Word on the street > Issue 99

Word on the Street: Issue 99

Weekly real-time market and industry intelligence from Morrissey Goodale firm leaders.

In This Issue

Sixteen Candles, Sixteen Lessons

Last week, we celebrated our 16th year in business. Since starting the firm in April 2006 with just a couple of Blackberrys (still miss that keyboard and playing Brickbreaker), we’ve had the privilege of helping hundreds of AE and environmental CEOs and their teams. We’ve also been lucky to make more than a few good friends along the way.

Over the past 16 years we’ve learned a thing or two as we’ve assisted our clients grow during the very good years B.F. (Before Facebook), navigate the challenges of the Great Recession, ride the subsequent decade of economic recovery and expansion, and pivot through the pandemic to the here and now.

As we were drinking our birthday milkshakes, Mark and I thought it might be a good idea to share with you 16 lessons that we’ve learned over the past 16 years. I’ll do my best to share my thoughts here. But as you know if you’ve worked with us or read our stuff, the more valuable and meaningful lessons will be found in Mark’s article below.

- The hard truths of layoffs: Nothing prepares you for layoffs. They don’t teach you how to handle them in school. There are no industry leadership programs that have a “How to lay people off” half-day session with a motivational speaker followed by lunch. And by their nature, layoffs come at you fast—either due to a general economic downturn or a crisis with a major account or in your biggest market sector. By virtue of a strong economy, the industry as a whole has not experienced widespread layoffs for over a decade. That means that many (most?) of today’s managers have thankfully never had to lay people off. In a prior life, I had to lay off 30% of my team—staff, managers, and principals. It was the worst. In the aftermath of the Enron collapse, and then again through the Great Recession years, I worked with numerous clients to “rationalize” their businesses. With 70-plus percent of a design or environmental firm’s costs consisting of labor—“rationalize” means one thing—layoffs. For those of you who have never had to lay people off, here are some lessons that I learned from the experience that might help you should this ever fall to you on your watch. First, assess the financial situation. This is as simple as matching forecasted cash in (as the economy is tanking in general or upon the disappearance of a significant part of your business) and matching it to cash out. That’s where the simplicity ends. You will find that your managers are unable to accurately forecast in the suddenly new and nasty business-impaired environment. They will give you “hopes” instead of forecasts. Your job is to establish the most conservative topline forecast as is realistic. Why? Because if you get it wrong, then you will likely be forced to make a second round of layoffs, which will kill firm morale. (The first round is bad enough.) So, get the topline forecast right. Then you need to figure out how much labor cost to cut. My rule of thumb is to cut enough to achieve at least a 10% profit on the post-trauma cash flow. Why? Because you have to ensure that your firm makes money after the layoffs so you can make the investments required to pivot and rebound. You can’t do that if you’re a non-profit organization.

- Trust, but verify: Since 2005, I’ve been tracking incidences of fraud and embezzlement in the industry. (If it’s ever a category in Jeopardy, I’m all set.) It happens about once a quarter at firms of all shapes and sizes for three reasons. First, design and environmental professionals in general have low financial acumen. They understand utilization because it’s been the KPI of choice since the design of the pyramids. (See Mark’s Lesson 11 below and please note the Indiana Jones-themed tie-in between “pyramids” and “Holy Grail,” but let’s get back to embezzlement.) Things get hazier for them when the discussion turns to multipliers, and they might as well be in a foreign country once balance sheet topics are on the agenda. (Can you point me to the nearest contra equity account?) Second, designers and scientists are a trusting bunch. They themselves are ethical and honest and assume their teammates are the same. And third, many managers suffer from imposter syndrome and have an aversion to displaying a lack of knowledge on business matters. They don’t want to look like they don’t belong in management or board meetings—even though they actually would prefer to be somewhere else. This creates the ideal environment for an unscrupulous financial manager to exploit and in the process line their pockets with hard-earned company earnings. A little playing around with line items, a little moving between accounts, some delays in reporting, and voila—$10,000 per month is moving out of the firm and into a condo on the beach. Make sure you have checks, balances, and verification on your CFO or financial manager through a third party. Don’t be a victim. (CFOs, before you send me an angry email, this is NOT about you or your integrity. It’s about an industry dynamic that allows malfeasance to take place.)

