Word on the street > Issue 116

Word on the Street: Issue 116

Weekly real-time market and industry intelligence from Morrissey Goodale firm leaders.

It’s a Small World After All (and consolidating quickly)

Last week, ENR released its 2022 Top 225 International Design Firms list (WSP is once again in the #1 slot). Perennially, the list is the benchmark for the global design industry and always includes insightful and thoughtful analysis by the ENR team.

I was particularly interested in seeing this year’s list ahead of my presentation over this past weekend to 200-plus shareholders of one of the largest and most successful Asia-Pacific engineering and environmental firms. The theme of my address was “Global AE Trends and Issues.” Here are just some of the trends that we’re seeing and hearing in our strategy and M&A advisory work for firms from around the world and for U.S. firms that have overseas operations.

La grande pression est mondiale: Think it’s hard to recruit a designer or scientist or graduate surveyor in Salt Lake City? Well, try doing it in Sligo, Selkirk, Stockholm, Seoul, or Sydney. The acute talent shortage is worldwide. Similar to the U.S., unemployment rates across the OECD are at or close to record levels. In Australia, the engineering job vacancy rate has increased by 97% in 12 months, something the main industry body, Engineers Australia, fears could have a “catastrophic” impact, including by delaying major infrastructure projects relied upon for the nation’s economic recovery. In the first quarter of this year, the shortage of skilled workers in Germany reached record levels with particularly large shortages “in the construction, architecture, engineering, surveying, and building services.” Meanwhile, 69% of the Top 225 are seeing an increase in backlogs. So, the big squeeze that firms are seeing in the U.S. from too much work and too few staff is playing out around the world.

More a kaleidoscope than a hybrid: AE and environmental firms around the world are grappling with their post-pandemic workplaces. In The Questions Raised by the Gloriously Heterogeneous AE Industry of 2022, I wrote about the splintering by region of the U.S. industry’s workplace model post-pandemic. Well, that’s playing out worldwide. And on a global scale, it’s further complicated by differing national labor laws, cultural preferences, and housing stock. (Working from your apartment with no air conditioning in Amsterdam during a heatwave sure makes bicycling to and from your air-conditioned office five days a week a lot more appealing—even if Gunter, that super annoying CAD manager, is also going to be there.)

Rapid global industry consolidation: Last year saw extraordinary levels of consolidation in the global AE and environmental industry. In all, we tracked close to 790 transactions in 2022—33% more than the prior record set in 2020. We fully expect this year to set another record with year-to-date transactions already exceeding 470 globally. (Of note—the U.S. accounts for approximately two-thirds of global transactions.) And while the share of overseas deals involving private equity is not as high as in the U.S.—it still accounts for a whopping 25% in certain regions.

Global buyer diversity: The most prolific global (non-U.S.-based) acquirers this year are RSK Group, U.K. (17 announced transactions); Egis Group, France (7) (just this month Egis through their architecture company 10Design merged with SB Architects out of San Francisco); WSP, Canada (7); and SOCOTEC, France (4). (We note that 13 different U.S. firms have already made more than four acquisitions this year.) The top four countries where buyers of design and environmental firms are headquartered (excluding the U.S.) are the U.K. (U.K. firms have made 56 acquisitions—domestic and overseas), Canada (31), France (16), and Australia (6). (If you’re keeping score at home, U.S. firms have made 302 acquisitions already this year.) Glaring omissions from the list of nations yielding prolific buyers are G8 members China, Japan, Germany, India, and Italy.

Hot zones: Excluding the U.S., the countries seeing the most consolidation this year are the U.K. (57 announced transactions), Canada (21), Australia (11), Ireland (10) (really punching above its weight), and Norway, the Netherlands, and France (each with 6). Again, it’s notable there is virtually no consolidation in the G8 economies of China, Japan, Germany, India, and Italy. While all five are giant economies, they each have specific socio-economic, tax, and regulatory factors that make consolidation—either by domestic players or global buyers—unattractive.

Increased interest in the U.S.: Domestic firms are benefitting from the booming global industry with an increasing number of them featuring in the expansion plans of well-capitalized, global players. Year-to-date we’ve seen 16 transactions involving a U.S. firm selling to an overseas acquirer—accounting for 5.6% of all U.S. deals. There’s been a 25% jump in domestic sales to global buyers since the pandemic. Overseas buyers are keenly aware of the infrastructure opportunities that will flow from the IIJA and looking to put “boots on the ground” in the U.S. in advance of those funds flowing into the economy. This is a similar pattern to what we saw after the Great Recession when overseas buyers snapped up a record number of ENR 500 brands. But it’s more than just getting a presence in the U.S. that is driving demand. Overseas buyers are also looking to access unmatched U.S. innovation, IP, know-how, and expertise.

A casbah of capital and ownership models: The Top 225 list provides a great insight into the diversity of capital models at play in the global industry. Among just the Top 50, the models include publicly traded (on a variety of national exchanges), state ownership, foundation ownership, employee, closely held private, and (my favorite) blended ownership (every conceivable combination of foundation, private equity—both minority and majority, state, and employee.)

