Word on the street > AE Industry Intelligence: Issue 81

AE Industry Intelligence: Issue 81

It’s Time For Predictions—but First, How Did We Do In 2021?

Next Monday, we’ll be sharing our 22 predictions for 2022. Today—as a palate cleanser—we take a look back to last November and the 21 predictions we made for 2021. These basically fall into the following four categories:

(Nailed It! Or as Larry David would say, “Pretty, pretty good.”) These are the predictions where we either stuck the landing or would have done well with hand grenades or horseshoes (we were close). Like the parents of a first-grade soccer player who just won a “participation” trophy, we proudly recognize our teammates who made these predictions and honor them as the “oracles” that they are who clearly have special powers.

(Jury Is Still Out) There’s definitely a trend afoot that these predictions captured—but the pattern is still murky, and the prediction didn’t 100% play out in 2021. We note the “forecasters” on our team who got these directionally correct(ish).

(Egg on Face or Dubious at Best) We own up and admit to where we obviously hadn’t a clue and immediately descend into some vicious internal vendetta-driven finger-pointing to lay blame at the feet of those “charlatans” who made those (now clearly ridiculous) claims.

(Mishegoss) We scratch our collective heads at the bizarre forecasts some of our “free thinkers” came up with last year and wonder what on earth they were talking about (or consuming at the time).

So, let’s take a look at how we did… (these are the verbatim predictions we made last year):

- Uncle Sam to the rescue. (Nailed It!): A Democratic administration will promote stimulus for small businesses and state and local governments that will include an infrastructure bill with a heavy focus on renewables and technology infrastructure (smart roads, charging stations, grid infrastructure, etc.). As this is a positive for our industry, we will still see significant consolidation as larger firms use this as a lever to capture market share. (Oracle: Brendon Cussio, Denver)

- Demographic shifts to lower-density settings. (Jury Is Still Out): High-density new urbanism will increasingly lose its luster, and social distancing becomes a permanent way of life. The many-year trend of the 21st century of people, especially young professionals, moving to dense urban cores will reverse as technology and investments therein enable people to relocate to more spacious, lower-cost environments away from the urbanized coasts. (Forecaster: Nick Belitz, Denver)

- Reimagined commercial space. (Nailed It!): Forward-thinking architects and developers will develop and push ways to re-position millions of square feet of commercial office space now left unused, leaving architects who are waiting for a return to the good old pre-pandemic days in the dust. Instead of JCPenney being a mall anchor store, it will be a Tesla showroom (I STILL love my 2016 Model S!) or an Apple store. (Oracles: Belitz—with Mick Morrissey, Boston, on the Tesla endorsement)

- Big boom in retrofitting and conversion. (Nailed It!): Now that firms have seen the savings of employees working from home and relatively stable productivity, urban offices will be reimagined and repurposed. There will be a real estate shift that will provide a boom to the A/E industry in the form of retrofits/conversions of these spaces. (Oracle: Cussio)

- At least a third of the industry will still be working from home by the end of 2021. (Nailed It!): Even with vaccines in play, this train has left the station. Employees love the flexibility. Firms are benefitting from reduced office-related expenses. Clients really don’t care where you work from so long as you get the job done safely and keep their data safe. Technology makes it all work smoothly. There’s no going back. And many employees know someone in high-risk categories. (Oracles: Belitz/Mark Goodale, Boston)

- You’ll tear up your employee manual. (Nailed It!): A/E firms will revisit their work-from-home policies and offer more flexibility as they now have the technology, processes, and confidence in place that this can work. Employees will expect to have more flexibility in their work environment, splitting their time between working on laptops, or on calls at Starbucks, or as they walk the dog (try it by the ocean—it’s productive AND therapeutic), or—perish the thought—in the office. (Oracle: Lisa Elster, Boston)

- Relocate? No big deal! (Jury Is Still Out): Firms will be more flexible on location requirements. By allowing more people to work remotely, relocation will not be required as much, which will make it easier to hire in many cases. The trend toward hiring people virtually will continue. In-person interviews will become a thing of the past. (Forecaster: Executive Search Team, Boston)

- Cut up your Platinum Amex business card. (Egg on Face): You won’t be travelling anywhere soon. Firms have realized they can get a bunch of stuff done in Virtual Reality and on Zoom and Teams without wasting a lot of time travelling and spending a ton of money on $15 salads at a Marriott. In-person conferences won’t be back until 2022 (that’s why all of our 2021 events will be in game-changing Virtual Reality). (Charlatan: Morrissey)

- Brain drain. (Nailed It!): The Great Recession, and now this. Many boomers will not want to stick around for the next act and will call it a career. The pressure will be on industry firms to transition institutional and industry knowledge before it’s lost for good. (Oracle: Goodale)

