Word on the street > AE Industry Intelligence: Issue 85

AE Industry Intelligence: Issue 85

2021: The Year Of The Big Raise

Inflation abounds, likely hitting a 39-year high last month. Our contractor cousins have seen construction and materials costs skyrocket this year with no slowdown in sight. And the AE industry is not immune. Across the country, firms are tossing out their carefully thought-out, largely conservative, pre-pandemic annual raise and bonus plans. Instead, AE leadership teams are opening their wallets wide, doling out raises and bonuses like never before, and sweetening benefits packages as if they were pals of Jay Gatsby as they face the tightest labor market in history and an insatiable demand for their firms’ services.

First priorities: Some of the headline findings from the hot-off-the-presses Engineering Business Sentiment report by the awesome team at the ACEC Research Institute included (a) 97% of respondents agreeing that the industry labor market is tight (note: This is a contender for understatement of the year.) and (b) 87% of respondents having at least one open position. Across the country, keeping and finding talent are priorities 1A and 1B for leadership teams. And there is no respite in sight.

What is average anymore? Like every other commodity in this economy, the price of labor is rising—fast. Faster than any of us have ever seen. Traditionally, leadership teams have budgeted raises using tried-and-true benchmarks from industry organizations and peer groups. They have carefully pledged to be “at market” or “above market.” (We hardly ever saw firms commit to be “below market.”) However, the pace of change in the labor market has rendered these traditional benchmarks useless and—in some cases—dangerous. The data just cannot be collected and compiled fast enough to be usable. Facing pressure to fill key positions, many leadership teams are making compensation decisions on the fly—with some major short-term and long-term implications for their firms and the industry overall.

A fear-driven upward spiral: Without benchmarks in a supply-and-demand pressure cooker, firms are increasing existing labor costs by amounts and at rates never seen before and paying above-asking price for new talent. Fear is a major contributing factor in this market. Management teams fear if they (a) lose any talent, then existing production capacity and client service—which are already both dangerously frayed—will take a giant step closer to failure. They fear that if they cannot onboard the new talent they need, then (b) they will be unable to take on the tidal wave of work headed their way (because who says “no” to work?) and, even worse, (c) burn out their existing talent risking (a). The net result? A step function increase in compensation across the industry.

Pre-emptive strikes: Rather than waiting until year-end to distribute raises as they have done in the past, many firms this year increased compensation across the board during the summer months. Their leadership teams deployed this tactic to proactively “protect” staff who were being recruited and/or hearing from their peers in other firms about their own (always inflated as in a game of “telephone”) raises and bonuses.

The problem with the New Kids on the Block: And no, I’m not talking about the prices of the 2022 tour tickets. The problem with bringing on board new talent in this environment is that at pretty much every existing salary band for every firm, new hires are blowing away the upper end of the band. When existing employees discover that the new Assistant Project Manager with fewer years of experience who appears to work no more than 40 hours a week is making more than they are for the same position, it leads to some very frank closed-door meetings (or private Teams calls) that generally then turn into another raise. Upward and upward.

Doubling down: Pre-pandemic industry raises were in the 2.5% to 3.5% range. As best as we can tell, the industry is headed for a close to 6% increase in base compensation this year. We are talking with many ENR 500 firms that have already increased compensation 5% across the board mid-year and are looking at further year-end raises (in addition to bonuses—see below). At the high end, we know of firms that are budgeting a whopping 10% increase for 2021 (10%!!). At the low end, we’re hearing 3%. Budgets for raises vary by firm size, region, service offerings, and markets served. But taken together, wage inflation in 2021 will blow away anything the industry has seen before.

Art of War tactics, Part 1: Many firms are using promotions to elevate employees into new compensation categories. We know of ENR Top 500 firms that have promoted over one-quarter of their entire staff or promoted specific “at-risk” cohorts already this year as a way to increase compensation and block competing offers.

Art of War tactics, Part 2: It’s raining bonuses. And who knew they could be so free-flowing and come in such variety? The 2021 family of bonus types includes spot, retroactive, promised, pre-emptive, unexpected, retention, reward, incentive, quarterly, year-end, and the classic “just for being you.” Taken together, the result is that this year will see hands-down the biggest bonus payouts ever for the AE industry. Management teams would prefer to use bonuses over raises because they don’t want to deal with “baked-in” compensation increases when the market cools off. (To which there are two responses: The first is “Don’t hold your breath” with the second being “Good luck with that.”)