Thoughts, insights, questions, photos from your summer trip to Greece? Contact Mick at [email protected] or 508.380.1868.

3 Valuable Business Lessons From an Epic Family Vacation

I just got back from a three-week cross-country family adventure. We drove our RV (a vehicle that I am in no way qualified to operate) nearly 6,000 miles through 22 states, with our longest stop being at the Grand Canyon. Along the way we visited Hershey Park (the family dentist is not going to be happy), took a golf cart tour of Nashville (try that in Boston), paid homage to Elvis at Graceland, strolled through the charming streets of Santa Fe, trekked about the mind-boggling Meteor Crater in Winslow, Arizona, viewed ancient cliff dwellings in Mesa Verde, enjoyed a cookout with extended family in Des Moines, visited the very cool RV Hall of Fame in Elkhart, Indiana, and ended our journey at the fabled Baseball Hall of Fame in Cooperstown.

While I managed to pretty much stay unplugged from work throughout the voyage, I couldn’t help but draw business lessons from some of the experiences I had. Here are a few that stuck with me:

Lesson #1: Sometimes taking a backward step makes a lot of sense.

Our RV is not the most aerodynamic vehicle ever built—it’s essentially a big shoebox on wheels. So when the leading edge of a massive storm blew in somewhere over the plains of Oklahoma, the sudden and significant buffeting that followed was downright jolting. But what really got the blood pumping a few minutes later was when the driver’s side windshield wiper blew off the RV onto the highway during a blinding downpour. My wife, who was sitting on the side of the RV with the working windshield wiper, calmly said, “It’s not that bad—I can still see pretty well.” Using those words as inspiration, I somehow managed to find an exit and felt my way to a gas station. I hopped outside the RV to inspect the damage and found a windshield wiper hanging down like a dead tree branch. It was clear the wiper arm was damaged and the fix would require more than a mere blade replacement. As the rain subsided, we momentarily contemplated driving on, but knew we couldn’t continue the trip until we fixed the problem. We had just fueled up at a full-service truck stop about 15 miles back, so we retraced our steps and were able to take care of the issue. The backtracking cost us a couple of hours, but sure enough, we hit several more rainstorms—and we were ready for them.

The episode made me think of an EA firm I worked with a couple of years ago. The firm’s two senior leaders were moving on and their positions needed to be filled—but dysfunction was welling up in the ownership group. So I put the brakes on succession planning and led an intervention of sorts. We worked on building trust, encouraging healthy dialogue, increasing buy-in, and strengthening accountability. Once the situation was stable, we set up the transition. The conversations were open and honest, and the group got behind and supported the two partners who ended up filling the vacated corporate roles. Since then, the firm’s leaders have successfully driven through a number of their own rainstorms.

Lesson #2: You are going to make mistakes. But being wrong isn’t the end of the world.

As we made our way through the Texas Panhandle, we decided to check out Cadillac Ranch, the public art installation and sculpture in Amarillo, Texas. The exhibit is in the middle of a field, bordered by a lengthy access road with cars and RVs parked along the far side. It was a busy day at the ranch and parking looked to be at a premium, so we decided to tuck in behind a small trailer at the back of the line. It had been raining earlier in the day, so the ground was soggy, but my bigger concern was getting the RV far enough off the road so other motorists could pass. I wedged the RV in where it needed to go, but I wasn’t happy with how much we were tilting to the right. I made a few more small adjustments, put the RV in neutral, engaged the air brake, and shut off the engine. My kids already had their spray paint cans in hand to decorate the Cadillacs (graffiti is allowed and encouraged at Cadillac Ranch). But something didn’t seem quite right. It was imperceptible at first, but I had the distinct feeling the RV was still moving. Unfortunately, I wasn’t imagining things. The back end of the RV was beginning to slide into a gully. I quickly started the engine and gently pressed the gas pedal. The tires spun deeper into the mud and we slid even more. I cut the engine and got everyone out of the RV, which was now leaning like the Tower of Pisa. A nice young man named Ricky pulled over and offered to try and tow us out of the mud with his pickup truck. While I appreciated the offer, I declined, fearing all kinds of damage to the front end of the RV—and there was no way a pickup truck was going to get us out of this jam. But Ricky wasn’t done trying to help. He called a towing service that he knew would have a rig big enough to pull us out, and even offered to stay until the wrecker showed up (he was the MVP of the day). The tow truck arrived, hooked up to our tow hitch in the back, and slowly but surely pulled us out of the mud. On the bright side, I did manage to hold up two-way traffic for about 20 minutes (kind of ironic since my concern about making sure everyone had room to get by ultimately resulted in a traffic jam). I messed up, but I did learn a valuable lesson on where and where not to park. I got us back on the road and didn’t run into any more parking issues the entire trip.

