Word on the street > Issue 121

Word on the Street: Issue 121

Weekly real-time market and industry intelligence from Morrissey Goodale firm leaders.

Under-performers get punished in the M&A market

Later this month, Nick Belitz of our team will be sharing the most up-to-date AE and environmental industry M&A valuation multiples at our Texas and Southern States M&A, Strategy, and Innovation Symposium in the Grand Ballroom of the very fancy (you can charge a Rolls Royce to your room—if you have such an ample expense account) Post Oak Hotel at Uptown, Houston. (Registration is closed, but there’s a waitlist should you have a last-minute hankerin’ to network with some 200 AE industry executives and investors from the U.S, Canada, Europe, and Australia.)

As Nick and his team were finalizing the 2022 multiples and circulating them internally for discussion, one thing really jumped out at me. Over the past 15 years, under-performing firms have seen practically zero increase in their M&A exit multiples (at the time of sale), whereas the multiples paid for high performers have increased 70% in the same period. Essentially, they’ve been stuck.

A tale in three parts: When we look at historical M&A valuations, we find it informative to break them out in three time tranches—2008 through 2017, 2018 to 2021, and year-to-date 2022. The year-to-date 2022 dataset is like the “Breaking News” of M&A multiples. It informs where the market is now and provides perspective on which way it’s heading—up, down, or flat. The pre-2018 data represents the “before times”—as in before the step-function increase that occurred in industry consolidation beginning in 2018. This was the year that deal activity jumped from 200-plus deals per year to 300-plus and hasn’t looked back (we’re looking at close to 500 transactions this year). The 2018 to 2021 deal-set reflects what happened to M&A valuations in the 48 months immediately following the bump in 2018 (the beginning of the new (ab)normal phase). All three tranches capture the almost 15 years of domestic economic expansion since 2009—post the Great Recession.

Disappointingly consistent: Over all three time tranches, the M&A multiples for under-performing firms have essentially remained static. Controlling for region and firm type since 2009, firms that can’t make money get punished in the M&A market. Designers that do great work but lose money (also known as “non-profits” or “hobbies” or “labors of love”) or environmental firms that swing from double-digit profits one year to break-even performance the next have had only losing hands to play over the past 15 years.

Flatline regardless: One would have thought that when industry consolidation jumped in 2018, as the economy roared and private capital started to become a “thing,” that a rising tide would have lifted all boats. But no. While valuations for high (and even median) performing firms saw, on average, a two click bump, under-performers saw no positive action at all in their valuations. They remained stuck at the same single-digit multiple of trailing 12 months EBITDA that they had been for the prior decade. Surely now in 2022, with valuations across the industry at record highs, and consolidation still robust with buyers and investors looking to snap up firms to better position for IIJA monies etc., the perennially moribund valuations of under-performers have seen a bounce? Nope. They stubbornly persist at bargain-basement levels. Why?

Buyers favor winners: It’s all about allocation of capital. And in this mature industry, where there is for all practical purposes nothing new under the sun in terms of a successful business model (see Will things get better for under-performers? below), buyers (and investors) prefer to place their bets on brands and leadership teams that have demonstrated track records of consistent, predictable, superior bottom-line performance. One reason for this is that most buyers don’t have a ton of excess management capacity lying around to turn under-performing acquisitions into winners. And so, they are willing to pay more for firms that have a winning formula, while avoiding making investments in under-performers. Sure, there are buyers for under-performers, but they ain’t paying premium prices, nor are they putting much, if any, cash up front into their acquisitions.

Self-fulfilling prophecy: In our strategy work over the past 30 years, it’s clear to us that under-performance is self-inflicted. It doesn’t matter if it’s a boom or bust economy; there are always leaders and laggards. And the laggards exhibit one common characteristic—a leadership team that is either asleep at the wheel or so dysfunctional that they have zero ability to influence their firm’s performance. They fail to see the big picture. They are unable to make necessary investments or changes. That dynamic translates to low demand on the part of buyers and sub-par M&A valuations.

