Word on the street > AE Industry Intelligence: Issue 63

AE Industry Intelligence: Issue 63

The Magnificent Seven: How the industry’s most in-demand firms keep getting more valuable

Our proprietary Deals Database provides real-time reporting of industry M&A multiples. It’s updated continuously and currently contains detailed pricing information on over 270 A/E and environmental firm acquisitions from 2011 through last week. The data can be sliced and diced by deal size (revenues, employees, backlog, EBITDA, etc.), deal type (A, A/E, E/A, environmental, etc.), region (state, city), buyer type (publicly traded, ESOP, employee-owned, private equity), and cohort (lower quartile, median, and upper quartile).

While the Deals Database is typically used as an analysis and decision-making tool, it also tells the story of how the industry has been changing over the past decade. And what’s most stunning is how it reveals the relentless increase in the value of the industry’s most highly sought-after firms.

- The gold standard indicator: The Rosetta Stone of the M&A world is EBITDA (earnings before interest, taxes, depreciation, and amortization). It’s the primary translator of an acquired firm’s performance to its valuation. Deal prices are frequently quoted as a multiple of the acquired firm’s EBITDA in the year before it was sold (commonly referred to as the “trailing twelve months”).

- An inexorable increase in valuations: What our Deals Database reveals is a steady increase in the upper quartile EBITDA M&A multiples over the past decade from 6.93 in 2011 to 8.2 where it currently stands—an 18% increase. This is distinct from the median EBITDA multiple which has remained relatively flat over the same period, and the lower quartile multiple which has actually declined over the past ten years (ouch!).

- The bifurcated market for firms is real: The past decade has seen a clear separation in the industry. The most sought-after acquisitions command ever-increasing premium pricing and higher multiples (and typically also more favorable terms), at the expense of the valuations for less attractive firms. Why do I say at the expense of? Well, while there is an abundance of capital pursuing industry acquisitions, it’s not unlimited. And if it favors higher performers, it therefore reduces demand for median or lower performers. In other words, there are winners and there are losers.

- The Magnificent Seven: A variety of factors or characteristics contribute to a firm achieving an upper quartile multiple at the time of sale. The more factors and characteristics in play, the higher the multiple that can be achieved. None of these factors or characteristics by themselves guarantee an upper quartile multiple, but they are good leading indicators. Those Magnificent Seven factors are:

- Size

- End markets

- Technical expertise

- Geography

- Financial performance

- Backlog

- Quality of leadership/management

- All things being equal: Each of the Magnificent Seven deserve an individual analysis that we don’t have time for here. But in general, larger firms with deep-dive technical expertise in “hot” end markets and geographies, with a track record of consistently strong financial performance, robust backlog, and a forward-looking leadership and management team have the highest probability of achieving upper quartile valuation multiples. Look at the strategic plans of some of the industry’s top performers and you will see that it’s no accident that they have goals and objectives articulated around each of these factors. Does your strategic plan look to create such value for owners?

M&A Update—ever-accelerating consolidation: This week we reported seven new deal announcements. The pace of M&A is now up 24% year-over-year. We continue to be on track for a year of massive industry consolidation.

Reasons to be cheerful part 3: Demand for architectural services continues to show great strength according to the American Institute of Architects (AIA). The AIA Billing Index (ABI) score jumped once again in May, building on a six-month positive trend.

Track record: To see a listing of the 10 transactions we have helped facilitate this year and over 120 deals that we have helped engineer since 2006, click here.

Early bird registration for the 7th Texas M&A Symposium expires Thursday at midnight! Join over 100 industry CEOs, M&A decision makers, and investors from Texas and around the nation on Oct 21. and 22 in Houston. Learn about the latest M&A trends, deal prices, and best practices. We’re proud to once again partner with our friends at ACEC Texas on this premier industry networking and learning event. Early bird registration rates fly away at midnight on Thursday, never to return.

Who we’re following on Twitter: Although we’re still unclear about crypto, we’ve a soft spot for Elon and his game-changing ventures SpaceX and Tesla. Check out the videos of the 1.2 g acceleration (faster than falling!) on the 2021 Model S Plaid.

