Word on the street > AE Industry Intelligence: Issue 79

AE Industry Intelligence: Issue 79

Private equity—the two big questions: Why? and Where Does This All End?

One of the stats we dropped during our Texas M&A Symposium last month was that 36% of all A/E industry transactions this year have involved private equity (PE). That’s 120 out of 336 deals for those of you who like numbers instead of percentages. Over the past decade, recapitalization of the industry by PE (never to be confused with Professional Engineer) has been steadily crowding out capitalization by employee-owners. The questions that I almost never get—but which I should—when I present on this topic are (1) “Why is this PE recapitalization happening to our industry now?” and (2) “Where does this all end?” Let me try to answer both of them here.

There are three answers to the “Why”: First, it’s not just happening in the A/E industry (we’re not that special). PE’s influence in the U.S. has been growing rapidly over the last decade plus—and has become pervasive in almost every industry. Per McKinsey, PE’s net asset value has grown more than sevenfold since 2002, twice as fast as global public equities. And consider the growth in U.S. PE-backed companies, which numbered around 4,000 in 2006 and rose by 106% to about 8,000 in 2017. Meanwhile, U.S. publicly traded firms fell by 16% from 5,100 to 4,300.

And there’s no slowdown in sight: PE has played an important—some might say outsized—role in reshaping the U.S. economy after recent economic crises. Indeed, there was a dramatic rise in PE involvement in the economy after the Great Recession when bank lending became subject to tighter regulations. And the coronavirus pandemic has set the stage for even greater growth. Deloitte predicts that Assets Under Management (AUM) by PE could total $5.8 trillion (with a “T”) by 2025, up 28% from $4.5 trillion at the end of 2019.

Infrastructure writ large is attractive to PE: This is the second reason why the A/E industry is seeing such an influx of PE investment. Infrastructure is an attractive investment vehicle for private investors with the promise of stable, long-term cash flows. The Public-Private Partnership (PPP) infrastructure model has worked well outside of the United States, and there is clearly a need for private investment in U.S. infrastructure—the public sector cannot fund it all. PE firms are active in the water and transportation infrastructure sectors domestically, and private investors are looking for more opportunities to directly participate in U.S. infrastructure projects. Also, in this socially conscious day and age, infrastructure is a great way for private investors to boost their ESG scores.

But, like a relationship status on Facebook—it’s complicated: The PPP model for infrastructure has and continues to face challenges here in the U.S. Private-sector participation is still minimal compared to the needs and the potential market. And PE players are concerned that the Biden administration’s $1 trillion infrastructure proposal doesn’t do enough to make it attractive for them to jump in.

Which is why the A/E industry is so attractive to PE: We provide the ideal investment vehicle to participate indirectly in the infrastructure space. We are the perfect adjacent investment. Design and environmental firms provide PE investors with an “asset-light” way to exploit opportunities in the infrastructure sector.

Endemic industry performance and structural features: This is the third reason why the A/E industry is seeing so much PE investment. Most firms in the industry never reach their potentials in terms of ROI, ROE, and ROA. This is largely due to (a) sub-optimal business management practices on the part of the architects, engineers, and scientists who lead the firms and (b) a lack of accountability for performance. (We are an industry run by very smart professionals who for the most part are not business savvy and fail to hold those around them to task.) This tendency to underperform makes design and environmental firms very attractive investments for PE sponsors. These investors bring both business acumen and access to cheaper capital via debt to the acquired firm. Combined, these features dramatically improve ROI, ROE, and ROA.

And then, of course, bigger is better: The PE model is based on the simple fact that scale in a professional services firm translates to higher value. PE firms invest in a design or environmental firm at a certain size at a specific multiple of EBITDA, and then they exit their investment (typically after about five years) having grown the firm to a larger size (with improved bottom-line performance along the way) at a higher multiple. At our Texas M&A Symposium last month we showed how the median EBITDA multiple for A/E and environmental firms between $25 million and $100 million in gross revenue is 5.1x while that for firms over $500 million is 10.4x. Buy low, sell high—usually to another PE firm. Our highly fragmented industry of over 40,000 firms—all of which are facing leadership and ownership challenges—is ripe for consolidation by PE.

So, where does this all end? In the long term, for a variety of socio-economic and demographic reasons, we’re headed inevitably to an industry that is majority PE-owned and minority employee-owned. Already, 15% of the ENR Top 100 is PE-backed. While the economy is strong, the PE model works well—just like any other capital model. The question becomes what happens when we hit the next economic recession or crisis. How will this new cohort of debt-burdened A/E and environmental firms fare when the industry faces headwinds instead of the tailwinds we’ve had for the past decade?

Industry savior or destroyer? There’s plenty of data that show that in the larger economy, PE-backed firms were able to navigate the Great Recession more successfully than firms with other capital models. So, I’m less concerned about the resilience of this new capital model in our industry. Rather, I see the risk in the capabilities of the leadership teams guiding these firms through the next recession or economic crisis. The opening pitch by most PE investors when they meet an A/E firm management team is usually: “We don’t know how to run a design firm—you do. We just want to partner with you to help you achieve your vision.” Come the next crisis, the PE investors better hope that the management teams actually do know how to navigate successfully through the storm.

