Word on the street > A Texas-Sized “Thank You” to Houston

Word on the Street: Issue 123

Weekly real-time market and industry intelligence from Morrissey Goodale firm leaders.

A Texas-Sized “Thank You” to Houston

When 200 AE industry executives and investors from the U.S., Canada, Europe, and Australia come together to learn, share best practices, and network in one of the world’s greatest (and fastest-growing) cities, you know it’s going to be a terrific time. And that’s exactly what it was last week when we hosted our Texas and Southern States M&A, Strategy, and Innovation Symposium at the stunning Post Oak Hotel at Uptown Houston.

Here are some of our team’s takeaways and observations from the Symposium:

Dr. Perryman sets the stage: If you’re running a business in Texas or are considering entering the Texas market and you’re not following Dr. Ray Perryman and his team at The Perryman Group, then you’re doing it wrong. Perryman’s opening keynote was—as always—as enjoyable as it was informative. Here’s what our own Nate Wentworth, senior consultant, took away from Dr. Perryman’s talk: “Dr. Perryman’s opening keynote addressed the broader economy and set the tone for the two-day conference with cautious optimism noting that while we are technically in a recession (two consecutive quarters of negative GDP growth), the strong labor market continues to bode well for the economy in general and for our industry in particular. It was eye-opening to learn that Texas accounted for most of the nation’s population growth last year! Those in attendance agreed that the industry is well-positioned in the near-term with record backlog and not enough talent to get the work done. The challenge of finding qualified talent is going to continue to be a concern for firms that need to burn through their record backlogs that continue to grow. Firms that used to turn to ‘acquihires’ to solve talent challenges are finding that these sellers are also coming with record backlogs of their own and not enough staff to do the work.”

The 2022 M&A scene is lit: Jon Escobar, vice president, delivered some jaw-dropping stats in his “2022 M&A Trends” presentation. For example, did you know that since the beginning of 2021 publicly traded AE industry acquirers have bought twice as many firms with 25 or fewer employees as they have firms of 100 employees or more? The “acquihire” model is real. Jon is anticipating 500 transactions of AE and environmental firms in 2022—another record year of consolidation. Prior to the Symposium, his team surveyed 70 of the industry’s most active buyers to get a read on their priorities for 2023. The top six areas they’re going to be targeting are: (1) transportation, (2) water and wastewater, (3) environmental, (4) MEP, (5) geospatial/surveying, and (6) architecture. When it comes to Texas and the Southern states, most of the consolidation is—not surprisingly—concentrated in the Texas Triangle. Who’s the most aggressive buyer of design and environmental firms in Texas and the South? It’s other Texas firms. Since 2018, Texas buyers have been behind over 30% of the acquisitions in the South.

When women rise, we all rise: The terrific Gen Oraa, partner at CohnReznick, co-moderated our “Advancing Women in the AE Industry” session with our own Tricia Washington, vice president. The guest of honor was Monica Silver, president of 600-person CobbFendley (Houston, TX) (ENR #184), who generously shared stories of her journey from project engineer to president of one of the industry’s leading firms. The networking session was designed to be the spark for participating firms to strategize on how to advance women in the industry and share ideas and perspectives. The attendees discussed thoughts around where the AE industry can impact more women staying and rising in the profession, given the fact that women tend to leave the profession at a much higher rate than men.

Innovate or die trying? Six important themes emerged from the “Innovation—From Concept to Market” panel moderated by Stafford Palmieri, principal advisor. Executives from AECOM, BST Global, WPM Technology, and Earthvisionz spoke to (1) the “corporate antibodies” that will conspire to kill innovation, (2) the importance to innovate “from the edge” and work to the center, (3) the gross understatement in saying that developing a software product is hard and expensive, (4) the need to secure a financial partner to take your software product to market, (5) the preference for the agile development of software—where you have your customers do the testing and validating, and (6) how “featuritis” (your internal team adding features that the market doesn’t need) is a colossal waste of time and energy that can single-handedly kill any chance of taking your concept to market (see theme 5).

Ad Astra: Morrisey Goodale principal Nick Belitz’s discussion around current M&A multiples elicited some audible gasps—and a few groans from the attendees. It was generally good news for sellers and equity holders and spoke to a more challenging market possibly for buyers. Will this market last? As Nick likes to say, “It depends.”

