Word on the street > The Outsiders—Quantity and Quality Check; You Know, Some of Your Websites Aren’t So Bad (Part 2 of 3)

Word on the Street: Issue 147

Weekly real-time market and industry intelligence from Morrissey Goodale firm leaders.

The Outsiders—Quantity and Quality Check

“I don’t need them to like me—but I need them to respect me, and I need to be able to trust them.” I’m paraphrasing the CEO of one of the industry’s most well-known, perennially high-performing, employee-owned firms. It has seen several planned leadership transitions over multiple decades. The quote came in the middle of a free-wheeling, wide-ranging discussion about good governance with a particular focus on the value of external board members. (In keeping with Chekhov’s gun, we’ll be coming back to the important first part of this quote below.)

This firm has all the hallmarks of governance best practices—an equal balance of executive (internal) and non-executive, market-rate compensated (external) board members; a regular schedule of board meetings with appropriately focused agendas; functional board committees (audit, compensation, nomination, risk, and ESG); defined terms for all board members; and a vested, engaged, pro-active chairman.

As a firm, they make good governance look easy. But it’s far from simple. And it hasn’t always been this way for them—or for those other leading and largest (generally ENR Top 100) employee-owned industry firms. Their governance practices have evolved over decades of multiple generations of leadership and ownership. And unlike their publicly traded peers, their good governance practices are a result of a series of choices that successive generations of their leadership have made rather than a reaction to the requirements necessary to list on a stock exchange. Those choices—while necessary—are neither easy nor, at the time, obvious. And they continue to be a challenge for most first- and second-generation design and environmental firms.

The foundational importance of agency relationships: Governance comes easy for publicly traded firms. For that group of 20 or so firms that are either immersed in or touch the AE and environmental industry, their agency relationships—those at the heart of good governance—between shareholders, management, and the board of directors are clear. The shareholders relinquish control to an agent (the CEO specifically, the professional management team by association) who is hired to run the firm. The responsibility of the board of directors is to ensure that the agent acts in the best interest of the shareholders. There are bright lines between the three entities—owners, managers, and board—and little if any overlap in personnel (although frequently the CEO and various managers are also board members, though usually “outnumbered” by external board members). These relationships are designed to bring transparency and accountability to the firm.

A different world: Governance of employee-owned AE and environmental firms is very, very different. In most cases there is a significant personnel overlap between owners, management, and board with multiple individuals falling into all three buckets. Some employee-owned firms reserve board seats for younger generations as a sort of executive training program. Still others use their boards as the last refuge of founders or a prior generation of owners who are no longer engaged in the firm but retain power via control of the board. This is a real challenge to good governance. As a board member, it’s kind of hard to hold the CEO accountable if during the regular work week, you report to that CEO, and she sets your compensation and quarterly bonus. It’s even harder if that CEO is the firm’s founder. And yet, this is the conundrum for most first-generation and many second-generation employee-owned AE and design firms. In a recent study of over 300 industry boards, we found that the founder was still present (and in many cases the chairperson) on over one-third.

An outside voice at the table: For many employee-owned firms, the addition of non-executive (external) board members is the most obvious, and ostensibly fastest, way to introduce good governance practices. The thinking being that outsiders bring objectivity, accountability (they don’t report to the CEO; instead, he reports to them), governance, or business savvy—or ideally all four traits—to the firm’s board dynamic.

Outsiders by the numbers: It’s not surprising that larger, more mature design and environmental firms tend to have proportionally more outside directors on their boards. Looking at the ENR Top 100, non-executive directors comprise about half of the entire board seat population. That figure falls faster than a pine tree on the 17th at Augusta for firms outside of the Top 100. Firms tend to expand their boards to add outside directors rather than replace internal directors as they grow. And so, you see boards with more seats at the higher echelons of the top design firms. The average number of board seats grows to nine among the ENR 100 from six for firms in the ENR 400 to 500 cohort.

The unicorn: Many design and environmental firms that seek an external board member envision a retired industry executive with prior large firm experience. The rationale being that the candidate has “been there, done that” and so can speak authoritatively about the opportunities and challenges that lie ahead for the business. Overall, this is a good thesis. Except for one big caveat. There is a meaningful difference in terms of what a retired CEO brings to the table as compared with a retired non-CEO executive. In this industry, business acumen falls off dramatically outside the office of the CEO—except maybe for that of the CFO. CEOs worth their salt have to be at the center of the action and at the heart of the circle of trust. This is not necessarily the case for other executives. So, all things being equal, former CEOs of large industry firms tend to be better investments as outside directors compared to the senior executives who were on their team.

