Word on the street > AE Industry Intelligence: Issue 45

AE Industry Intelligence: Issue 45

All-employee meeting: 2022 edition (part 2 of 2)

(Continued from last week)

It’s February 16, 2022. The world is back to normal and you’re hosting your firm’s first all-employee meeting of the year. As you do, you think back to the all-employee meeting you held on February 16, 2019— way back when the world was “normal” and compare notes.

- Sales and Marketing 2019: You announced the investment of $100,000 in a marketing consultant to “train” the firm’s “next generation of seller doers.” The consultant would focus particular attention to (a) how to comport oneself on the golf course, (b) allowable and unallowable expenses at dinners and conferences, (c) best practices in “schmoozing”, and (d) public speaking.

- Sales and Marketing 2022: You announce a $250,000 investment in a complete overhaul of the firm’s digital marketing strategy including (a) unified branding with global reach across all e- and social media channels and (b) a new cloud-based CRM that is 100% integrated with your website, digital communications, and knowledge sharing systems. You give a shout out to your digital marketing and sales team that recently identified, tracked, and closed a $5 million asset management contract for a new customer that no one in the firm has ever actually met face to face. You note how this is part of an evolving pattern for the firm and how “sales” expenses are at a record low. You also note that the firm is no longer paying monthly golf club membership fees for principals.

- Staffing 2019: Recruiting new employees was your #1 challenge. You believed you were doing everything you could to recruit talent but with woeful results. You declared “The only limitation on our growth is our ability to find the right talent! So, we are now offering a $5,000 bonus to any employee who refers a new hire to the firm.”

- Staffing 2022: Recruiting new employees is still your #1 challenge. You announce a new referral bonus program of $25,000 per hire. Coincidentally, that’s the same amount you are spending monthly on both Indeed.com and LinkedIn Recruiter.

- Ownership 2019: You announced seven new owners for the firm- all of them Rising Leaders. They were purchasing at the Associate level or 0.5% of the firm’s shares. And you were happy to let everyone know that there were two new Senior Associates who would be moving to the 1% ownership level (their bonuses for the next 3 years would be paid in stock instead of cash). You then invited one of the firm’s two founders to say a few words. At 79 years of age, he was still the firm’s largest shareholder with 20% of the equity and Chairman of the Board. The buy back of his shares was expected to take at least half of the firm’s free cash flow over the next five years. In a rambling speech that went well over his allotted time he managed to discuss the introduction of the fax machine and the importance of the building of the Hoover Dam.

- Ownership 2022: You announce that the firm’s new private equity partner – StoneRockRiverGateMountainIronOak Capital is investing the necessary funds to help the firm meet its strategic vision. The new ERP system is ready to launch. There are new leaders of Facilities and Transportation coming on board. Acquisitions of competitors are in the works. And the firm’s founders will formally retire at the end of the month. You indicate that none of this could be happening so quickly without the firm’s new investor.

- Innovation 2019: Towards the end of the meeting, you handed the floor to one of the firm’s Rising Leaders who was recently named Chair of the firm’s Innovation Committee. She summarized the committee’s recent work and expressed frustration that progress was slow. This stung as you were the brains behind the Innovation Committee concept. It allowed you to position the firm as supporting innovation without actually doing anything innovative. You knew that innovation was important for your younger folks, but you also knew that any innovation would be driven by your boomer P&L managers. The only way they would “innovate” was if the client paid for it, they sure as heck were not going to “fund’ it out of annual profits which would hit their bonuses. So, the Innovation Committee seemed like a good middle ground.

- Innovation 2022: You turn the meeting over to your 27-year-old Director of Digital Innovation (she was formerly Chair of the now-defunct Innovation Committee). She announces a flurry of items including (a) the successful roll out of the firm’s BuildIt! App which allows university clients to access all of the designs and permits necessary to fast-track their campus renovations, (b) a strategic partnership with a 3-D printing company, and (c) the rave reviews of the firm’s mixed-reality meeting platform that allows clients to blend in-person meetings with Virtual Reality and Augmented Reality thus enhancing collaboration while lowering costs.

- That’s a wrap 2019: The meeting ended abruptly and unintentionally when the massive TV monitor in the HQ training room began pixelating and the audio feed failed. One of your employees asked why not use Skype in the future so that everyone could just join the meeting from their laptops. You responded that it was important to get everyone together physically to build “real” relationships. As was tradition, at meeting’s end everyone at HQ remained in the training room for a while to catch up socially. You wondered if this also happened in the satellite offices, because it was a nice thing to do.

- That’s a wrap 2022: You thank everyone for joining the call. You remind them about next week’s new Wellness + Giving-back Monday— the day for everyone to either take time to focus on self-care OR give back to their communities. You encourage the vaccine holdouts to reconsider their position. And then you give the nod to your virtual assistant (who is located somewhere in Arizona, you’ve never met him – you found him through Upwork— but you’ve seen his Instagram and he looks like he’s living his best life plus you don’t have to pay him any benefits) to assign everyone to their “Coffee Talk” breakout rooms in Teams. Since annus horribilis 2020 this has become a new “tradition.” You’ve assigned folks to cross-office, cross-function, cross-discipline small-group social discussions after every all-employee meeting. You love this because it has fostered social capital across the entirety of the firm in a way that you didn’t even consider back in 2019. Before you jump into one of the Coffee Talks you pause and smile. You’ve just received news that your Hamilton tickets from March 2020 have been rescheduled to next month. You make a note to update your Vaccine Passport App to provide proof of vaccination to allow you to fly to NYC, stay at the hotel, and enter the Richard Rodgers theater. “Normal” never felt so good, nor did it ever look like this, but you’ll take it!

