Word on the street > From Great to Good

Word on the Street: Issue 125

Weekly real-time market and industry intelligence from Morrissey Goodale firm leaders.

From Great to Good

No, it’s not an ironic refresh of the 2001 omnipresent business book by Jim Collins (seriously, every AE firm CEO at the time bought that book—and most stopped reading after the discussion of a Level 5 leader—but I digress). But it is how many AE and environmental firm leaders are seeing their markets and businesses trending.

Great or the Greatest? The past decade has been one of almost continuous expansion and prosperity for our industry. And since the beginning of the pandemic, that dynamic has been super-charged. Survey after industry survey—from the deep-dive analysis by the super-smart folks at the ACEC Research Institute to the 43rd annual Deltek Clarity Architecture & Engineering Industry Study to the 18th annual Architecture and Engineering Studies (both released this week!) by Boston’s own DGC—show that these continue to be remarkable wealth-creation times for AE and environmental firms. And the vast majority of our clients are experiencing the same. Profits galore. Backlogs off the charts. Quarterly employee bonuses. ROE, ROI, and ROA combining for winning Wordles. Mortgages cashed out. Second homes purchased. College tuition bills paid in cash, not financed. Bucket-list trips taken. Has this been a Great or the Greatest era in living memory for AE and environmental firms? Take your pick.

Winter is coming: But listen carefully, and you’ll hear talk of changes in the market dynamic. Some of these are almost imperceptible, others more obvious. Some have been signaled for a while, while others have appeared almost magically like a leprechaun. Some are driven by obvious external factors—interest rate increases and Ukraine war-related first- and second-order impacts. Others are the result of endemic industry factors—frustrated leadership teams, burned-out employees, and middle managers stuck between both.

Can you feel it? No, not the 1981 foot-stompin’ classic by the Jacksons. But instead, the softening of the development markets for AE and environmental services. In our work, a growing number of clients and M&A prospects are reporting a slowdown by residential developers—directly related to rising interest rates. It’s a mixed bag—primarily hitting “marginal” projects or ones that were in early stages without funding locked in. Second-order effects could translate into slowed capital improvements in public-sector projects such as the K-12 market. Activity among homebuilders is beginning to cool down. Some are now looking for their designers to cut their fees. This also varies by region—with slowdowns more frequently reported in the Sun Belt. Commercial development, too, is in flux around the country. Proposal activity in certain Southeast states has slowed, and the number of commercial development deals that will never make it to proposal has spiked. Reports from the West and Midwest speak to still-strong commercial and industrial development markets.

Post-pandemic hangover: Firms that were making money hand-over-fist in the warehouse and distribution boom that was driven by everyone shopping online during the Tiger King phase of the pandemic have seen that market slow down and shift. The smart firms anticipated the change and have already made the pivot to still-hot adjacent industrial markets such as life sciences and data centers. Despite all of the talk of pandemic-driven “reshoring,” some clients are reporting slowdowns in task orders in certain pharma and biotech niches. Part of this is because so many owners pushed projects through at year-end 2021, and part is due to delayed/reduced capital spending in anticipation of economic headwinds. New task orders are still strong but being rolled out at a less frenetic pace than 12 months ago.

Calm before the storm: Some leadership teams are even becoming worried about their municipal work—particularly in the Mountain states and west. They have not seen a slowdown yet, but there’s been a sentiment that they expect the local agencies and municipalities to get “cautious” and start to delay decision-making and/or they anticipate pushback on pricing. Pro tip: Those who are feeling least concerned about this possible market shift have dedicated resources in-house to help their municipal clients secure funding. This should be a table-stakes investment for any firm serving municipalities, and it’s a critical one in tight times (not seen since 2010ish). The IIJA funds will flow. But accessing the money will be like navigating a corn maze for municipalities and agencies. Firms that bring this expertise to the dance will win the blue ribbon for the largest pumpkin. We’re also hearing of slowdowns—or pauses—in public-sector work in Texas. But most firms are anticipating that this is but a calm before the IIJA storm makes its way to them.

Reading the tea leaves: More and more in our strategy and M&A work, we are seeing this market softening beginning to play out in financial performance. This time last year, our analysts were poring over income statements and balance sheets that all pretty much screamed “record year, yea!” This year is different. We’re starting to see a compression of profits in 2022. Plus, we are seeing many firms coming off of huge growth years in 2021 that have leveled out or grown only nominally this year, while supplies, G&A expenses, and labor costs have grown exponentially. (Turning around to check on the canary I brought down in the mine with me to write this article.)

A white flag of truce? Could we be seeing a moderation in the white-hot market for talent? We’re hearing from more and more clients that they are seeing some labor market shifts over the summer. Better candidates have been in the market, and they’re making “more reasonable” salary demands. Too early to tell if things are cooling off, and certainly inflation for goods and services is still rampant. But maybe, just maybe, employees are concerned that there might not be such a robust talent market next year (spoiler alert—there will be) and are choosing to find a place to “settle” now and not feel “overpriced” in their new home.