Paying it forward: I had the honor of co-moderating the “Strategy for the Modern AE and Environmental Firm” panel along with the multi-talented Karen Erger, senior vice president and director of practice risk management for Lockton. CEOs from four of the industry’s leading firms—STV Inc. (ENR #35), Huitt-Zollars (ENR #160), CobbFendley (ENR #184), and CDM Smith (ENR #23) shared their knowledge, insights, and advice on industry and market trends, strategy, and strategic planning and best practices. We’re deeply appreciative that Greg Kelly, Bob McDermott, Monica Silver, and Tim Wall—four industry leaders at the top of their games—took the time to share their perspectives with our guests.

The pain of acronyms: A lively “Sellers Best Practices” panel included some humorous discussions around the painful topics of quality of earnings and net working capital—more commonly referred to in the M&A world as QofE and NWC. The panelists shared how important it is for sellers to be aware of these concepts early in any deal negotiations.

Attendee sentiment—cautiously optimistic: We know our own Jeff Lookup, vice president, as a serial networker. No one works the room better than him. Here’s some of what he was hearing from his conversations with execs and investors this week: “Many of the firms I spoke with have some concern relative to market conditions in 2023. Specifically in the residential, commercial, and industrial vertical infrastructure market. But they are all busy and have a significant amount of backlog moving into 2023. In general, the attendees in the public infrastructure markets reported that they have multi-year backlogs and are feeling very confident. But they are also ‘watching for changes in the wind direction from the federal government.’ Even with this cautious optimism, I did not find any attendees that were looking to pull back on their M&A program. I also heard from several buyers that much of their M&A effort is now focused on adding staff capacity in niche services (electrical, mechanical, structural, and survey). In general, they don’t care where the staff are located because they have become comfortable with the hybrid/remote work model. Several firms told me they are targeting MBE/WBE firms for this capacity. Buyers are not as concerned today if they lose some of the capacity/backlog due to loss of the special designation.”

Time is of the essence—or is it? Time was a central theme of the “Buyers Best Practices” panel. Panelists were asked if they were speeding up or slowing down their acquisition processes. The consensus was neither. Buyers are staying the course on their acquisition strategy with refinements along the way. When asked about predictions for the future, the panelists were firmly committed to “more of the same” with ongoing strategy reviews to ensure that acquisitions were pointed towards “smart growth” versus “just growth” and a universal agreement that no matter how far along you are in the deal process, it’s never too late to walk away.

Expertise counts: “The 500 Club” of M&A experts brought a wealth of experience about how deals are getting done and integrated in 2022. George Christodoulo, Dave Sullivan, Kent Collier, and our own Brendon Cussio, vice president, shared legal, tax, risk, and business best practices related to getting deals done.

Couldn’t join us in Houston? Not to worry. We’ll soon be opening registration for our Southeastern States M&A,

Strategy, and Innovation Symposium. The venue will be the beautiful Mandarin Oriental in Miami, and the dates will be March 23 and 24, 2023. This will be another power networking and learning event for AE and environmental industry execs and investors.

Sadly, missing from our team in Houston this year was our partner Mark Goodale.

Questions, thoughts, ideas? To connect with Mick Morrissey, email him at [email protected] or text/call at 508.380.1868.

See you, Dad

Robert “Bob” Goodale was born on June 7, 1934. To say his upbringing was a difficult one would be a vast understatement. The second of eight children, he fended for himself throughout his childhood in every way. He was a rather scrawny kid, but a scrappy one. He was never one to back down from a fight and always gave at least as good as he got, regardless of the odds.

At 17 years old, he left high school to join the U.S. Marines, where he served in Korea. He didn’t talk about it much, but from what I understand, he helped build bridges and sweep mines, and performed other hazardous duties. He also pulled out his own aching tooth while he was there. So yes, he was tough.

He also happened to be a tremendously gifted artist. He was so talented, in fact, that Disney recruited him to be an illustrator. But the job required relocation to the West Coast and my father was too rooted to the Boston area to leave. So, we were destined to shovel snow.

My father’s pencil sketch of his hero, Ted Williams (for my son), and his early 1970’s oil painting of Bobby Orr (actual size 4’ x 6’).

