Word on the street > Issue 111

Word on the Street: Issue 111

Weekly real-time market and industry intelligence from Morrissey Goodale firm leaders.

A Hybrid Hell Of Flexible Half Measures

A lot of my consulting work this year has been advising clients on their “working models”—both present and future. By “working model,” I mean how work gets done across the enterprise. Underlying every conversation, plan, and initiative (with its inevitable subsequent retooling) in this area are two words—“flexible” and “hybrid.”

Both terms are often used incorrectly, frequently thrown around interchangeably, and invariably subject to different interpretations by management and employees. Many managers are sick of hearing either of them uttered. In some firms, they are banished. In others, they have become proxies for culture. In some cases, they have come to define a firm’s brand. Whether you see them as liberating or limiting, they are now pervasive features of the modern AE and environmental firm workplace, shaping the daily lives of employees and managers. They are the “Love” and “Hate” tattooed across the knuckles of CEOs and HR Directors everywhere who are consumed with figuring out the optimal working environments for their firms.

So, in a nod to 100 years of Ulysses, here’s a mid-summer stream of consciousness on the state of the AE industry workplace in 2022, how it relates to work trends in the larger economy, and where things may be headed:

- “Hell of half measures”: The quote comes from Jeremy Stoppelman, the CEO of Yelp. His prediction is that more and more firms will go “full remote” over the next six months. He reasons that the hybrid model fails to deliver any of the benefits of the fully remote model since employees still waste time commuting and it reinforces a culture where face time matters more than “the work.” At the same time, it doesn’t deliver the claimed benefits of in-person work as folks are in the office on different days and different times. And why go into an office to do a Zoom call when you can do it from home?

- The New, New Normal: Last week in The Questions Raised by the Gloriously Heterogeneous AE Industry of 2022 we posited that the AE industry has shifted from a pre-pandemic norm where “all firms pretty much work the same way” to “firms work differently depending on if and how they are deploying a hybrid working model.” The latest American Opportunity Survey by McKinsey of 25,000 U.S. workers from this spring builds upon that. One of the headline stats from the study is that 58% of employed respondents (the equivalent of 92 million American workers) reported that they had the option to work from home all or part of the week. Another of the survey’s revelations: When people have the chance to work flexibly, 87% of them take it. This dynamic is widespread across demographics, occupations, and geographies. Industries experiencing rapid digital transformations are seeing the greatest deployment of hybrid and flexible models. So it’s no surprise that the AE industry ranks third out of twenty industries in terms of remote-work options availability for employees (82% have the option to work remotely) with an average of 2.4 days being worked remotely.

- The worst of both worlds: Most design and environmental firm CEOs who are running firms with a hybrid model would agree with Stoppelman. Their offices are ghost towns on Mondays and Fridays. Tuesdays and Thursdays are an eerie half-full at best. “Welcome back” Wednesdays see maybe 80% of folks “making the effort” to occupy the bricks and mortar that their company leases. (My anecdotal experience is that most CEOs are inflating the number of employees who are choosing to spend time in the office much like male movie stars inflate their heights.) The whole thing feels like spending the month of August in Paris—the buildings and history are there, but the French are at the beach. Employees and managers variously describe the in-person office experience in the hybrid model as (depending on what day of the week they are discussing) “hopeful,” “empty,” “tentative,” “weird,” “good,” and “eerie.” Nobody raves about it. Nobody loves it. For those who worked in the “before times,” it’s underwhelming and unsatisfactory. For those who are new to the workforce or the firm, it’s disappointing and disjointed. And while one can make the argument that pre-pandemic office workplaces were inefficient, the hybrid model is patently no better, and likely worse. At the same time, AE and environmental CEOs (and their CFOs) miss the full remote model when their bottom lines doubled and everything was black and white. The hybrid world, however, is a palette of grays—one more bleak than the other—like a rainy day in Soho.

