Word on the street > Issue 107

Word on the Street: Issue 107

Weekly real-time market and industry intelligence from Morrissey Goodale firm leaders.

From Steinbeck To Shakespeare: Seven Takeaways From Our Western States Symposium

When over 150 AE industry leaders and investors from the U.S., Canada, Mexico, the EU, and New Zealand come together to learn, share best practices, and network in one of the world’s most beautiful cities, you know it’s going to be a great time. And that’s exactly what it was last week when we hosted our Western States M&A, Strategy and Innovation Symposium at the sleek Hotel Nikko in (a surprisingly sunny, not foggy) San Francisco last week.

From Wednesday’s opening networking lunch through the thought-provoking Strategy (more on this below from Mark G.) and Innovation panels that afternoon to the high-energy cocktail reception on the 25th floor (with sweeping views of the glittering Bay), and from Thursday’s presentations on M&A trends and deal pricing (spoiler alert: they are higher than ever) through the best practices panel discussions involving buyers, sellers, and M&A experts to the closing reception that evening, the enthusiasm was strong, the learning was abundant, and the networking was fast and furious. In truth, the “next level” networking—where mergers, transactions, and strategic partnerships (whatever they may be) were being hatched or consummated—took place on Wednesday and Thursday evenings over dinners at window tables and in private booths in restaurants scattered across the city Steinbeck described as “a golden handcuff with the key thrown away.”

Much had changed for both the industry (the 3 “R”s—record results delivered remotely) and the Bay Area (average daily office occupancy is still just 31% of what it was pre-pandemic) since we last hosted our Western States Symposium during a glorious pre-pandemic June week in 2019. So, it wasn’t a surprise that everyone was eager to engage around what was going on in their firms and those of their peers and the collective opportunities and challenges that they saw in their future.

Here are seven takeaways (actually eight with a bonus) from last week’s Symposium:

- “I wasted time, and now doth time waste me”: Wednesday’s Innovation from Concept to Market panel discussion placed the reimagination of the design industry’s business model front and center. Panelists Jennifer Prescott (Kleinfelder), Eoin Howlett (Trinnex), Frank Joanlanne (Borton-Lawson), and Javier Baldor (BST Global) shared advice on how to foster innovation and not only bring new tech-enabled services and products to market but also scale them. One clear message was that sitting on the sidelines and waiting is not an option. Also, everyone is keeping one eye on what disruptive plans industry vendors may have for our data—and for us. This panel tied into a trend discussed the following morning on how a growing number of AE and environmental firms are acquiring SaaS, ML, AI, and AR/VR firms.

- “Boldness be my friend”: How optimistic are buyers and investors? Very. How do we measure that confidence? With our interstate M&A activity index, that’s how. Year-to-date 7 in 10 transactions involve a buyer acquiring a firm in a different state from their headquarters. Buyers are using acquisitions to aggressively grow and diversify. Message for sellers: There’s a high probability that your buyer does not move in the same local professional industry circles that you do. With three-quarters of the ENR 500 headquartered east of the Rockies, it’s no surprise that 6 in 10 acquisitions of design and environmental firms in the Western States involve an out-of-region acquirer looking to enter or expand in the West.

- “What’s done cannot be undone”: As a mature consolidating industry, we’re in uncharted territory and moving inexorably toward a steady end-state of full consolidation (a theoretical maximum similar to full employment). There’s no going back. 2021 was the first time we crossed the 400-deal threshold in a calendar year, representing a step-function increase in consolidation activity. The first half of 2022 is already the most active six months ever on record for transactions, and the deal volume suggests that this year the industry is on track to see a record 500 transactions—a whopping 17% increase. Demand for quality, high-performing design and environmental firms by strategic buyers and financial sponsors is literally off the charts. But is it sustainable in light of the seeming gathering economic storm clouds?

- “Expectation is the root of all heartache”: Deal multiples have risen steadily into a rarefied atmosphere. Upper-quartile deal multiples for larger sellers (median gross revenues of $100 million) have jumped a stunning 20% since we last hosted our Western States Symposium three years ago. For smaller transactions (median seller size of $15 million), the increase has been a respectable 13% over the same period. But as teammate and valuation guru Nick Belitz made clear, not every firm is an upper-quartile one. The two big questions now are (a) how much higher will they go and (b) when does the punch bowl get taken away and the party stops.