The great retooling: Those firms that are seeing a slowdown in their development markets are already redeploying talent from there to public-sector projects. Importantly, they are also investing in training and development for these employees to adapt their skill sets and mindsets (BIG difference between working for private-sector clients and public sector-ones) to prepare for an anticipated skew to the public sector over the next five years as IIJA funds flow to the states.

Who took away the punch bowl? Borrowing costs have increased ballpark 10% this year, and lenders have become more cautious when deploying capital. Some private equity and family offices (let’s call ‘em Platinum PEFO) are more than adequately capitalized to blunt the impact of higher debt costs. But Gold and Silver level PEFOs—less well positioned, later to the party—will feel the pinch. The results? First-order effect: Less demand for AE and environmental firms seeking a recapitalization. Second-order effect: Lower valuations. (There’s a very good chance your firm is less valuable today than it was just six months ago just by virtue of rising rates—life is so rich.) Third-order effect: The return of the earnout component in deals. Nobody likes them in the mix. But they will become a necessary evil to get deals done in 2023 as confidence in future projections becomes blurrier (we saw this in the second half of 2020 when the M&A market was defibrillated after stopping in the spring of that year). Fourth-order effect: Relatively more firm sales to publicly traded, ESOP- and employee-owned buyers. Fifth-order effect: This may become the year that family office investors with an infinite hold timeline can outpace private equity in the great industry recapitalization. Coda: If there is a general economic slowdown next year, our industry will definitely still be attractive to investors and certainly more so than industries such as trucking, etc.

This time it’s different? As an industry, we don’t do recessions well. We tend to be one of the first industries to get hit (projects get pulled) and one of the last ones to emerge. So many firms serving the development markets—particularly in the Sun Belt—had their balance sheets shredded during and after the Great Recession (Rule #1: Get paid for your work; don’t let the boom times take your eye off of your AR) and were forced into bankruptcy or sold for pennies on the dollar. Same with prior recessions stretching back to the late ’80s—we got hammered. But things are different this time. While interest rates are rising and hitting development, the economy grew 2.6% in the third quarter, backlogs are still at record levels, and the IIJA looks set to buoy public-sector projects around the country.

Great to Good? So, while we’ve been conditioned as an industry to view a slowdown in markets as a harbinger of hard times (Gerard Manley Hopkins would be proud), there are plenty of signs that would suggest that that is not the case for us this time around. Maybe instead of going from boom times to bust, we’ll be going from Great to just, kinda, well…Good.

Thoughts, comments? Where is the industry headed in the short term? Are the boom times over? Email or call Mick at [email protected] or 508.380.1868.

Sweat Some of the Little Things

Are you the type of person that loses sleep over the lone poor grade your firm received on a client perception survey? Are you mortified when your firm’s proposal to the state DOT has the name of another client on one of the footers? Do you feel compelled to return a client call about a simple request in a matter of minutes as opposed days or weeks? Do you even allow enough time for the coffee stain on the rug in front of the reception desk (assuming you are even in an office these days) to set before you’ve already scrubbed it out?

Well then, you are just what the doctor ordered. If more people in the AE industry had your mindset, we’d see more examples of excellence in all facets of our businesses, your clients would be experiencing far better service, and your employees would be more engaged. Now before you get the wrong idea, I’m not suggesting that becoming a carpet cleaner is the highest and best use of your time—in fact, chances are, you probably need to get out of the weeds and delegate more. Nevertheless, here are some little things that are worth sweating over and how addressing them can lead to greater success in your firm:

Little thing #1: Slow responses.

How many of you have the discipline to quickly respond to a request from someone inside or outside your company? We don’t like it when we have to call our attorney three times to get a simple document finalized or ask an employee five times to return a client call. It’s a huge time-waster and incredibly frustrating. Those who depend on you or want to reach you don’t like it any better when they bring an important issue to your attention and it takes you two weeks to respond.

What’s in it for you:

If you promote responsiveness into your firm’s core culture, your clients will simply be blown away and you’ll leave your competition in the dust.

Little thing #2: Typos.

Whether it’s a proposal, report, or presentation, make sure the folks in your firm get in the habit of proof-reading documents before they go out the door- especially boilerplate sections. Mistakes are often buried in boilerplate because they often need to be slightly altered in between versions. Typically, a client name needs to be changed or a sentence altered to fit a specific situation, but these minor edits end up getting missed. An out-of-context paragraph here, a wrong client name there— it all adds up to, “We don’t care.”

What’s in it for you:

Your firm will be seen as reliable, professional, and conscientious. You become the low-risk choice for clients.

Little thing #3: Missed information.

It’s astonishing to me how few firms take advantage of the fantastic, user-friendly, off-the-shelf solutions out there. Client intel is gold. Load in contact information and anecdotes, track your leads and proposals, and update new information. Assign a dedicated resource to review the status of leads and proposals with PMs at least once a month.