There’s no shortage of AE industry examples of the same kind of thing. Whether it’s a botched internal communication, a failed attempt at introducing a new technology, or a revised organization structure that causes more problems than it solves, we’ve all been there as leaders. We’re not going to hit every ball out of the park. We’re going to have our share of strike outs. But those strike outs are only failures if we don’t learn from them. Being wrong is not the bedbug of intellect. Instead, it represents an opportunity to learn and avoid the costliest of mistakes. Learning requires a different relationship with “wrongness” and an understanding that trial and error is how we human beings figure things out.

Lesson #3: Focus is much more effective than panic.

Winding through the Rockies at nearly 11,000 feet with no guard rails in a 29,000 lb. RV that tends to waft in the general direction it is steered (as opposed to actually turning) requires supreme concentration. It would certainly have been easy for me look at the sheer drop to my right and let panic set in, but that wasn’t going to get me and my family (safely) down the mountain. I had to stay focused on steering, braking, gearing, and two-way traffic. There was simply no use in thinking about all of the dire consequences that could instantly follow an even minor error. Instead, I blocked out all of the noise in my head and in the RV, and simply drove. By doing so, there wasn’t a single moment during our descent of several thousand feet that I felt out of control (well, there was one switchback that was a tad dicey—but that was it).

In a way, leaders of AE firms face a similar challenge. Whether its political divisiveness, civil unrest, or economic upheaval, there is no shortage of threats and distractions that could paralyze the best of leadership teams. But you still have to get down your mountain. One of our clients got down their mountain by investing in leadership training for personal mastery and resilience which put their focus where it needed to be and helped them remain stable throughout the pandemic.

Incidentally, we’ve already planned our next family vacation. And yes, we will be flying this time.

Share your Chevy Chase-like vacation adventures by sending an email to [email protected].

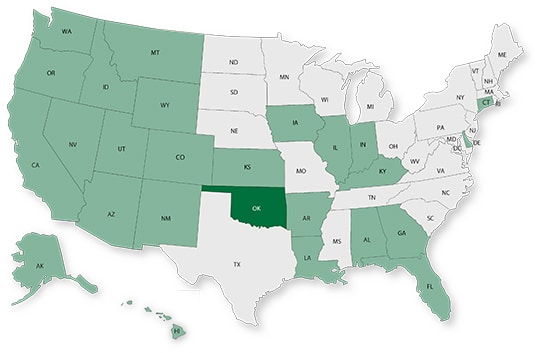

50 in 50: Oklahoma

50 states in 50 weeks: U.S. states economic and infrastructure highlights.

Key Economic Indicators

GDP: $195.1 billion

GDP 5-year compounded annual growth rate (CAGR) (2017-2021): -0.3% (U.S: 1.6%)

GDP per capita: $49,873 (U.S.: $58,154)

Population: 4.0 million

Population 5-year CAGR (2017-2021): 0.3% (U.S.: 0.5%)

Unemployment: 3.0% (U.S.: 3.9%)

Economic outlook ranking: #4 out of 50

Fiscal health ranking: #19 out of 50

Overall tax climate ranking: #26 out of 50

Key Sectors and Metro Areas

Top five industry sectors by 2021 GDP:

Top three industry sectors by GDP 5-year CAGR (2017-2021):

Top three metro areas by GDP:

- Oklahoma City

- Tulsa

- Lawton

Top three metro areas by population 5-year CAGR (2016-2020):

- Oklahoma City

- Tulsa

- Lawton

Infrastructure Highlights

Infrastructure:

Back in 2004, federal transportation officials pointed out severe issues with Oklahoma’s bridge conditions, and since then, state officials have been investing capital to improve safety on these structures. The new bridge program from the Bipartisan Infrastructure Law (BIL) will not require a state match, which will help to repair and replace off-system bridges. ODOT has identified more than 300 projects as part of an eight-year plan to improve its transportation infrastructure. Additionally, Oklahoma is looking to continue investing in resiliency projects to minimize impact of flooding, heat, and water quality in certain communities. Over the next five years, Oklahoma’s BIL funds will address the following categories of projects (additional funds may be deployed as federal grants get awarded to states):

Construction spending (Value of Construction Put in Place – CPiP):

- Private Nonresidential 2021 CPiP: $4.0 billion; 0.8% 5-year CAGR (2017-2021), below overall U.S. CAGR of 1.4%

- State & Local 2021 CPiP: $3.8 billion; -2.9% 5-year CAGR (2017-2021), below overall U.S. CAGR of 4.0%

AE Industry

ENR 500 firm headquarters (2022): 2

M&A activity since 2018:

- 10 deals with buyers from Oklahoma

- 11 deals with sellers from Oklahoma

For customized market research, contact Rafael Barbosa at [email protected] or 972.266.4955. Connect with him on LinkedIn.

Weekly M&A Round Up

Industry M&A is up 21% over the past 12 months: Last week saw new transactions announced in TX, PA, and NJ. You can check all the week’s M&A news here.

If you’d like to know more about our M&A services, and how we can help you either confidentially sell your firm or grow through acquisition then please contact Nick Belitz, Principal, at [email protected] or 303.656.6151.

Subscribe to our Newsletters

Stay up-to-date in real-time.