Word on the street > Inside the Pressure Cooker of the Overwhelmed AE Manager

Word on the Street: Issue 126

Weekly real-time market and industry intelligence from Morrissey Goodale firm leaders.

Inside the Pressure Cooker of the Overwhelmed AE Manager

Four factors are combining to stress out AE and environmental firm project and operations managers across the industry. There’s no relief in sight—and it’s taking a toll on morale.

Record backlogs: Spend time with any industry manager and eventually the conversation will turn to just how much work the firm has. How much work? “A year’s worth.” “A year and half.” “Years!” “Never had so much work.” “I’ve never seen this backlog of work before—ever.” Check out the Q3 earnings reports from the industry’s publicly traded giants. Their backlogs stand at record levels and have grown consistently over the past 12 months. When they get some time to reflect (rare these days), managers view the situation as bittersweet. Sweet, because of the guaranteed work and healthy bonuses that come with such unprecedented demand for their firm’s services. Bitter, because they’ve been on this treadmill for close to three years, and not only has someone removed the big red “stop” button to prevent them from getting off the treadmill, they can’t even put the machine into “cool down” mode. It’s everything all the time. The primary and only mission is to manage the backlog. Don’t drop the ball. Stay as close as you can to keeping on schedule and keeping clients happy. 24/7. For the foreseeable future and beyond. The opportunities for managers to rest, recover, and replenish are fewer and farther between. Many of them can’t believe it’s already November. The year has flown by. And next year looks like more of the same.

I still haven’t found what I’m looking for: In a perfect world, years of backlog would be the greatest problem ever. But we’re far from nirvana. Need to on-board an architect with 7 to 10 years’ experience pronto? Critical that you hire a deputy project manager with a PE and SE? Can’t deliver on your backlog of work without a registered surveyor? Well, good luck with that. A dearth of qualified talent is nothing new in this industry—we’ve been in that valley for 20-plus years. But the pain felt today by managers scouring resumes from Indeed and ZipRecruiter and sitting through yet another interview with a candidate who is maybe a “B” player but feels like they should be compensated like an “A” player while working maybe 30 hours a week is like nothing before. Every one-hour interview that they conduct is a weird blend of hope and resentment. Hope, that this 10th interview of the week will yield Neo, “the one.” Resentment, because I have a deliverable that needs to be checked and sent by 6 P.M., but instead I need to put on my “we’re a great place to work” face and calmly answer a stranger’s questions about if there will be opportunities for her to travel as part of this position. Every manager has hiring needs in the urgent/important quadrant with many of those being in that quadrant for over a year. Across the industry, managers have had to work with their teams and departments understaffed for over two years. This is the new normal. And it’s not healthy for managers, employees, clients, or firms. While we’re not happy with it, we’ve become conditioned to it. The industry’s managers are nothing if not accountable and responsible—to their clients and their firms. They live by a code of “I made the commitment, so I’ll keep the commitment. I won’t let my client down.” So, they grin and bear it. But, without enough staff to do the work, managers end up managing AND doing the technical work. This further adds to their stress. And it drags them into lower-leverage activities, a dynamic that as it continues over time is corrosive to the soul, not sustainable, and a contributing factor to managers getting burned out and leaving.

Unwarranted, unbelievable, untenable: Such are today’s compensation requirements of new hires—at every level. Managers need the help desperately. But they also have salary and compensation guidelines that are supposed to keep order in their world. Call them what you will, these guidelines (limits? budgets? rules?) have been thrown out over the past year and replaced instead by “exceptions to the rule” on a regular basis. Managers resent blowing up their internal systems for new hires. They feel it violates the loyalty and implicit contracts that they have with their existing team. And they’re correct. Because when word gets out—as it always does—that a new hire’s compensation blows away that of teammates who have kept their heads down and taken the 3.5% annual raise for 3, 5, 10 years, the team dynamic goes sideways—just at the time when the manager needs the team fully focused on working through backlog. Then the next thing is the manager has a long-time employee standing in their office (or these days on a Teams call) upset with the situation and demanding more pay, or else…The domino effect. More pressure. More risk. And the backlog continues to grow.

Hello, I must be going: AE and environmental firms big and small, around the country, of every type, are seeing spikes in voluntary turnover. Mostly it’s happening with less tenured and younger employees. But the phenomenon is real, and it’s compounding the stress felt by operations and project managers. No sooner have they put their team in place, one or more employees, who they were relying on, hands in their notice. They’re headed to another firm for more money. Or a different state to practice basket weaving. Or maybe a new country to get in touch with their inner self. Regardless of the reason, it’s happening at record levels—everywhere. It’s yet another source of pressure for operations and project managers. The dynamic inserts a huge element of uncertainty into an already fraught dynamic where managers are overworked and understaffed. It also provides a perverse incentive for managers not to hire staff, out of concern that new hires from 2022 and 2021 cannot be relied on to stay and become embedded. Managers are reluctant to invest precious time in training and development that has a higher probability of being wasted when an employee leaves after a year. They figure that time would have been better spent actually managing and making a dent in the backlog of commitments that they have.