- The dotted line is a cop out: I’ve crafted Lord knows how many organization charts for all types of organizational models since 2006. (On that note, thanks for nothin’ Bill Gates. How has Microsoft managed to flood the market with software that makes drawing organization charts (a) impossible beyond the C-suite level and (b) look like they were drawn by a third grader?) From the matrix structure to the market-sector model, and from the regional office profit center model to the hybrid, I’ve mapped them all out. I even had a brief flirtation with a (very successful, I might add) circular model that placed all the revenue-generating, high-dollar principals at the extremities of the business (engaging directly with clients) surrounding an inner core of operations—the “circling the wagons” model. Everybody wants a clear organization chart with lines and boxes (or 3-D bubbles in the case of architecture firms) that clearly shows who is responsible for what so that “we can have accountability.” Everyone wants it that is, until they have to show who reports to who. Then the “closed door” meetings start, which go something like this—“I can’t report to her! She’s only been here a year. I’ve been here over 30 years! Sure, I know that she’s building the business far better than I ever did, but it’s just not right that my line goes up to her! As the senior executive vice president for special projects with a staff of zero, I HAVE to report directly to the President!” And so, a bunch of dotted lines start appearing on organization charts. I refuse to allow them anymore. Why? Because they are a cop out. They represent a lack of functionality and accountability. Everybody should have one boss and one boss only. And for the CEO, that boss should be the board.

- CEOs need love too: Doesn’t matter if she’s the firm’s founder or a second- or third-generation CEO. Regardless of whether he has multiple executive education certificates from different Ivy League schools (a seemingly very popular choice) or has come through the (excellent) ACEC Senior Executive Program. Or if they attend every CEO conference in the industry hosted by us or our peers. Regardless, every CEO still has blind spots or an Achilles’ heel (and if they are over 60, they have a dodgy knee too). For them—and their firms—to be successful, they need help in overcoming those weaknesses. They require honest, constructive feedback in real time in order to improve. They are supposed to get it from their boards. But internal board members are fearful (see Mark’s Lesson 9 below on trust) or ill-equipped to do so, and external Board members (who are still mostly male in this industry and largely received no executive coaching or mentoring themselves) are mostly MIA on this. The number of industry CEOs who have executive coaches is shockingly low. It’s as if the industry collectively believes that once someone becomes a CEO, they have nothing left to learn and have no opportunity for improvement. If it were me, I’d have it written into every CEO job description and contract that they receive a 360-degree review every year and have monthly executive coaching sessions—the results of which are reported to the board.

- Just like dragons: Mergers of equals are not real. They don’t exist. Transactions between firms may be marketed as such. But in reality, there is always one firm that is taking over another. It doesn’t matter if the individual firm names such as GER Associates and MER Designers are craftily and Wordle-like combined into MERGERArch+ post-transaction by the marketing department. One firm is always the more dominant. There’s just one of each of the power functions—one CEO (although there are still a handful of architecture firms trying to disprove that and who I’m sure I will hear from on this topic), one COO, and one CFO. If you want to know who the acquirer is in a deal that’s represented as a merger, look to see who occupies those seats.

- Culture doesn’t come from capitalization: Just because you’re “employee-owned” doesn’t mean you’ve a better culture than a private-equity backed firm. It doesn’t mean your people are “happier” or “more engaged.” Employees are not more likely to “give 120%” if you’ve got an ESOP than if you’re publicly traded. Staff turnover rates fall between 9.5% and 12.5%. Would it surprise you to know that there are private-equity backed firms with less than 5% turnover? There are—and more than a handful. Culture, engagement, and collaboration are not directly correlated to your capital model. They are however inextricably linked to how your employees feel—about themselves and their potential. It’s about jobs and careers. When employees feel like they are partners in the journey, that’s when the magic happens. And that’s a direct result of the quality of leadership—not about how many shares are owned.

- For the last time, please send your written weekly project updates: This is the simplest, most powerful, greatest ROI organizational development tool that you have. Make sure that all your PMs are providing a written status update to every client on every project every week. Oh, and copy everyone who should be copied on the client team and your internal team. The memo should simply state what was accomplished on the project last week, what will be done next week, and flag any issues to be addressed. Doesn’t matter if it gets to the client by app, email, or carrier pigeon. It just needs to get there—weekly, like clockwork. Let the pushback begin. (“We’ve too many projects!” “I don’t have time to do that!” “Our projects are too small for us to do that, we’ll lose money!” “My client would never like that; they prefer to talk with me!” “Does this mean I can’t call or visit my client?”) We’ve heard all of the excuses—and they’re all wrong. Added bonus: The weekly project update helps your PMs learn how to write succinctly and effectively.

