Word on the street > Going Global—World Cup Edition

Word on the Street: Issue 130

Weekly real-time market and industry intelligence from Morrissey Goodale firm leaders.

Going Global—World Cup Edition

Over the years, we’ve helped a number of overseas AE and environmental firms craft and execute their strategies (typically through acquisition) to enter the U.S. market. But it’s not until this year that we’ve been approached by U.S.-based firms to help them craft and execute their strategies to grow overseas. For some, it’s because they’ve been inspired by the gleaming towers and seemingly permitting-free, super-modern infrastructure of 2022 World Cup host nation Qatar. (Although, can it really be called a World Cup if footballing giants Ireland are not in the competition?)

But for most, it’s a result of market opportunities—either strategic or opportunistic—and trying to figure out how to capitalize on them. If you’re considering growing beyond the U.S. 50 states and 14 territories, here are some points to consider:

Risk vs. reward: There better be a massively superior return available to your shareholders in order for you to take on the additional risk of working overseas. Regardless of whether it’s Luxembourg or Liberia, or if you’re following a long-time, trusted client or starting an office from scratch (on the latter, please just don’t do it anywhere outside of the U.S.), your firm’s risk profile jumps dramatically when you move offshore. What additional risks? The spectrum is as wide as it is scary. It starts with the relatively benign currency risk—you won’t end up in jail, but you may end up in the poorhouse. And then—like the double black-diamond slope that you mistakenly took the chairlift to—it moves hard right and down fast to those risks that are more stomach-turning for the uninitiated, ill-advised, and under-capitalized. These include country/political risk (from coups to wars—do you really want your people on the ground when things get hot?), regulatory risk (Elon’s learning a thing or two about EU labor laws and how hard it is to fire or lay off folks in other countries), and compliance risk (believe me, there is plenty of opportunity here at home that does not require your general counsel scheduling a “private” Teams call with you titled “Foreign Corrupt Practices Act—What We Should Have Known”). And I haven’t even covered commercial or intellectual property risks. For some reason, architecture firms seem to regularly ignore several of these risks when pursuing overseas iconic projects.

Sure, globalization is real, but…: What does that mean for a U.S. AE or environmental firm that is looking to grow overseas? A key finding from the 2021 DHL Global Connectedness Index Update is helpful: “Global connectedness is still limited in absolute terms. Domestic activity far surpasses international activity, and international flows are strongest between neighboring countries.” Further, research by Pankaj Ghemawat, Director of NYU Stern’s Center for the Globalization of Education & Management, and Steven A. Altman, senior research scholar at the NYU Stern Center for the Future of Management, shows that exports of goods and services add up to only about 20% of world GDP (once adjusted for output that crosses borders more than once). Surprised? You’re not alone. Managers they surveyed across six countries estimated these international production and trade metrics between 37% and 41%. We’re not nearly as “globalized” as we think. In other words, maybe Toronto, not Tokyo, is your future overseas headquarters. Plus, talk to any retired CEOs who have run a global business in our industry, and they’ll tell you the pain of long-haul flights to Asia, Africa, and Europe. The answer to your global expansion may be closer to home than you think.

The trade agreement formerly known as NAFTA: Look, I know the feeling all too well. You’re trying to cross into Canada on a business trip, and it seems like USMCA doesn’t help you at all and is just a really bad opening Wordle word. But in reality, USMCA provides you with the almost perfect platform for expansion beyond the U.S. Given that Canada and Mexico are the second- and third-biggest trading partners for the U.S., you should seriously consider any initial overseas expansion into one of these two neighbors. After you’ve spent six months and a ton of money on research to assess which countries you should consider prioritizing to help set your strategy, you’ll find that they are the world’s 9th and 15th largest economies, respectively. You’ll see that they fall into the “Mostly Free” (Canada) and “Moderately Free” (Mexico) categories of the 2022 Index of Economic Freedom. On that note, the U.S. also falls into the “Mostly Free” category. If I were advising you, I’d suggest you think twice about looking to expand in any of the 57 countries in the “Mostly Unfree” category. And if you plan on having an actual money-making venture overseas that your employees and clients feel good about, don’t even think about countries that fall into the “Repressed” category. (“Why does it always seem like there is someone listening in on our Teams calls with our North Korea office?”) There’s a high probability that one of your existing clients or employees or business connections already has supplier or sales connections in one of these two countries. So, between their proximity to the U.S., the opportunities presented by their economies, and their relatively business-friendly business environments, you would do well to focus your expansion strategies on one or both of Canada or Mexico.