Will things get better for under-performers? No. Short term we think there could be a pull back or slowdown in overall industry valuations from the highs seen in the first half of this year. This is primarily due to buyers adjusting to a higher interest-rate environment. Under-performers will get hit harder in the short term as their inability to generate profits will make them an even less attractive investment or take-over target. Over the longer term, we see the M&A valuation model for the industry fundamentally changing. Higher M&A multiples will be seen by those firms that successfully migrate to a tech-enabled business model. Ninety-nine percent of under-performers don’t have a chance of making such a pivot, and their M&A valuations will continue to decline.

Thoughts? Comments? Questions? Contact Mick at [email protected] or 508.380.1868.

Your likeability could be the difference between winning and losing

A lot goes into competing for projects in the AE industry—developing specialized expertise, creating a trusted brand, establishing a respected reputation, building deep business relationships, and a whole lot more.

But what gets you over the hump? What does it take to win? When all else is equal, it’s often simply because they like you.

Sure, expertise matters. Experience and technical ability matter, too. But our industry is already teaming with smart, capable architects, engineers, planners, and scientists, and with AE services becoming more and more commoditized for a variety of reasons, your “likeability” can go a long way in cinching the win.

But what makes one likeable?

You have to defeat “relationship blockers, which are the things that keep you from being able to demonstrate your credibility, integrity, and authenticity. And when you can’t demonstrate those things, you can’t tap into a client’s goals, passions, and struggles—the foundation of a long-lasting business relationship. To say it another way, your clients don’t care what you know until they know you care. Here are a few tips on how to circumvent those pesky relationship blockers:

Go easy on the hard stuff. Don’t hyper-focus on the “hard” skills—or your technical prowess. You might think showcasing your knowledge and expertise would impress a would-be client, but you’d only accomplish sounding like your competitors, or worse yet, appearing as a commodity. Instead, start by showing genuine interest in the goals, passions, and struggles of your client.

Be present. Be aware of your surroundings and know you’re being evaluated. Use the opportunity to reinforcing trust, reliability, concern, and competency. Don’t get caught solving problems while clients are asking themselves:

- Do I believe what this person is saying?

- Is this someone I can trust and respect?

- Do I really want to do business with this person?

- How will this person work with my team?

Don’t keep them waiting. If you made a promise to a prospective client, come through on it, whether it’s a proposal, a reference, or the answer to a question. Don’t stall. Clients want to know they are high on your priority list. Responsiveness is not just liked, it’s loved—especially these days.

Listen. And here’s what that means:

- Stop talking. You can’t be listening if you’re talking.

- Put all your energy into listening.

- Notice your own filters.

- Don’t argue mentally (agreeing or disagreeing).

- Resist the urge to immediately answer questions.

- Adjust to the situation (it’s never the way you think, moods are different, circumstances are different).

- When in doubt about whether to talk or listen, keep listening and don’t assume you have to do anything but listen.

- Work at listening.

- Listen generously with a willingness to be influenced.

Develop a rapport. Allow clients to set the tone. Don’t get too chummy too soon—e.g., going for big air by making a risky joke or bringing up a controversial topic. Ask neutral questions, instead. Let clients make the first common ground decision and see which way they take the discussion.

Establish objectives. When you converse with clients, it’s some about you and a lot about them. Know what you want to learn and collaborate on how your interactions will play out—get mutual agreement on how you’re going to explore the situation together. It might sound something like this: “What I’d like to do today is briefly introduce our firm and learn more about your facility challenges (or goals, passions, struggles).” Put three or four things you want to learn in your back pocket and keep them firmly in mind—try to cover as many as possible in the time you have. After stating what you want to learn about and discuss, get a clear understanding of how your time together will proceed as well as the desired outcome.

Establish credibility. Ask questions that display your sincerity as well as your competence regarding the topic, then ask follow-up questions that reinforce that competency. Asking the right questions early on does far more than providing solutions that have not yet been requested. I repeat, they don’t care what you know until they know you care. Stick with the facts and resist embellishment. And “go ugly early”—if there is an issue that on the surface could jeopardize your opportunity, expose it anyway.