- Do the right thing: Not only a great Spike Lee joint—but words we’ve tried to live by at Morrissey Goodale since day one. I remember someone saying to me before we started our business that picking the right partner is the most important thing in business. And I’ve been extraordinarily lucky in that my original business partner, Mark, exemplifies doing the right thing. He always goes the extra mile—not just for clients, not just for our team, but also for everyone that he interacts with. It always amazes me how he finds time to help folks when he has no obligation to—especially in business by making connections or providing advice to folks asking or expecting nothing in return, but just trying to help them. Those interactions invariably come back to benefit us as a firm, but that’s not why he does them. That’s just the way he is. And I’m doubly blessed now that our entire team and my newest partners—Nick, Brendon, and Jon—are wired the same way.

- Trust is so incredibly important: Leadership teams that are able to cope in any kind of weather seem to have one thing in common—relationships that are built on a strong foundation of trust. Team members are willing to listen to each other, accept opinions other than their own, and build on ideas together. They believe the words and intentions of their partners are motivated by good intentions, even when initial comments or actions might seem objectionable. Instead of assuming negative intent, which they know will make them angry and defensive, they focus on listening without filters. They don’t waste time and energy on misattributing comments or behaviors by dreaming up less-than-flattering stories in their heads. Instead they talk it through until they fully understand what’s really driving the “situation”—and whether there actually even is a “situation.” While there may be stress from time to time within these teams, each member shows a genuine, mutual respect for their partners. They rarely go long periods without communicating with one another and they don’t hold grudges. Leadership teams that have this foundation of trust hit issues head on and move quickly and eagerly to the next challenge. They realize that pointing their weapons at problems rather than each another ultimately propels their firms to greater success.

- Good food fast really does work: We’ve been in business for 16 years without ever making a cold call for work. Not a single one. What’s the secret? Creating a marketing machine that gets your knowledge out to your clients and potential clients in bite-sized chunks by executing a variety of coordinated activities such as e-marketing, consistent PR, original research, and consistent client perception monitoring. It’s not the only way for a professional services firm to position itself as an expert in its chosen market sectors, but it’s the best way. It’s important to know and accept that it’s a numbers game. If you have hundreds of client database, make it thousands. If you have thousands, make it tens of thousands. Then hit that list with information your audience will value—over and over again. Stealth marketing doesn’t work in the AE industry.

- Utilization isn’t the Holy Grail: Most industry firms manage for resource efficiency. In other words, firms aim to maximize utilization. And that means keeping everyone busy. But what is actually getting done? Is staff working on things that add value? Are they getting the work done in a short amount of time? Most firms have so much design work in process it’s almost impossible to figure out what’s finished and what’s not. Managing for flow efficiency, on the other hand, is about finishing what is started and minimizing WIP. Multi-tasking and task-switching kill efficiency, which for many, including me, is a counter-intuitive concept—but it’s true.

- We can be sloppy with language: When you ask someone (anyone) in your firm to do something for you, how often are you satisfied with the outcome? How often are you surprised by that outcome—in a good way? On the other hand, how often do you find yourself muttering something along the lines of, “I should have just done it myself”? If it’s more of the latter, you’re in the same boat with the thousands of smart, hard-working, well-intentioned AE professionals I’ve worked with. The hard truth is if you aren’t getting what you ask for, look in the mirror. Are you being clear about what you expect? Is the timeline specific? Does the person you put on the task have the competency and enough time to execute? Are your conditions of satisfaction clear and acceptable? AE firms are project-driven organizations, and projects are networks of commitments and promises—nothing more, nothing less. Very few firms realize this and practice at getting better at making and securing reliable commitments. But when they do, they find themselves taking better care of themselves and their teammates, their clients, and their companies.

- Delegation is the key to retaining great people: I can’t tell you how many times I’ve heard clients tell me they lost good people because they weren’t getting opportunities to learn and develop. I get it. Firms pride themselves on the quality of their work, but that may lead some of the more experienced people in these companies to think they can’t delegate, particularly if they don’t believe the younger professionals are not fully competent, whether due to inexperience or a lack of drive or intellectual curiosity. But delegation needs to happen if anyone else in your firm is going to learn and fully engage. And this learning period will almost always mean that quality, and maybe even creativity, declines at first. Eventually, the protégé may deliver even better than the mentor, and this potential may also be a conscious or unconscious inhibitor to delegation. In any event, delegation is necessary for the development of those employees who are looking to do something special with their careers—and those are the people who are most likely to become leaders, whether in your firm or someone else’s.