China 0 – Mexico 1: You may have noticed that things are not going swimmingly in China these days (see Foxconn riots, Covid lockdowns). And with it, U.S. businesses are getting concerned. It’s not just Apple that’s reconsidering its commitment to China. The U.S.-China Business Council (USCBC) reported recently that more than half of its 117 member firms had cancelled or delayed investments in China due to ongoing instability. One of the likely beneficiaries of this situation specifically, and “reshoring” in general, will be Mexico. The country’s combination of manufacturing competencies, low-cost structure, direct access to U.S. markets, and relative political stability makes it a likely destination for a lot of new industrial development over the next decade.

What’s the exit strategy? Most U.S. design and environmental firms seem to find themselves working overseas for one of three opportunistic reasons. Either a private-sector client has asked them to support them in a project in another country (how can you refuse?). Or an employee has a private- or public-sector connection (most likely through a relative) with a project opportunity. Or there’s an RFP for an iconic facility or infrastructure element that requires U.S. know-how and capital. These three opportunities tend to have very different outcomes. For most, the first approach lives and dies with the client’s work, and the exit strategy can be managed so long as the client relationship is solid. The second almost always turns out to be a major (unprofitable) distraction—a terrible waste of time, treasure, and talent and a painful exit. The third tends to end with an exit strategy that results in an iconic project featured on the company’s website, a burnished reputation, and a 50/50 chance of a balance sheet shredded by poor risk management.

Three tips for strategic success: If you are planning to expand overseas strategically (rather than responding to an opportunity), here are three tips to keep in mind: (1) Make sure your first overseas operations are located in a city that is a direct, non-stop, non-connection flight from your U.S. headquarters. If you have to take a connection, you’re essentially throwing sand into the gears at the very start of your initiative. It’s a huge disincentive to connect physically with your overseas clients and employees and creates an unnecessary time sink. Keep it simple; keep it direct. (2) Leverage your clients. In your assessment of which country to prioritize, your clients are your force amplifier. If they are already doing business there, use their connections to advance your agenda. (3) Know your strengths. Be they technical or otherwise, figure out what it is about what you are offering that will allow you to overcome the cultural, business, and regulatory differences in your targeted country.

Opportunity cost: The question at the start of any consideration to grow overseas is “Why?” There’s a reason that there are more acquisitions of U.S. design and environmental firms annually by overseas firms (31 and counting in 2022) than in any other country. That’s because the U.S. market for AE and environmental services is the largest, most stable, and most accessible in the world. So, if you’re considering expanding overseas, into a nation that likely has a GDP less than either of California or Texas, has less regulatory and commercial protections, and less political stability, someone on your team should be asking “Why?” Most U.S. firms have minimal shares of the markets they serve domestically. A cold, hard analysis would likely show a more sustainably profitable future for most U.S. firms lies in the U.S. and not overseas.

Overseas expansion. Is it in your future? Questions or comments, email or call Mick Morrissey at [email protected] or 508.380.1868.

The Two Biggest Wastes in Your Firm Today—Guaranteed

Why do employees in some AE firms produce a whole lot more value than employees in others? Are they smarter? More innovative? More resourceful? More talented? More driven? Or maybe they just “get it”?

Nope. It’s none of those things. The abilities and potentials of AE professionals do not differ much from one firm to the next. I’ve worked with architects, engineers, and scientists from more than a thousand companies, and on the whole, they are intelligent, creative, talented, skilled, hard-working, well-intentioned people.

So, why do employees in some firms crawl while employees in other firms fly? Because in some companies people listen and speak, and in others, they don’t.