Retiring on the job: Ideally an outside board member brings a wealth of knowledge and thoughtfulness to a firm. However, unless their last name happens to be ChatGPT, then the pool of viable candidates tends to be older and, in many cases, have retired from one or more careers. So, gaining this experience comes with a major risk—that the candidate may use your board as a way to have a well-funded post-retirement. It’s first up to the selection committee to be the guard against this happening, and then it’s up to the board chairperson to hold an underperforming board member (external or internal) to account.

Chummy ≠ competence: This goes back to the first part of the CEO quote “I don’t need them to like me…” This is hugely important to maximize your ROI on a non-executive board. Far too often I see non-executive board members having real cozy relationships with the CEO. Golf, fishing, retreats, and dinners all build “social capital.” But they also tend to water down the “trust but verify” and “accountability” elements of the relationship that are critical for the firm to maximize its investment in an outside board member. This type of dynamic is often a result of the genesis of the relationship, as frequently outside board members are selected based on their prior social or business relationship with the CEO. This is especially prevalent in first-generation firms. And it’s problematic.

Good governance investment: The investment in the right external board member can dramatically enhance your governance culture, allowing your firm to grow with greater confidence. However, the quality and motivations of the individual non-executive directors are as important as their resumes. Do your due diligence. And remember, you don’t want your external board members to like you, but you do want them to respect you, and you need to trust them to do what you hired them for.

Questions, comments? What are your thoughts on non-executive directors? Contact Mick at [email protected] or 508.380.1868.

You Know, Some of Your Websites Aren’t So Bad (Part 2 of 3)

The march through the alphabet of AE firm websites continues this week with I through P. After a good bit of digging, here are some that pop:

IMEG (Engineering, Rock Island, IL, ENR #71): There’s nothing static about IMEG’s home page. Video and images are attention-grabbers because of the way they enter and exit the page. Flash-bulb videography (non-blinding, by the way), zoom, and panning effects combine for a lively introduction to the firm. CLICK HERE

IPS – Integrated Project Services LLC (Engineering/Architecture, Blue Bell, PA, ENR #89): This is an engaging website. I didn’t know about the Annex 1 deadline, but now I do thanks to a visible banner across the top of the home page. There is just enough animation, like around the “IPS Molecules” feature, to make you feel like there’s a consciousness to the site. CLICK HERE

JMT (Engineering/Architecture, Hunt Valley, MD, ENR #60): Great movement on the home page brings the site alive. Scrolling down is a seamless experience, ditching the series of blocks for a more blended, gentler transition from feature to feature. CLICK HERE

J-U-B Engineering (Engineering, Meridian, ID, ENR #240): Another sharp site with great videography on the home page—and some of the more important features of the site are visible without scrolling. “Soroptimist Coeur d’Alene” reflects the firm’s values. CLICK HERE

Kapur (Engineering, Milwaukee, WI, ENR #356): Big, bold statements; a crisp look; and snappy statements define the site. The “all in” theme is impactful and gives off the vibe of a company that is determined, focused, and up for a challenge. CLICK HERE

KCI (Engineering/Construction, Sparks, MD, ENR #48): Gives off a sophisticated feel and speaks to a capable brand. Lively animation of the features on the home page draw attention, but the special effects don’t repeat once you’ve scrolled through—attention to detail that is, no doubt, appreciated by visitors. CLICK HERE

Larson Design Group (Engineering/Architecture, Williamsport, PA, ENR #297): Just well executed overall. Professional video, clean scrolling, uncluttered. It all says high-end. There is something believable about the “every detail matters” theme featured throughout the site. CLICK HERE

LMN Architects (Architecture, Seattle, WA, ENR #357): Crisp, vibrant images set the tone. The bold, white text contrasted by a black background demands attention. Large group pictures of employees are notoriously hard to pull off without looking like an ad for a local, family-owned auto dealership—but the one on this home page works. CLICK HERE

