Word on the street > AE Industry Intelligence: Issue 56

AE Industry Intelligence: Issue 56

What CEOs could learn from Simone Biles and George Costanza

In a perfect world, a firm’s CEO embodies a firm’s values. She “lives the values” “walks the talk” – however you want to put it. In every interaction, with every stakeholder, every day. Internally she inspires employees and managers – from the person answering phones at the front desk (do phones even get answered at the front desk anymore?) all the way to her direct reports. Externally, she’s the firm’s “brand ambassador” with clients, investors, strategic hires, M&A candidates, vendors, community leaders and teaming partners. She’s a catalyst for improved business performance and organizational development. In a perfect world, she positively reinforces the firm’s brand with every interaction with all internal and external stakeholders.

- But it’s not a perfect world: CEOs do their best to bring it every day. But sometimes they fail. Many learn from those failures (“Going forward, I’ll delegate more low-leverage activities, so I can dedicate more time to develop my successor” or “I’ll deal with a non-performing principal directly and immediately rather than avoiding the matter and dragging it out as I have in the past.”) and improve.

- However, many CEOs lack the self-awareness or motivation to improve: They – like most of us – are stuck in learned patterns of behavior. Most are unaware of their blind spots. Most of them lack a feedback loop to coach them on their deficiencies (“Hey boss, things would be a lot better around here if you showed up for meetings on time” or “Next time try not to impugn the business practices of commercial developers in a meeting with an M&A target that does 50% of its business with commercial developers.*) Action item for Boards – get your CEOs a coach, your shareholders will thank you for it.

*This is based on a real meeting that I was privy to. Not only did this happen but there was also a door kicked in as part of an entrance by one of the buyers. Needless to say, the two parties never consummated the deal. - The savviest CEOs understand the power of their personal NPS: What’s an NPS I hear you ask? Net Promoter Score. It’s a super powerful market research tool that basically boils down to asking customers “Would you recommend a company, product, or service to a friend or colleague?” Every firm has an NPS, and every CEO has one too. Many however don’t know it or haven’t sought it out. Savvy CEOs understand a powerful trick that allows them to consistently amplify their personal NPS and in doing so increase that of their firm. What’s their secret?

- They focus on how things end: The highest NPS scores are achieved when customers or clients (for CEOs those are the firm’s internal and external stakeholders) feel a deep connection. While that connection has to be built consistently and over time, it can be “goosed up” at a transition point in a relationship or in a final transaction. Smart CEOs understand the “power of the ending” in increasing their NPS. They use how they “depart” or “finish” to “goose up” their NPS. Think about it. It’s how you leave a party that makes the most impression on the host (always make a point of saying a big thank you and how great a time you had). It’s your behavior in the 2 weeks after you give your notice at a job that resonates with your past employer and colleagues (always give 100% and help make the transition successful). Your life and career are a series of endings. The best CEOs use those endings to continually promote their individual brand and the brand of their firm.

- The Simone Biles effect: Watch the best CEOs in action and they intentionally nail the dismount every time when moving on from a meeting or conversation or event. They end their leadership team and strategy meetings with a restatement of the important take-aways for all participants. They close M&A discussions by ensuring they own the final ten minutes to make their case and affirm the go-forward plan. They make sure that they are the last person in the room when leaving a client or teaming meeting so that they are the last voice to be heard before a decision is made. When recruiting or on-boarding new talent – they reserve the last part of the conversation to make clear the firm’s values and their expectations. They minimize what is left open to interpretation and maximize the clarity of their message.

- The Costanza rule: The need for CEOs to represent the firm’s brand internally and externally is axiomatic. The end – of every relationship and interaction – provides each CEO with optimal timing for them strengthen their firm’s NPS. Or as George Costanza perfectly put it – always leave them on a high note.

- One more thing: A growing number of CEOs are supplementing their regular all-employee audio or video meetings with an all-employee podcast. Why? Well first they understand that communicating only once about important topics is sub-optimal. More importantly, they recognize that the deep connection created though a podcast dramatically increases their NPS with their employees. Its ‘one to one’ format creates a deeper more meaningful bond between CEO and employee and reinforces important messages far better than a group call.

M&A Update: U.S M&A is up 7% year-over-year. You can get a deep dive assessment of the M&A trends and stats shaking up the A/E industry in our Q1 Infographic and Review.