Let’s take a closer look at the two biggest wastes in your organization today.

Waste #1: Not Listening

Whenever power is concentrated at the top, there’s a good chance listening isn’t happening on a regular basis. Either there isn’t sincere interest in listening in the first place, or the desire is there, but the CEO dominates the discussion and dismisses every observation, comment, and question (or worse yet, treats each of them as a hostile challenge). As a result, potentially good thoughts and ideas are wasted, and people don’t develop.

Listening at a master level requires a great deal of self-awareness and practice. If you’re serious about becoming a good listener, here are a few rules to keep in mind:

1. Don’t talk.

The first rule of listening is “Don’t talk.” If you are talking, you can’t be listening. If in doubt whether to listen or talk, listen. Don’t assume you have to do anything but listen.

2. Be aware of your own filters.

The world shows up to us in different ways. We all have unique experiences and views, and they can shape how we process what people are trying to show or tell us. Being conscious of our own filters allows us to open up to all kinds of possibilities.

3. Don’t argue mentally.

Architects and engineers are pretty good at not talking over people—but they do tend to argue mentally. That means they silently agree and disagree with what’s being said. When the listener does that, there’s no reason for the speaker to go on. So listen to understand, and you may be surprised at what you learn after you thought you already knew it all.

4. Resist the urge to solve problems.

Architects and engineers are problem solvers by nature. But you don’t need to solve everyone’s problem every time. Often people don’t even want you to solve their problems—they just want you to listen. Listening is a function of giving your full attention and a willingness to be changed by what is being said. Listen from a place of curiosity. Don’t try to solve the puzzle. Don’t make a case. Just endeavor to understand.

It only takes one or two instances of not listening to teach even those who would speak up to clam up instead. And that brings me to the second biggest waste…

Waste #2: Not Speaking

If you can’t say good things about others, don’t say anything at all. It’s better to be thought a fool than speak and remove all doubt. Be quiet or speak something worthwhile.

It’s this kind of conventional wisdom that has conditioned us to fear being judged by what we say. We’re afraid of being labeled as the one who always asks the dumb question, floats the goofy idea, or whines. There are lots of negatives associated with speaking up, and people can get discouraged trying to make something good happen. They give up being dissatisfied and become resigned. They figure that the organization doesn’t listen, so they quit speaking.

Others use the excuse that they don’t have enough knowledge or experience to offer an observation or opinion, or it’s not their place to speak up. Given the life and safety consequences associated with many types of AE projects, this kind of dynamic can prove disastrous.

In any case, while fear and resignation are understandable, they greatly diminish the potential of an organization and the people in it, and sometimes could even put both at risk.

Not listening and not speaking, two wastes joined at the hip, are incredibly limiting to AE firms. So make it a 2023 company goal to get much better at listening and speaking, and you’ll find yourself tapping into the ingenuity, talents, and wisdom of your people—I guarantee it.

To improve two-way communication at your firm, call Mark Goodale at 508.254.3914 or send an email to [email protected].

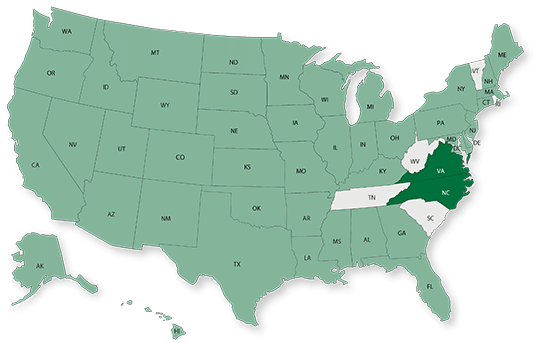

50 in 50: North Carolina and Virginia

50 states in 50 weeks: U.S. states economic and infrastructure highlights.

Our team is putting together new content and a different format to kick off Word on the Street in 2023. For that reason, we will be publishing the remaining states of the 50 In 50 Series in a combined fashion. This week we are featuring North Carolina and Virginia.

