers, builders, and top industry talent in the coming years. (Jon Escobar, Consultant)

- There will be record industry consolidation. We anticipate approximately 380 deals in the U.S. next year driven by a continued inflow of baby boomer owners selling out to private equity capital and strategic buyers that are expanding into Texas, the Southeast, and the West. (M&A Advisory Team)

- Private equity will account for four in ten transactions. The great recapitalization of the industry will accelerate next year with about 40% of all deals being completed using capital from private equity or family offices. (Nate Wentworth, Consultant)

- Twenty of the industry’s top A/E firms will sell or recapitalize. Typically, about ten firms in the ENR Top 500 sell or recapitalize in any given year. Next year, that that number will double. At least one publicly traded firm will be taken private next year. (M&A Advisory Team)

- Acquisitions of tech and software firms will increase. Design and environmental firms will acquire more tech and software firms next year to try to escape a horrendous downward spiral of commoditization AND move from a business model selling time for money to a model that generates recurring earnings through technology. Less than 50% of these acquisitions will be successful. (Morrissey)

- Firm values in Texas and the Southeast will rise disproportionately. Their economies will rebound faster from the pandemic and population migration to those states will accelerate. Strategic buyers— particularly those in the Northeast and Mid-West— will be even more incentivized to buy their way into these markets. (Morrissey)

- The rise of new breed of tech-savvy CEOs. Every CEO who barely paid attention to what was actually in the IT/telecommunications budget approved before the pandemic will finally— and joyfully— understand what the firm was paying for. They will also wonder why they are spending so much on cybersecurity— see the next point. (Belitz)

- The rise of the robots. A select group of trailblazing organizations will acquire and leverage advanced technology, such as AI and AR, to create a new class of industry firm that focuses on delivering world-changing innovation vs. traditional A/E design services. (Goodale/Wentworth)

- The incredibly shrinking importance of the employee. Between relentless investments in technologies and massive infusions of capital, the balance of power between labor and capital will shift from employees to capital. And since our industry does not unionize (except for specific professionals in specific states), the influence that talent has on our industry will begin to decline. (Morrissey)

- You’ll be happy you bought cybersecurity insurance. More and more A/E firms and their clients are the victims of cyber-attacks. The data is cloudy on this as many management teams are ill equipped with respect to how to communicate on the topic. However, by our estimation the attacks this year on design and environmental firms and their clients numbered in the hundreds. The frequency of these attacks will only increase in 2021. (Morrissey)

- Industry adoption of Virtual Reality will move quickly in 2021. Particularly by firms that understand how it can be used to get closer to customers and shut out the competition. Our next Virtual Reality (VR) CEO Week is now over 60% full. 100 A/E & Environmental firm CEOs and presidents will come together in game-changing VR to discuss industry changes, trends, and best practices. If you’re a CEO you can attend for the week or choose the days that work for you. You have to experience VR to believe it. Early-bird registration is available through midnight November 30.

VR Trailblazer Packages

Lead your firm into the future and be the VR Trailblazer for your firm. Learn how you can use VR to get a competitive edge in 2021. Select either our CEO VR Trailblazer Package or our Leadership Team VR Trailblazer Package to explore a whole new world of possibilities for your firm.

Industry M&A

It was another busy week for industry consolidation – with deals down just 4% over last year.

If you have questions about this week’s “Word on the Street,” or need help planning for or navigating the New Reality, call Mick Morrissey @ 508.380.1868 or email him at [email protected].

Four Factors to Watch

Infrastructure Stimulus

If nothing else, Washington is at least referencing infrastructure again. While a vast gulf still exists between Republicans and Democrats on what an infrastructure program should contain and how it should be paid for, the hope is that the next White House can create a reasonable degree of alignment on the matter.

Last week, President-Elect Biden said that his infrastructure plan, which we highlighted in last week’s issue, would strengthen the nation’s economic competitiveness and create millions of jobs. John Barrasso (R., Wyo.), the No. 3 Republican in the Senate and the chairman of the Environment and Public Works Committee, was recently quoted in the Wall Street Journal as saying, “[An infrastructure bill] would seem to be something that we can work together on in a productive way.” Democrats, like Rep. Kathy Castor (D., Fla.), the chairwoman of the House Select Committee on the Climate Crisis, see an infrastructure bill as one of the few opportunities to address climate change in Congress. In addition, House Speaker Nancy Pelosi (D., Calif.) said last week that infrastructure will be a focus for Democrats next year.