Congratulations to our friends at DiPrete Engineering (Cranston, RI), who this week announced its merger with Andrews Surveying & Engineering (Uxbridge, MA).

Missed our Texas M&A Symposium? Want to catch up on the latest M&A trends and deal multiples? Would you like to know post-pandemic best practices for buyers, sellers, and integrators? We can help! We’ve recorded the entire Symposium and will be making it available soon. Sign up here to be notified when the video recording of the Symposium is available for purchase.

Early-bird registration for the Southeast States M&A Symposium is open: Interested in growing through acquisition in the Southeast? Or are you based in the Southeast and considering a merger or sale? Or would you like to have a business-justified reason to spend a long weekend in Miami this January? If you answered “Yes” to one or more of these questions, our Southeast States M&A Symposium in Miami, Florida, is for you!

Questions? Insights? What do you see as the endgame for the PE movement in our industry? Email Mick Morrissey at [email protected] or call him at 508.380.1868.

REMOTE MENTORING? YEAH, IT’S POSSIBLE

“In this world, nothing is certain, except death and taxes.” Often credited to Mark Twain and Benjamin Franklin (reasonable assumptions given they coined and invented practically everything else), the famous quote was first voiced by English actor and dramatist, Christopher Bullock, in 1716. And while many readers would readily add a third item to Bullock’s brief list of life’s assurances— namely that mentoring can’t happen remotely— it fails to make the cut. Why? Because it simply isn’t true.

But don’t take my word for it. Here’s what A/E firm leaders have to say:

“During the pandemic, I have focused my mentoring on maintaining a sense of belonging,” reflects Reg Christopher, founder of Insight Group, a growing, South Carolina-based, specialized geotechnical, environmental, and construction consulting firm. “It’s hard to ‘belong’ in a virtual world, so listening for keys of disengagement or loss of focus is important to maintaining a sense of belonging.” Christopher combines listening with action to produce positive results. “My experience with remote mentoring is more action-focused, which has been good for us. The attention to your people is heightened because it is remote. Better listening and more touches has been the result. And while we are hard-wired for community and face-to-face interaction can never be replaced, it can be replicated with listening, actions, and an overall increased conversational intimacy.” Christopher believes remote mentoring has helped him address an unhelpful tendency, as well. “During face-to-face mentoring, I had the habit of kicking the action can down the road. But remote mentoring has been more acute in that we couldn’t let any uncertainty creep in. So, we are hypersensitive to disruptions of the maintenance and development of our team.”

Sanjay Agrawal, President & CEO of AG&E Structural Engenuity, a successful, Texas-wide structural engineering firm, believes when the commitment is there, mentoring happens, regardless. “Mentoring someone essentially involves ‘adopting’ them and being invested in their success,” says Agrawal. “It requires constant contact and complete trust between the mentor and the protégé. Working from home only changed the medium of communication between the two, but that should not change the bedrock of the relationship. If the relationship is sound, how the parties communicate is immaterial.”

One President and CEO from a leading East Coast-based ENR Top 500 Design Firm acknowledges the difficulties of remote mentoring but sees the upside as well and intends to pursue it. “Mentoring is a challenge. We don’t have a formal program but have spent this year working to formalize one,” he says. “Remote mentoring is something we have limited experience with, but I believe it creates new learning opportunities and relationships that otherwise might not happen. We have multiple offices and talent is now dispersed in many geographies including the ‘work-from-home’ talent. Remote mentoring seems like a real necessity, and technology reduces the friction of matching up the senior talent with the less experienced staff in the ‘work-from-anywhere’ environment. We’ll have more experience with remote mentoring a year from now. We’ve made it a growth investment priority and have a team pushing it. We’re looking for ways to reduce the traditional barriers to mentoring, whether in-person or remote.”

For Kevin Fitzpatrick, President and CEO of Benesch, #112 on ENR’s Top 500 Design Firm list, remote mentoring is nothing new. “With offices across the country, remote mentorship has always been an integral part of employee development at Benesch. Even before the pandemic put an increased focus on remote work, we’ve always encouraged employees to seek mentorship from outside of their own office. Though maybe not the traditional way to mentor, it allows for more skill sharing and helps employees form new connections.” Fitzpatrick says remote mentoring is infused throughout the organization. “For our national railroad team in particular, remote mentorship is key to their success, not just to get work done for our clients, but to ensure professional development as the team continues to grow in offices across the country,” he says. “They find that the more engaged their team is, the more mentorship occurs as a result. Making a conscience effort to have a video call or pick up the phone and connect is a great start. Our aviation group has a similar outlook, and we owe a lot of our aviation success in Georgia to the mentorship coming from our Lincoln, Nebraska office. They rely on three main elements to successfully mentor from afar: proactive communication, accountability, and relationship building. By having weekly check-in meetings, the team identifies opportunities for mentorship and forms stronger relationships remotely.” Fitzpatrick says at a corporate level, the firm embraces technology and offers various learning programs. “Through company wide use of Microsoft Teams, we encourage employees to connect with video calls, allowing them to maintain face-to-face connections even virtually. We also have monthly discipline-specific tech group meetings that bring together employees interested in specific skills or practice areas from across the country, and that’s been going on for several years now. These groups help employees develop their skills and find potential mentors they may not have known about,” he adds.