- Fear and Loathing: But while many design and environmental firm CEOs may be frustrated with the hybrid model, they fear (although they will not say it out loud) that if they required all employees to come back to the office, they would lose some key employees who now expect the flexibility of the hybrid model and “could go somewhere else.” Or they would reduce their chances to recruit talent that expects the flexibility of a hybrid workplace. FOLT (Fear of Losing Talent) and the equally despicable FOITR (Fear of Inability to Recruit) are the terrible twins born of the flexible hybrid combo. But the concerns are warranted. Per McKinsey, a flexible working arrangement is a top-three motivator for finding a new job in 2022.

- The Greatest Love of All: Everyone thinks of it as a Whitney Houston song. But it was originally recorded by George Benson, and his is still the best version. But I digress. The industry’s newest talent coming out of schools and younger generations of employees need access to the office. They want to engage in person with experienced and knowledgeable design and technical talent. They want to learn from talent who has been there and done that. They also want to get out of their apartments or their parents’ houses. It’s notable from the McKinsey survey that about 55% of 18- to 34-year-olds offered the option to work fully remote say mental-health issues impacted their abilities to perform effectively. And leadership needs to have those younger employees in the office to engage them and have them stick around to become owners, the foundational premise of employee-owned firms.

- The connector: Pre-pandemic, a power position in any design or environmental firm was the Chief Operations Officer (also known as “the traffic cop,” “the enforcer,” or “the hand of the king”). In this New World Order of the hybrid, I believe we will see the rise of a new power position—the Chief Connections Officer (CCO). She will be the one charged with understanding the specific individual career development needs of every employee and “connecting” them with the in-person, in-house, digital, and out-of-enterprise resources necessary. She will be a combination of the pre-pandemic COO and Director of Human Resources function. And she will rule.

- Scylla or Charybdis: Folks who advocate for fully remote have a point. And have the data to support it. Take, for example, Lucy Suros, CEO of Articulate, the world’s #1 provider of creator platforms for online workplace training and one of Inc. magazine’s Best Workplaces of 2020. Founded in 2002, the firm’s 400-plus employees were fully remote long before the pandemic. Articulate has consistently exhibited upper-quartile KPIs. This (and other) fully remote models debunk the notion that remote work is an anathema to innovation, collaboration, or culture. On the other hand, those who advocate for fully back in the office have decades of success to support a return and an almost universal emotional connection to the way we were (thank you, Ms. Streisand). “Small talk, passing conversations, even just observing your manager’s pathways through the office may seem trivial, but in the aggregate they’re far more valuable than any form of company handbook,” write Anne Helen Petersen and Charlie Warzel, the authors of the highly recommended book Out of Office.

- All generalizations are false, including this one: (Thank you, Mark Twain.) If you want to build a unified, one-firm culture (and who doesn’t), then neither the hybrid nor fully remote models are your allies. Sure, the Articulate example and others show that the fully remote model can work—short-term and longer-term. But it’s much harder to do so than the in-person or “well managed” (see the CCO bullet above) hybrid. The constraints of the hybrid and remote models were the subject of a recent Derek Thompson “Work in Progress” article in The Atlantic. Among the examples he cited was a 2020 study commissioned by Microsoft using researchers from UC Berkeley to study how the pandemic changed its work culture. Researchers combed through 60,000 employees’ anonymized messages and chats. They found that the number of messages sent within teams grew significantly, as workers tried to keep up with their colleagues. But information sharing between groups dropped dramatically. Remote work made employees more likely to collaborate with their existing teams and less likely to meet and connect with co-workers beyond. Though employees could accomplish the “hard work” of emailing and writing reports from anywhere, the Microsoft-Berkeley study suggested that the most important job of the office is “soft work”—the sort of connection that facilitates long-term trust and innovation.

- Your leadership superpower: The AE workplace is in flux and will be for years. Flexibility, remote work, and hybrid models will be enduring features—each with all of their respective benefits and warts. Your superpower is to see beyond the physical and temporal ecosystems and capture and convey the “meaning” of working for your firm. You need to take that and make it attractive and meaningful for every one of your employees… “yes I said yes I will Yes.”