- “No legacy is so rich as honesty”: Panelists Michelle Willis (David Evans and Associates), Neil Churman (Woolpert), and Grant Reindl (Salas O’Brien) shared lessons learned from years of experience in acquiring and successfully integrating firms in the Buyers Best Practices panel. From tips on deal origination to how to retain and integrate newly onboarded employees, the attendees loaded their iPads with nuggets to help them be successful acquirers. The panelists also had a key piece of advice for sellers: to be honest with themselves about their wants and needs from a transaction—and to be honest and transparent with their potential acquirers sitting across the table (real or virtual). Hidden agendas tend not to survive due diligence, and a lack of forthrightness is a lousy way to start a new relationship.

- “We know what we are, but know not what we may be”: For those Symposium-goers who are considering selling their firm, the Sellers Best Practices panel is always a highlight. The panel goes a long way in just 75 minutes to helping potential sellers envision their future post-transaction and how they can achieve it. And this panel sure didn’t disappoint. Panelists Jill Wells Heath (NV5) (formerly CEO of CALYX) and Karl Knapp (Westwood) (formerly CEO of CVL Consultants) and industry M&A expert Gen Oraa (CohnReznick) stressed the importance of preparation for a successful sale. From getting your team aligned to making sure your financials are clean and ready for scrutiny, this was 75 minutes drinking from a firehose of direct, unvarnished advice. The real-life narratives and industry expertise melded with some very interesting perspectives on taxes and taxation for an entertaining and informative panel discussion.

- “Neither a borrower nor a lender be”: The 500 Club of George Christodoulo (Lawson & Weitzen), Dave Sullivan (DGC, a division of PKF O’Connor Davies), and Brendon Cussio (Morrissey Goodale) made two separate appearances on Thursday afternoon. In the first they wore their “buyer advisory” hats, and in the second their remarks focused on advice for sellers in 2022. Two topics common to both panels were (a) the importance of understanding the phrase “cash free, debt free” and (b) buyers and sellers negotiating an agreed-upon working capital amount for a successful, acrimony-free transaction.

- “To be or not to be”: With upper-quartile M&A multiples in double digits, CEOs and leadership teams of employee-owned firms of all sizes and types are engaged in existential discussions about the importance of independence and being in control of their own destinies. At the heart of the matter is the choice to take advantage of the unprecedented current M&A environment to realize shareholder value and immediate liquidity and recapitalize—or not. These teams are well aware that 35 of their ENR 500 firm peers have chosen the recapitalization option over the past 18 months.

“Love sought is good, but given unsought is better”: We owe a debt of gratitude to our awesome sponsors and partners whose support and engagement allow us to create the best experience possible for our Symposium guests. Thanks to our partners Benesch, Borton-Lawson, David Evans and Associates, DGC a division of PKF O’Connor Davies, ESA, Lawson & Weitzen, Salas O’Brien, Trinnex, Westwood, Wilson & Company, and Woolpert. And many thanks also to our sponsors BST Global, Lockton, CTA, Ames & Gough, FullSail Partners, and CohnReznick.

Couldn’t join us in San Francisco? Not to worry. Within the next two weeks we’ll be opening registration for our Texas and Southern States M&A, Strategy and Innovation Symposium at the stunning Post Oak Hotel at Uptown Houston. This will be the #1 networking and learning event for AE and environmental industry execs, buyers, sellers, and investors in—and interested in—Texas and the Southern States.

“Summer’s lease hath all too short a date”: Questions, thoughts, ideas? To connect with Mick Morrissey, email him at [email protected] or text/call at 508.380.1868.

Golden Nuggets From San Francisco

We gathered some valuable nuggets to share with you from our Western States Symposium last week in San Francisco. Karen Erger (Sr. VP of Lockton) and I led a panel discussion featuring the CEOs of three ENR Top 200 firms, including:

• Kevin Fitzpatrick, President & CEO of Benesch, a 900-person planning, engineering and professional services firm headquartered in Chicago with 40 offices across the U.S.

• Leslie Moulton-Post, President and CEO of ESA, a San Francisco-based environmental consulting firm with 21 offices across California, the Pacific Northwest, and the Southeastern United States.

• Jim Brady, President and CEO of Wilson & Company, a 600-plus person multi-disciplinary engineering, architecture, planning, environmental, survey & mapping, and construction management firm based in Albuquerque with 16 offices in 9 states.

We talked about the big-picture external factors impacting AE firms today as well as the strategies they employ for building successful firms during these turbulent times. Here are some of the highlights:

MGOOD: What’s your take on the economy? There are no shortage of factors—rising inflation and interest rates, impact of the IIJA, supply chain woes—the list goes on and on.

KF: We’re 80-90% transportation so the IIJA is a huge benefit. This is a once in a career-type of a program which will be a positive external factor for us. Inflation is a factor with wage increases and the ability to increase fees are a concern, but we’re seeing some wiggle room there. We’re not heavily leveraged so interest rates don’t really affect us.

