Word on the street > AE Industry Intelligence: Issue 52

AE Industry Intelligence: Issue 52

In This Issue

Make it a feature not a bug!

It’s a common refrain we hear from CEOs. They say they want their employees back in the office and in the field the way they were pre-pandemic. But then they pause, stare wistfully into the distance, and acknowledge that they will not be able to mandate that. And while that’s the right outcome, many are reaching that conclusion for the wrong reasons – and are missing a huge opportunity in the process.

- The #1 and #2 reasons: The #1 reason CEOs will not bring everyone back to the office post-pandemic is “..because our competition is providing the option to work remotely and we will lose folks to them if we don’t do the same.” The #2 reason is “(many) potential recruits tell us that they won’t work for us if they have to come into an office.” Both statements are factually correct. Both are also reactionary and defensive. Both anticipate a post-pandemic work environment where flexible remote working is a bug not a feature – and that’s a problem.

- The train has left the station: The pandemic was the fast forward button for every trend that was in play prior to March 2020. The steady decline in movie theater attendance? Fell off a cliff in 2020. The relentless rise in on-line retail? Rocket to the moon last year. The growing openness to more flexible and remote work? It became THE story for the professional class last year. These changes are not cyclical – they’re structural. The horse bolted from the barn on remote and flexible work last March.

- Clients and employees will drive the post-pandemic working model: A/E leadership teams don’t need to struggle too much trying to figure out what their post-pandemic work model will be. If clients require an A/E firm to deliver services from the office, then that is what will drive the model. Period. Absent that however, the future model will be driven by employee preferences.

- “It’s not you, it’s me”: And those employee preferences will be all over the map. At one end of the spectrum will be talent who will fully embrace working in the model. On that note does it surprise ANYONE that married professionals and professionals with school age kids are more eager to return to the office than singles? At the other end will be those who may want to never set foot in the office again. A/E leaders need to face the reality that their firm’s relationship with many of their employees has moved to another phase. Whereas in the past “the office” may have been an important element of that relationship, in the future it may not play a role at all. Indeed “the office” or any implication of a return to it may be a relationship-breaker. If you mandate a return to the office, there will be employees who determine that “they’re just not that into you”.

- When you see a chance take it: This brave new world of the workplace provides A/E firm leaders with a wonderful opportunity to revisit and reaffirm their values and strategic plan. In doing so they can challenge what their commitment to being an “Employer of choice” (or whatever variation of that aspiration they have written on paper, published digitally, or stenciled on walls) actually means post-pandemic. They can then deploy strategies and policies that allow them to embrace those values.

- Make it a feature not a bug: I’d suggest in redesigning those strategies A/E firm leaders recognize (a) that between 20% to 30% of employees in the future will value a more flexible working model (b) the technologies are in place to support that model and (c) that excellent talent will continue to be the most scarce and valuable resource. Add all three up and the answer is simple. Make remote working a feature not a bug. Embrace it in your commitment to be a great place to work.

M&A Update: The big news last week was the recapitalization of industry transportation icon TranSystems by Sentinel Capital. Our prediction of a record 20 recapitalizations among the ENR Top 500 looks spot on.

Why is Private Equity recapitalizing the A/E Industry? Why now? Get the answer to these questions and more in my conversation with Gerry Donohoe on the ACEC Engineering Influence Podcast.

Due to popular demand…..: We’ve received a ton of requests to expand participation in our VR events beyond CEOs. So we’ve opened eligibility for our next Virtual Reality Conference in June to CEOs and C-suite executives (folks who report directly to the CEO). This first-ever two-day themed VR Conference will focus on Strategy + Execution and M&A/Capitalization. Click here for early-bird pricing. (Re)connect and learn with your peers without the hassle and expense of travelling via fully immersive 3-D Virtual Reality.