Is there something missing in your week? We’ve heard from a number of readers that they’ve not been receiving our emails recently. Apparently, this started in May as a result of changes to the Microsoft 365 security platform. We’re working with our email provider, Constant Contact, as well as Microsoft to resolve the issue. If you wish, you can help us address this issue by having your IT department add the following Constant Contact IPs to your safelist to allow our e-Newsletter emails to filter safely to your inbox:

- 208.75.123.0/24

- 205.207.106.0/24

Questions? Insights? What characteristics do you believe create an upper quartile multiple for your firm? Email Mick Morrissey @ [email protected] or call him @ 508.380.1868.

Four Factors to Watch

1. Infrastructure Bill

President Biden and a group of centrist senators agreed to a roughly $1 trillion infrastructure plan in a bipartisan effort that will now need to pass through Congress. A larger package is still being pursued by Democrats. But passing the infrastructure deal may still depend on whether additional aspects of Biden’s $4 trillion economic agenda are approved. The next few weeks will prove to be contentious as Congress weighs both initiatives.

What has been agreed to so far is the physical infrastructure elements. Biden originally said he wouldn’t sign the infrastructure portion of the plan unless the rest of his agenda comes with it, but has since stepped back from that statement.

The bipartisan plan calls for $579 billion of spending above expected federal levels and a total of $973 billion of investment over five years. That total will reach $1.2 trillion if the program is continued over eight years. The focus is primarily on investments in the electrical grid, transportation, roads, and bridges.

The spending bill will be paid for by repurposing existing federal funds, public-private partnerships, and more vigorous IRS collections procedures, among other sources.

2. COVID-19 Case Numbers

In the last week, the seven-day average of daily COVID cases dropped from 12,220 to 11,370. However, the seven-day average of daily fatalities increased slightly from 308 to 314. The Delta variant is becoming an increasing percentage of new COVID cases. Seven-day averages of COVID cases increased in California and Texas:

- California: from 883 to 942

- Texas: from 1,055 to 1,219

3. Employment

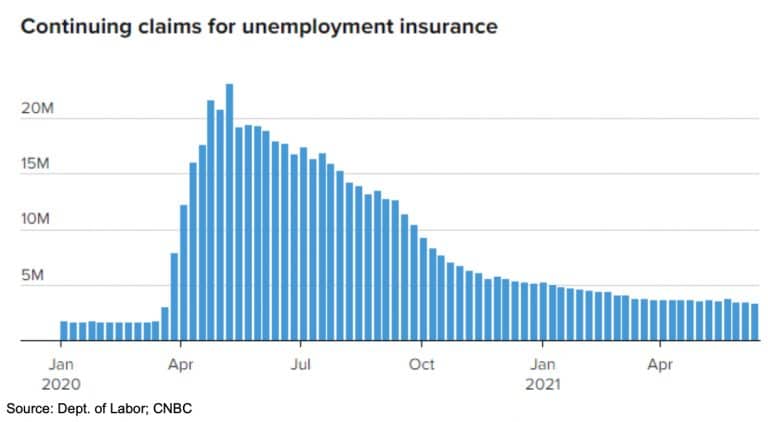

First-time jobless claims declined from 418,000 last week to 411,000—the second straight week claims have totaled over 400,000. Economists projected 380,000 claims. It appears that the sharp drops in claims earlier in the spring have plateaued. At the same time, job openings now total a record 9.3 million, which is roughly comparable to the approximately 9.6 million unemployed Americans. The current level of initial claims is about double of what it was just prior to the pandemic.

4. Inflation

The May core personal consumption expenditures (PCE) price index rose 3.4% from a year ago, which was in line with Wall Street estimates. It is the fastest increase since April 1992. The core PCE price index increase indicates rapid economic expansion and the resulting upward price pressures. Despite the growing concerns around inflation, Fed officials continue to see the current situation as temporary and believe costs will come back down to earth as we enter a post-COVID business environment.

5. COVID Vaccine Update

About 151 million Americans (a little over 46% of the population) have been fully vaccinated, up from 148 million last week. In California, 48.8% of the population have been fully vaccinated. In Texas, 40.3% have been fully vaccinated. In Florida, 44.7% of the population have been fully vaccinated. Vermont, Maine, and Massachusetts populations are all above 60% fully vaccinated, while the percentage of populations fully vaccinated in Mississippi, Alabama, and Louisiana range from the high 20s to the low 30s.

Subscribe to our Newsletters

Stay up-to-date in real-time.