- Strategy shifts. (Jury Is Still Out): With people home more than ever, A/E firms will shift their strategic focus away from major metros and reallocate their growth investments towards the long-term prospects of second-tier markets, also known as 18-hour cities—such as Denver, Austin, and Nashville, amongst others. These cities provide affordable living, strong job growth potential, and growing economies and will draw investors, designers, builders, and top industry talent in the coming years. (Forecaster: Jon Escobar, Chicago)

- There will be record industry consolidation. (Pretty, pretty good): We anticipate approximately 380 deals in the U.S. next year, driven by a continued inflow of baby boomer owners selling out to private equity capital and strategic buyers that are expanding into Texas, the Southeast, and the West. (Oracles: M&A Advisory Team)

- Private equity will account for 4 in 10 transactions. (Pretty, pretty good): The great recapitalization of the industry will accelerate next year with about 40% of all deals being completed using capital from private equity or family offices. (Oracle: Nate Wentworth, Boston)

- Twenty of the industry’s top A/E firms will sell or recapitalize. (Pretty, pretty good): Typically, about 10 firms in the ENR Top 500 sell or recapitalize in any given year. Next year, that number will double. At least one publicly traded firm will be taken private next year. (Oracles: M&A Advisory Team)

- Acquisitions of tech and software firms will increase. (Nailed It!): Design and environmental firms will acquire more tech and software firms next year to try to escape a horrendous downward spiral of commoditization AND move from a business model selling time for money to a model that generates recurring earnings through technology. Less than 50% of these acquisitions will be successful. (Oracle: Morrissey (surprisingly))

- Firm values in Texas and the Southeast will rise disproportionately. (Nailed it!): Their economies will rebound faster from the pandemic, and population migration to those states will accelerate. Strategic buyers—particularly those in the Northeast and Midwest—will be even more incentivized to buy their way into these markets. (Oracle: Morrissey)

- The rise of a new breed of tech-savvy CEOs. (Mishegoss): Every CEO who barely paid attention to what was actually in the IT/telecommunications budget approved before the pandemic will finally—and joyfully—understand what the firm was paying for. They will also wonder why they are spending so much on cybersecurity—see the next point. (Free thinker: Belitz)

- The rise of the robots. (Dubious at Best): A select group of trailblazing organizations will acquire and leverage advanced technology, such as AI and AR, to create a new class of industry firms that focuses on delivering world-changing innovation vs. traditional A/E design services. (Charlatans: Goodale/Wentworth)

- The incredibly shrinking importance of the employee. (Egg on Face): Between relentless investments in technologies and massive infusions of capital, the balance of power between labor and capital will shift from employees to capital. And since our industry does not unionize (except for specific professionals in specific states), the influence that talent has on our industry will begin to decline. (Charlatan: Morrissey)

- You’ll be happy you bought cybersecurity insurance. (Nailed It!): More and more A/E firms and their clients are the victims of cyber-attacks. The data is cloudy on this as many management teams are ill-equipped with respect to how to communicate on the topic. However, by our estimation the attacks this year on design and environmental firms and their clients numbered in the hundreds. The frequency of these attacks will only increase in 2021. (Oracle: Morrissey)

- The rise of the circular economy. (Jury Is Still Out): The A/E industry will have the opportunity to lead the circular economy. The circular economy is a systemic approach to economic development designed to benefit industry, society, and the environment—vs. the linear model of “take–make–waste.” A massive portion of energy is associated with constructing infrastructure and buildings and operating them for long lives. Progressive A/E firms will have a wide-open opportunity to innovate and make great change in this area. (Forecaster: Goodale)

- Industry adoption of virtual reality will move quickly in 2021. (Jury Is Still Out): Particularly by firms that understand how it can be used to get closer to customers and shut out the competition. (Forecaster: Morrissey)

What does our team see for 2022? Next week we will reveal our predictions for 2022. And if you have predictions for next year, feel free to email them to me. (Thanks to those of you who have sent along predictions over the past week—I’ll be responding to you later this week.)

Congratulations to our friends at The HFW Companies (St. Louis, MO): Last week the leadership team of this newly formed platform and partnership focused on investing in architecture, engineering, and construction services firms announced their first member firm—Miller Legg (Fort Lauderdale, FL), an award-winning engineering, design, and planning services firm. We feel privileged that The HFW Companies team trusted us to initiate this transaction on their behalf and advise them.

Congratulations are also in order to our friends at Ardurra Group (Tampa, FL) (ENR#190): The team at Ardurra—one of the most prolific and skilled acquirers in the A/E industry—announced that they had acquired and merged with Ritoch-Powell & Associates (Phoenix, AZ), a leading regional civil engineering and surveying firm specializing in transportation, public works, renewable energy, and private development projects. We’re happy that we were able to initiate this combination of these two awesome firms.