Amy Day, Vice President and Director of Talent Management at Psomas, another leading multi-discipline firm high up on the ENR Top 500 Design Firm list, says, “The way we connect with colleagues in the workplace has shifted, but the tried-and-true principles of meaningful ‘connection’ have not. Mentoring in a remote environment is more critical than ever and is possible with a thoughtful approach. Applying these principles through video or phone feel different than in-person but can have the same impact.” Day offers the following advice:

- Embrace mentorship as a two-way street. Establish a true partnership where both individuals have the ability to offer valuable insight.

- Gain commitment and establish a schedule; light ground rules and be flexible if needed.

- Take the time to personally orient toward your mentee. While this is a professional relationship, our personal lives are dynamically intertwined.

- Cultivate empathy to see life from your mentee’s perspective.

- Encourage your mentee to set his/her intention. What do they hope to gain from this relationship? Why is this important?

- Be fully present with your mentee. Your time and attention matter.

- Actively listen and stay curious. Ask powerful questions and avoid over prescribing solutions.

- Be vulnerable. Share your experiences. Your mentee will appreciate seeing you as a fellow human!

- Keep a pulse on the relationship to ensure the mentee is receiving what he/she needs.

For better or worse, remote is here to stay for at least a while— a long while. And since remote mentoring is better than no mentoring at all, don’t allow ‘perfect’ to become the enemy of ‘better’ in this instance. You may even find hidden advantages to creating mentoring relationships in the virtual world.

If you’d like to learn more about how Morrissey Goodale can help your firm’s people achieve their full potential, call Mark Goodale at 508.254.3914 or email him at [email protected].

Four Factors to Watch

1. Government Spending

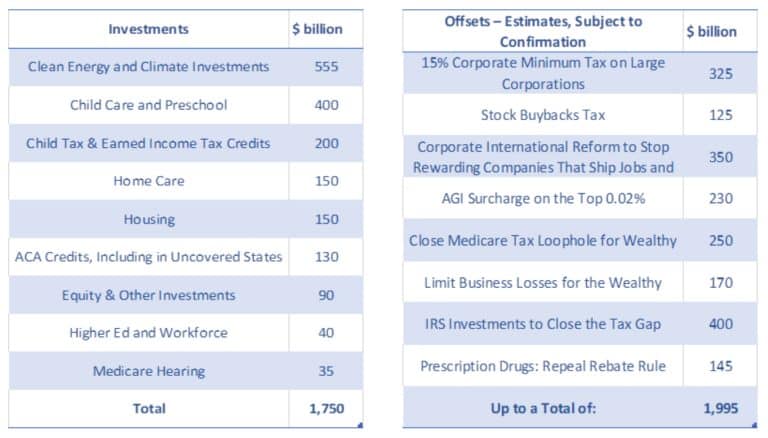

The White House published a new framework for the Build Back Better Act, which was communicated by President Biden last Thursday. The latest major portion of the original $3.5 trillion to be sliced was the paid leave program, lowering the proposal now to $1.75 trillion. Biden used the words “compromise” and “consensus” while describing the process to get to this version. Nonetheless, more discussions and changes are to be expected, particularly as they relate to the demands from the Congressional Progressive Caucus for social and climate provisions as a prerequisite to back the Infrastructure Bill. Many more hours are expected to be spent deciding which tax measures will ultimately help fund the package.

2. Consumer Economics

The Conference Board Consumer Confidence Index increased in October to 113.8, following declines in the previous three months. More consumers believe there will be more jobs and that their income will increase in the next six months. There was also an increase in the portion of consumers who are planning on making big purchases, like homes, cars, and major appliances. Additionally, more consumers are willing to travel and spend on in-person services. Overall, these are good signs for economic growth in Q4, despite concerns of short-term inflation.

3. Pending Home Sales

Home sale contract signings fell 2.3% in September vs. August, signaling a slowdown in the residential real estate market. In comparison to September 2020, the decrease was approximately 8%. Regionally, the Northeast had the largest drop from a year ago (18.5%) and the Midwest declined the most from August (3.5%). National Association of Realtors’ chief economist stated that some potential buyers are postponing home searches to later in 2022 when higher inventories are expected. Additionally, renters may seek homeownership in order to avoid higher rent prices as a result of inflation.

4. U.S. GDP

Real gross domestic product (GDP) increased at an annual rate of 2% in the third quarter of 2021, according to the Bureau of Economic Analysis. The result is in line with economists’ expectations and reflect Delta variant impacts as well as the winding down of federal stimulus programs. A slowdown in personal consumption expenditures of goods – mainly motor vehicles and parts – and services – primarily food services and accommodations – contributed to the deceleration of GDP growth in Q3. All other types of spending also declined, with the exception of housing and utilities and financial services.

Subscribe to our Newsletters

Stay up-to-date in real-time.