Word on the street > Does 2023 Herald a Return of the “Old” Normal?

Word on the Street: Issue 133

Weekly real-time market and industry intelligence from Morrissey Goodale firm leaders.

In recognition of the Martin Luther King Holiday, next week’s Word on the Street will be published on Tuesday instead of Monday.

Does 2023 Herald a Return of the “Old” Normal?

A review of M&A activity and valuation trends from the second half of 2022 and early this year has me wondering if 2023 is going to be a replay of 2018. Why? Let’s read some tea leaves.

M&A stalling out? Industry consolidation dropped 18% in the final quarter of last year compared with the same period in 2021. Announced deals fell from 121 in Q4 2021 to 99 in Q4 2022. That’s the first time we’ve seen a drop in Q4-over-Q4 deal-making since 2016/2017—and back then it was just a 7% hiccup. The overall result is that deal activity rose just 6% year-over-year as opposed to the 10% increase we were forecasting. It’s also notable that there were fewer deals announced in our first M&A Update of 2023 compared with the first week of 2022. Which way is consolidation headed in 2023? We still think it will accelerate, but we’re actively revising our forecasts.

Demand destruction? The difference in deal-making that took place between the beginning of 2022 and when the ball dropped at midnight December 31 is even more telling. Announced deals dropped from 259 in the first half of the year to just over 200 in the second half—a 22% fall-off in activity. We’ve only seen this pattern once since 2016. In 2019, deal-making dropped 21% from the first half of the year to the second. The number of sellers in the market last year didn’t decline, but it sure looks like demand choked. In large part this was due to smaller private equity and family office investors getting spooked by rising interest rates. For context, the second half of last year was still the fourth most active for industry consolidation on record.

The return of the employee-owned buyer? While the pace of industry consolidation cooled in the second half of 2022, the profile of the typical buyer changed too. Back in 2018, employee- and ESOP-owned firms were the dominant buyers in the market. They were the apex predators on the savannah, accounting for almost three-quarters of all acquisitions that year. But then private equity arrived on the scene with fistfuls of cash at close and business plans akin to blank canvases that allowed sellers to keep their brand names. The result? The percentage of industry deals done by employee- and ESOP-owned firms declined steadily and precipitously, bottoming out in 2021 at just over 50%. But that changed last year, with deals by employee- and ESOP-owned firms rebounding to almost 58%. As smaller private equity firms and family offices continue to spend more time examining and less time acquiring, and as more and more mature ESOP- and employee-owned firms realize that an internal business transition is not viable, we’ll be looking to see if this buyer type becomes more prevalent in 2023.

Back to a buyer’s market? Perhaps the most relevant indicator as to whether 2023 might signal a return to the “old” normal is where M&A valuations appear to have been trending. One of the datasets that we watch closely to get a read on where the industry is headed is comprised of those transactions that are not yet completed but are under LOI and expected to close somewhere between 30 to 90 days from now. We refer to this as the “pending deals” dataset—and it’s a good forward-looking indicator on valuations. Right now, the median and upper quartile adjusted TTM EBITDA multiples in this dataset are down meaningfully from their historical highs of 7.64x and 11.58x seen in 2022 and now are much closer to levels not seen since 2018. Will this downward trend continue? We’re keeping a close watch on this.

Back to “normal”? There are lots of clues in the broader economy that suggest certain socioeconomic swathes are returning to pre-pandemic norms (see layoffs at Salesforce and Amazon and last year’s swooning stock market for examples). AE industry executives and investors have become accustomed to rapid industry consolidation and rising valuations. Could those be reverting to pre-pandemic levels in 2023? We’ll know more for sure as the year progresses. And we’ll be sharing the latest data at our Southeast M&A, Strategy, and Innovation Symposium this March in Miami where you can network with over 200 AE industry executives and investors on beautiful Biscayne Bay.

Where do you think the M&A market is headed in 2023? Questions or comments, email or call Mick Morrissey at [email protected] or 508.380.1868.

Bipartisan Infrastructure Law Status—Where’s the Beef?

It’s been over a year now since the Bipartisan Infrastructure Law (or BIL, also known as the Infrastructure Investment and Jobs Act, or IIJA) was signed into law by President Biden in November 2021. But while the numbers are gargantuan, the government is struggling to administer the massive program.

Last week, I caught up with Dave Anderson, president of Proviamo Enterprises LLC—a federal infrastructure consultancy that provides business development, federal solutions, and investor services to a wide variety of organizations—to get his take on where BIL funding currently stands with the U.S. Army Corps of Engineers, one of his team’s specialties. Here’s how our conversation went:

![]()

Dave, thank you for contributing to Morrissey Goodale’s Word on the Street!

![]()

I’m honored to be included!

![]()

Tell me a little about the Corps.

![]()

The Corps is the primary engineering force for the federal government. It employs roughly 38,000 civilians and military personnel to deliver engineering services in more than 110 countries around the world. The main components are the Engineer Regiment (which includes combat engineers), military construction (military works and lines of transport and communication), and civil works (critical infrastructure systems, including navigation, water supply, flood and storm risk reduction efforts, emergency response, and aquatic ecosystem restoration projects). The civil works program is the largest and fastest-growing program with 1,900 projects across the country. The Corps doesn’t have the only engineers in the federal government, but they are the best source of AE expertise.