If you need help surfacing your inner likability, call Mark Goodale at 508.254.3914 or send an email to [email protected].

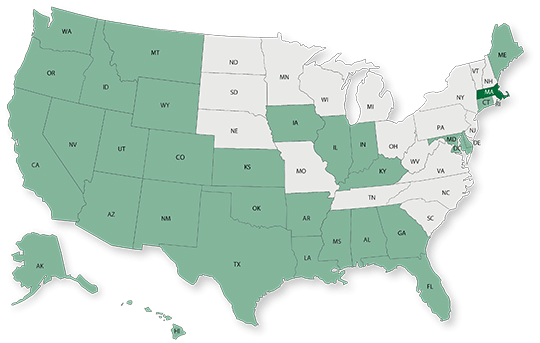

50 in 50: Massachusetts

50 states in 50 weeks: U.S. states economic and infrastructure highlights.

Key Economic Indicators

GDP: $530.5 billion

GDP 5-year compounded annual growth rate (CAGR) (2017-2021): 2.3% (U.S.: 1.6%)

GDP per capita: $77,789 (U.S.: $58,154)

Population: 7.0 million

Population 5-year CAGR (2017-2021): 0.4% (U.S.: 0.5%)

Unemployment: 3.6% (U.S.: 3.9%)

Economic outlook ranking: #28 out of 50

Fiscal health ranking: #47 out of 50

Overall tax climate ranking: #34 out of 50

Key Sectors and Metro Areas

Top five industry sectors by 2021 GDP:

Top three industry sectors by GDP 5-year CAGR (2017-2021):

Top three metro areas by GDP:

- Boston-Cambridge-Newton

- Worcester

- Springfield

Top three metro areas by population percentage increase in 2021 vs. 2020:

- Barnstable Town

- Worcester

- Pittsfield

Infrastructure Highlights

Infrastructure:

A major capital funding bill recently passed in Massachusetts will help the state improve transportation and other major infrastructure. The legislation authorizes more than $11 billion to be spent on several areas of passenger transportation. Massachusetts is also investing in clean energy legislation, making headway in offshore wind development as well as implementing bans for fossil fuels use in many municipalities. Meanwhile, there are concerns of a widening funding gap towards the state’s aging natural gas lines, which need immediate attention. Additionally, funds for 26 projects were announced as part of the Dam and Seawall Program and is headed to 23 different cities across the state. Massachusetts’s BIL funds will address the following categories of projects (additional funds may be deployed as federal grants get awarded to states):

Construction spending (Value of Construction Put in Place – CPiP):

- Private Nonresidential 2021 CPiP: $12.7 billion; 3.6% 5-year CAGR (2017-2021), above overall U.S. CAGR of 1.4%

- State & Local 2021 CPiP: $7.4 billion; 5.8% 5-year CAGR (2017-2021), above overall U.S. CAGR of 4.0%

AE Industry

ENR 500 firm headquarters (2022): 18

M&A activity since 2018:

- 67 deals with buyers from Massachusetts

- 55 deals with sellers from Massachusetts

For customized market research, contact Rafael Barbosa at [email protected] or 972.266.4955. Connect with him on LinkedIn.

Weekly M&A Round Up

Industry M&A is up 22% over the past 12 months. Last week was another active week for industry consolidation with eleven domestic deals in NC, GA, OH, WV, CA, CT, WA, MI, TX, and MO. Transactions included architecture, engineering, interiors, and environmental firms. You can check all the week’s M&A news here.

If you’d like to know more about our M&A services, and how we can help you either confidentially sell your firm or grow through acquisition then please contact Nick Belitz, Principal, at [email protected] or 303.656.6151.

June 12-14, 2024 Las Vegas, NV

Western States M&A and Business Symposium

Join us for the 10th annual Western States Symposium, bringing together over 200 AE and environmental industry executives and investors in one of the world’s most vibrant and iconic cities.

Learn More

Subscribe to our Newsletters

Stay up-to-date in real-time.