Word on the street > Issue 101

Word on the Street: Issue 101

Weekly real-time market and industry intelligence from Morrissey Goodale firm leaders.

In This Issue

Rumors

Rumors. A classic 1977 album by Fleetwood Mac? Yes! A huge problem for leadership teams exploring a sale of their firm? For sure. Rumors can kill a firm sale. It’s the CEO’s job to manage them.

- The first rule of “Sellers Club” is: There is no firm sale. If you are exploring the sale of your firm, the best practice is to keep the exploration process confidential within a “circle of trust” (most often the board, founders, or C-suite depending on the situation) until practical to do so (typically after you sign an LOI and enter due diligence). Why keep things confidential? You don’t want your clients to know you are considering a sale as it may impact contract (re)negotiations or project bids. You don’t want to alarm your employees because they’ll worry unnecessarily about how a change in control will impact them individually and create a self-perpetuating internal gossip machine that needlessly distracts everyone from doing their jobs. And you definitely don’t want anything leaking to your competitors as they may use the information to interfere with your employees or clients. (Note: The last concern is almost always overblown, but it’s a legitimate worry for sellers.) Importantly, you also want to keep the exploration of a sale confidential because you may not end up actually selling the firm since the right buyer or investor may not materialize.

- Those who know don’t talk: However, with record industry M&A activity (there will be over 450 acquisitions this year), the rumor mill is in full swing. The gossip mongers among your peers, competitors, and employees are having a field day. It seems like everyone (warning: REO Speedwagon reference ahead) has a friend who heard it from a friend who heard it from a friend whose cousin is the CFO at ABC Associates who has it on very good authority that the firm is selling to “venture capital.” Or that ABC is “spinning off” its water business to “one of the big publicly traded firms and everyone is leaving!” (Every rumor tends to come with some drama or salacious innuendo.) It’s the classic old game of telephone (readers under 40 should Google this). The rumor distorts and magnifies as it gets passed around until it bears little resemblance to the original conversation, which itself may not have been grounded in fact. In this super-heated M&A environment anyone who is not in the 450 industry “circles of trust” is likely aware of these rumors and suspects that their own firm may be for sale. And that particular dynamic has led to an increasing number of awkward conversations for CEOs who are actually leading the exploration of a sale.

- Preparing for the “I hear we’re for sale” conversation: All the internal controls (including Non-Disclosure Agreements) put in place by leadership teams around the exploration of a sale of their firm cannot protect against the giant rumor mill that’s at play in the industry at large today. So, it’s not uncommon for CEOs who are leading the effort to explore a sale to get an unexpected visit in their office or to receive an unscheduled Teams call from a concerned employee (or even a group of employees) asking if the rumors that they have heard about the firm being sold are true. This puts the CEO in a really tough position. He must keep the sale process confidential to the agreed-upon “circle of trust.” However, he must also do his best to allay concerns and stop the rumor mill. It’s a crucial conversation, a hard one to navigate, and one for which most CEOs receive no coaching. If you are in this position, here are three pieces of advice I like to give CEOs and their respective “trust circles” to help them prepare for and navigate these discussions.

- First, don’t be defensive: Acknowledge the specific rumors, make it clear that you are aware of them circulating, and importantly put them into context. I like to coach CEOs to respond with something like this (said with a smile): “I’ve heard those rumors too! Indeed, the board recently discussed a rumor floating around that we are selling our mission-critical business (or insert other actual rumor here). Seems like every meeting I go to these days folks are talking about this or that firm that’s for sale. Listen, I try to stay away from rumors, and you should too.”

- Second, address the business case: Make it clear that a firm sale is not beyond the realm of possibility, however you and the firm’s leaders would only choose to sell the firm if it were in the best interests of all stakeholders. My suggested coaching here is along the lines of: “In this market, we get approached all the time about selling the firm. It’s no surprise because we are so successful and have a great reputation. If we were ever to actually sell the firm, it would only be if the board felt it presented a way for us to better serve our clients and provide more opportunities for all of our employees.” What you are doing here—correctly—is distinguishing between exploring the sale of the firm (which you are duty bound to keep confidential) and the act of “selling” the firm—which technically only occurs when the purchase and sale agreement is signed. It’s a fine line, but if you stick to it, you can achieve all the goals you need to in the discussion.