After my father left the service, he joined what was then Foster Wheeler as a draftsman for a stint, then interviewed for a job with Sumner Schein & Associates, a Boston-based AE firm that was the preeminent firm for retail development in New England. Sumner was a true Renaissance man. He was a registered architect, a P.E., a P.L.S, a professional figure skater, and, among other things, a lawyer. He didn’t want to be a lawyer. He just wanted to know what he was up against when working deals, so he went to law school and passed the Bar on his first attempt.

On a Saturday in the early 1960s, my father was cutting the lawn when Sumner called the house asking if my father would come to his office and see him about a job. My father instantly dropped what he was doing and raced into Boston. When he got there, Sumner said, “We need draftsmen.” My father said, “That’s what I do.” Sumner added, “We have a lot of work. There will be a lot of overtime.” My father responded, “Good, I have a growing family and could use the work.” Sumner then asked my father to draw a sketch and do some lettering. When my father handed him his work ten minutes later, Sumner said, “Bob, that’s some of the best drawing I’ve ever seen. But I need to see what you can do freehand. Don’t use a straight-edge.” My father said, “That is freehand.” Sumner simply replied, “Oh, ok. You’re hired.”

My father worked for that same firm for 53 years (it was acquired by Carter & Burgess in the mid-90s, then Jacobs several years after that, but he never left the organization). He was eternally grateful and loyal to Sumner and his family for giving a young man with no formal education a shot.

My father built his own drafting table in the basement and worked down there every night on side jobs—house additions, churches, etc. He knew how important a formal education was, so he took on as much work as possible to make sure his five kids could go to college someday. When I was a little boy, I set up my own drafting table next to his. He would outline buildings for me to color in. But my work never quite seemed to measure up. I said, “Dad, mine doesn’t look like yours.” He quickly replied, “That’s ok. You should go into something that makes you money anyway.”

I’ll always remember the times we spent together riding in the car to and from baseball practices and my youth hockey games. He never missed one. He stood by himself in freezing cold rink after freezing cold rink at all hours, and just watched. He never shouted at a referee or a coach, and never forced me to play anything. I’ll always remember Christmas mornings when that present I wanted so badly but just knew I would never have somehow miraculously appeared under the Christmas tree. And I’ll always remember the late-night calls we had when the New England Patriots (yeah, I know—I ruined the moment for many of you) would somehow pull out a victory long after I had given up. In fact, he and I had the good fortune of going to the famous “Tuck Rule” game in 2001—the year the Patriots won their first Super Bowl. For those of you unfamiliar with that particular game, the Patriots were trailing the Oakland Raiders late in the contest. As Tom Brady moved the team down the field in a driving snowstorm for one last chance to tie the game, he fumbled the ball and the Raiders recovered. Game over. The play was under review, but I just wanted to beat the traffic. “Let’s go, Dad! Let’s get out of here!” I shouted. But my father, who never gave up on anything or anyone, said, “Hold on now, let’s just see what happens.” As the snow continued to accumulate, all I could think of was getting out of that parking lot. It was bad enough the Patriots were going to lose. I didn’t want to sit stuck in traffic ruminating about it. Finally, the referee walked out to the middle of the field and declared, “After reviewing the play, the quarterback’s arm was going forward. It was an incomplete pass.” The rest was history. We closed down Foxboro Stadium in style that night, but if it weren’t for my father, I would have missed the birth of a 20-year dynasty.

When my father was diagnosed with bladder cancer this summer, he took it right to the end of the game, just like he did that snowy night in Foxboro. He never once gave up, never once gave in, despite what he was going through and the literally impossible odds. He showed astonishing courage and strength, and withstood far, far more than I thought was humanly possible. And he did it all without a single complaint. My father passed away last Tuesday morning at the age of 88.

Thank you, Dad, for giving us the childhood you never had. Thank you for being the quintessential role model. And thank you for being what a man is meant to be.

See you, Dad.

Bob Goodale

1934-2022

Mark Goodale

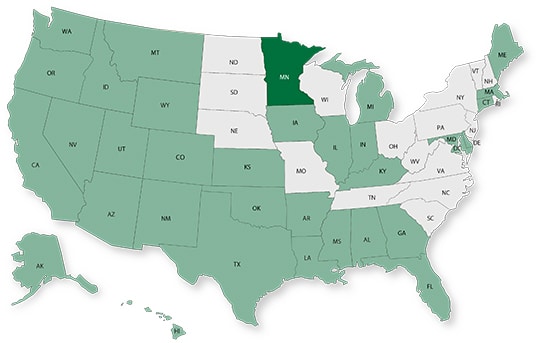

50 in 50: Minnesota

50 states in 50 weeks: U.S. states economic and infrastructure highlights.