McFarland Johnson (Engineering, Binghamton, NY): The professionally produced video on the home page captures the innovation the firm produces and the people who produce it. CLICK HERE

Mead & Hunt (Engineering/Architecture, Middleton, WI, ENR #91): Time-lapse video and lots of action highlight impressive projects—without being frenetic. The online application form is well-done. CLICK HERE

Newcomb & Boyd (Engineering, Atlanta, GA, ENR #403): The three channels—healthy buildings, intelligent buildings, and regenerative buildings—is a creative concept. The healthy buildings channel contains an e-book for download called Health & Wellness in the Workplace. The other two channels offer webinars and videos. Smart branding. CLICK HERE

NV5 (Engineering, Hollywood, FL, ENR #24): Carousels are nothing new on websites, but sometimes I feel like I’m playing beat the clock because I don’t know how long I have before another image wipes in. But NV5 solved the problem with a sliding white line at the bottom of the page that serves as a timer. When the line reaches the right side of the screen, the image changes. Nice touch. CLICK HERE

O’Dell Engineering (Engineering, Modesto, CA): Great resource center. It’s loaded with conference information, publications, and helpful links. The funding opportunities page includes about 200 active listings—no skimping there. CLICK HERE

Origin Design (Architecture/Engineering, Dubuque, IA): It’s crisp and clean from head to toe. The green highlighter effect works, as does the “working on tomorrow” theme. Engaging videos and photography serve to personalize the firm. The site is a brand-enhancer. CLICK HERE

Populous (Architecture, Kansas City, MO, ENR #107): A really well-executed site. Great videography does justice to noteworthy projects. “We design the places where people love to be together”—I can only imagine how much word-smithing that took, but they got it right. CLICK HERE

P.W. Grosser (Environmental, Bohemia, NY): Love the podcast! A great way to share knowledge and showcase personalities. It’s prominently displayed on the home page and easy to access. CLICK HERE

Next week, we finish the alphabet. Stay tuned.

Need some pop in your marketing strategy? Call Mark Goodale at 508.254.3914 or send an email to [email protected].

Market Snapshot: Roads (Part 1)

Weekly market intelligence data and insights for AE firm leaders.

Overview

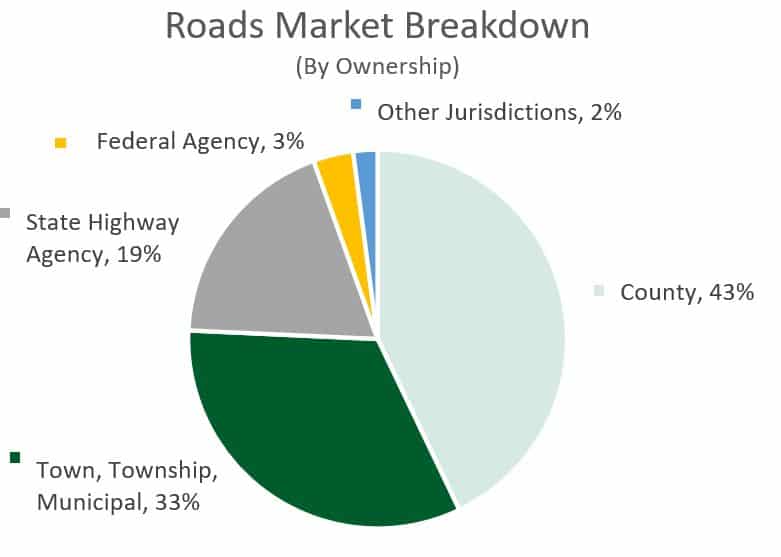

- The roads category of construction is made up primarily of the pavement classification, which includes highways, roads, streets, culverts, gutters, and sidewalks (as defined by the U.S. Census Bureau). Projects will often include spending related to lighting, retaining walls, tunnels, toll and weigh stations, maintenance buildings, and rest facilities (Please note we reported the bridges category separately on Word on the Street Issue #139).

- In 2022, the highway and street category accounted for 12% of the total nonresidential value of construction put in place.

- According to the Bureau of Transportation Statistics, there are nearly 4.2 million miles of public roads and streets in the U.S. About 70% (2.9 million miles) is classified as rural. The American Society of Civil Engineers (ASCE) reports that 43% of the country’s public roadways are in poor or mediocre condition.