Don’t miss your early bird pricing for our CEO and C-suite Virtual Reality: It expires on May 10. We’ve received a ton of requests to expand participation in our VR events beyond CEOs. So, we’ve opened eligibility for our next Virtual Reality Conference in June to CEOs and C-suite executives (folks who report directly to the CEO). So, beyond CEOs you’ll be networking and learning with CFOs, CMOs, CTOs and CPOs! This first-ever two-day themed VR Conference will focus on Strategy + Execution and M&A/Capitalization. Click here for early-bird registration pricing and for multi-attendee discounts.

Live and in-person October Texas M&A Symposium! Our M&A Symposium series is back live and in-person with our 6th Texas M&A Symposium in Houston this October 21 and 22. Join us as we host at the super sleek Post Oak Hotel (the ONLY Five Star Hotel & Spa in Houston). Network with A/E executives and investors from Texas and around the nation. Get the latest M&A trends, stats and best practices from industry experts, buyers, and sellers. We’re proud to once again partner with our friends at ACEC Texas on this premier industry event. Click here for updates and to be notified when registration opens.

Who we’re following on Twitter. This week we were glued to the twitter machine following all the action at #ACEC2021ANNUAL. Faced with adversity, the crew at @ACECNational did a fantastic job hosting a tremendous virtual Spring conference. We were thrilled to once again be a sponsor and host a session on how successful A/E firms are deploying Virtual Reality technologies!

Questions? Insights? How are you seeing the industry changing? Email Mick Morrissey @ [email protected] or call him @ 508.380.1868.

Four Factors to Watch

1. Economy

First-quarter GDP spiked 6.4% on an annualized basis. It was the second-best quarter for GDP since Q3 2003. Bolstered by another round of Federal stimulus checks, consumer spending was up 10.7%. Goods increased 23.6% and services were up 4.6%. Within goods, durable goods rocketed up 41.4%. Nevertheless, the savings rate increased from 13% in Q4 2020 to 21% in Q1 2021. Imports rose 5.7% and exports declined 1.1%. With U.S. spending ahead of most other countries, inventories declined which detracted from GDP. However, that drop in Q1 will likely lead to a subsequent increase in overall growth.

2. COVID-19 Case Numbers

In the last week, the seven-day average of daily COVID cases dropped from 59,900 to 51,500. The last time cases were at this level prior to the winter spike was mid-October. The seven-day average of daily fatalities dropped from 711 to 697. Seven-day averages of COVID cases once again trended down in California, Texas, and Florida:

- California: from 2,220 to 1,700

- Texas: from 3,310 to 3,190

- Florida: from 5,820 to 5,310

3. Employment

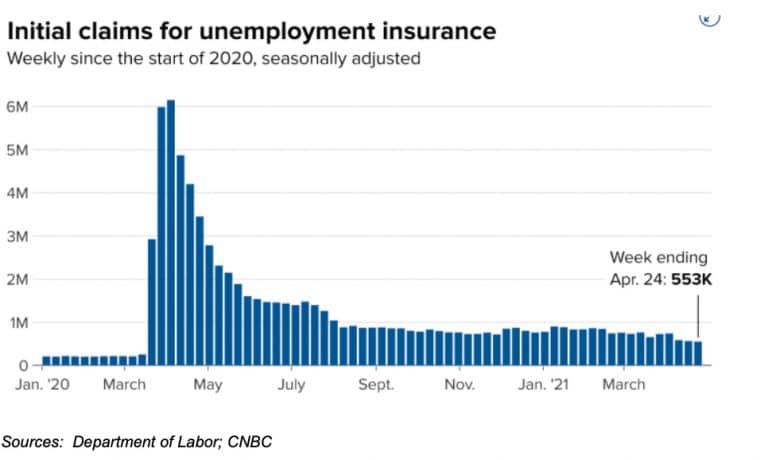

Jobless claims fell from 566,000 (adjusted the previous week) to 553,000 last week, but were above the Dow Jones projection of 528,000. It is the lowest weekly mark since the pandemic began in earnest in March 2020. Continuing claims continues to hover around 3.67 million. Roughly 14 million of the 22 million that lost their jobs since the beginning of the pandemic have returned to work, according to Federal Reserve estimates. The unemployment rate has dropped from its peak of 14.7% to 6%, but still remains above 3.5% which was the prevailing rate in February of last year.

4. COVID Vaccine Update

Vaccines appear to be finally starting to turn the tide against new COVID cases in the U.S. More than 37% of U.S. adults have now been fully vaccinated while data from Johns Hopkins University indicates the seven-day average of new cases has been trending lower than the 14-day average for over a week— a sign that the rate of new daily cases is dropping. On Tuesday, the U.S. Centers for Disease Control and Prevention declared it is now safe for fully vaccinated people to be outdoors in small groups without masks.

Subscribe to our Newsletters

Stay up-to-date in real-time.