- Third, bring it home with confidence: Here, you are reaffirming your relationship with employees and also signaling to them what may happen (in reality what will happen if you are successful). It makes clear their importance as stakeholders and again reinforces you are on point. My suggested coaching is to say something like: “Believe me—if we were ever to be in a position where we made the decision to actually sell the firm, you and the rest of the employees would know the details first, and you would know long before any rumor-spreader from the outside would become aware.”

- The upshot: Selling your firm is one of the most important things you will do. It’s also a fraught process. The rumor mill that goes along with today’s super-heated M&A environment is creating additional challenges for sellers to successfully manage the exploration of a firm sale. CEOs should be prepared to address rumors of a firm sale in a way that maintains the confidentiality while at the same time addressing employee concerns.

The M&A beat goes on: Industry M&A is up 37% over the past 12 months. Last week saw eight new transactions announced including three in the Western U.S. states of CA, CO, and NV.

Consolidation nation? If you’re thinking there seems to be a lot of M&A activity this year, you’re right! This first quarter of 2022 has been the most active three months of industry M&A ever! Here are the 15 transactions announced since the beginning of the year that the Morrissey Goodale M&A team has helped make happen. If you’re interested in selling your firm, email Vice President Brendon Cussio at [email protected]. Or if you’re interested in our buy-side services, contact Vice President Jon Escobar at [email protected]. We’re here to help.

Questions? Insights? What rumors have you heard about firms for sale? Email Mick at [email protected] or text him at 508.380.1868.

Stop. Look. Prepare.

With demand for AE services outstripping supply by a significant margin, adequately staffing projects remains the primary challenge across the industry. But the combination of surging inflation (the Consumer Price Index was up 8.5% in March—the largest jump in 40 years), rising interest rates (expect a collective 1.5-point increase by the end of July), stubborn supply-chain woes, and the unpredictable implications of the war in Ukraine could ultimately lead to a recession.

Apparently, these trends have grabbed the attention of the nation’s largest bank, JPMorgan Chase which, according to the WSJ, set aside $900 million in new funds to prepare for economic turmoil. Those extra funds are being set aside to cushion the bank if the economy tips into recession, sending loan defaults higher.

I had a conversation with one of our senior financial analysts, David Rabinovitz, about how AE firms can take measures to prepare for a downturn before it comes. Here’s the ground we covered:

- While wage pressure keeps building, make sure you know what’s going on with your spending. AE firms are flush with cash and are aggressively using their stash to grow. It’s not uncommon, for example, for employees in the $140-150k annual salary range to be offered $200k or more by competing firms to make the switch. But that kind of spending will be difficult to sustain in the long term. Those who are paying through the nose for people may find themselves in a bind when the economy slows down. While business seems great for many of you now, make sure you know what’s going on with your firm’s spending so if things do retract, you will be able to handle the dip without too much drama. Start by categorizing your company’s employees according to level and reviewing the last two years of salaries. Then add up the total wages in each category (keep in mind that 50-70% of revenue goes toward employee costs) and see if the distribution between the top, middle, and lower tiers is holding steady. If your firm is getting top-heavy, you risk having a whole lot of high-wage people on your payroll without a whole lot of high-wage work to do should things come back down to earth.

- The lure of a higher salary is seldom the reason why people leave AE firms, so address the root cause. Most employees don’t quit because of salary. In fact, that reason is pretty far down the list. The hard truth is they leave because they don’t see a future with your firm. They are easily poached, and the bump in salary only serves to make their decision to leave that much easier. So rather than throw money at the problem, recognize and compensate managers for being people leaders and developers (as opposed to utilization kings and profit heroes), and encourage them to engage, coach, and delegate so you retain more of your firm’s rising talent without blowing the salary curve.

- Use variable compensation and transparency to keep your salary structure in check. Instead of giving steep pay raises, frame and internally market aggressive bonus programs. This way when the markets turn, you’ll have some flexibility. Tie bonuses to the things employees can control and influence (e.g., sales, flow efficiency, quality, direct labor) and share the information they need to optimize their performance in those specific areas.