![]()

How is funding allocated throughout the organization?

![]()

The program that the Corps is overseeing is a generational infrastructure investment. Its total current program is over $90 billion, about $50 billion of which is committed to the civil works program. It also includes over $1 billion for R&D; $5 billion for Army work; $28 billion for work for their DoD partners, like the Air Force and Defense Logistics Agency; and roughly $13 billion for interagency and international partners, such as the Veterans Administration and Foreign Military Sales cases.

![]()

That seems like a lot to handle, even for an organization the size of the Corps.

![]()

It is, especially considering that the amount allocated from the Bipartisan Infrastructure Bill alone—$17.1 billion—is nearly the size of their typical annual program. The Corps is structured, organized, and staffed for what has historically been a $20-22 billion annual program, not including storm supplementals. Meanwhile, the Corps is competing for the same talent as the rest of the industry. This massive program simply won’t be fully executed if the Corps relies on legacy staffing and business processes. It has to grow, become nimbler, and be the best possible business partner for industry.

![]()

Is there no way out of the quagmire?

![]()

As I mentioned, legacy federal systems aren’t built for this kind of massive investment. The Corps, in particular, is constrained by processes which, in many cases, are dictated in law or regulation, such as the Federal Acquisition Regulation—well-intended to protect the taxpayer’s funds and to ensure fairness in hiring and in contracting, but not necessarily nimble, innovative, or transparent. From hiring to contracting to design to construction oversight, the Corps is going to have to significantly streamline its business practices to “get ‘er done.” The Corps’ leadership is working this hard right now. But industry needs to see results at the project level.

![]()

How will this pressure impact the federal government’s need for AE consultants?

![]()

The Corps has to rely more on industry than ever before. It self-performs design on a relatively small percentage of its projects, and industry performs basically 100% of its construction. Industry partners may have to help with that staff augmentation and contracting, and the Corps has already taken some aggressive steps to better work with them. In 2022, LTG Scott Spellmon, the Chief of Engineers, signed a partnership charter with the Associated General Contractors of America to enable collaboration to overcome obstacles and increase innovation, agility, and efficiency. He also published a “Partnering Playbook” to provide guidance and tools for delivering projects with industry. But partnering is a two-way street. One common area of industry frustration has been bureaucracy, delays, and lack of transparency in the contracting process. This is an area that the Corps is going to have to really advance to be good partners with the entire industry and deliver the program.

![]()

What does it take for an AE firm to be successful in this arena?

![]()

The federal government needs firms that have a history of delivering; it values strong past performance above almost all other traits. Firms that don’t have a significant background in this type of work need to look for “competimates” to team up with firms like Dewberry, WSP, AECOM, and many others that have that big experience. You have to build your federal resume by getting on teams like theirs. You can also look to the SBA’s mentor/protégé programs (formal mentoring commitments) and the joint ventures that can be born from them. It’s worth looking into because the amount of funding that is coming down the pike is significant.

![]()

What other advice do you have for AE firms looking to enter the fray?

![]()

If your firm is in a strong cash position, consider building your federal resume by acquisition. Bluntly stated, buying federal past performance may be the speediest way to get it on your resume. Or if it fits your company’s lifecycle and situation, consider selling to a firm that has a strong federal background and needs capacity, which is just about all of them these days.

![]()

Will small AE firms be left out in the cold?

![]()

Oh goodness, no. The Department of Defense has a goal to award about 23% of all federal prime contract dollars to small businesses and for large business to subcontract about 32% of contract value to small business. Not a lot of battleship and weapons systems are being produced by small businesses, so DoD needs to maximize its business with industries like the AE industry, where it can be successful using small businesses. So there will be more small business opportunities than ever before.

![]()

When do you see the BIL projects really taking off?

![]()

In many cases, they already have. But I would look to 2023 and 2024 and beyond before we start seeing the real heavy workload driven by BIL. Given the prediction of a looming recession, that’s all the more reason to seriously consider the federal market as part of your strategy in the coming years.

Mark Goodale leads Morrissey Goodale’s strategic planning practice. Call him at 508.254.3914 or send an email to [email protected].

Market Snapshot: Office (Part 1)

Weekly market intelligence data and insights for AE firm leaders.

Introducing the Market Snapshot series. This section will include sector-specific market intelligence data and insights to help AE firm leaders stay informed.

Overview

- The office category of construction primarily includes administration buildings, computer centers, office buildings, and professional buildings.