LMP: We’re in transportation, water, and energy, and will see a benefit from IIJA. We may see some opportunity in community development, too. There are some staffing constraints that the federal government is experiencing in actually deploying the IIJA funds, which is concerning, but it’s still an opportunity to advance the planning studies and front-end work for projects in our space. Now, we are in coastal markets and cities, so we’re seeing the COL upward pressure. Having inflation layered on top of it is challenging, especially with competition for talent being so fierce. We do need to be mindful of rising billing rates to adjust for rising labor costs.

JB: The world is in chaos. We’ve lived through economic cycles before, but this one is odd because we have our feet on the gas and brake at the same time. There’s division in our country, global unrest, wars, etc. all on top of historic economic issues that are ongoing. We’re trying to lead through the chaos and continue to look at the long view and be intentional in our decision making, which can be difficult. Pre-pandemic, we got some leadership training on personal mastery and resilience which helped us remain stable throughout the pandemic and helped to put our focus on the future rather than what’s right in front of us.

MGOOD: What about socio-cultural factors, like justice, equity, diversity, and inclusion?

LMP: This is a huge topic for us as a firm. We had a diversity committee and accelerated it. We took an honest look at ourselves and said we’re not as inclusive as we need to be. We need to foster a culture that is welcoming and a create a place people can see themselves staying at for a long time. It has been a real focus for us at all levels internally and externally. We’re still learning, but it can’t be business as usual.

JB: We have a similar feeling. Some of this is easier said than done, and there is not a clear goal line, but we are working hard to become an inclusive environment for everyone. This is a long haul and an area that we continue to focus on. ESG is actually in the AE industry’s wheelhouse. That’s exciting for me. We should align the ESG culture with our firm. Part of our business ethics and training as AE professionals is to be stewards of our environment. This is an opportunity for our entire industry.

KF: When we think we’re doing all we can, we sit back and look at what we’ve achieved and what we have in front of us, and we see we’re not as close to our goals as we want to be. It’s difficult and will take time, but we continue to pursue it.

MGOOD: The competition for talent is at the top of the challenge list. How do your firms find, keep, and develop smart, hard-working people? What works?

LMP: It’s all about connecting to people’s purpose. We spend so much time at work. We need to focus on purpose and make sure that we’re moving our people and our firms forward. We have a broader sense of purpose and mission with the DE&I and ESG focuses as of late. We’re spending a lot more attention and time on our team members.

JB: We feel like some of the success we’ve had with retention is when we can connect culturally. The staff get more engaged when the values align. For us, we made a lot of investments in our culture and “squishy stuff” but we’re all at this inflection point in the industry. We were working on certain initiatives pre-COVID. The return to work program and flexible work program is great on paper but we’re flying the plane while we’re trying to build it. We’re losing some of the personal connections that we had pre-COVID. There are fewer folks going to lunch together and having close relationships. I think 2022 will see higher turnover as compared to the past years. We have work to do to get folks connected to the work and culture again. I want people to feel that we’re efficient and that we’re a connected firm. This leads to retention. We’ve been able to hire but we have work to do with retention.

KF: Three years ago, we had one part-time recruiter. Since then, we’ve hired a director of talent acquisition who now has six full-time staff under her. We need to continue to go out and find the staff, and do what we can to retain them. There aren’t many people sitting on the sidelines waiting for work. Everyone is getting calls from recruiters. When our employees get those calls, I want them to say “No, I’m good where I am.”

MGOOD: Lots of CEOs find themselves stuck when they realize they haven’t developed next-generation leaders with the necessary skillsets to take care of the concerns of their companies. How do you build a pipeline of capable leaders to ensure continuity in your firms?

KF: I am most passionate about this. Learning and development is key for upcoming leaders. We invest in them and make it front and center. We hired a professor from Duke University to bring 24 people through a mini-MBA course on the engineering business. It’s a 10-hour commitment per month for training, executive coaching, and other things.

LMP: We’ve been doing leadership training with external conferences and courses, but the long-term goal is to have an in-house course like Kevin was talking about

JB: Sign me up for Kevin’s course! We’re at an inflection point, ourselves. We’ve outsourced our executive coaching but are working on something that is similar to what Kevin mentioned. We are trying to establish a framework for people development at the entry-level, mid-level, and senior-levels. Outsourcing this training can be costly, especially as we scale.

MGOOD: So when it comes to growth, how do you decide which markets and regions to pursue?

