Word on the street > Issue 113

Word on the Street: Issue 113

Weekly real-time market and industry intelligence from Morrissey Goodale firm leaders.

Inside the Mind of the CEO (Dog Days of Summer Edition)

It had been a good six months for the new CEO of AE2Env+. Her firm—an ENR Top 100 full-service architecture, engineering, environmental, construction services, and surveying/mapping leader—had been nominated for numerous ACEC and AIA project awards, had been named a “Best Place to Work” in one industry and one business publication, and had seen two quarters of strong financial performance. The firm had just announced its acquisition of Green Pied Piper, a virtual reality/digital twinning firm (at least that’s what she thought it was) in Utah, its 11th acquisition in five years.

The year was going very well for the firm. And for her. The board had just awarded her a $1 million cash bonus in addition to a boatload of stock options. But something didn’t feel right. She was restless, uneasy. She needed a new challenge. Last year, the firm had realized the four most important goals of its Vision 2022 five-year strategic plan. Those goals were to (a) have offices in all 50 states, (b) be full-service, (c) have a 50/50 split between public- and private-sector work, and (d) “be a billion-dollar firm that clients and employees are passionate about.” While she was proud of all that she and her team had achieved, she was not one to rest on her laurels. It was time to set a new five-year strategic plan. But first, she was to host her mid-year all-employee meeting.

The day had started well. She had completed Wordle (“TRYST”) in two guesses (a personal best, with a number of her playing partners doubting the veracity of the result). And she was still singing along in her head to “Philadelphia Freedom” from last night’s Elton John concert. (She still couldn’t believe that the man was playing 100 two-hour shows at 75!)

As distinct from her State of the Firm end-of-the-year presentation, this mid-year employee meeting format was essentially a more relaxed “coffee-talk” Q&A session where any employee could ask her a question. The original plan was to livestream the session from the conference room in the firm’s stunning, self-developed and self-designed headquarters in Miami. However, most of her executive team—including her—had caught COVID at a retirement party for one of the firm’s founders the week before, so she was instead fielding questions from her home office as she quarantined. The kids were away at camp. She had assigned her husband to take the dogs for a long walk (“In this heat?!” he pleaded), and she had cancelled the landscapers and cleaners.

She sat in front of her huge monitor. Coffee mug in hand. Camera turned on. The screen filled with the faces of just some of the 1,250 employees of AE2Env+ in their offices, homes, or coffee shops or in the field. In her AirPods, she heard her assistant counting down, “Getting ready for the first question in 3, 2, 1…” She smiled, looked straight into the camera, and listened to the first question.

- Are you concerned about a recession and how it might hurt the firm? (From a 22-year-old environmental scientist in the Baton Rouge, LA, office.) Well, we’re monitoring the economy closely for any signs of a slowdown, and as we all know, the U.S. economy has contracted for two quarters in a row. But right now, we don’t see any signs of weakness for our business. If there is a recession, our diversified business, strong balance sheet, and record backlog put us in a great position to weather any downturn. (She was indeed worried about a recession. You don’t live through the Great Recession when you laid off 70% of your staff in your Florida and Arizona operations and not worry about one. But she was even more concerned that she couldn’t figure out just what was happening with the economy and whether a recession was inevitable in the next 12 months or not. None of her peer-group CEOs seemed to know either. Nor did the clients whom she spoke with. While a number of clients cited rising interest rates making marginal developments untenable, others were reporting ramping up their investments. The firm’s federal clients were spending money like drunken sailors while residential developers were retooling projects from build-to-sell to build-to-rent. The economists and research groups that she trusted were all over the map. The current economic indicators were out of sync with anything she’d seen before. One thing she did know though was this: If there was a recession, the LAST thing she was going to do was lay off employees. There just was not enough good talent in the industry to follow the knee-jerk reactions of the past. Indeed, one of the reasons why she had slowly and steadily increased cash reserves—at the expense of bonuses—over the past two years was to make sure that if there was a slowdown AE2Env+ could weather it without shedding employees.)

- What’s going on with our hybrid work model? People are supposed to be in the office three days a week, but nobody is! (From a 52-year-old senior project manager—and well-known snitch—in the Jersey City, NJ, office.) Our policy is clear. Regardless of where you work or what you do, you must be in the office three days a week. It’s your responsibility to schedule these three days with your manager in advance so that team and client activities and office space can be assigned accordingly. It’s important that we all spend more time together in person to strengthen and foster collaboration and innovation. (She hated this hybrid workplace model that her firm had become. She despised every variation of it that her team had tried to implement through and after the pandemic. She was concerned about the regional, generational, and social fissures it was exposing in the firm. And she was deeply disturbed by the lies that it was creating—everyone knew that nobody was adhering to the three-day-in-the-office protocol—but nobody wanted to acknowledge it. The hybrid was distorting the firm’s values. She knew addressing this would be a central part of the firm’s next strategic plan.)