No Q4 slowdown in industry M&A: This week saw eight new A/E and environmental transactions announced in the U.S. Deals are up almost 30% on the year, and we’re anticipating over 400 mergers and acquisitions to have taken place by the end of the year.

You missed early-bird registration for the Southeast States M&A Symposium: Interested in growing through acquisition in the Southeast? Or are you based in the Southeast and considering a merger or sale? Or would you like to have a business-justified reason to spend a long weekend in Miami this January (average temperature for the month is 74 degrees) to better understand how M&A can benefit your business? If you answered “yes” to one or more of these questions, our Southeast States M&A Symposium in Miami, Florida, is for you! You missed early-bird registration—but there are still some places left in the sunshine. However, they’ll be gone soon, so best to reserve your place today.

What we’ve been tweeting about recently: We’re spending a lot of time in our strategy engagements assisting clients to design new workplace environments, customer-engagement interfaces, and workflow systems. All of our work in this area starts with the question “Why?”, and we continue to ask it throughout the process. As companies look to bring remote workers back to the office, a writer asks: “Why?”

Questions? Insights? How good were your predictions for how things would play out in 2021? What are your predictions for 2022? Email Mick Morrissey at [email protected] or call him at 508.380.1868.

Negative Assessments— Pure Gold

As 2021 grows longer and longer in the tooth, many A/E firms are gearing up to conduct performance reviews of their staff. (Hopefully you are separating performance reviews from compensation and bonus reviews, but I’ll save that topic for another day.) Anyway, you know the drill—give some positive feedback, discuss areas for improvement, reflect on the past year, set goals for next year, and so on. But what about when you are on the receiving end of feedback? How do you react to negative assessments? Do you:

- Defend your behavior?

- Explain away your actions?

- List excuses to justify your performance?

- Make a case and argue?

- Deny?

- Get upset?

If the answer is yes to any of these questions, you’re missing a golden opportunity to improve yourself and your firm.

Think about elite athletes. They don’t become elite if they don’t thrive on negative feedback. They don’t necessarily want to hear it, but they seek it out because they know they have blind spots. Yet we don’t behave that way in our professional settings. We hide from criticism. We suppress negative assessments we may have about others, and we discourage others from offering them to us. We are conditioned—and condition ourselves—to keep quiet, believing that doing so will preserve our relationships, keep us out of trouble, and so forth. Yet what are we left with? Two of the biggest wastes in almost every firm I work with: not talking and not listening.

Before we go deeper, let’s take a brief moment to review the definition of a few key words that can help us better understand how to make the most out of negative assessments:

- Assertions are claims about what is observable in the world. They can be classified as true or false. For example, “Today’s temperature is 82 degrees.” That statement is either correct or incorrect.

- Assessments, on the other hand, are evaluations, judgments, or opinions about the world. They cannot be verified by observers. For example, “It’s a nice day for golf.” Well, I might think so, but you might not. Regardless, neither of us is right nor wrong (although, as I look out my window, it really is a nice day for golf).

- A grounded assessment is one that is accompanied by assertions that support the assessment. You can understand the opinion because facts exist to back up it up. For example, I might say, “Joe is a flake.” If I simply heard that opinion third-hand, and it is otherwise baseless, I have made an ungrounded assessment (and an unhelpful characterization to boot). But if I learned Joe fell asleep during three meetings and missed a fourth, “Joe is a flake,” becomes a grounded assessment because the opinion is supported by fact. Still, it’s only an assessment. It’s not true or false.

Too often, we miss out on the value of feedback. Why? Because we allow assessments, grounded or not, to live as assertions (facts) in our minds—particularly when they are negative and about us. We think, “Hey, this comment is negative and it’s about me. It has to be true!” So that comment somebody made, perhaps in a careless way—has now hurt us. And we assume the intention was to do just that while ignoring the very real possibility that the comment could have simply been made out of the blue, or we completely misunderstood the context. As a result, we make cases for why that particular opinion we just heard is flat-out wrong. But again, since assessments can’t be right or wrong, making a case for either is illogical. So instead, seek to fully understand the assessment. Catch yourself when you start trying to prove the assessment wrong and simply say, “I can see why you might say that. I appreciate you bringing your thoughts to my attention.” If you need clarification to fully understand the assessment, ask for it. Then consider how what you just learned might change your world for the better going forward, and think about what actions you might take to improve.

You can do all of this without gritting your teeth—if you assume the person giving the assessment is well-intended. However, therein may lie your biggest challenge. If you simply won’t allow yourself to get there, none of these thoughts will help you better handle, and benefit from, negative assessments.

The bottom line is when we fail to capitalize on the feedback we receive, we fall short of our potential. So, value negative assessments for what they are—pure gold.

To learn how Morrissey Goodale can help you improve your firm’s organizational health, call Mark Goodale at 508.254.3914 or send an email to [email protected].

Four Factors to Watch

1. Infrastructure bill

The infrastructure bill passed. Now what?

