Word on the street > Issue 97

Word on the Street: Issue 97

Weekly real-time market and industry intelligence from Morrissey Goodale firm leaders.

In This Issue

Takeaways From M&A Symposium Focus On The Three “S’s” 50 in 50

Acceleration — Seven Takeaways From Our Southeast States M&A Symposium

When over 170 AE industry leaders and investors come together to learn, share best practices, and network in one of the world’s most exciting cities, you know it’s going to be a great time. And that’s exactly what it was last week when we hosted our first Southeast States M&A Symposium since January 2020 at the beautiful Mandarin Oriental in sunny Miami.

From the salsa-themed opening reception on the beach on Brickell Bay to the presentations on M&A trends and deal pricing, and from the best practices panel discussions involving buyers, sellers, and M&A experts to the closing reception overlooking the stunning Miami skyline, the enthusiasm was strong, the learning was abundant, and the networking was fast and furious.

Here are seven takeaways from last week’s Symposium:

- It’s a seller’s market, but…: Buyers are flush with cash, have access to still relatively cheap capital, are seeing record backlogs, are optimistic about the future, and want to make acquisitions fast. It’s a great time to be a seller. However, buyers are also being very savvy about the market and are next-level speed dating. They are approaching multiple M&A targets at a pace and on a scale that we have never seen before. So, if a seller has one too many internal problems (e.g., poor business practices) or challenges (e.g., recalcitrant minority shareholders, over-concentration in a market), buyers are more than happy to move on to Plan B. This means that sellers need to have their ducks in a row before they get into M&A discussions. If you’re going to sell in this super-heated market, you’d better make sure your financials are clean and can survive a rigorous Quality of Earnings (QoE) examination and that you can quickly produce accurate forecasts and projections. Otherwise, you’ll find yourself waiting at the altar after your suitor leaves you for another.

- Faster, faster! That was the headline message from The 500 Club panel discussion involving three M&A deal-makers who between them have closed over 500 industry transactions. Buyers want to get deals done faster than ever before. What’s “fast” you ask? In some cases, as fast as 45 days after signing an LOI. Sound crazy? It’s the new normal. This puts enormous pressure on sellers to produce all of the information (contracts, leases, share certificates, etc.) needed for a successful deal closing. Most sellers cannot do this in a compressed time frame and need to outsource it.

- Accelerating consolidation: As an industry, we’re in uncharted territory. 2021 was the first time we crossed the 400-deal threshold in a calendar year, representing a step function increase in consolidation activity. The first quarter of 2022 is already the most active quarter ever on record for transactions, and the deal volume suggests that this year the industry is on track to see over 450 transactions—a 7% increase. Demand for quality, high-performing design and environmental firms by strategic buyers and financial sponsors is off the charts.

- Jaw-dropping or eye-popping: It’s your choice how you want to describe them. But either way, M&A deal prices are more Ferrari than Ford. Median deal multiples have increased over 5% since our last Southeast Symposium in January 2020. Upper-quartile deal multiples have jumped a stunning 17% over the same period. However, there’s barely been any increase in lower-quartile multiples. This speaks to the widening gap between quality firms that are either run well, in a hot region, or have specific expertise and those firms that are undifferentiated or under-performers. It’s a bifurcated market.

- You always knew the Southeastern Conference was special: Or was it the former ACC? Either way, AE and design firms in the Southeast are special. And that’s borne out when you compare recent deal valuations of Southeast firms with those in the rest of the nation. All things being equal, pound for pound, a design or environmental firm in the Southeast is about 13% more valuable than one in any other state in the Union (except Texas). Why? When you look at the strategic plans of the largest firms in the industry or the investment theses of the investors looking to enter the AE industry, the Southeast is a top priority. The economic outlook for the region and its business-friendly environment are big reasons why buyers pay a premium to enter the market.

- How optimistic are buyers and investors? Very. How do we measure that confidence? With our interstate M&A activity index, that’s how. This year, 7 in 10 transactions involve a buyer acquiring a firm in a different state from their headquarters. This continues the record level of cross-border M&A activity that we saw in the second half of last year. Buyers are using acquisitions to aggressively grow and diversify. Message for sellers: There’s a high probability that your buyer does not move in the same local professional industry circles that you do.