- What does the sale of our competitor Heathline, Peregrine and Bloughbock mean for us? (From a 42-year-old “rising leader” in the Billings, MT, office) We’ll have to wait and see. This could be a huge opportunity for us if some of the HPB employees don’t like the new situation and choose to look elsewhere. We would certainly welcome them here. (She didn’t really expect there to be much, if any, of an opportunity. The firm’s long-time frenemy HPB had not been “sold.” Instead, it had been recapitalized by The Dalek Group, a private equity-backed engineering firm created in a laboratory two years ago. It had acquired five ENR Top 500 firms in the past 18 months and with this recent acquisition of HPB was now larger than AE2Env+. She viewed what was happening with HPB as both an immediate and longer-term existential threat. Immediate in that The Dalek Group’s recap of HPB would invigorate the firm—which had been slowly stagnating for years. Longer-term in that a growing number of AE2Env+’s peers were choosing this private equity capitalization model. She worried about its impact on the industry and profession. She had seen how private equity had changed other industries.)

- What’s the plan for our newest acquisition, Green Pied Piper? (IT Director, corporate office, Miami, FL) We see this acquisition as being critical to accelerate our ability to deliver digital and VR solutions to clients nationally. We will fully integrate Green Pied Piper into AE2Env+ so that its domain expertise will be immediately transportable across the enterprise for seamless deployment. (She was unhappy with herself that she had felt the need to use so much jargon in response to the question. She lived by the rule—or razor—that if something could not be explained to a five-year-old, then it was probably baloney. She had anticipated this question from her IT Director. They had been involved in a struggle for the past three years on the best approach to digitize the firm’s business. The IT Director was an advocate for internal development. Initially, the CEO agreed and over the years had committed significant investments in the pursuit of a digital business model. None of which panned out. So, the decision was made to undertake an acquisition. She was convinced that “fully integrating” the acquisition was the absolute wrong way to go about things. But one of the firm’s external board members—formerly of Silicon Valley—convinced her otherwise.)

Question time with the CEO ended about 10 minutes early, which the CEO appreciated. It gave her time to (a) do a rapid self-test, which when it showed up negative, allowed her to (b) drive to the local 7-11 to buy $20 worth of Mega Millions tickets. This was going to be her lucky day.

Thoughts, insights? What’s on the minds of your employees this summer? To connect with Mick Morrissey, email him at [email protected] or text/call at 508.380.1868.

CEO Spotlight: 18 Months In

I caught up with Jon Kramer, president of OHM Advisors, a Michigan-based ENR Top 500 full-service AEP firm that serves a wide variety of public- and private-sector clients.

Jon transitioned into the role of president in January of last year, but it seems like he’s been in the saddle for 10. He previously served as the firm’s COO, overseeing the firm’s rapid geographic expansion during that time.

I asked Jon about what it’s like being 18 months into his role as president.

![]()

Jon, thank you for taking time out from your vacation to contribute to Word on the Street!

![]()

You’re welcome!

![]()

What was it like trying to transition leadership in the middle of the pandemic?

![]()

We delayed my taking on the role of president for over six months because we were in the throes of the pandemic—Covid hit near the end of my tenure as OHM’s COO. It really was a great exercise in running the firm’s operations, that’s for sure. The delay allowed us to better plan for the transition. During that time, we had to tackle a variety of things we never thought we’d have to deal with, but dealing with those things made us stronger and more adaptable—and that’s what we need moving forward for the next decade.

![]()

How have things shaken out since the pandemic?

![]()

A lot of the things we were worried about at the beginning of Covid weren’t things that ended up being issues. On the other hand, things that we didn’t think would be issues are the ones we will be arm-wrestling going forward. Remote work and Zoom adaptability, for example, are yesterday’s tricks. Topics like DEI and Roe vs. Wade are now the complex priorities of the workforce that must be effectively addressed.

![]()

Does it seem like 18 months?

![]()

It’s almost like time itself is its own dimension. I feel like I just took over some of the things I’ve actually been working on for a while now while it feels I’ve had other responsibilities for 10 years. But the variety of issues we have dealt with and our growth and expansion have actually made it fun.

![]()

Given all that’s gone on in the last couple of years, did you expect the kind of growth OHM has achieved?

![]()

Expansion is at the forefront of our goals, but I did not see the massive growth coming when I took over the reins. If anything, I thought we would be flat or even shrink. Yet we are now at 650 employees and it seems like growth will continue on, even with the headwinds of rising interest rates and fuel costs. Sure, they will likely affect the macroeconomy in some way, but we think our lines of business are pretty solid. In fact, we are opening a Frankfurt, KY, office, which is OHM’s 18th.

![]()

Have you had any epiphanies about yourself in these first 18 months as president?

![]()

I’ve always been good at delegating, but I like to learn those things first before I delegate. The realization I’ve had is that I might not have the luxury of solving all the first-time problems before I delegate them. Instead, I am learning that I have to rely on others to solve them. I’d like to say I can do it all first, but with all of the growth we have achieved and more in front of us, I really can’t. It’s more important than I thought it would be to shed some things. I also realize that I need to continue to be myself. Just being me is what got me here. It wasn’t trying to be what I think the role needs to be in some sort of traditional way. As a COO, I always had my own style. I thought I couldn’t be that person when I became president, but I am hearing from others that I can be myself.