Once Biden signs the $1.2 trillion Infrastructure Investment and Jobs Act (IIJA), federal agencies will start their efforts on making the funds available for the implementation of various new programs and grants. Likewise, state and local officials, the owners of most infrastructure, will be engaging in prioritizing projects and then procuring the design and build resources for key infrastructure investments. The giant bill will be implemented across several agencies and programs and will likely shape the country’s infrastructure for generations, especially if it ends up paired with the Build Back Better Act, a top priority in Washington this month.

It will likely take years to see tangible results as local, state, and federal agencies will need to coordinate the deployment of several large initiatives. Furthermore, kicking off projects amid unpredictable logistics, a shortage of workers and materials, and inflation might prove to be an epic undertaking. Public sectors, just like private industries, will need to find solutions to fulfill the need for professionals and tools to plan and execute. We’ll continue monitoring progress as funds are deployed and more details are made public.

2. Inflation

Inflation measures continued to strengthen, marking the fifth straight month above 5%. The consumer-price index was up 6.2% from a year ago, the highest since 1990. Correspondingly, consumers are getting worried. The University of Michigan’s consumer sentiment index dropped to a 10-year low of 66.8 in the preliminary November report, down from 71.7 in October.

On the other hand, history shows that every time there is an economic recovery, higher inflation is expected. This time, following a sharp pandemic recession, there is a supply shock as a result of the overheated reopening of the economy. Additionally, some economists point to the fact that debt and reckless management are not currently a problem in the market—there is no excessive spending and many companies’ debts have been restructured. Ultimately, the level at which the constrained supply restricts output and erodes income will be a key indicator, but as of now, demand still holds strong.

3. Labor Market

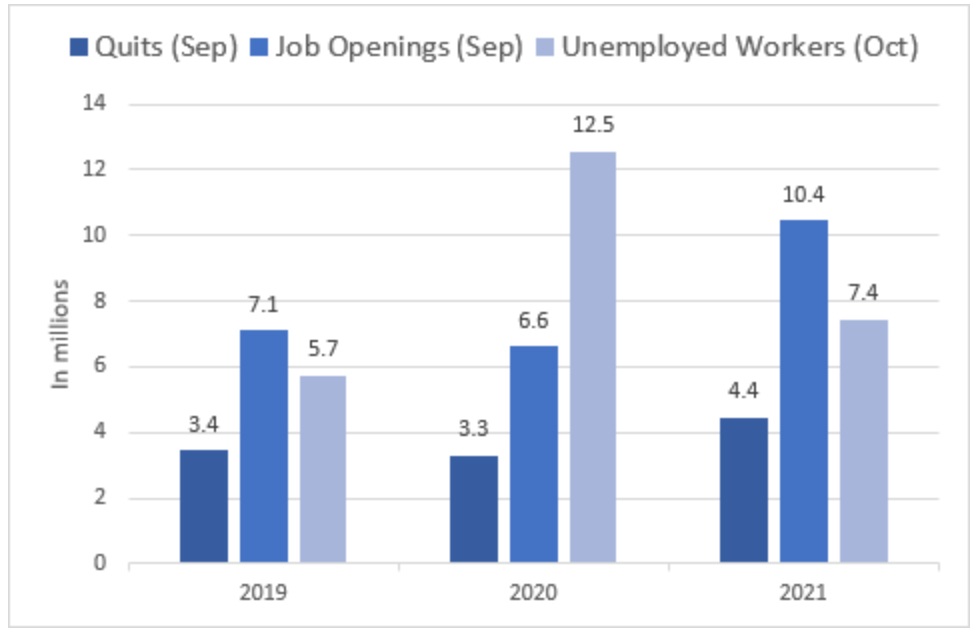

Another record-breaking economic indicator has been published. The U.S. Bureau of Labor Statistics (BLS) released data from its Job Openings and Labor Turnover Survey (JOLTS) showing that 4.4 million people, about 3% of the labor force, quit their jobs in September. The figure is the highest-ever in a single month (seasonally adjusted). The measure for the full year is on pace to be higher than in 2019, when total quits reached over 42 million, the highest since 2001 when BLS started the survey.

Congruently, there were 10.4 million job openings in September but only 7.6 million unemployed workers to potentially fill them. The situation is worrisome for employers facing the elevated risk of workers, who now have more leverage, leaving for better pay and benefits elsewhere. Additionally, people seem to be still adjusting different aspects of post-pandemic personal and professional lives.

4. COVID-19

The seven-day moving average of new cases reported declined 4% vs. the prior week (from 76,000 to 73,000 as of November 11) and 19% vs. a month ago. According to the CDC, 68% of the U.S. population has received at least one vaccine dose, and 14% of those fully vaccinated have received a booster dose

Subscribe to our Newsletters

Stay up-to-date in real-time.