Key Economic Indicators

| Measure | North Carolina | Virginia |

| GDP (billions) | $533.1 | $494.6 |

| GDP 5-year CAGR (U.S.: 1.6%) | 1.8% | 1.4% |

| GDP per capita (U.S.: $58,154) | $51,561 | $57,964 |

| Population (millions) | 10.5 | 8.6 |

| Population 5-year CAGR | 0.7% | 0.5% |

| Unemployment (U.S.: 3.7%) | 3.8% | 2.7% |

| Economic outlook ranking | #3 | #24 |

| Fiscal health ranking | #14 | #12 |

| Overall tax climate ranking | #11 | #25 |

* Compounded annual growth rate (2017-2021)

Top three industries by GDP Growth (last five years):

| # | North Carolina | Virginia |

| #1 | Professional, scientific, and technical services | Information |

| #2 | Information | Management of companies and enterprises |

| #3 | Administrative and support and waste management and remediation services | Administrative and support and waste management and remediation services |

Areas with the highest population percentage increase in 2021 vs. 2020:

| # | North Carolina | Virginia |

| #1 | Pinehurst-Southern Pines, NC Micro Area | Winchester, VA-WV Metro Area |

| #2 | Kill Devil Hills, NC Micro Area | Richmond, VA Metro Area |

| #3 | Raleigh-Cary, NC Metro Area | Charlottesville, VA Metro Area |

Infrastructure Highlights

North Carolina has allocated about $2.9 billion from American Rescue Protection Act (ARPA) funds towards infrastructure projects. Over 60% of those funds went towards water and wastewater system improvements. As for the more recent Bipartisan Infrastructure Law (BIL), according to the American Road & Transportation Builders Association (ARTBA), the state has started 862 transportation projects after the first year of implementation. In addition, $199 million has been announced for water infrastructure as well as $139 million for resilience against weather events.

Virginia has been allocated over $4.3 billion so far from the BIL. According to the ARTBA, 908 transportation projects have been started with the $3 billion that has been made available for roads and bridges. As to water funding, $126 million has been announced and will cover lead pipe replacements and other projects intended to ensure safe drinking water for residents. Most of the water funding will be deployed through the U.S. Environmental Protection Agency (EPA).

AE Industry

| AE Industry Metric | North Carolina | Virginia |

| ENR 500 firm headquarters | 8 | 25 |

| M&A buyers since 2018 | 34 | 58 |

| M&A sellers since 2018 | 86 | 63 |

For customized market research, contact Rafael Barbosa at [email protected] or 972.266.4955. Connect with him on LinkedIn.

Weekly M&A Round Up

Congratulations to Atwell (Southfield, MI) (ENR #81): The fast-growing consulting, engineering, and construction services firm acquired Ben Dyer Associates (Mitchellville, MD), a civil engineering, planning, and surveying firm. The acquisition expands Atwell’s reach into the Mid-Atlantic region and will strengthen Atwell’s ability to support a variety of land development projects, including single- and multi-family residential, commercial, and industrial. We’re thankful that the Atwell team trusted us to advise them on this transaction.

Congratulations also go to Cal Engineering & Geology (CE&G) (Walnut Creek, CA):The geotechnical engineering firm is joining environmental and engineering consultant Haley & Aldrich (Burlington, MA) (ENR #110). The combination strengthens both firms’ abilities to help clients address pressing geotechnical, environmental, and sustainability issues. We feel privileged that the CE&G team trusted us to advise them on this transaction.

Industry M&A is up 4% over the past 12 months: Deals last week in FL, NH, and MD showcase how the competitive environment up and down the East Coast is being transformed by M&A. Other deals took place in CA, TX, LA, Australia, Norway, Denmark, and the UK. You can check all the week’s M&A news here.

June 12-14, 2024 Las Vegas, NV

Western States M&A and Business Symposium

Join us for the 10th annual Western States Symposium, bringing together over 200 AE and environmental industry executives and investors in one of the world’s most vibrant and iconic cities.

Learn More

Subscribe to our Newsletters

Stay up-to-date in real-time.