What’s in it for you:

More informed interactions with clients and potential clients who see that you understand and care about their needs. Make grounded assessments and sound decisions about which opportunities to pursue and which to throw back.

Little thing #4: Web site errors.

You don’t have to search far and wide to find many a glaring error or typo on web sites. Don’t make it easy for your competition by stumbling here.

What’s in it for you:

You make a good first impression with clients and potential recruits, and you don’t chip away at your own staff’s pride in your firm.

Little thing #5: Lonely first days.

Given how hard it is to find and keep good people, the last thing you want to do is send lousy signals on an employee’s first day of work. Ensure that new hires have consistent contact with their supervisors right out of the gate. Lunch on the first day with a senior manager and direct supervisor should be a given. If your new hire is working remotely or in a satellite office, it’s all the more important to make sure the welcome wagon is ready and waiting.

What’s in it for you:

The decision to join your firm is validated and new employees feel like their future contributions will be appreciated and rewarded.

If you sweat some of these little things, you’ll be in for some big rewards.

What “little things” get your attention? Email your thoughts to [email protected].

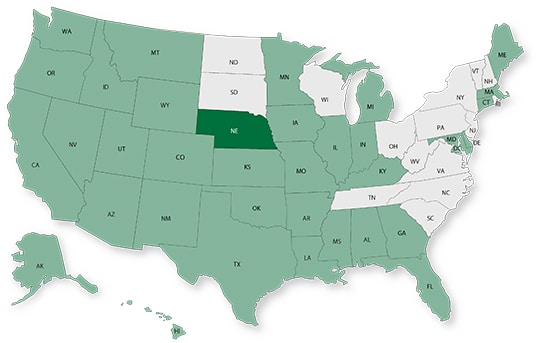

50 in 50: Nebraska

50 states in 50 weeks: U.S. states economic and infrastructure highlights.

GDP: $123.9 billion

GDP 5-year compounded annual growth rate (CAGR) (2017-2021): 2.0% (U.S.: 1.6%)

GDP per capita: $62,849 (U.S.: $58,154)

Population: 1.9 million

Population 5-year CAGR (2017-2021): 0.6% (U.S.: 0.5%)

Unemployment: 2.2% (U.S.: 3.9%)

Economic outlook ranking: #36 out of 50

Fiscal health ranking: #7 out of 50

Overall tax climate ranking: #35 out of 50

Key Sectors and Metro Areas

Top five industry sectors by 2021 GDP:

Top three industry sectors by GDP 5-year CAGR (2017-2021):

Top three metro areas by GDP:

- Omaha-Council Bluffs

- Lincoln

- Grand Island

Top three metro areas by population percentage increase in 2021 vs. 2020:

- Lincoln

- Omaha-Council Bluffs

- Grand Island

Infrastructure Highlights

Nebraska has identified over 85 projects for the $715 million in funding the state has been allocated thus far as part of the Bipartisan Infrastructure Law (BIL). Over half a billion has gone towards roads, bridges, transit, ports, and airports. The City of Lincoln is in the process of implementing an action plan to reduce emissions and deploy EV infrastructure. Of the $63 million made available for water projects in the state in 2022, $28 million is dedicated to lead pipe and service line replacement, and another $17 million for drinking water investments. Over the next five years, Nebraska’s BIL funds will address the following categories of projects (additional funds may be deployed as federal grants get awarded to states):

Construction spending (Value of Construction Put in Place – CPiP):

- Private Nonresidential 2021 CPiP: $2.5 billion; 2.2% 5-year CAGR (2017-2021), above overall U.S. CAGR of 1.4%

- State & Local 2021 CPiP: $2.9 billion; 11.7% 5-year CAGR (2017-2021), above overall U.S. CAGR of 4.0%

AE Industry

ENR 500 firm headquarters (2022): 5

M&A activity since 2018:

- 9 deals with buyers from Nebraska

- 5 deals with sellers from Nebraska

For customized market research, contact Rafael Barbosa at [email protected] or 972.266.4955. Connect with him on LinkedIn.

Weekly M&A Round Up

Industry M&A is up 19% over the past 12 months: Last week we reported seven new U.S. transactions in ME, CO, CA, MA, TX, and IL. The pace of U.S. M&A is slowing somewhat with the 12-month moving average now up just 19%. You can check all the week’s M&A news here.

If you’d like to know more about our M&A services, and how we can help you either confidentially sell your firm or grow through acquisition then please contact Nick Belitz, Principal, at [email protected] or 303.656.6151.

June 12-14, 2024 Las Vegas, NV

Western States M&A and Business Symposium

Join us for the 10th annual Western States Symposium, bringing together over 200 AE and environmental industry executives and investors in one of the world’s most vibrant and iconic cities.

Learn More

Subscribe to our Newsletters

Stay up-to-date in real-time.