Thoughts, insights? How is work getting done in your firm today as compared to the past? To connect with Mick Morrissey, email him at [email protected] or text/call at 508.380.1868.

Strategic Planning: Don’t Waste Your Time

Ok, so I threw you a curve ball with the title of this article. Guilty as charged. I’m not saying strategic planning is a waste of time for AE firms. But AE firms do tend to waste a lot of time while going through the process of strategic planning.

One of the first steps of creating a strategic plan is assessing your firm’s current condition. It’s a critical step. But the problems start when the strategic planning committee members allow themselves to get sucked into the issues before the full picture has been established, and before you know it, you’re down one rabbit hole after another with no resolution.

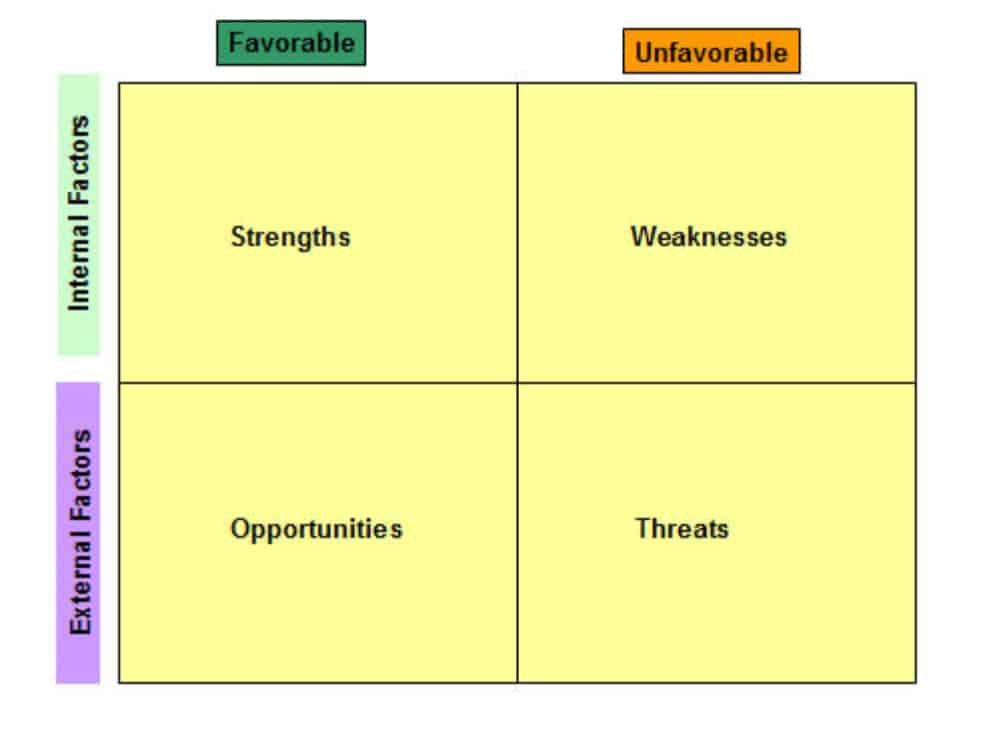

And some strategic planning tools, while popular, end up being dead ends. Take the traditional SWOT analysis, for example.

Undoubtedly, most of you have used a SWOT assessment at one time or another in your strategic planning efforts. It’s attractive because it’s a convenient method of classifying the internal aspects of a firm (its strengths and weaknesses—think management and business functions) and the external environment in which it operates (opportunities and threats—think industry and economic trends and patterns). The model supports a traditional notion that there must be a good “fit” between the firm and its environment to ensure long-term performance, and it’s a logical place to start. But it only serves as a ‘laundry’ list of items without a clear direction as to what to make of it or do with it.

To go beyond SWOT, put the four SWOT categories in a matrix format and pair them up to generate strategic alternatives in a systematic manner.