Discussions on another coronavirus relief bill will likely happen first, but could grease the skids for the passage of a subsequent infrastructure bill.

COVID-19 Case Numbers

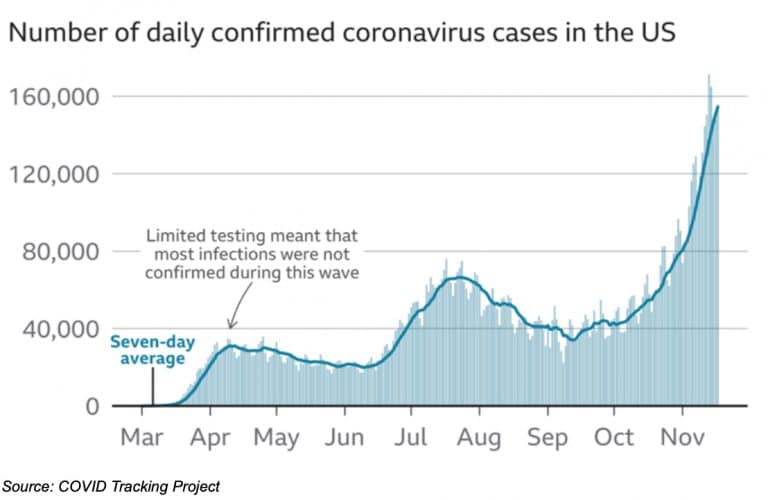

Just last week, we noted the jump of daily COVID cases in the U.S. from 75,000 in September to over 120,000. Heading into last weekend, daily cases in the U.S. eclipsed 180,000. Nearly 11 million people in the U.S. have had confirmed coronavirus infections.

Jobless Claims

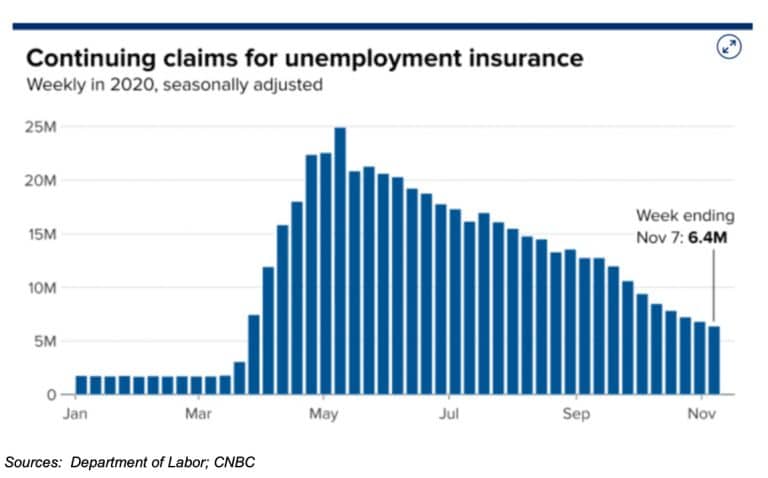

The four-week decline in first-time claims for unemployment insurance came to an end last week. Weekly job claims were up from 709,000 the previous week to 742,000 last week. On the bright side, continuing claims dropped substantially, declining 429,000 to 6.37 million— a new low during the pandemic.

Vaccine Developments

On Friday, Pfizer and BioNTech applied for an emergency use authorization for their coronavirus vaccine. It is the first vaccine to seek regulatory approval in the U.S. The companies reported that the vaccine will be available to high-risk populations by the end of the year. Phase 3 results of the vaccine began in late July and involved nearly 44,000 volunteers. The final analysis from the trial determined the coronavirus vaccine was 95% effective in preventing infections, including in older adults, and caused no serious safety concerns.

Subscribe to our Newsletters

Stay up-to-date in real-time.