- A fast-moving industry recapitalization: Sure, we all know that private equity and family offices are becoming more influential in the industry. They now account for over one-third of all transactions. But did you know just how quickly they’ve been remaking the industry? Get this, in the first three months of 2022 alone, financial sponsors have been responsible for 37 acquisitions. That’s DOUBLE the number of acquisitions they made in the entirety of 2016! Buyers backed by private equity make up the majority of the most-prolific acquirers in the market. The private-capital model is supplanting the traditional employee-owned model. In 2016, three-quarters of ENR Top 100 firms were employee- or ESOP-owned. That’s now down to two-thirds. Over the same period, PE-backed firms have grown from 4% to 15% of the ENR Top 100 firms. We are moving rapidly from a majority employee-owned industry to a minority employee-owned one. Employees will still have ownership—but on a much-diminished scale.

Couldn’t make it to Miami? We’ve got you covered! We’ve recorded the Symposium and will be making it available soon. Sign up here to be notified when the video is available for purchase for just $250.

Pace of industry consolidation gathers steam: Industry M&A is up 45% over the past 12 months.

Consolidation nation? If you’re thinking there seems to be a lot of M&A activity this year, you’re right! Here are the 14 transactions announced since the beginning of the year that Morrissey Goodale’s M&A team has helped make happen. For more on our sell-side practice, email Vice President Brendon Cussio at [email protected]. Or if you’re interested in our buy-side services, contact Vice President Jon Escobar at [email protected].

Questions? Insights? Thoughts on where all this industry consolidation is heading? Email Mick at [email protected] or text him at 508.380.1868.

Today More Than Ever, A Leader’s Focus Belongs On The Three “S’s”

With current demand for AE services outstripping supply by a wide margin, I’ve observed literally hundreds of principals in the past 12 months spending more and more time working in their businesses and not on them. Believe me, I get it. You’ve got to do what you’ve got to do, and because of that, you often find yourself in the weeds.

But if you aren’t watching out for the golden goose in this time of incessant change, who is?

Still, maybe you believe you’ve got your priorities straight. Maybe you think your focus is where it needs to be. Well, I’ve got a little challenge for you. First, track what you are doing every couple of hours for a week—and I mean literally (red-lining a set of plans, plowing through emails, putting out a project fire, etc.). Then compare that list to the Three “S’s” described below (a.k.a., leadership agendas) and see what, if any, similarities there are between the two.

“S” #1: Sustainability

Definition

- Sustainability refers to how a firm uses its resources—capital, people, and systems—over time.

Food for thought

- In the short term, burning the candle at both ends may be acceptable to satisfy an important client or get through a busy period. But in the long term, unsustainable practices related to employees or financial resources will exact a heavy toll.

- Lots of firms today require significant overtime to complete all of the work that needs to be done. But taking a closer look often reveals that much of this extra effort is “failure demand”—superfluous work caused by a system breakdown. Whether it’s rework, resubmissions, resubmittals, or responding to an RFI, profits get eaten up while no additional value is delivered. It is the definition of waste.

- Adopting Lean operating strategies is an effective approach to reducing failure demand, and reducing the burden on employees and financial resources.

“S” #2: Serviceability

Definition

- Serviceability is the ability to always give clients what they need and consistently provide good service.

Food for thought

- Serviceability requires the capacity to meet client demand. The ability of your firm to quickly hire qualified people for existing and future staffing needs directly affects the level of serviceability your firm can achieve. It influences how management deals with marginal employees, leadership and ownership transition, and how a firm responds to the loss of a key person.

- Many firms are bolstering their capacity to serve clients through acquisitions, as well. The process requires establishing acquisition criteria, crafting a compelling message, conducting outreach, courting, deal-making, and integration.

- Innovation is a key ingredient for serviceability, and it means delivering something to market that the market couldn’t get before. Innovating something doesn’t necessarily require the invention of any new materials, tools, or processes, yet something new is nevertheless created. Tiny houses are a good example. They can be put on a flat bed or pulled behind a truck, and can have many different configurations, including pop-out slides. This innovation came not through invention, but instead by recognizing what’s called the relevant “domain of action” (in this case, living spaces) and addressing the pervasive concerns in that domain (mobility, expense, personal values, and so forth). The more you operate in a particular domain of action, the more you can look at alternate ways of taking action in them—otherwise known as “innovating”.