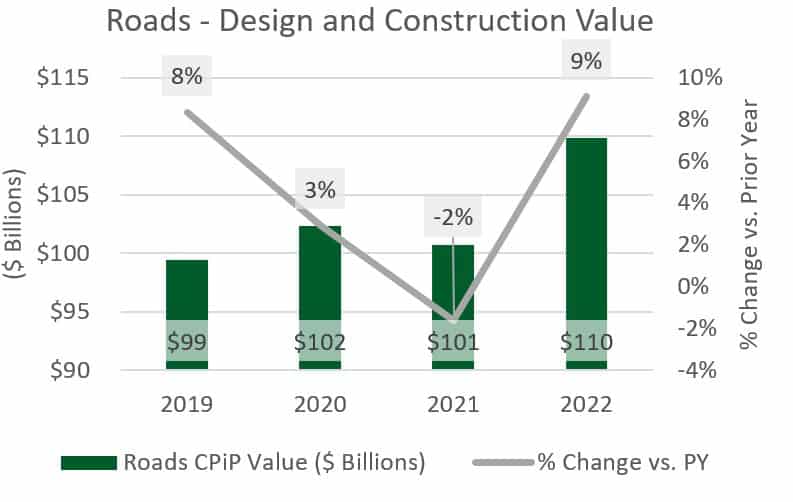

Market Size

$109.8 billion*

*Based on Value of Construction Put in Place (CPiP) – 2022 (U.S. Census Bureau); excludes bridges (reported separately on the 2/21/2023 issue of Word on the Street)

Outlook

- With the signing of the Bipartisan Infrastructure Bill (BIL), highway programs are now funded until 2026 with more than $300 billion in contract authority from the Highway Trust Fund (HTF), which reflects an annual increase of 29% in comparison with 2021.

- With the BIL, funding increased for existing programs, and several new ones are being implemented. Examples of new programs include (amounts are for FY 22-26):

- Safety:

- Safety Streets and Roads for All ($5.0 billion)

- Climate and Resilience:

- Carbon Reduction Program ($6.4 billion)

- National Electric Vehicle Formula Program ($5.0 billion)

- Promoting Resilient Operations for Transformative, Efficient, and Cost-Saving Transportation (PROTECT) ($1.4 billion)

- Rural areas:

- Rural Surface Transportation Grants ($2.0 billion)

- Mega-Projects:

- National Infrastructure Project Assistance Program ($5.0 billion)

- Safety:

- According to Dodge Construction Network, construction starts for streets and highways will go up by 20% in 2023.

- The latest ACEC Engineering Business Sentiment Report showed that the level of optimism for the roads and bridges market is higher than any other industry sector.

- Additionally, in a survey conducted by Roads & Bridges, 89% of highway contractors indicated they expect their business in 2023 to be excellent, very good, or good.

In next week’s issue, we’ll look at trends and hot spots for this sector. To learn what’s ahead for other markets, check out Morrissey Goodale’s 2023 Market Outlook for the AE Industry. Click here to access recording and materials.

To learn more about market intelligence and research from Morrissey Goodale, schedule an intro call with Rafael Barbosa. Connect with him on LinkedIn.

Weekly M&A Round Up

A shift to highly active: The M&A market has moved from “hyperactive” to “highly active.” Deal-making has fallen back to 2021 levels and valuations are also changing at the same time. Last week we reported eight deals in Florida, Arkansas, Oklahoma, and abroad. You can check all the week’s M&A news here.

.

Searching for an external Board member?

Our Board of Directors candidate database has over one hundred current and former CEOs, executives, business strategists, and experts from both inside and outside the AE and Environmental Consulting industry who are interested in serving on Boards. Contact Tim Pettepit via email or call him directly at (617) 982-3829 for pricing and access to the database.

Are you interested in serving on an AE firm Board of Directors?

We have numerous clients that are seeking qualified industry executives to serve on their boards. If you’re interested, please upload your resume here.

June 12-14, 2024 Las Vegas, NV

Western States M&A and Business Symposium

Join us for the 10th annual Western States Symposium, bringing together over 200 AE and environmental industry executives and investors in one of the world’s most vibrant and iconic cities.

Learn More

Subscribe to our Newsletters

Stay up-to-date in real-time.