- Declarations are powerful: One thing AE firm leaders can do that their employees cannot is make declarations. Owners make declarations—a company vision statement is one of the most important declarations a leader can make. That’s how they show up as leaders in their firms. Their lives are influenced by those kinds of declarations, and so are the lives of many others. Your future leaders can and should make declarations as well. As long as you don’t cut them at the knees and their declarations are supported, their direction will be taken. Once that happens, they start showing up as leaders to the rest of the staff—and they begin to shape the future.

- Responsiveness never goes out of style: Showing up is truly half the battle. The more responsive you are, the more fiercely loyal your clients tend to be. It makes a tremendous difference. Regardless of your title or tenure, or how much bureaucracy might exist in your organization, being reachable and quick to respond is a tough combination to beat.

- Don’t have your first child five days after you start a business: But, actually, I wouldn’t have it any other way. Happy Sweet 16, Natalie!

For help on how to make the next 16 years even better for your firm, call Mark Goodale at 508.254.3914 or send an email to [email protected].

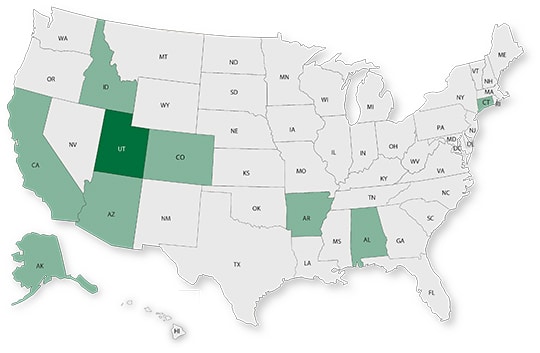

50 in 50: Utah

50 states in 50 weeks: U.S. states economic and infrastructure highlights.

Key Economic Indicators

GDP: $182.9 billion

GDP 5-year compounded annual growth rate (CAGR) (2017-2021): 4.3% (U.S: 1.6%)

GDP per capita: $55,762 (U.S.: $58,154)

Population: 3.3 million

Population 5-year CAGR (2017-2021): 1.8% (U.S.: 0.5%)

Unemployment: 2.1% (U.S.: 3.9%)

Economic health ranking: #4 out of 50

Fiscal health ranking: #4 out of 50

Overall tax climate ranking: #8 out of 50

Key Sectors and Metro Areas

Top five industry sectors by 2021 GDP:

Top three industry sectors by GDP 5-year CAGR (2017-2021):

Top three metro areas by GDP:

- Salt Lake City

- Provo-Orem

- Ogden-Clearfield

Top three areas by population 5-year CAGR (2016-2020):

- St. George

- Provo-Orem

- Logan

Infrastructure Highlights

Infrastructure: ASCE Infrastructure Grade (2020): C+

In Utah, according to the ASCE, the infrastructure for levees and canals are considered poor or at risk but most categories are rated above the U.S. average. In terms of wastewater infrastructure, aging systems and new nutrient regulations are driving many districts to implement upgrades. The fast-growing population is also a significant driver for investments in overall infrastructure in the state. Utah will receive nearly $4.0 billion from the Infrastructure Investment and Jobs Act (IIJA) over the next five years, divided into the following categories of projects (additional funds may be deployed as federal grants get awarded to states):

Construction spending (Value of Construction Put in Place – CPiP):

- Private Nonresidential 2020 CPiP: $2.6 billion; 6.4% 5-year CAGR (2016-2020), above overall U.S. CAGR of 2.0%

- State & Local 2020 CPiP: $5.5 billion; 16.7% 5-year CAGR (2016-2020), above overall U.S. CAGR of 4.8%

AE Industry

ENR 500 firm headquarters (2021): 2

M&A activity since 2018:

- 4 deals with buyers from Utah

- 8 deals with sellers from Utah

For customized market research, contact Rafael Barbosa at [email protected] or 972.266.4955. Connect with him on LinkedIn.

Subscribe to our Newsletters

Stay up-to-date in real-time.