M&A Update: This week we highlight deals in California, Hawaii, Wisconsin and overseas. California has been the hottest market for deals thus far in 2021.

2020 M&A Year in Review: Our 2020 M&A Infographic gives you insight into all of last year’s M&A trends and provides our predictions for 2021.

Mark your calendars Part 1: In March we’ll be hosting the first ever combo Virtual Reality and livestream events for the AE industry. On Tuesday March 23 it’s our New Reality: 2021 Edition and on Thursday March 25 it’s our Q1 M&A Symposium. Strap on your VR goggles to fully immerse yourself in the presentations and mingle with the MG team and the other attendees in our VR Auditorium. Or catch the livestream on your laptop. The choice is yours.

Mark your calendars Part 2: This June we’ll be hosting our third Virtual Reality CEO Conference with new content and features. Registration opens soon. Click here to be kept updated.

Questions? Comments? How do YOU envision your first all-employee meeting of 2022 being different from that in 2019? Email Mick Morrissey @ [email protected] or call him @ 508.380.1868.

Four Factors to Watch

1. Economy

Confidence in the recovery is rapidly growing by the day. GDP and unemployment forecasts are becoming rosier— Goldman Sachs, for example, is predicting the US economy will grow faster than it has since the late 80s. The health crisis easing and a real end is potentially in sight, and the government is providing trillions in aid. Another $2 trillion is expected which represents over a quarter of the nation’s annual GDP. Some economists are calling for a “summer mini-boom” with GDP climbing 6.4% in 2021 and 5% in 2022.

2. COVID-19 Case Numbers

In the last week, the seven-day average of COVID cases has dropped from about 126,000 a day to 91,000— the first time the daily count has been under 100,000 in months. The seven-day average of fatalities continues to remain stubbornly steady; but again, it is a lagging indicator and the hope is those numbers will drop in the coming weeks. Seven-day averages of COVID cases in California, Texas, and Florida dropped in all three states last week:

- California: 13,900 to 9,700

- Texas: 17800 to 10,600

- Florida: 8,300 to 7,100

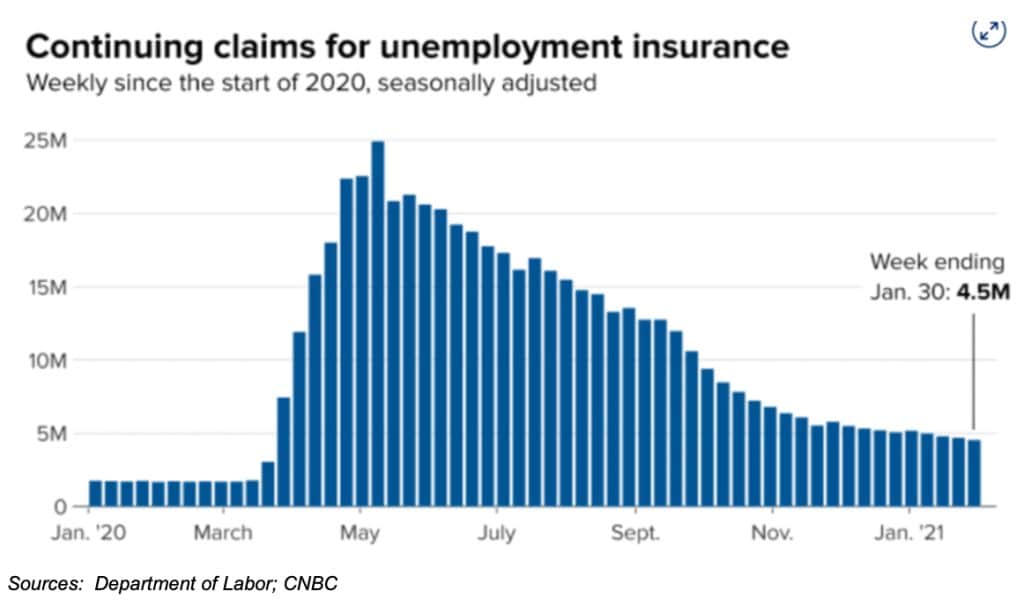

3. Jobless Claims

According to the Labor Department, first-time weekly claims totaled 793,000 which was higher than the 760,000 estimate from economists surveyed by Dow Jones and down from the revised number of 812,000 the previous week. Continuing claims also dropped by 145,000 to 4.54 million— the lowest it’s been since late March.

4. COVID Vaccine Distribution

According to information collected by Bloomberg, 173 million doses in 77 countries have been administered, compared to 128 million doses in 73 countries the week before. The average number of daily doses increased from 4.69 million to 5.96 million.

To date, 53.8 million doses have been administered in the U.S., up from 40.5 million last week. An average of 1.68 million doses per day are now being administered compared to 1.43 million last week. Across the U.S., 16.4 doses have been administered for every 100 people and 77% of the allotment delivered to states thus far have been administered, compared to the previous week of 12.3 doses per 100 people and 68% of the allotment.

Subscribe to our Newsletters

Stay up-to-date in real-time.