When Strengths and Opportunities are matched in the SO box, they represent possible ways in which the firm can use its strengths to capitalize on opportunities and favorable trends in the environment.

Similarly, the ST box represents ways in which strengths could be used to protect the organization from threats.

The WO box suggests areas internally that need to be addressed to take advantage of the opportunities.

And the WT box shows how the weaknesses make the organization most vulnerable against threats, and thereby points to defensive tactics.

Finally, draw from the action statements in each box to create coherent strategic alternatives. Then, depending on the firm’s mission, values, vision, and culture, your leadership team can select a defined path to take.

If your firm is going to undertake strategic planning, get your head wrapped around the solutions, not the axle.

Want more insight on how to get the most out of your strategic planning efforts? Call Mark Goodale at 508.254.3914 or send an email to [email protected].

50 in 50: Indiana

50 states in 50 weeks: U.S. states economic and infrastructure highlights.

Key Economic Indicators

GDP: $352.6 billion

GDP 5-year compounded annual growth rate (CAGR) (2017-2021): 2.0% (U.S: 1.6%)

GDP per capita: $52,495 (U.S.: $58,154)

Population: 6.8 million

Population 5-year CAGR (2017-2021): 0.5% (U.S.: 0.5%)

Unemployment: 2.2% (U.S.: 3.9%)

Economic outlook ranking: #7 out of 50

Fiscal health ranking: #13 out of 50

Overall tax climate ranking: #9 out of 50

Key Sectors and Metro Areas

Top five industry sectors by 2021 GDP:

Top three industry sectors by GDP 5-year CAGR (2017-2021):

Top three metro areas by GDP:

- Indianapolis-Carmel-Anderson

- Fort Wayne

- Evansville

Top three metro areas by population 5-year CAGR (2016-2020):

- Indianapolis-Carmel-Anderson

- Fort Wayne

- Lafayette-West Lafayette

Infrastructure Highlights

Infrastructure: A report card issued by the White House in 2021 gave the state of Indiana a C- grade for its overall infrastructure condition. Indiana has approximately 1,157 bridges (6%) that are structurally deficient and over 5,478 miles (about 23%) of highways in poor condition. Between water and wastewater systems, the state needs an estimated $14.7 billion in future investments. With recent inflationary pressures, state lawmakers will likely have a challenging process of planning 2023 spending. A Law Enforcement Academy building project in Indianapolis for instance, is 22% above costs projected in 2019. Some projects may get downsized or postponed, increasing ad hoc repairs in an effort to save. Over the next five years, Indiana’s BIL funds will address the following categories of projects (additional funds may be deployed as federal grants get awarded to states):

Construction spending (Value of Construction Put in Place – CPiP):

- Private Nonresidential 2020 CPiP: $6.5 billion; 5.7% 5-year CAGR (2016-2020), above overall U.S. CAGR of 2.0%

- State & Local 2020 CPiP: $6.4 billion; 3.4% 5-year CAGR (2016-2020), below overall U.S. CAGR of 4.8%

AE Industry

ENR 500 firm headquarters (2022): 8

M&A activity since 2018:

- 9 deals with buyers from Indiana

- 25 deals with sellers from Indiana

For customized market research, contact Rafael Barbosa at [email protected] or 972.266.4955. Connect with him on LinkedIn.

Weekly M&A Round Up

We would like to congratulate our friends at Environmental Design Group (EDG) (Akron, OH): The planning, environmental design, and engineering firm acquired Spagnuolo & Associates (Fairlawn, OH), a civil engineering and land survey consulting firm. We feel privileged that the EDG team trusted us to initiate this transaction on their behalf and advise them.

Industry M&A is up 29% over the past 12 months: Last week saw new transactions announced in OH, TX, CA, AL, TN, and PA.

If you’d like to know more about our M&A services, and how we can help you either confidentially sell your firm or grow through acquisition then please contact Nick Belitz, Principal, at [email protected] or 303.656.6151.

Subscribe to our Newsletters

Stay up-to-date in real-time.