Live and in person October Texas M&A Symposium! Our M&A Symposium series is back live and in person starting with our 6th Texas M&A Symposium in Houston this October 21 and 22. Join us as we host at the stunning Post Oak Hotel (the ONLY Five Star Hotel & Spa in Houston). Network with A/E executives and investors from Texas and around the nation. Get the latest M&A trends, stats and best practices from industry experts, buyers, and sellers. We’re proud to once again partner with our friends at ACEC Texas on this premier industry event. Click here for updates and to be notified when registration opens.

Who we’re following on Twitter this week: We love to check in on John Kissinger, President and CEO of GRAEF. He’s a keen observer and commenter on the A/E industry, politics, sports, technology, and all things Wisconsin.

Questions? Insights? How do you plan to work in the future? Email Mick Morrissey @ [email protected] or call him @ 508.380.1868.

Four Factors to Watch

1. Infrastructure Bill

President Biden unveiled his $2 trillion plan for infrastructure and jobs, with a focus on roadways, railways and bridges, and clean energy. Transportation infrastructure will receive $621 billion, with $174 billion, or just over a quarter of the transportation portion, on electric vehicles. That includes 500,000 electric vehicle stations and replacing diesel transit vehicles and buses with electric vehicles. It would also provide for tax incentives and rebates for electric cars. About $115 billion will go toward road and bridge repair, including 20,000 miles of highways and roads, the 10 most “economically significant” bridges in the U.S. as well as 10,000 smaller bridges. Another $85 billion would be dedicated to modernizing transit systems and $80 billion for Amtrak improvements, repairs, and route extensions. Airports, ports, and waterways would also be included.

2. COVID-19 Case Numbers

In the last week, the seven-day average of COVID cases increased to 65,600 from 61,500 the previous week. The seven-day average of fatalities dropped slightly from 980 to 890. Seven-day averages of COVID cases remained steady in California, dropped slightly in Texas, and rose slightly in Florida:

- California: 2,600 to 2,600

- Texas: 3,800 to 3,700

- Florida: 5,000 to 5,300

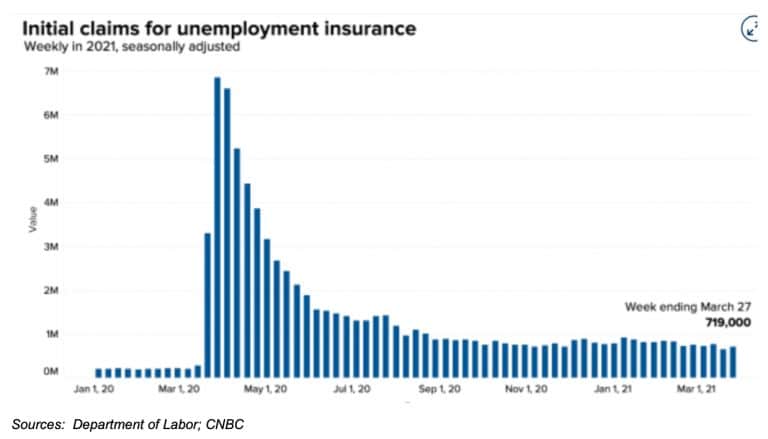

3. Jobless Claims

According to the Labor Department, first-time weekly claims totaled 719,000, up from the previous week’s tally of 658,000 (adjusted down from 684,000), and higher than the Dow Jones estimate of 675,000.

Continuing jobless claims dropped 46,000 from the previous week to just below 3.8 million.

4. COVID Vaccine Update

According to information collected by Bloomberg, 611 million doses have been administered in 150 countries, compared to 535 million doses in 141 countries the week before. The average number of daily doses increased to 15.3 million from 14.5 million the week before. The number of doses delivered is enough to vaccinate about 4% of the global population, up from 3.5% the previous week.

To date, 158 million doses have been administered in the U.S., up from 143 million last week. An average of 2.99 million doses per day are now being administered, which is up from the daily rate of 2.71 million last week. At this pace, it will take another four months to cover 75% of the population.

Subscribe to our Newsletters

Stay up-to-date in real-time.