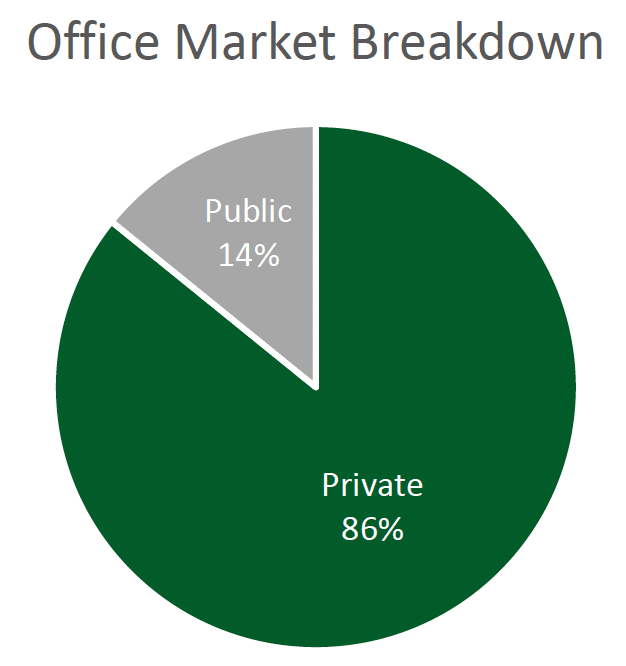

- Approximately 86% of total office construction is private.

- Government-owned buildings include city halls, courthouses, state capitols, and other municipal buildings.

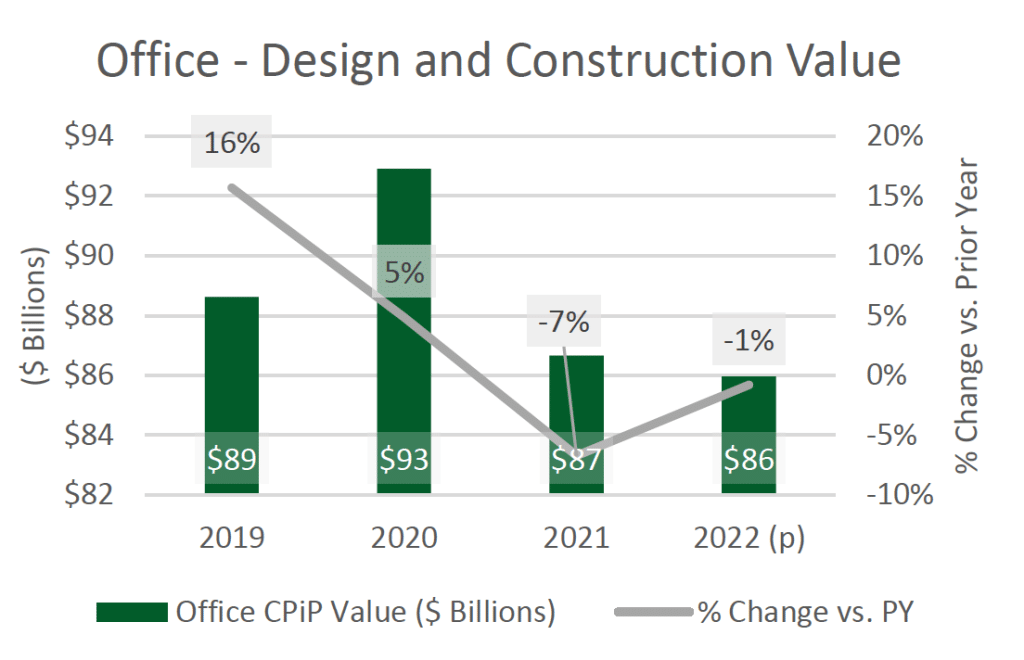

Market Size*: $86.0 billion

*Based on Value of Construction Put in Place (CPiP) – 2022 preliminary estimate (U.S. Census Bureau)

Outlook

- The market for office building design and construction is expected to decline in 2023.

- The increase in remote work and hybrid arrangements is driving office vacancies. However, it will increase demand for redesigns and improvements favoring collaboration, space sharing, energy efficiency, and well-being.

- Changing occupancy patterns (e.g., days of the week) may impact building operations and maintenance needs.

In next week’s issue, we’ll look at trends and hot spots for this sector. To learn what’s ahead for other markets, don’t miss our January 24 online event: Morrissey Goodale’s 2023 Market Outlook for the AE Industry. Click here for details and registration.

For customized market intelligence and research, contact Rafael Barbosa at [email protected] or 972.266.4955. Connect with him on LinkedIn.

Weekly M&A Round Up

Congratulations to Bruce E. Brooks & Associates (BBA) (Philadelphia, PA): The MEP engineering firm joined IMEG (Rock Island, IL) (ENR #71), a national engineering and design consulting firm. The addition of BBA adds to IMEG’s continued growth in the eastern part of the country and expands the firm’s service offerings in the Philadelphia area. We’re thankful that the BBA team trusted us to initiate and advise them on this transaction.

Industry M&A is up 6% over the past 12 months: The new year kicked off with nine new domestic deals, including three in the rapidly consolidating Southeast. One overseas transaction occurred in the UK. You can check all the week’s M&A news here.

June 12-14, 2024 Las Vegas, NV

Western States M&A and Business Symposium

Join us for the 10th annual Western States Symposium, bringing together over 200 AE and environmental industry executives and investors in one of the world’s most vibrant and iconic cities.

Learn More

Subscribe to our Newsletters

Stay up-to-date in real-time.