Something’s gotta give: Overwhelmed and understaffed, managers have less time to invest in the training and development of their people and their own career development. This is especially true in hybrid work environments where the opportunity for physical interaction between managers and employees has become limited and most frequently happens on Tuesdays and Thursdays. I’ve seen this many times over the past year in our work with clients. High-caliber, high-potential employees—particularly younger ones—feel like they are not getting the opportunity to advance and that their managers are not “there” for them. This is not surprising given everything that their managers are dealing with. But this is a vicious circle that is a contributing factor to the higher-than-usual turnover rates that the industry is experiencing. And for the most part, the ability to access support or help to break this cycle is woefully lacking as corporate services are also maxed out.

First- and second-order impacts: The current dynamic of too much work and not enough staff adds up to one thing—record profits. Which on the face of it is a great thing. But in reality, the system is out of balance. The industry is likely building up record levels of mistakes (rushing a design and/or learning on the job is no way to run a business; we all know that) in deliverables that will have to be paid for down the road. We’ve seen mergers put on ice because the seller cannot meet its backlog requirements because they don’t have enough project managers to do the work that they have in-house. The buyer doesn’t want to take on this liability and puts a condition in place that they will not do the deal until the seller hires the PMs. See above. It ain’t happenin’. Manager burnout and turnover is also up industry-wide. The perennial industry problem of elevating great technical folks to lousy managers has been brought into focus over the past two years. I’ve talked with countless managers in 2022 who would love nothing more than to be designing, calculating, analyzing, checking – anything but managing.

Releasing the pressure: There’s no easy answer here. But larger firms are better equipped to deal with the challenges. They have more resources to invest in recruiting and retention. They have better knowledge systems in place to support collaboration and optimize human capital allocation. They have a greater ability to outsource overseas. They tend to have better HR leadership that invests in flooding the system via social media, campus visits, and direct recruiting from competitors so that they have a more robust pipeline of talent to choose from. They (should) be able to provide better benefits packages and be in a better position to provide more flexible working arrangements to meet the unique needs of individual employees.

Questions, thoughts, ideas? To connect with Mick Morrissey, email him at [email protected] or text/call at 508.380.1868.

Don’t Just Hope—Ask These 4 Questions Instead

Will things break against us in 2023? I hope not. But hope is a lousy business strategy. Instead, think about how you are going to lead your business through 2023—a year that could very well be full of landmines—by asking yourself these four questions:

1. What is truly driving my business?

- Within each of your business units, determine what is in your control, such as marketing, business development, collections, etc., vs. what is out of your control (e.g., interest rates, inflation, etc.). With those factors in mind, determine whether you can increase your competitiveness in specific business lines, and how.

- Determine what your clients need from you today and what will they need 18-24 months from now. Understand what they are willing to pay for, and what they plan to live without. If your firm starts losing clients, find out why, and fast. Is your firm being replaced by other service providers, or are clients simply going into hibernation in certain sectors?

- Observe how your toughest competition is adapting to these same drivers. How are they being innovative about marketing and business development? Are they hiring key staff, unloading costs, or leveraging technology in a different way?

2. Am I hanging on to strategies and people that aren’t working out?

- Given the massive backlogs many firms appear to be accruing these days (see Mick Morrissey’s article), you may have turned a blind eye to strategic initiatives that continue to go nowhere and people that aren’t working out for one reason or another. But you need to be decisive in this economy. Put the right people in the right roles and don’t let fear, turf, ego, or inertia hold you back from making the moves you know need to be made for the good of the company.

- If you need to abandon a business line, do it, and do it fast. Do not support a service that is no longer valued by your clients. If there is potential upside to underperforming business units and offices, keep them on a tight leash.

- Not only must you be aware of the firm’s cash situation, but you also need to regularly update and inform your senior managers as well. They need to understand the firm’s cash position so they can positively influence it. Shielding managers and staff from the firm’s actual financial performance will do more harm than good.

- Continue to challenge your firm’s current rate of spending. Revisit your lease agreements to see if you can reduce monthly payments for office space, negotiate lower interest rates on loans and lines of credit, reduce vendor and supplier costs, and ramp up collections efforts. Get into good habits before the pressure is on.

3. What parts of my business need investment?

- Look at your business units as though they are part of your own, personal investment portfolio. Which businesses would you invest in and why? Some of your businesses likely feed others, so that value must be taken into account. Develop a simple filter that allows you to compare the growth opportunities that exist within your firm’s business lines. Is there funding? Does the business have the potential to help position the firm as an industry leader? Does the business allow the firm to provide superior service? Does the business lead to the firm being a great place to work? Do you have a champion for the business? Is there passion for the business? Place your bets accordingly.