![]()

Has your role changed the relationships you have with people in the firm?

![]()

The relationships I have are wholly solidified. The respect for the role is there and I expected it to be there so there are no surprises in that regard. People know to respect my time and yet they want to get their fair share of touches in, and to me, that was to be expected.

![]()

How do you like the role so far?

![]()

I am enjoying my job and I think that goes a long way. I’ve been supported by our partners and staff, and they kind of have given me a good start. We were dealing with such major issues when I transitioned in that I wasn’t able to communicate the upbeat things we’ve been doing and where we are going. Mask on, mask off; stay home, come in, etc. When those kinds of things were front and center, people weren’t looking for news from me. But now they are pushing me for it in year two. I think there have really been just some very enjoyable parts of the role I didn’t think I would enjoy so much, like being out there as the voice of the firm and being in different circles, both internally and externally.

For information on Morrissey Goodale’s leadership transition advisory services, call Mark Goodale at 508.254.3914 or send an email to [email protected].

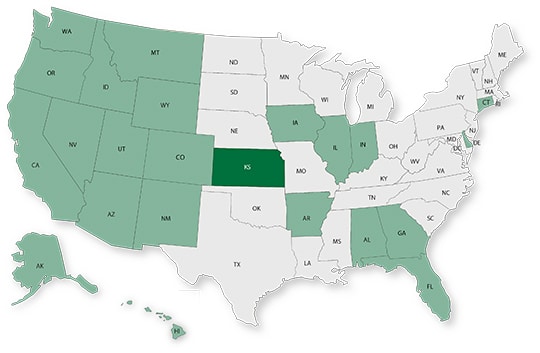

50 in 50: Kansas

50 states in 50 weeks: U.S. states economic and infrastructure highlights.

Key Economic Indicators

GDP: $162.7 billion

GDP 5-year compounded annual growth rate (CAGR) (2017-2021): 1.2% (U.S: 1.6%)

GDP per capita: $55,632 (U.S.: $58,154)

Population: 2.9 million

Population 5-year CAGR (2017-2021): 0.2% (U.S.: 0.5%)

Unemployment: 2.4% (U.S.: 3.9%)

Economic outlook ranking: #28 out of 50

Fiscal health ranking: #27 out of 50

Overall tax climate ranking: #24 out of 50

Key Sectors and Metro Areas

Top five industry sectors by 2021 GDP:

Top three industry sectors by GDP 5-year CAGR (2017-2021):

Top three metro areas by GDP:

- Wichita

- Topeka

- Manhattan

*Kansas City, MO-KS would be the top-ranked metro area if included in this data.

Top three metro areas by population 5-year CAGR (2016-2020):

- Lawrence

- Wichita

- Topeka

*Kansas City, MO-KS would be the top-ranked metro area if included in this data.

Infrastructure Highlights

Infrastructure: ASCE Infrastructure Grade (2018): C

Kansas will receive almost $4 billion in funding from the Bipartisan Infrastructure Law (BIL) over the next five years. The state’s government has created the Kansas Infrastructure Hub, which will prioritize and maximize investment by promoting best practices in obtaining and deploying infrastructure funds. It is composed of representatives from the Departments of Transportation, Administration, Agriculture, Commerce, Health, and Environment, as well as the Corporation Commission and the Kansas Water Office.

According to the last ASCE report card for Kansas, aviation, roads, dams, and stormwater infrastructure are the categories that need the most improvement throughout the state. Kansas’ BIL funds will address the following categories of projects (additional funds may be deployed as federal grants get awarded to states):

Construction spending (Value of Construction Put in Place – CPiP):

- Private Nonresidential 2020 CPiP: $3.3 billion; 1.3% 5-year CAGR (2016-2020), below overall U.S. CAGR of 2.0%

- State & Local 2020 CPiP: $3.5 billion; -1.0% 5-year CAGR (2016-2020), below overall U.S. CAGR of 4.8%

ENR 500 firm headquarters (2022): 5

M&A activity since 2018:

- 20 deals with buyers from Kansas

- 6 deals with sellers from Kansas

For customized market research, contact Rafael Barbosa at [email protected] or 972.266.4955. Connect with him on LinkedIn.

Weekly M&A Round Up

Congratulations to The HFW Companies (St. Louis, MO): The fast-growing professional services firm with a national focus on the AE industry announced a strategic partnership with 4Ward Land Surveying (Austin, TX), a firm with experience in commercial, residential, and public works projects. The new partnership allows 4Ward to accelerate its strategic growth plan and expand its geographic reach beyond Texas. We feel privileged that the HFW team trusted us to advise them on this transaction.

Industry M&A is up 24% over the past 12 months: Last week saw new transactions announced in TX, MT, AL, MO, MA, OR, CA, and OH. You can check all the week’s M&A news here.

If you’d like to know more about our M&A services, and how we can help you either confidentially sell your firm or grow through acquisition then please contact Nick Belitz, Principal, at [email protected] or 303.656.6151.

Subscribe to our Newsletters

Stay up-to-date in real-time.