- Put a lid on office space. If your firm’s productivity went up while working remotely during the pandemic (or at least maintained pre-pandemic productivity levels), endeavor to grow without adding more office space. Empty office space is one of the more bitter pills swallowed in a downturn.

- Don’t overlook collections. Working capital is a big deal for AE firms, especially in a time of skyrocketing costs. Formalizing the billings and collections process helps a firm pay its bills, compensate staff, and reinvest without incurring unnecessary debt. In terms of the billings process, align invoicing with client A/P cycles and invoice continuously (at project milestones). For collections, confirm that your clients received your invoice after 10 days, send a copy of the invoice at 30 days, and call at 45 days to inquire about payment status. Being machine-like in these areas can significantly reduce your average collection period and build up cash reserves for when you need them most.

With all that’s going on today, it can be a challenge to find the time and energy to plan for a rainy day. But with storm clouds forming on the horizon, do what you can now to maintain a rational cost structure and healthy cashflow so you’re ready for whatever the economy dishes out.

If you’d like help in preparing your firm for the future, call Mark Goodale at 508.254.3914 or send an email to [email protected].

50 in 50: Oregon

50 states in 50 weeks: U.S. states economic and infrastructure highlights.

Key Economic Indicators

GDP: $224.4 billion

GDP 5-year compounded annual growth rate (CAGR) (2017-2021): 2.2% (U.S: 1.6%)

GDP per capita: $54,139 (U.S.: $58,154)

Population: 4.2 million

Population 5-year CAGR (2017-2021): 0.6% (U.S.: 0.5%)

Unemployment: 3.8% (U.S.: 3.9%)

Economic health ranking: #17 out of 50

Fiscal health ranking: #10 out 50

Overall tax climate ranking: #15 out of 50

Key Sectors and Metro Areas

Top five industry sectors by 2021 GDP:

Top three industry sectors by GDP 5-year CAGR (2017-2021):

Top three metro areas by GDP:

- Portland-Vancouver-Hillsboro

- Salem

- Eugene-Springfield

Top three areas by population 5-year CAGR (2016-2020):

- Bend

- Albany-Lebanon

- Salem

Infrastructure Highlights

Infrastructure: ASCE Infrastructure Grade (2019): C-

In Oregon, according to the ASCE, the infrastructure for wastewater, levees, and dams are considered poor or at risk. While the state is relatively advanced in terms of renewable energy expansion, its current electric grid and petroleum transmission systems are aging and constrained. Additionally, as Oregonians plan for infrastructure investments, they have been encouraged to prepare for a potential major seismic event as another Cascadia subduction earthquake could cause major damages. Oregon will receive at least $5.4 billion from the Infrastructure Investment and Jobs Act (IIJA) over the next five years, divided into the following categories of projects (additional funds may be deployed as federal grants get awarded to states):

Construction spending (Value of Construction Put in Place – CPiP):

- Private Nonresidential 2020 CPiP: $6.1 billion; 14.9% 5-year CAGR (2016-2020), above overall U.S. CAGR of 2.0%

- State & Local 2020 CPiP: $4.8 billion; 14.5% 5-year CAGR (2016-2020), above overall U.S. CAGR of 4.8%

AE Industry

ENR 500 firm headquarters (2021): 4

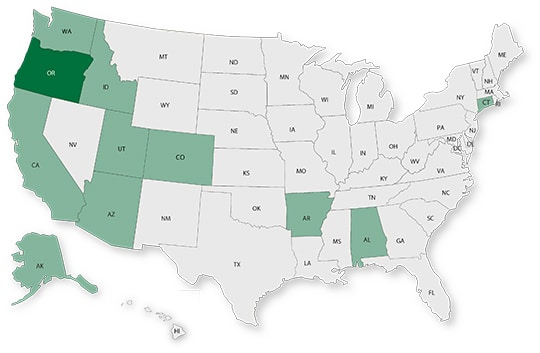

M&A activity since 2018:

- 16 deals with buyers from Oregon

- 27 deals with sellers from Oregon

For customized market research, contact Rafael Barbosa at [email protected] or 972.266.4955. Connect with him on LinkedIn.

Subscribe to our Newsletters

Stay up-to-date in real-time.