The upshot: Absent the ability to pass on these cost increases to clients, this dynamic speaks to some significant margin challenges for many firms in 2022—particularly for those that are unable to sustain their operational performance of the past two years. This is the inevitable result of the industry’s perennial refrain of “We don’t have enough people,” combined with stagnant/declining graduation rates from design and engineering programs, as well as competition from other higher-paying industries and our clients (ouch!) for the talent our industry needs. The ultimate winners? AI, digitization, and machine learning. Robots don’t need raises.

Industry M&A up 34%! With three weeks still to go in 2021, the industry has already seen more transactions this year than it did in 2010 and 2011 COMBINED! This week we recorded eight more U.S. transactions in CA, TX, FL, KS, PA, NC, CO, and LA. You can bet your bottom dollar that there will be a flurry of deals closed by midnight on December 31 to avoid any pesky tax increases next year.

Winter is coming: For many of you, it’s already here. Escape the cold and dark this January with AE industry leaders and investors from across the Southeast and the nation in sunny Miami for our Southeast States M&A Symposium. Join us if you’re interested in growing through acquisition in the Southeast. Or if you are based in the Southeast and considering a merger or sale. Or if you’d like to have a business-justified reason to spend a long weekend in Miami this winter (average temperature for the month is 74 degrees) to better understand how M&A can benefit your business. Register today to reserve your place in the sun.

Questions? Insights? How is wage inflation playing out at your firm? Where is this all headed for the AE industry? Email Mick Morrissey at [email protected] or call him at 508.380.1868.

Thinking About Getting Out? Here’s How.

Whether the pandemic was the last straw, the plan was to start selling down at this point all along, or it’s just time to go, a wave of AE firm owners are ready to transition ownership and begin the move to the next phase of their lives.

So, what’s the right transition option for you? There are a number of factors to consider. Were promises of ownership made to key staff? Do you have able successors who can take care of the concerns of the firm the way you have tried to take care of them? Is getting full value for your equity top of mind? Is there an internal market for the firm’s stock? Are you getting more and more calls from prospective buyers? Are the owners on the same page about an exit strategy?

Ownership transition options essentially boil down to a few main alternatives, and your particular situation will dictate which one(s) check some, if not all, of your boxes:

Internal transfer

This is the traditional method of ownership transition in the AE industry. It typically involves multiple buyers and sellers in multiple phases and is governed through a shareholder (or buy-sell) agreement with a stated valuation formula.

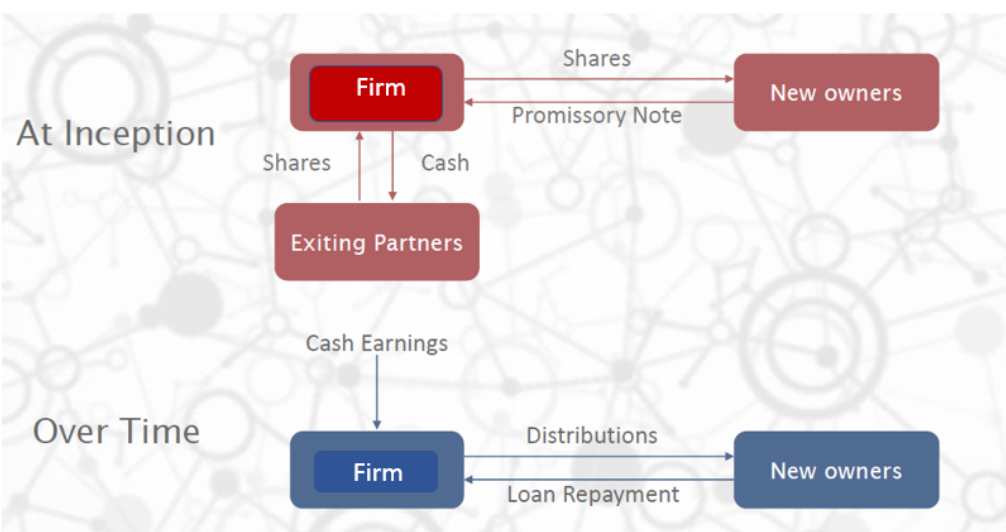

Cash flow is used to fund the transition. At inception, the firm buys back shares from exiting partners while new owners obtain shares through a promissory note, with the firm essentially acting as a pass-through entity.

On the plus side, internal transition provides for a seamless transfer of ownership and leadership to the next generation, and the firm’s history, identity, and culture remain, for the most part, intact. On the downside, owners likely won’t get paid a premium, nor will they be paid all at once. The next generation has to be successful in leading and managing the firm, or the outgoing owners will not be able to extract full value.