Agenda #3— Survivability

Definition

- Survivability means a) consistently generating enough profit to pay for today and invest in tomorrow, and b) ensuring that competent leadership will always be in place to secure the firm’s future as a going concern.

Food for thought

- For many AE firms, one of the main challenges associated with survivability is navigating ownership and leadership transition. Job 1 is preparing next-generation owners to take the reins. We often observe significant leadership gaps between the founders and the next level in AE firms, and closing that gap requires future leaders to adopt an “ownership mindset” which means being fully responsible for their own experience of working in the firm, the experience clients have, and the overall performance of the company.

- There are a number of teachable behaviors that provide a broad capacity for successfully taking care of the needs of an AE firm, and these behaviors are available to everyone in your company, given knowledge and practice. Adopting these behaviors is not “difficult”, per se. It just takes focus and effort.

If your to-do list bears little resemblance to the Three S’s, you’d be well-served to create a “to-don’t list” and rethink your priorities.

For more information on how Morrissey Goodale can help your firm plan for and achieve sustainable, profitable growth, call Mark Goodale at 508.254.3914, or send an email to [email protected].

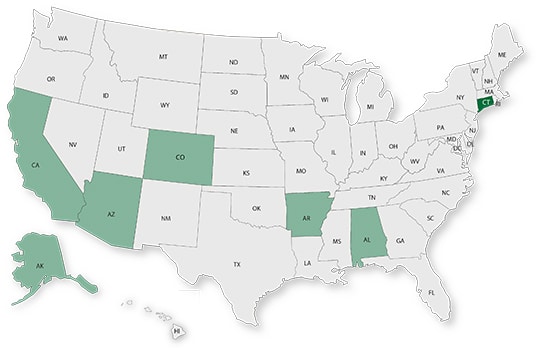

50 in 50: Connecticut

50 states in 50 weeks: U.S. states economic and infrastructure highlights.

Key Economic Indicators

GDP: $244.0 billion

GDP 5-year compounded annual growth rate (CAGR) (2017-2021): -0.3% (U.S: 1.6%)

GDP per capita: $67,678 (U.S.: $58,154)

Population: 3.6 million

Population 5-year CAGR (2017-2021): 0.2% (U.S.: 0.5%)

Unemployment: 5.3% (U.S.: 3.9%)

Economic health ranking: #45 out of 50

Fiscal health ranking: #47 out of 50

Overall tax climate ranking: #50 out of 50

Key Sectors and Metro Areas

Top five industry sectors by 2021 GDP:

Top three industry sectors by GDP 5-year CAGR (2017-2021):

Top three metro areas by GDP:

- Hartford-East Hartford-Middletown

- Bridgeport-Stamford-Norwalk

- New Haven-Milford

Top three areas by population 5-year CAGR (2016-2020):

- Bridgeport-Stamford-Norwalk

- Hartford-East Hartford-Middletown

- New Haven-Milford

Infrastructure Highlights

Infrastructure: ASCE Infrastructure Grade (2018): C-

Connecticut will receive nearly $6.0 billion in infrastructure funds from the Infrastructure Investment and Jobs Act (IIJA), which will help the state address aging water and wastewater systems and a significant high percentage of roads in deteriorating conditions. The state will have the opportunity to raise its current worrisome economic outlook by applying extra efforts into identifying projects focused on winning competitive grants. The IIJA will make the following funds available to Connecticut over the next five years (additional funds may be deployed as federal grants get awarded to states):

Construction spending (Value of Construction Put in Place – CPiP):

- Private Nonresidential 2020 CPiP: $2.8 billion; 9.5% 5-year CAGR (2016-2020), above overall U.S. CAGR of 2.0%

- State & Local 2020 CPiP: $2.8 billion; -3.3% 5-year CAGR (2016-2020), below overall U.S. CAGR of 4.8%

AE Industry

ENR 500 firm headquarters (2021): 4

M&A activity since 2018:

- 26 deals with CT buyers

- 22 deals with CT sellers

For customized market research, contact Rafael Barbosa at [email protected] or 972.266.4955. Connect with him on LinkedIn.

Subscribe to our Newsletters

Stay up-to-date in real-time.