GDP: $345.2 billion

GDP 5-year compounded annual growth rate (CAGR) (2017-2021): 1.2% (U.S.: 1.6%)

GDP per capita: $61,544 (U.S.: $58,154)

Population: 5.7 million

Population 5-year CAGR (2017-2021): 0.6% (U.S.: 0.5%)

Unemployment: 1.9% (U.S.: 3.9%)

Economic outlook ranking: #46 out of 50

Fiscal health ranking: #11 out of 50

Overall tax climate ranking: #45 out of 50

Key Sectors and Metro Areas

Top five industry sectors by 2021 GDP:

Top three industry sectors by GDP 5-year CAGR (2017-2021):

Top three metro areas by GDP:

- Minneapolis-St. Paul-Bloomington

- Rochester

- Duluth

Top three metro areas by population percentage increase in 2021 vs. 2020:

- St. Cloud

- Rochester

- Mankato

Infrastructure Highlights

Infrastructure: ASCE Infrastructure Grade (2022): C

In Minnesota, with the exception of roads, all infrastructure categories assessed by the ASCE in 2022 have a ‘C-‘ grade or better. About a month ago, Minnesota was awarded two grants totaling $35 million toward bridge rehabilitation and highway expansions intended to increase safety, decrease congestion, and improve freight movement along Interstate 90 and Highway 212. In August, $99 million was awarded to the state for six other transportation projects.

It is worth noting that Minnesota’s aviation system is solid. Several safety and operational improvements were completed over the last ten years, which expanded capacity in terminals and runways. As it relates to water and wastewater, priorities revolve around system components reaching the end of their useful life as well as the risk of legacy and emerging contaminants in service lines. In addition to the $116 million made available in 2022 from the Bipartisan Infrastructure Law (BIL), Minnesota has recently increased user fees to help address clean and safe water issues.

Over the next five years, Minnesota’s BIL funds will address the following categories of projects (additional funds may be deployed as federal grants get awarded to states):

Construction spending (Value of Construction Put in Place – CPiP):

- Private Nonresidential 2021 CPiP: $4.2 billion; -1.7% 5-year CAGR (2017-2021), below overall U.S. CAGR of 1.4%

- State & Local 2021 CPiP: $8.4 billion; 5.7% 5-year CAGR (2017-2021), above overall U.S. CAGR of 4.0%

AE Industry

ENR 500 firm headquarters (2022): 19

M&A activity since 2018:

- 56 deals with buyers from Minnesota

- 28 deals with sellers from Minnesota

For customized market research, contact Rafael Barbosa at [email protected] or 972.266.4955. Connect with him on LinkedIn.

Weekly M&A Round Up

Congratulations to Matthews Design Group (MDG) (St. Augustine, FL): The Florida-based full-service civil engineering, roadway design, land development, landscape architecture, and consulting firm joined DCCM (Houston, TX) (ENR #174). The acquisition is DCCM’s first in Florida, and MDG will continue to be the local firm that clients trust and value but now with a more diverse set of capabilities, national support, and increased resources. We’re thankful that the MDG team trusted us to initiate and advise them on this transaction.

Congratulations also to L2P (Philadelphia, PA): The architecture, interior design, and planning firm joined ENR’s #12 ranked global design firm, Stantec (Edmonton, Canada). The acquisition will bolster Stantec’s science and technology and commercial workplace offerings in the Mid-Atlantic states and beyond. We feel privileged that the L2P team trusted us to initiate and advise them with this strategic initiative.

Industry M&A is up 15% over the past 12 months: Last week we reported six deals announced in Florida, Pennsylvania, Illinois, Hawaii, New Jersey, and North Carolina. You can check all the week’s M&A news here.

If you’d like to know more about our M&A services, and how we can help you either confidentially sell your firm or grow through acquisition then please contact Nick Belitz, Principal, at [email protected] or 303.656.6151.

June 12-14, 2024 Las Vegas, NV

Western States M&A and Business Symposium

Join us for the 10th annual Western States Symposium, bringing together over 200 AE and environmental industry executives and investors in one of the world’s most vibrant and iconic cities.

Learn More

Subscribe to our Newsletters

Stay up-to-date in real-time.