ESOP

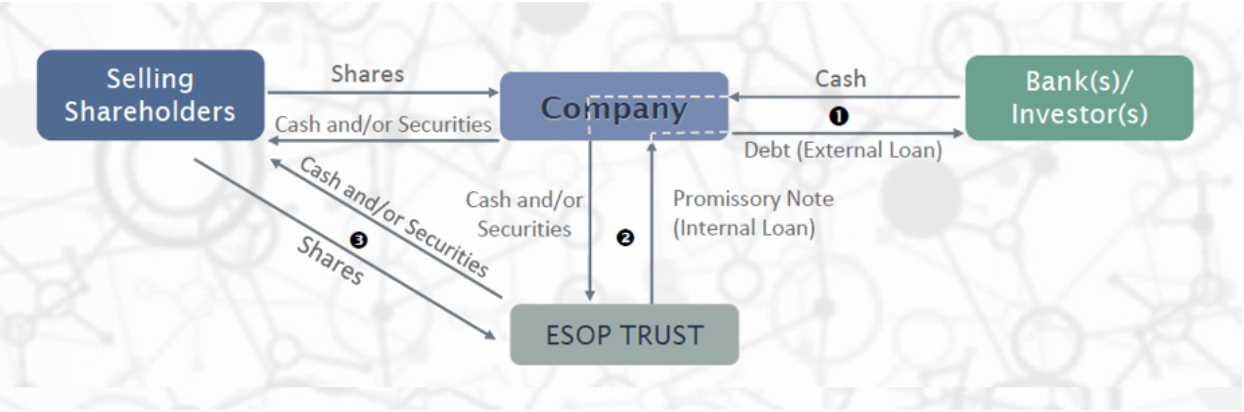

An ESOP, or employee stock ownership program, is a tax-advantaged share ownership plan, enabling selling shareholders to receive immediate liquidity.

In an ESOP, the company borrows funds from a bank or investors and then lends the funds to the newly formed ESOP trust. The ESOP trust acquires shares from the selling shareholders in exchange for cash and/or securities.

ESOPs provide a tax-advantaged mechanism to transition large blocks of stock and delivers immediate liquidity to selling shareholders. On the other hand, they can be costly to maintain, and it can sometimes be challenging to convince staff of their value.

External Sale

An external sale involves finding a buyer for the company. A buyer may be strategic (as in a larger AE firm looking to expand into new markets and regions) or financial (as in a private equity firm that will look to build value in the firm via recapitalization then sell the firm for a profit). Multipliers for AE firms are strong right now as we routinely see companies sell for 6-8x EBITDA and above.

External sales typically yield the highest value of all options due to the application of a control premium, which is the amount a buyer would pay for assuming control of the acquired entity. They also provide outgoing owners with liquidity and staff with additional career opportunities. The trade-offs include loss of control, a culture change (and the culture WILL change), and post-transaction flight risk of key staff.

No exit strategy is a panacea, but if you plan well, you can maximize the advantages and minimize the risk associated with whichever path you decide to take.

For more information on how Morrissey Goodale can help you transition ownership in your firm, call Mark Goodale at 508.254.3914 or send an email to [email protected].

Four Factors to Watch

- Government Deficit and Spending

The Treasury Department reported a $191 billion deficit in November, reaching a cumulative gap of $356 billion after the first two months of the 2022 fiscal year. The deficit is down 17% from the same period in 2021, thanks to increased tax revenues. Government spending is 3.9% higher for the October-November period when compared to prior year. The update comes as the federal government is beginning implementation of the new infrastructure law and $118 billion is transferring to the Highway Trust Fund on December 15. The package, however, is not expected to add to the deficit until the next fiscal year.

- Inflation

The consumer price index, the most common measure of inflation, rose to 6.8% in November. The Fed is anticipating a shift in policy that will likely result in tapering bond-buying stimulus and raising interest rates a few months earlier than anticipated in 2022.

- Labor Market

The Conference Board published results of its biannual Salary Increase Budget Survey. According to the November edition, accelerating inflation and the rise in new hire wages has led to an increase in budgets dedicated for salary increases in 2022 from 3.0% (based on April’s results) to 3.9%. This is the highest increase in projections since 2008. Also last week, the Labor Department reported the lowest weekly jobless claims since 1969 at 184,000.

- Supply Chain

The container ship backlog in the port of Los Angeles, something that was uncommon before the pandemic, can be a representative measure of the ongoing supply chain bottlenecks that have had a significant impact in the U.S. economy this year. The number of container ships anchored offshore of the port of Los Angeles has come down from 56 on November 26 to 28 on December 10.

Subscribe to our Newsletters

Stay up-to-date in real-time.