KF: We focused on chasing rooftops. Where is the population going? We’re going to the Southeast. Charlotte, Raleigh, Tampa, Jacksonville…that’s what we’re doing. Where people go, infrastructure will be needed. Growing organically into those new markets is a difficult thing to do. We look for acquisitions in strategic geographies. If that is successful, we have resources to put to work there and take on larger projects that the acquisition couldn’t do on its own. We acquire, then pile on strategic growth.

LMP: We do both organic and M&A, with our most recent acquisition being Sitka Technology Group. We’re not looking to grow geographically right now. We’re using a blend of strategies to add capability and expertise.

JB: We’re in the public infrastructure business. Where there is population growth, they need us. For the next five years, we’re in good enough growth markets that we can do a heck of a lot of growing where we are. We’ve been able to do that in the past through organic growth (12-13% organic growth per year), but we would like to incorporate M&A because we can get subject matter experts and build production capacity more rapidl

For help creating a strategic plan for your firm, call Mark Goodale at 508.254.3914 or send an email to [email protected]. In the meantime, if you missed our Western States event, join us in October at Morrissey Goodale’s Texas and Southern States M&A, Strategy, and Innovation Symposium!

50 in 50: Delaware

50 states in 50 weeks: U.S. states economic and infrastructure highlights.

Key Economic Indicators

GDP: $64.3 billion

GDP 5-year compounded annual growth rate (CAGR) (2017-2021): 1.4% (U.S: 1.6%)

GDP per capita: $65,651 (U.S.: $58,154)

Population: 1.0 million

Population 5-year CAGR (2017-2021): 1.2% (U.S.: 0.5%)

Unemployment: 4.5% (U.S.: 3.9%)

Economic outlook ranking: #30 out of 50

Fiscal health ranking: #45 out of 50

Overall tax climate ranking: #16 out of 50

Key Sectors and Metro Areas

Top five industry sectors by 2021 GDP:

Top three industry sectors by GDP 5-year CAGR (2017-2021):

Top metro areas by GDP:

- Wilmington (Considered a metropolitan division and part of Philadelphia-Camden-Wilmington MSA)

- Dover

Infrastructure Highlights

Infrastructure: Delaware has a high percentage of roads in good condition and has improved its bridges significantly over the last five years. The ASCE estimates the state needs over $1 billion in water & wastewater infrastructure investments over the next two decades. Officials in the state plan on addressing concerns with sea level rise and preparedness against extreme weather events like coastal storms and hurricanes. In addition, leaders intend to expand support for environmental-focused programs as well as solar and wind power projects to help build new clean energy infrastructure. Delaware will receive nearly $2.4 billion from the Bipartisan Infrastructure Law over the next five years, divided into the following categories of projects (additional funds may be deployed as federal grants get awarded to states):

Construction spending (Value of Construction Put in Place – CPiP):

- Private Nonresidential 2020 CPiP: $1.2 billion; 16.0% 5-year CAGR (2016-2020), above overall U.S. CAGR of 2.0%

- State & Local 2020 CPiP: $767 million; -1.1% 5-year CAGR (2016-2020), below overall U.S. CAGR of 4.8%

AE Industry

ENR 500 firm headquarters (2022): None

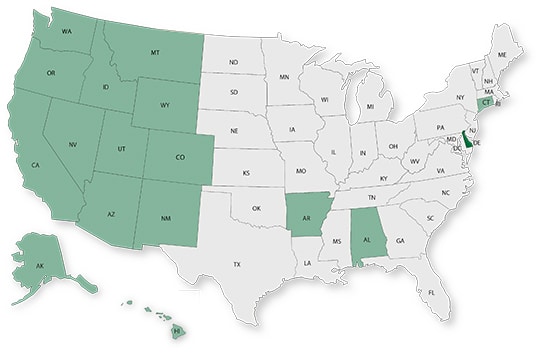

M&A activity since 2018:

- One deal with buyer from Delaware

- Six deals with sellers from Delaware

For customized market research, contact Rafael Barbosa at [email protected] or 972.266.4955. Connect with him on LinkedIn.

Weekly M&A Round Up

Congratulations to our client Alliance Transportation Group (Austin, TX): The firm’s leadership team announced that they had joined fast-growing DCCM (Houston, TX) (ENR #174), which is backed by White Wolf Capital (Miami, FL). This is DCCM’s sixth acquisition in less than two years. We’re thankful that the leadership team of Alliance Transportation Group trusted Morrissey Goodale to advise them on this important growth initiative.

Industry M&A is up 31% over the past 12 months: Last week saw new transactions announced in FL, TX and MO.

If you’d like to know more about our M&A services, and how we can help you either confidentially sell your firm or grow through acquisition then please contact Nick Belitz, Principal, at [email protected] or 303.656.6151.

Subscribe to our Newsletters

Stay up-to-date in real-time.