4. Do the employees see me as a strong leader?

- All eyes are on you. You need to keep your staff engaged, confident, and busy. And to do that, you need to be engaged, confident, and busy as well. If you are not coming across that way, don’t expect morale to hold up. Connect frequently with the staff, let them know where the company stands and what they can do to help the firm make the most of a bad economic situation. And tell your top performers how much you value them and why. This type of recognition can go a long way in encouraging your staff to do all they can to help the firm survive and thrive.

I hope we don’t experience a downturn. I also hope you don’t rely on hope in 2023.

Need help planning for 2023 and beyond? Call Mark Goodale at 508.254.3914 or send an email to [email protected].

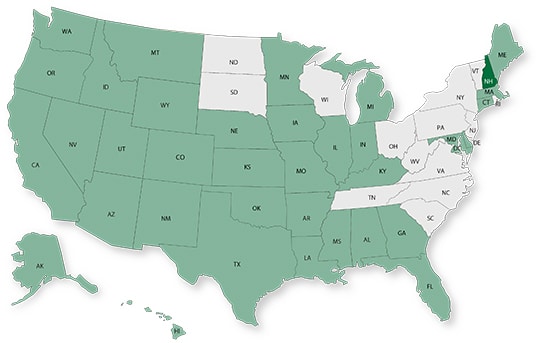

50 in 50: New Hampshire

50 states in 50 weeks: U.S. states economic and infrastructure highlights.

Key Economic Indicators

GDP: $81.9 billion

GDP 5-year compounded annual growth rate (CAGR) (2017-2021): 2.5% (U.S.: 1.6%)

GDP per capita: $60,275 (U.S.: $58,154)

Population: 1.4 million

Population 5-year CAGR (2017-2021): 0.7% (U.S.: 0.5%)

Unemployment: 2.2% (U.S.: 3.9%)

Economic outlook ranking: #18 out of 50

Fiscal health ranking: #25 out of 50

Overall tax climate ranking: #6 out of 50

Key Sectors and Metro Areas

Top five industry sectors by 2021 GDP:

Top three industry sectors by GDP 5-year CAGR (2017-2021):

Top areas by population percentage increase in 2021 vs. 2020:

- Laconia, NH (Micro Area)

- Keene, NH (Micro Area)

- Lebanon, NH-VT (Micro Area)

Infrastructure Highlights

In New Hampshire, ports, stormwater, and wastewater infrastructure received the lowest grades based on the last ASCE report. This year, the state saw a 47 percent increase in the amount of money dedicated to roads and bridges, which allowed certain underfunded projects to get going. Additionally, 16 communities received about $18 million in grants and loans for water and wastewater projects. New Hampshire has identified over 22 projects for the $407 million in funding the state has been allocated thus far as part of the Bipartisan Infrastructure Law (BIL). Over the next five years, New Hampshire’s BIL funds will address the following categories of projects (additional funds may be deployed as federal grants get awarded to states):

Construction spending (Value of Construction Put in Place – CPiP):

- Private Nonresidential 2021 CPiP: $856 million; -1.1% 5-year CAGR (2017-2021), below overall U.S. CAGR of 1.4%

- State & Local 2021 CPiP: $754 million; -3.9% 5-year CAGR (2017-2021), below overall U.S. CAGR of 4.0%

AE Industry

ENR 500 firm headquarters (2022): 1

M&A activity since 2018:

- 2 deals with buyers from New Hampshire

- 11 deals with sellers from New Hampshire

For customized market research, contact Rafael Barbosa at [email protected] or 972.266.4955. Connect with him on LinkedIn.

Weekly M&A Round Up

Congratulations to Delta Engineering & Inspection (Lakewood Ranch, FL): The consulting and engineering firm that offers inspection, engineering, project management, and expert witness services joined forensic engineering and technical consulting services firm Rimkus Consulting Group (Houston, TX). With services along the entire Gulf Coast, in Florida, and up into the Carolinas, Delta will strengthen Rimkus’ position in the Southeastern United States. We’re thankful that the Delta team trusted us to initiate and advise them on this transaction.

Industry M&A is up 15% over the past 12 months: Last week we reported eleven deals announced in FL, TX, ID, CO, NV, CA, and OH. Five new international transactions were announced in Australia, South Africa, the UK, and Canada. You can check all the week’s M&A news here.

If you’d like to know more about our M&A services, and how we can help you either confidentially sell your firm or grow through acquisition then please contact Nick Belitz, Principal, at [email protected] or 303.656.6151.

June 12-14, 2024 Las Vegas, NV

Western States M&A and Business Symposium

Join us for the 10th annual Western States Symposium, bringing together over 200 AE and environmental industry executives and investors in one of the world’s most vibrant and iconic cities.

Learn More

Subscribe to our Newsletters

Stay up-to-date in real-time.